Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

In the automotive sector, halo-butyl rubber plays a pivotal role in the production of tire inner liners. With the automotive industry increasingly emphasizing high-performance tires to enhance fuel efficiency and durability, the demand for halo-butyl rubber remains robust. Its unparalleled barrier properties ensure proper tire inflation and reduce air permeation, ultimately leading to improved fuel efficiency and prolonged tire lifespan.

The pharmaceutical industry also reaps the benefits of halo-butyl rubber's remarkable attributes. It assumes an indispensable role in the crafting of pharmaceutical stoppers and healthcare packaging, safeguarding the integrity and shelf life of critical pharmaceutical products.

Industries dealing with corrosive chemicals rely on halo-butyl rubber for gaskets, seals, and linings. Its exceptional resistance to chemical exposure serves as a reliable safeguard against leaks and ensures effective containment, thereby providing a trustworthy solution for maintaining safety and operational efficiency.

In the food and beverage sector, halo-butyl rubber plays a vital role in preserving product freshness and quality. Its capability to prevent the ingress of oxygen and moisture is pivotal, making it an ideal choice for packaging materials.

With the advent of specialty tire applications and ongoing innovations in material properties, the halo-butyl rubber market is poised for sustained growth. Its impermeability, resilience, and adaptability position it as the material of choice across a spectrum of industries, solidifying its stature as a significant player in the United States rubber market.

Key Market Drivers

Growing Demand of Halo-Butyl Rubber in Pharmaceutical Industry

Halo-butyl rubber, renowned for its exceptional air and moisture resistance, is widely acclaimed in the production of pharmaceutical stoppers and seals. Its remarkable properties ensure the integrity and safety of vital vaccines and injectable medicines. With the recent United States health crisis amplifying the demand for such life-saving products, the need for high-quality and reliable packaging solutions has surged in parallel. This surge in demand has further emphasized the importance of halo-butyl rubber in the pharmaceutical industry.Thanks to continuous research and development efforts, bromo and chloro butyl rubber variants have emerged, displaying even greater resistance to permeability. This enhanced impermeability makes them a perfect choice for critical medical applications. These halo-butyl variants not only boast exceptional sterility but also offer superior resealability, a crucial feature for multi-dose vials. The combination of heightened sterility and improved resealability ensures the safety and efficacy of medical products, providing healthcare professionals and patients with peace of mind.

Furthermore, the rising trend towards self-medication and home healthcare has fueled the demand for pre-filled syringes and auto-injectors. These user-friendly devices have become increasingly popular for their convenience and ease of use. As a result, the demand for halo-butyl rubber components, integral to the functionality and reliability of such devices, has experienced substantial growth. The compatibility of halo-butyl rubber with these advanced drug delivery systems has further propelled the expansion of the United States Halo-Butyl Rubber Market.

In conclusion, as the pharmaceutical industry continues to expand and evolve, the demand for halo-butyl rubber is poised to witness significant growth. This upward trend, coupled with ongoing research and development efforts to enhance its properties, positions the United States Halo-Butyl Rubber Market for sustained and substantial growth in the coming years. The versatility and indispensable role of halo-butyl rubber in ensuring the safety and efficacy of pharmaceutical products make it an indispensable component in the ever-evolving healthcare landscape.

Growing Demand of Halo-Butyl Rubber in Automotive Industry

Halo-butyl rubber, highly regarded for its exceptional air retention and heat resistance properties, is extensively utilized in the production of tire inner liners. Due to its superior qualities, it has become the preferred choice for manufacturers in the automotive industry. With the ongoing expansion and advancements in the automotive sector, the demand for tires incorporating halo-butyl rubber is experiencing an unprecedented surge, directly propelling the growth of the halo-butyl rubber market.In addition to the expanding automotive sector, the increasing adoption of electric vehicles (EVs) has further contributed to the rising demand for halo-butyl rubber. As EVs require tires with low rolling resistance to maximize their range, halo-butyl rubber, with its exceptional low permeability, perfectly meets this requirement. Consequently, it has become the material of choice for EV tire manufacturers, driving the demand for halo-butyl rubber even higher.

Moreover, the rise in vehicle production, particularly in emerging economies such as China and India, has significantly fueled the demand for halo-butyl rubber. As these economies continue to experience rapid growth and urbanization, the need for reliable and high-performance tires in the automotive sector is expected to increase proportionately. This, in turn, will drive the demand for halo-butyl rubber in these regions.

In conclusion, the growing demand for halo-butyl rubber in the automotive industry stands as a key driver of the United States market. With the continuous evolution of the automotive sector, particularly with the shift towards electric vehicles, the halo-butyl rubber market is poised for sustained growth in the coming years, supported by the increasing demand from tire manufacturers and the expanding automotive production in emerging economies.

Key Market Challenges

Volatility in Prices of Raw Materials

The production of halo-butyl rubber, a key component in industries such as automotive and pharmaceuticals, depends on stable and affordable access to raw materials. However, recent upheavals in the raw material market, coupled with turmoil in the energy sector, have contributed to soaring prices.This price volatility is further exacerbated by government policies that affect the cost of butyl rubber. Such unpredictable fluctuations can lead to increased production costs, which are often passed on to consumers, potentially impacting demand. For instance, when the prices of raw materials rise significantly, manufacturers may have to adjust their pricing strategies to maintain profitability, which can have a direct effect on consumer purchasing behavior.

In addition to these market dynamics, the rubber industry's supply chain complexity adds another layer of challenge. The world's productive capacity for butyl rubber, including its related"cousin" halo-butyl, is approximately 2 billion pounds annually, sourced from over 12 scattered production plants. This dispersion can lead to supply chain disruptions, further contributing to price instability. For example, if one or more of these production plants face unexpected downtime due to maintenance or logistical issues, it can create a ripple effect throughout the entire supply chain, causing delays and shortages.

In conclusion, while the United States Halo-Butyl Rubber Market is poised for substantial growth, the volatility in raw material prices poses a significant challenge. Market players will need to devise robust strategies to mitigate these risks and ensure long-term profitability. This may involve diversifying the raw material sources, establishing strategic partnerships with suppliers, and implementing effective risk management practices. by taking proactive measures, companies can navigate the complexities of the market and maintain a competitive edge in the industry.

Stringent Environmental Regulations

Halo-butyl rubber, a versatile material used extensively in industries such as automotive and pharmaceuticals, is produced through a complex chemical process that warrants attention to potential environmental implications. The production process, while efficient, can lead to the emission of harmful substances, making the industry a prime target for stringent environmental regulations.With an increasing United States focus on sustainability and environmental responsibility, many countries have taken significant steps to tighten their environmental norms and align with the goals set by the Paris Agreement. Notably, the European Union has enforced strict regulations on carbon emissions, directly impacting the chemical industry. As a result, manufacturers face increased costs as they strive to invest in innovative technologies and implement sustainable processes that reduce emissions and ensure compliance with these regulations.

Moreover, the disposal of waste products from halo-butyl rubber production poses additional environmental challenges. Improper waste disposal can lead to soil and water pollution, further intensifying regulatory scrutiny and emphasizing the need for effective waste management systems.

In conclusion, while the United States demand for halo-butyl rubber continues to grow, the industry faces significant challenges due to increasingly stringent environmental regulations. To thrive in this evolving landscape, players in the halo-butyl rubber market must embrace innovation and adaptability, investing in cleaner production methods and robust waste management systems that align with sustainability goals. by doing so, they can not only meet regulatory requirements but also contribute to a greener and more sustainable future.

Key Market Trends

Increased Focus on Chemical Resistance

Halo-butyl rubber, known for its outstanding resistance to chemicals, heat, and ozone, is rapidly gaining traction across various industries. This unique chemical resistance property is particularly advantageous in applications where the material is exposed to harsh or corrosive environments, ensuring optimal performance and longevity.One of the primary consumers of halo-butyl rubber is the automotive industry, which highly values this material for its exceptional resilience against a wide range of automotive fluids and extreme temperatures. Specifically, in the manufacture of tire inner liners, the exceptional chemical resistance of halo-butyl rubber plays a crucial role in ensuring the durability and longevity of tires, even in challenging conditions.

In the pharmaceutical industry, the chemical resistance of halo-butyl rubber makes it an ideal choice for stoppers and seals used in drug packaging. These components come into direct contact with various drugs, making it vital that they withstand any potential chemical reactions. The reliability and compatibility of halo-butyl rubber contribute to the safe and efficient packaging of pharmaceutical products.

Moreover, the oil and gas industry also benefit significantly from the exceptional chemical resistance of halo-butyl rubber. It is widely used in the production of gaskets and seals that need to withstand the harsh conditions encountered in drilling and refining processes. The superior chemical resistance of halo-butyl rubber ensures the integrity and reliability of these critical components, enhancing overall operational efficiency and safety.

In conclusion, the increased focus on chemical resistance is a significant trend shaping the United States Halo-Butyl Rubber Market. As industries continue to demand materials capable of withstanding even the harshest environments, the market for halo-butyl rubber is poised to experience exponential growth, driven by its exceptional chemical resistance properties and its ability to meet the diverse needs of various industries.

Segmental Insights

Type Insights

Based on the category of type, the Chloro-Butyl Rubber segment emerged as the dominant player in the United States market for Halo-Butyl Rubber in 2022. Chloro-butyl rubber, a type of synthetic rubber, possesses exceptional impermeability to gases, including air, oxygen, and moisture. This remarkable property makes it highly valuable in a wide range of applications where maintaining a hermetic seal or barrier is of utmost importance. For instance, in the pharmaceutical industry, chloro-butyl rubber is extensively used for producing stoppers for vials, ampoules, and infusion bags, ensuring the protection of sensitive medications and medical devices from the harmful effects of oxygen and moisture.In addition to its use in the pharmaceutical sector, chloro-butyl rubber has found extensive application in the tire industry, specifically in tire inner liners. This material has become a major staple in the tire manufacturing process due to its ability to enhance air retention, reduce rolling resistance, and improve overall tire performance. These desirable qualities have significantly driven the demand for chloro-butyl rubber among tire manufacturers worldwide.

Apart from its contributions to the pharmaceutical and tire industries, chloro-butyl rubber's excellent resistance to chemicals, oils, and solvents makes it an ideal choice for various industrial applications. Its reliable performance as gaskets, seals, and linings in equipment and containers offers vital protection against corrosive substances. This versatility and durability have made chloro-butyl rubber a preferred material in industries that deal with potentially harmful chemicals and solvents.

Overall, chloro-butyl rubber's remarkable impermeability, versatility, and resistance to chemicals have established its importance in critical sectors such as pharmaceuticals, tire manufacturing, and industrial applications, where maintaining high-quality performance and protection are paramount.

Application Insights

The Tubes & Tires segment is projected to experience rapid growth during the forecast period. Halo-butyl rubber, a type of synthetic rubber, exhibits exceptional impermeability to gases, including air. This remarkable property is particularly crucial in tire inner liners, where it plays a vital role in maintaining proper tire inflation over an extended period of time. by effectively retaining air, halo-butyl rubber enhances overall tire performance, fuel efficiency, and safety, ensuring a smooth and reliable driving experience.Tires made with halo-butyl rubber inner liners not only offer superior impermeability but also provide reduced rolling resistance compared to those made with other materials. The lower rolling resistance translates to improved fuel efficiency in vehicles, making tires with halo-butyl rubber highly desirable for both manufacturers and consumers alike. Moreover, the impermeability of halo-butyl rubber contributes to the longevity of tires by preventing the penetration of air and moisture, thereby reducing the risk of oxidation, aging, and degradation. As a result, tires made with halo-butyl rubber are widely recognized for their exceptional durability and extended lifespan.

The increasing demand for high-performance tires is driven by various factors, including the rising popularity of sports cars, luxury vehicles, and consumers' preferences for enhanced handling and safety. To meet these demands, tire manufacturers often incorporate halo-butyl rubber in the inner liners of high-performance tires. This strategic use of halo-butyl rubber ensures that these tires deliver superior performance, offering exceptional grip, traction, and responsiveness on the road.

In summary, the remarkable impermeability, lower rolling resistance, and extended durability of halo-butyl rubber make it an ideal material for tire inner liners. Its contribution to maintaining proper tire inflation, improving fuel efficiency, and enhancing overall tire performance has positioned halo-butyl rubber as a highly sought-after component in the tire industry.

Regional Insights

Midwest emerged as the dominant player in the United States Halo-Butyl Rubber Market in 2022, holding the largest market share in terms of value. The Midwest region has undergone a significant period of rapid industrialization and urbanization. This accelerated growth has resulted in a surge in demand for halo-butyl rubber across various industries, including automotive, pharmaceuticals, construction, and chemicals.Among these industries, the automotive sector stands out as a major consumer of halo-butyl rubber, primarily for tire manufacturing. In recent years, the Midwest region has witnessed remarkable growth in automotive production. This exponential increase in production has significantly contributed to the region's dominance in the halo-butyl rubber market.

As a result, the region has become a hub for tire manufacturing, with numerous tire production facilities strategically located in this area. Halo-butyl rubber plays a pivotal role as a crucial component in tire inner liners, ensuring optimal performance and safety. The region's booming tire industry has thus driven substantial demand for this specialized material.

Key Market Players

- Exxon Mobil Corporation

- ARLANXEO Holding BV

- SIBUR Holding PJSC

- LANXESS AG

- Natraj Rubbers

- Zhejiang Cenway Materials Co., Ltd.

- Eswar Rubber Products Pvt. Ltd.

- Sinopec Group

- Reliance Industries Limited

- Japan Butyl Co. Ltd.

Report Scope

In this report, the United States Halo-Butyl Rubber Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:United States Halo-Butyl Rubber Market, by Type:

- Chloro-Butyl Rubber

- Bromo-Butyl Rubber

- Others

United States Halo-Butyl Rubber Market, by Application:

- Tubes & Tires

- Pharmaceuticals

- Construction

- Automotive

- Others

United States Halo-Butyl Rubber Market, by Region:

- Northeast

- Midwest

- South

- West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the United States Halo-Butyl Rubber Market.Available Customizations

The following customization option is available based on your specific needs: Detailed analysis and profiling of additional market players (up to five).This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Exxon Mobil Corporation

- ARLANXEO Holding BV

- SIBUR Holding PJSC

- LANXESS AG

- Natraj Rubbers

- Zhejiang Cenway Materials Co. Ltd.

- Eswar Rubber Products Pvt. Ltd.

- Sinopec Group

- Reliance Industries Limited

- Japan Butyl Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 90 |

| Published | October 2023 |

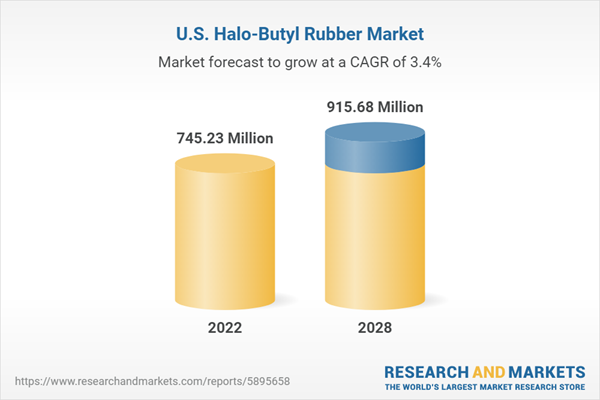

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 745.23 Million |

| Forecasted Market Value ( USD | $ 915.68 Million |

| Compound Annual Growth Rate | 3.3% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |