The closed loop was the dominant segment in 2022 and is expected to maintain its position over the forecast period. A closed-loop geothermal heat pump has a continuous loop of underground piping to circulate a heat transfer fluid, such as water or a mixture of water and antifreeze. This loop is buried in the ground and can be installed horizontally or vertically, depending on the site conditions wherein it is to be used.

Geothermal heat pumps provide significant energy savings and can be installed in a wide range of commercial facilities, including office buildings, medical facilities, schools, courthouses, and training facilities. Increasing usage of large geothermal heat pumps in commercial buildings for space cooling or heating is expected to be one of the major factors influencing the growth of the market.

Moreover, the adoption of geothermal heat pumps in industrial applications is rising in the country owing to potential energy savings, cost reduction, and environmental benefits offered by them. These pumps are used in process heating and cooling, food processing, and manufacturing industrial applications. Geothermal heat pumps are also used for heating and cooling industrial buildings and process equipment. They are also employed to preheat or precool process fluids, thereby reducing energy consumption and costs.

U.S. Geothermal Heat Pump Market Report Highlights

- In terms of volume, the commercial application segment accounted for a prominent share of the market in 2022 and is expected to continue witnessing steady growth over the forecast period

- Based on type, the closed loop segment accounted for the largest share of 86.40% in 2022, in terms of volume. Closed-loop geothermal heat pumps are popular in the country as they are highly efficient and reliable

- Various strategic initiatives recorded over the past few years have contributed to the growth of the market. For instance; In April 2023, Stiebel Eltron announced an expansion in Germany by investing USD 491 million in a manufacturing facility located in Holzminden, Germany

Table of Contents

Companies Mentioned

- Bard HVAC

- Carrier

- ClimateMaster, Inc

- Daikin

- Dandelion

- Encon Heating & AC

- Glen Dimplex

- Ingersoll Rand (Trane)

- Maritime Geothermal

- NIBE

- Robert Bosch LLC

- Stiebel Eltron

- Vaillant Group

- Viessmann

- Spectrum Manufacturing

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 89 |

| Published | June 2023 |

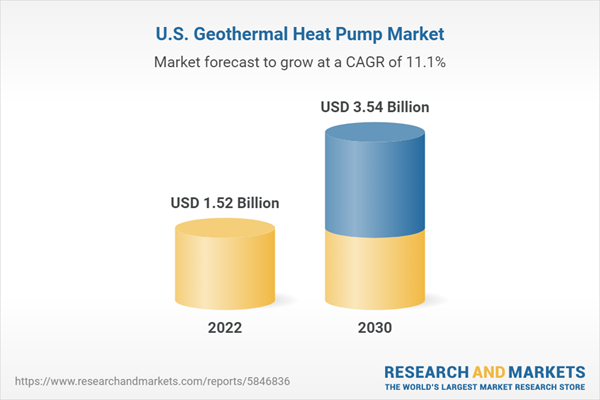

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 1.52 Billion |

| Forecasted Market Value ( USD | $ 3.54 Billion |

| Compound Annual Growth Rate | 11.1% |

| Regions Covered | United States |

| No. of Companies Mentioned | 15 |