Diabetes, also referred to as diabetes mellitus, is a group of metabolic diseases in which a person suffers from high blood glucose. This can be either caused by the inappropriate response to insulin by the body, inadequate insulin production. If not monitored properly, diabetes can be fatal and cause serious health complications such as heart diseases, stroke, amputation, blindness and kidney diseases. According to the Centers for Disease Control and Prevention (CDC), more than 30 million adults have been diagnosed with diabetes or prediabetes in the United States. In 2018, the United States represented the third largest diabetes patient pool owing to the increasing geriatric population and rising obesity levels. Apart from this, physical inactivity and unhealthy lifestyle have further contributed to the escalating diabetic population.

The increasing diabetes prevalence has led the Government of US to launch diabetes prevention programs, raise awareness about its symptoms and encourage healthier lifestyle behavior amongst the citizens. In line with this, there has been a rise in diabetes diagnosis, monitoring and drug treatment rates. Moreover, the FDA has approved the production of Basaglar and Admelog, the biosimilar versions of insulin glargine and lispro. Several other diabetes drugs are also expected to gain approval in the coming years, which will further drive the growth of the market. Apart from this, rapid technological advancements have enabled the manufacturers to develop continuous glucose monitoring (CGM) device. It allows type-2 diabetes patients to check their blood periodically with the help of testing strips and easily monitor their blood sugar levels.

Key Market Segmentation:

The report provides an analysis of the key trends in each segment of the United States diabetes market report, along with forecasts for the period 2024-2032. Our report has categorized the market based on segment.Breakup by Segment:

InsulinOral Antidiabetics

At present, insulin exhibits a clear dominance over oral antidiabetics on account of the convenience and efficacy of insulin delivery devices. Amongst the various product types, long acting insulin represents the largest insulin class in the US, whereas DPP-IV inhibitors are the leading oral-antidiabetics class in the nation.

Competitive Landscape:

The report has examined the competitive landscape of the market and finds that it is highly fragmented in nature with the presence of numerous small and large manufacturers. Some of the key players operating in the market are:

Sanofi US Services Inc.Novo Nordisk Inc.

Eli Lilly and Company

Merck & Co. Inc.

Zeneca Holdings Inc.

Johnson & Johnson

What this Report Achieves:

Comprehensive situation analysis of the US diabetes epidemiology and its dynamics:

Focus of the Analysis:

Historical, current and future prevalence of diabetes in the USImpact of COVID-19 on the diabetes market in the United States

Historical, current and future prevalence of type-1 and type-2 diabetes in the US

Historical, current and future prevalence of diabetes in the urban and rural regions in the US

Historical, current and future prevalence of diabetes among males and females in the US

Historical, current and future prevalence of diabetes among various age groups in the US

Historical, current and future diagnosis rates for diabetes in the US

Historical, current and future drug treatment rates for diabetes in the US

Comprehensive situation analysis of the US Oral Antidiabetics market and its dynamics:

Focus of the Analysis:

Performance of the Oral Antidiabetics market in the USPerformance of key classes

Performance of key players

Market outlook

Comprehensive situation analysis of the US Insulin market and its dynamics:

Focus of the Analysis:

Performance of the Insulin market in the USPerformance of key classes

Performance of key players

Market outlook

Table of Contents

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 139 |

| Published | July 2024 |

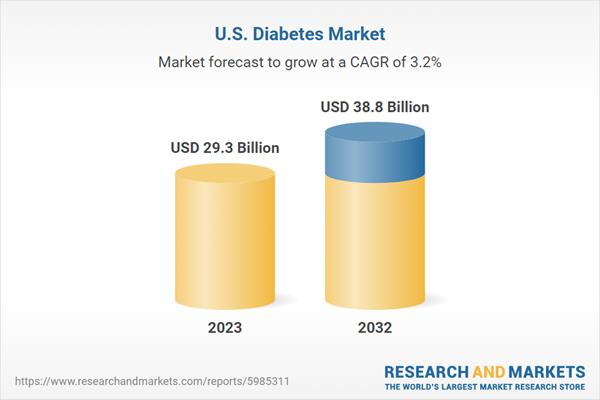

| Forecast Period | 2023 - 2032 |

| Estimated Market Value ( USD | $ 29.3 Billion |

| Forecasted Market Value ( USD | $ 38.8 Billion |

| Compound Annual Growth Rate | 3.2% |

| Regions Covered | United States |