Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Sustainability-focused initiatives by airlines, hotel chains, and tour operators are transforming travel norms. The rise in electric vehicle rentals, carbon offset programs, and nature-based tourism reflects a wider shift toward greener alternatives. Enhanced by supportive government policies and corporate environmental commitments, the sector is gaining momentum. National parks and protected ecosystems are also seeing increased interest, especially among travelers who value ecological preservation and responsible tourism.

Key Market Drivers

Growing Consumer Demand for Eco-Friendly Travel

A major factor propelling the U.S. sustainable travel market is the increasing consumer demand for eco-conscious travel experiences. Millennials and Gen Z travelers are especially focused on minimizing their carbon footprint and supporting responsible tourism. They are choosing environmentally friendly transport options, sustainable accommodations, and travel experiences that promote conservation and community welfare. Social media plays a pivotal role in this trend, with digital influencers and travel bloggers spotlighting destinations and businesses that uphold sustainability values. Certifications such as LEED and eco-tourism labels have gained prominence, prompting hotels and travel service providers to implement greener practices to appeal to this environmentally aware customer base.Key Market Challenges

Rising Popularity of Eco-Friendly Accommodations

The growing preference for eco-friendly lodging presents both an opportunity and a challenge in the sustainable travel market. Travelers are increasingly opting for accommodations that emphasize energy efficiency, reduce water usage, and implement waste management systems. To meet this demand, major hotel brands have introduced green programs such as renewable energy usage and plastic-free initiatives. Meanwhile, boutique eco-lodges and sustainable rentals on platforms like Airbnb are capturing market share by offering immersive, eco-conscious stays. Accommodations with certifications like Green Key and EarthCheck are becoming benchmarks for sustainability. However, the challenge lies in scaling these practices across the industry while maintaining affordability, guest satisfaction, and transparency in sustainability claims.Key Market Trends

Integration of Smart and Sustainable Travel Technology

The adoption of technology is revolutionizing sustainable travel in the United States by enhancing operational efficiency and reducing environmental impact. AI and data analytics help optimize travel planning by suggesting low-impact transportation routes, eco-certified accommodations, and tracking travel emissions through carbon calculators. Smart hotels are incorporating automation in energy and water management, delivering sustainability while improving guest convenience. Blockchain is also emerging as a tool for tracking carbon offset commitments with transparency. Additionally, mobile apps now offer real-time information on EV charging stations and sustainable transport options, empowering consumers to make eco-friendly choices. These innovations are streamlining sustainable travel, making it more intuitive, efficient, and appealing.Key Market Players

- G Adventures

- Intrepid Travel

- Natural Habitat Adventures

- Responsible Travel

- Gondwana Ecotours

- Kind Traveler

- SafariSmiths Travel

- Preferred Travel Group

- Green Tortoise Adventure Travel

- Alaska Alpine Adventures

Report Scope:

In this report, the United States Sustainable Travel Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below.United States Sustainable Travel Market, By Accommodation Type:

- Hotels, Resorts & Villas

- Cottages & Cabins

- Tents

- Ecolodges

- Others

United States Sustainable Travel Market, By Booking Channels:

- Online

- Offline

United States Sustainable Travel Market, By Region:

- South

- West

- Midwest

- Northeast

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the United States Sustainable Travel Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- G Adventures

- Intrepid Travel

- Natural Habitat Adventures

- Responsible Travel

- Gondwana Ecotours

- Kind Traveler

- SafariSmiths Travel

- Preferred Travel Group

- Green Tortoise Adventure Travel

- Alaska Alpine Adventures

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 86 |

| Published | April 2025 |

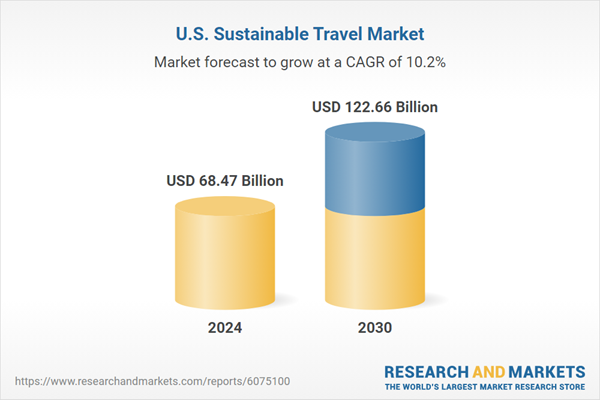

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 68.47 Billion |

| Forecasted Market Value ( USD | $ 122.66 Billion |

| Compound Annual Growth Rate | 10.2% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |