Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Green chemicals are produced using renewable resources, such as biomass or waste materials. These chemicals have a much lower carbon footprint than traditional chemical products, and they can be used in a wide range of applications, from packaging materials to pharmaceuticals. Another important area of growth in the green chemical market is the development of green solvents. Traditional solvents can be harmful to human health and the environment, and there is a growing demand for safer alternatives. Green solvents are produced using renewable resources and have a much lower impact on the environment than traditional solvents. According to the European Chemical Industry Council, chemicals and pharmaceuticals were the UK's second-largest manufacturing sector in 2021, trailing only machinery and transport equipment, with exports exceeding USD 54 billion and value added to the economy of USD 30.7 billion. The green chemical market is also driven by government regulations and policies, which are aimed at reducing the impact of the chemical industry on the environment. Many countries have introduced regulations that require companies to use more sustainable methods of production and reduce their carbon emissions. This has led to a shift in the chemical industry towards the production of greener chemicals.

The green chemical market in the United Kingdom is a rapidly growing sector, driven by increasing concerns about climate change and the need for more sustainable products. The United Kingdom government has set ambitious targets for reducing carbon emissions and promoting sustainability, which has led to a surge in the development and production of green chemicals. According to the government of the United Kingdom, in 2016, the construction sector, which includes contracting, manufacturing, and professional services. It had a turnover of about USD 406 billion, contributing 9% or USD 151 billion, to the UK economy through exports of goods and services. The United Kingdom is a major player in the global chemical industry, and the green chemical market is becoming an increasingly important part of this sector. The market for green chemicals in the United Kingdom is driven by several factors, including government regulations, consumer demand for environmentally friendly products, and the growing awareness of the impact of traditional chemical products on human health and the environment. According to the government of the United Kingdom, the chemicals sector is a natural innovator, spending more than USD 5.9 billion in 2019 on research and development. This accounts for more than 20% of the UK’s R&D expenditure.

Supportive Government Regulations and Policies Regarding Green Chemicals

The government of the United Kingdom has put forth several laws and policies designed to encourage sustainability and lessen the environmental damage caused by the chemical industry. They include the industrial decarbonization strategy, which outlines a strategy to cut industry's emissions by two-thirds by 2035, and the adoption of rules that compel businesses to utilize more environmentally friendly production techniques and cut their carbon emissions. One of the key government regulations for the green chemical market is the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation. As per the Society of Motor Manufacturers and Traders, the automobile sector is an essential component of the UK economy and plays a key role in promoting leveling up, net zero, global Britain, and growth objectives. The UK economy receives USD 73.5 billion in sales and USD 15.3 billion in value added from the automotive industry, which normally invests about USD 3.2 billion annually in R&D. Also, more than 30 manufacturers work with 2,500 component suppliers and some of the most talented engineers in the world to create more than 70 different vehicle types in the UK. In 2021, the Kingdom produced over 859,000 cars, 72,913 additional commercial vehicles, and 1.6 million engines. Further, eight out of every ten automobiles built in the United Kingdom are exported to 130 different countries and markets. This regulation requires companies to register chemicals produced or imported into the European Union and to provide information about the properties of these chemicals. This information is used to assess the risks associated with the use of these chemicals and to identify any measures needed to control these risks. The United Kingdom government has also introduced policies to promote the development and use of bio-based chemicals. In 2018, the government launched the Bioeconomy Strategy, which aims to create a more sustainable economy by using renewable resources to produce a range of products, including chemicals. The strategy includes measures to support the development of new bio-based chemicals, including funding for research and development and the establishment of a bioeconomy task force. Overall, a plethora of laws and policies have been passed by the British government to encourage the creation and expansion of the market for green chemicals. These actions aim to make the United Kingdom more environmentally friendly and lessen the environmental damage caused by the chemical industry. These regulations are anticipated to have a positive impact on the green chemical market in the United Kingdom, opening new business opportunities and fostering the development of a more sustainable future for the nation.Increasing Consumer Demand for Environmentally Friendly Products

In the United Kingdom, there has been an increase in demand for green products in recent years. The need for products that are made sustainably and have less of an impact on the environment has had a substantial impact on the market for green chemicals. Growing knowledge of how urban development affects the environment, particularly pollution, climate change, and the loss of natural resources, is one of the major forces behind this movement. Consumers are looking for products that are produced sustainably and have less environmental impact as they become more conscious of the need to lessen their environmental imprint. The United Kingdom government has also played a role in driving consumer demand for environmentally friendly products. The government has introduced a range of regulations and policies aimed at promoting sustainability and reducing the impact of the chemical industry on the environment. These policies have helped to raise awareness of environmental issues and to promote the use of sustainable products. The United Kingdom market for green chemicals has expanded dramatically in recent years in response to this rising demand. Businesses are investing in R&D to create novel, sustainable production techniques and products that are safer and more environmentally friendly. In recent years, the market for bio-based chemicals which are made from resources that can be renewed has expanded because of customer desire for environmentally friendly products.Market Segmentation

United Kingdom green chemicals market is segmented into product, application, region, and company. Based on product, the market is divided into bio-alcohols, bio-organic acids, bio-ketones, biopolymers, and others. Based on application, the market is divided into industrial & chemicals, pharmaceuticals, construction, packaging, automotive, and others. Based on region, the United Kingdom the market is segmented into Scotland, South-East, London, South-West, East-Anglia, Yorkshire & Humberside, East Midlands, and rest of the United Kingdom.Company Profiles

Mitsubishi Chemical UK Limited, Cargill PLC, BASF SE, Arkema UK Limited, Toray International U.K. Ltd. (TIUK), Evonik Industries AG, Mitsubishi Chemical Group, DSM United Kingdom Limited, Aemetis, Inc., and Albemarle Corporation are some of the key players of United Kingdom green chemical market.Report Scope:

In this report, United Kingdom green chemical market has been segmented into the following categories, in addition to the industry trends, which have also been detailed below:United Kingdom Green Ammonia Market, By Chemicals:

- Bio-Alcohols

- Bio-Organic Acids

- Bio-Ketones

- Biopolymers

- Others

United Kingdom Green Ammonia Market, By Application:

- Industrial & Chemicals

- Pharmaceuticals

- Construction

- Packaging

- Automotive

- Others

United Kingdom Green Ammonia Market, By Region:

- Scotland

- South-East

- London

- South-West

- East-Anglia

- Yorkshire & Humberside

- East Midlands

- Rest of United Kingdom

Competitive landscape

Company Profiles: Detailed analysis of the major companies in United Kingdom green chemical market.Available Customizations:

With the given market data, the publisher offers customizations according to a company’s specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Mitsubishi Chemical UK Limited

- Cargill PLC

- BASF SE

- Arkema UK Limited

- Toray International U.K. Ltd. (TIUK)

- Evonik Industries AG

- Mitsubishi Chemical Group

- DSM United Kingdom Limited

- Aemetis, Inc.

- Albemarle Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 72 |

| Published | October 2023 |

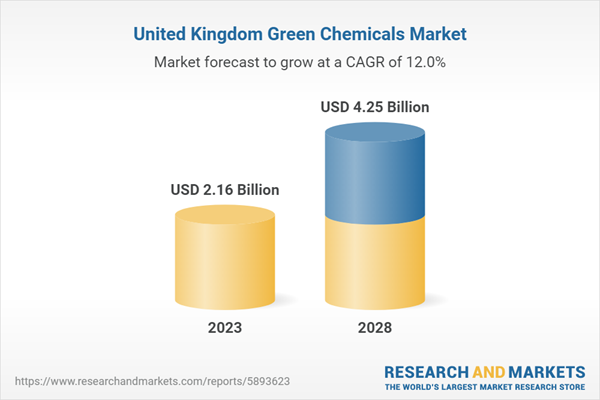

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 2.16 Billion |

| Forecasted Market Value ( USD | $ 4.25 Billion |

| Compound Annual Growth Rate | 12.0% |

| Regions Covered | United Kingdom |

| No. of Companies Mentioned | 10 |