Similar to many other industries, the COVID-19 pandemic has had an impact on the U.S. market for gene therapy. While the market is expected to grow significantly in the coming years, the pandemic has caused delays in clinical trials and disruptions in the supply chain. The pandemic also highlighted the importance of gene therapy in treating and preventing diseases, which could lead to increased funding and investment in the field. Overall, while the pandemic has caused some challenges for the U.S. gene therapy industry, there is still significant potential for growth and advancement in the coming years.

The gene therapy pipeline in the U.S. is currently quite robust, with several promising therapies in various stages of development. Many of these therapies focus on rare genetic diseases, such as spinal muscular atrophy, choroideremia, Duchenne muscular dystrophy, and hemophilia. In addition, gene editing technologies like CRISPR-Cas9 are being used to develop therapies that can target specific genetic mutations with greater precision. For instance, in December 2023, Vertex Pharmaceuticals Incorporated and CRISPR Therapeutics jointly made the announcement of CASGEVY (exagamglogene autotemcel [exa-cel]), a genome modified cell therapy using CRISPR/Cas9 technology, has been approved by the U.S. FDA for treating sickle cell disease in patients aged 12 and above who have recurrent vaso-occlusive crises (VOCs).

However, drug companies have attached very high prices to these narrowly targeted treatments, resulting in one being pulled from the market in Europe and another struggling to attract patients. For instance, in November 2023, Sarepta Therapeutics revealed the price of the drug per infusion of the Elevidys, gene therapy for Duchenne muscular dystrophy (DMD), which is approximately USD 3.2 million.

U.S. Gene Therapy Market Report Highlights

- Large B-cell lymphoma dominated the indication segment with the largest revenue share of 36.04% in 2023. This is attributed to the high prevalence of this type of cancer in the country. Additionally, gene therapy has shown promising results in treating this disease, leading to increased adoption by healthcare providers and patients.

- The intravenous route of administration held the larger market share in 2023 and is expected to grow at a higher CAGR during the forecast period. This route of administration involves the use of viruses, such as adenovirus, retrovirus, or lentivirus, to deliver the desired gene into the patient's cells.

- Based on vector type, the lentivirus segment dominated with the largest revenue share in 2023. On the other hand, AAV is anticipated to grow at the highest CAGR from 2024 to 2030, owing to the rising demand and their usage in clinical trials due to the higher accuracy level in delivering the gene to the region of interest.

Table of Contents

Companies Mentioned

- Amgen Inc.

- Novartis AG

- F. Hoffmann-La Roche

- Gilead Sciences, Inc.

- bluebird bio, Inc.

- Bristol-Myers Squibb Company

- Legend Biotech.

- BioMarin.

- uniQure N.V.

- Merck & Co.

- Sarepta Therapeutics, Inc.

- Krystal Biotech, Inc.

- CRISPR Therapeutics.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 90 |

| Published | March 2024 |

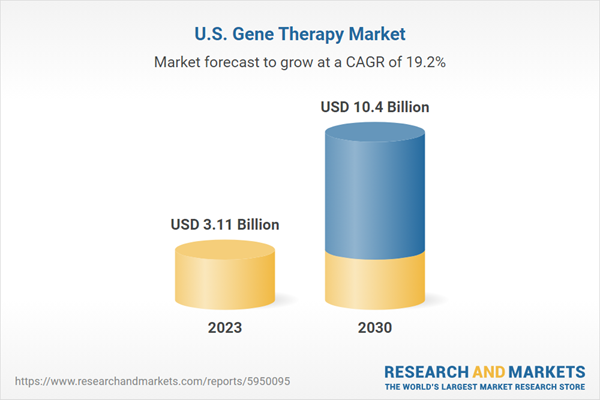

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 3.11 Billion |

| Forecasted Market Value ( USD | $ 10.4 Billion |

| Compound Annual Growth Rate | 19.2% |

| Regions Covered | United States |

| No. of Companies Mentioned | 13 |