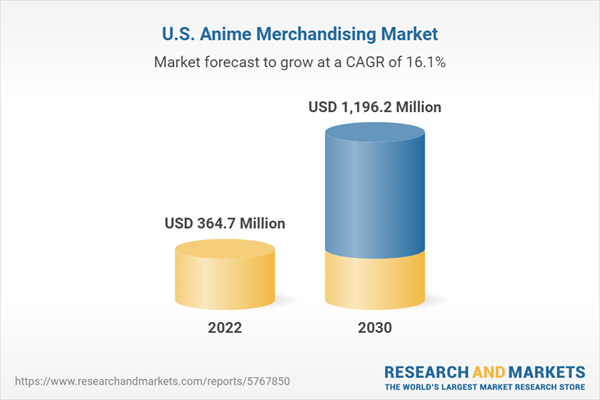

The U.S. anime merchandising market size is expected to reach USD 1,196.2 million by 2030, registering a CAGR of 16.1% from 2023 to 2030. The considerable growth can be credited to the increasing consumer interest in figurines, apparel, accessories, books, posters, toys, etc., featuring anime characters in the country. Rising adoption of anime titles such as Jujutsu Kaisen, Demon Slayer, One Piece, Naruto, and Blue Lock, among others, as mainstream entertainment is accelerating the growth of the anime merchandising market in the U.S.

The growing anime popularity across the globe has created lucrative opportunities for the anime merchandising market. Selling merchandise forms a big part of the anime market and is expected to observe notable growth in the years to come. Anime fans are showing an increased interest in buying merchandise related to their favorite series. Several fans believe merchandising is crucial to keep the fan community together and support the anime industry. Some of the popular merchandise items include figurines, shirts, hats, and stickers.

The online fan communities and growing consumer interest in anime are significantly driving the growth of the U.S. anime merchandising industry. Streaming platforms, such as Netflix, Crunchyroll, and Funimation have strongly influenced viewers’ interest in anime, thereby impelling the demand for anime items in the country.

Several companies operating in the U.S. anime merchandising market focus on launching new products and offerings to attract a larger customer base and strengthen their foothold in the industry. For instance, in 2022, Bandai Namco Toys & Collectibles America introduced its latest line of Gundam Infinity figures to deliver an enhanced experience to anime fans through customization. The new product range is an exciting line of customizable figures, with several interchangeable parts and accessories.

U.S. Anime Merchandising Market Report Highlights

- The figurine product segment is expected to capture a significant revenue share of nearly 36.0% by 2030 owing to increasing demand for anime miniatures and collectibles driven by growing fandom for movies and series in this genre

- The posters segment is expected to record a substantial CAGR of more than 17.0% over the forecast period, with increasing sales of high-quality anime-inspired posters, especially through online stores

- Based on the distribution channel, the online segment is anticipated to grow at a CAGR of 17.3% during the forecast period. The pricing discounts, free home delivery, and ease of shopping from home are factors boosting the growth of the online segment

- The key market players include Atomic Flare, Kotobukiya Co., Ltd., Bandai Namco, Good Smile Company USA, Crunchyroll (Sony Music Entertainment), Sentai Filmworks, LLC (AMC Networks), Viz Media LLC, Kodansha LTD., Kinokuniya Book Stores of America Co., Ltd., The Walt Disney Company, Toei Animation USA, Eleven Arts, and Lions Gate Entertainment Inc.

Table of Contents

Chapter 1 Methodology and Scope1.1 Market Segmentation & Scope

1.2 Market Definitions

1.3 Information Procurement

1.3.1 Information Analysis

1.3.2 Market Formulation & Data Visualization

1.3.3 Data Validation & Publishing

1.4 Research Scope and Assumptions

1.4.1 List of Data Sources

Chapter 2 Executive Summary

2.1 Market Snapshot

2.2 Segment Snapshot

2.3 Competitive Landscape Snapshot

Chapter 3 U.S. Anime Merchandising Market Variables and Trends

3.1 Market Lineage Outlook

3.2 Industry Value Chain Analysis

3.3 Market Dynamics

3.3.1 Market Driver Impact Analysis

3.3.2 Market Restraint Impact Analysis

3.3.3 Industry Challenges

3.4 Industry Analysis Tools

3.4.1 Porter’s Five Forces Analysis

3.4.2 Macroeconomic Analysis

3.5 Most Popular Anime Titles in the U.S., 2022

3.6 Top-Selling Anime Items in the U.S.

3.7 List of Key Distributors and Retailers for the Anime Merchandising Market

3.8 Pricing Analysis

Chapter 4 U.S. Anime Merchandising Market: Product Estimates & Trend Analysis

4.1 Product Movement Analysis & Market Share, 2022 & 2030

4.2 U.S. Anime Merchandising Market Estimates & Forecast, By Product (USD Million)

4.2.1 Figurine

4.2.2 Clothing

4.2.3 Books

4.2.4 Board games and toys

4.2.5 Posters

4.2.6 Others (accessories)

Chapter 5 U.S. Anime Merchandising Market: Distribution Channel Estimates & Trend Analysis

5.1 Distribution Channel Movement Analysis & Market Share, 2022 & 2030

5.2 U.S. Anime Merchandising Market Estimates & Forecast, By Distribution Channel (USD Million)

5.2.1 E-commerce

5.2.2 Brick & Mortar

Chapter 6 U.S. Anime Merchandising Market - Competitive Landscape

6.1 Company Categorization

6.2 Participant’s Overview

6.3 Financial Performance

6.4 Product Benchmarking

6.5 Company Heat Map Analysis

6.6 Key Company Analysis, 2022

6.6.1 Anime Market, Key Company Market Share Analysis, 2022

6.6.2 U.S. Anime Merchandising Market, Key Company Analysis, 2022

6.7 Strategy Mapping

6.7.1 Expansion

6.7.2 Mergers & Acquisition

6.7.3 Collaborations

6.7.4 New Product Launches

6.7.5 Research & Development

List of Tables

Table 1 Key market driver impact

Table 2 Key market restraint impact

Table 3 U.S. Anime Merchandising Market Revenue Estimates and Forecast, By Product, 2018 - 2030

Table 4 U.S. Anime Merchandising Market Revenue Estimates and Forecast, By Distribution Channel, 2018 - 2030 (USD Million)

Table 5 Company heat map analysis

List of Figures

Fig. 1 U.S. Anime Merchandising Market Segmentation

Fig. 2 Information Procurement

Fig. 3 Data Analysis Models

Fig. 4 Market Formulation and Validation

Fig. 5 Data Validating & Publishing

Fig. 6 Market Snapshot

Fig. 7 Segment Snapshot

Fig. 8 Competitive Landscape Snapshot

Fig. 9 Anime Market Value, 2022 (USD Million)

Fig. 10 U.S. Anime Merchandising - Industry Value Chain Analysis

Fig. 11 U.S. Anime Merchandising Market Dynamics

Fig. 12 Various forms of OTT solutions

Fig. 13 Notable OTT trends

Fig. 14 Price Fluctuation of Plastic Material and Resins

Fig. 15 Price of Plastic Materials and Resin (Annual Change)

Fig. 16 U.S. Anime Merchandising Market: PORTER’s Five Forces Analysis

Fig. 17 U.S. Anime Merchandising Market: Macroeconomic Analysis

Fig. 18 U.S. Anime Merchandising Market, by Product: Key Takeaways

Fig. 19 U.S. Anime Merchandising Market, by Product: Market Share, 2022 & 2030

Fig. 20 Figurine market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 21 Clothing market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 22 Books market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 23 Board games and toys market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 24 Posters market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 25 Others market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 26 U.S. Anime Merchandising Market, by Distribution Channel: Key Takeaways

Fig. 27 U.S. Anime Merchandising Market, by Distribution Channel: Market Share, 2022 & 2030

Fig. 28 E-Commerce market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 29 Brick & mortar market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 30 Key company categorization

Fig. 31 Company Market Share Analysis, 2022

Fig. 32 Strategic framework

Companies Mentioned

- Atomic Flare

- Bandai Namco

- Crunchyroll (Sony Music Entertainment)

- Eleven Arts

- Good Smile Company USA

- Kinokuniya Book Stores of America Co. Ltd.

- Kodansha LTD.

- Kotobukiya Co. Ltd.

- Lions Gate Entertainment Inc.

- LLC (AMC Networks)

- Sentai Filmworks

- The Walt Disney Company

- Toei Animation USA

- Viz Media LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | March 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 364.7 Million |

| Forecasted Market Value ( USD | $ 1196.2 Million |

| Compound Annual Growth Rate | 16.1% |

| Regions Covered | United States |

| No. of Companies Mentioned | 14 |