Speak directly to the analyst to clarify any post sales queries you may have.

MARKET DRIVERS

Growing Importance of IVD In Healthcare: The technological innovation and its application in healthcare are leading to the practical implementation of new treatment methods. The expectations for personalized medicine are growing, wherein medication and treatment are tailored to each patient's unique characteristics and medical condition. Testing is likely to play an increasingly important role in healthcare, as the realization of personalized medicine will require testing to confirm individual characteristics. For instance, cancer genomic medicine, which has begun earnestly, requires analysis of genetic information within cancer cells through genetic testing. Sysmex is working to achieve this type of cancer genomic medicine and to make liquid biopsy a reality.Increasing Adoption Of Automation in Laboratories: Integrating automation into the IVD manufacturing process has many benefits for IVD device designers and manufacturers. Automation allows for the inclusion of software-based calculation, calibration, and documentation, improving test efficiency, calibration schedules, regulatory compliance, and instrument/equipment traceability. These benefits reduce labor, lower error (standardization) risk, and fewer calibration tests. Furthermore, automated volumetric measurements simplify production fabrication processes by giving manufacturers better control over manufacturing equipment and steps in the production line.

U.S. IN-VITRO DIAGNOSTICS MARKET HIGHLIGHTS

- The reagents and consumables product segment occupies a major market share of over 67% in the U.S. in-vitro diagnostics (IVDs) market. Reagents and consumables are used in in-vitro diagnostics procedures as a medium and transporter of specimens. With the increasing adoption of in-vitro diagnostics solutions, the demand for reagents and consumables is increasing. Infectious diseases and pandemics such as COVID-19 significantly fuel the demand for reagents in diagnosis.

- By technology, the hematology segment is growing significantly, with the highest CAGR of 3.05% during the forecast period. The growth of the segment is attributed to the increasing incidences of blood disorders and other diseases, rapid technological advances in hematology, and the emergence of high-throughput hematology analyzers.

- The diabetes application segment is propelling, with the fastest-growing CAGR in the U.S. market during the forecast period. The rising health consciousness among the population and the demand for diabetes monitoring devices, coupled with the easy availability of advanced diabetes devices, are fostering market growth in this country.

- The standard reference labs segment dominated the market share of the U.S. in-vitro diagnostics market. The segmental growth is primarily due to impeccable quality control standards, delivering top-tier testing services to hospitals, clinics, and various public and private healthcare institutions. Standard reference laboratories majorly contribute to the in-vitro diagnostics (IVD) market. These facilities undertake multiple responsibilities and a broad network of labs across regions. They are adept at conducting intricate and high-risk tests for many purposes.

VENDOR LANDSCAPE

The U.S. in-vitro diagnostics (IVDs) market report contains exclusive data on 83 vendors. The competition among market players in the IVD market is significantly high for products, solutions, reagents, consumables, and services in terms of pricing, product, and associated brand image, services, and associated quality, a new product launched and developed, customer services, and financing terms. The leading market players in the US IVD market are F Hoffmann-La Roche, Abbott, Thermo Fisher Scientific, Diasorin, Biomerieux, Danaher, Bio-Rad, and Siemens Healthineers, competing with rapidly emerging market players. Vendors in the market are increasing their market share through inorganic growth strategies.SEGMENTATION & FORECAST

- Products & Services

- Reagents and Consumables

- Instruments/Analyzers & Software

- Services

- Technology

- Immuno and Clinical Chemistry

- Molecular Diagnostics

- Hematology

- Microbiology and Cytology

- Others

- Application

- Infectious Diseases

- Diabetes

- Cardiology

- Oncology

- Autoimmune Diseases

- Nephrology

- Drug Testing

- Others

- End-Users

- Standard reference labs

- Hospital Affiliated Labs

- Individuals

- Clinics

- Others

Vendors List

Key Vendors

- Abbott Laboratories

- bioMerieux

- Danaher

- Roche

- Bio-Rad

- Siemens Healthineers

- Thermo Fisher Scientific

- Diasorin

Other Prominent Vendors

- Qiagen

- Quest Diagnostics

- Atomo Diagnostics

- Sysmex Corp

- Accelerate Diagnostics

- Arkray Inc

- Agilent Technologies

- BD

- Illumina

- Mindray

- Revvity

- Grifols

- Hologic

- Amoy Diagnostics

- Altona

- Cepheid

- Exact Sciences

- Beckman Coulter

- QuidelOrtho

- Tosoh

- Myriad Genetics

- AccuBio Tech

- Agappe Technologies

- Balio Diagnostics

- B&E BIO-TECHNOLOGY

- bioLytical Laboratories

- Biosynex

- Biocartis

- Biocept

- Biomerica

- Boule Diagnostics

- Cupid

- Caredx

- Chembio Diagnostics

- Clindiag Systems

- Contec Medical Systems

- CellaVision

- Dialab

- Dexcom

- Diagon

- Diatron

- Dirui

- Drucker Diagnostics

- EDAN Instruments

- EKF Diagnostics Holding

- ELITechGroup

- Erba Diagnostics

- Genrui Biotech

- High Technology

- Horiba

- Linear Chemicals

- INTEC

- J. Mitra & Co.

- Maccura Biotechnology

- Medsource ozone Biomedicals

- Meril Life Sciences

- MP Biomedicals

- NIHON KOHDEN

- Norma

- NOWDiagnostics

- OPKO Health

- OraSure Technologies

- Perkin Elmer

- Prestige Diagnostics

- Seasun Biomaterials

- Sekisui Diagnostics

- SFRI

- Shenzhen Dymind Biotechnology

- Shenzhen Landwind Medical

- Sinocare

- Spinreact

- The Binding Site Group

- Trinity Biotech

- Trivitron Healthcare

- Trividia Health

KEY QUESTIONS ANSWERED

1. How big is the U.S. in-vitro diagnostics (IVDs) market?2. What are the key trends in the U.S. in-vitro diagnostics (IVDs) market?

3. Who are the major players in the U.S. in-vitro diagnostics (IVDs) market?

4. What is the growth rate of the U.S. in-vitro diagnostics (IVDs) market?

Table of Contents

Companies Mentioned

- Abbott Laboratories

- bioMerieux

- Danaher

- Roche

- Bio-Rad

- Siemens Healthineers

- Thermo Fisher Scientific

- Diasorin

- Qiagen

- Quest Diagnostics

- Atomo Diagnostics

- Sysmex Corp

- Accelerate Diagnostics

- Arkray Inc

- Agilent Technologies

- BD

- Illumina

- Mindray

- Revvity

- Grifols

- Hologic

- Amoy Diagnostics

- Altona

- Cepheid

- Exact Sciences

- Beckman Coulter

- QuidelOrtho

- Tosoh

- Myriad Genetics

- AccuBio Tech

- Agappe Technologies

- Balio Diagnostics

- B&E BIO-TECHNOLOGY

- bioLytical Laboratories

- Biosynex

- Biocartis

- Biocept

- Biomerica

- Boule Diagnostics

- Cupid

- Caredx

- Chembio Diagnostics

- Clindiag Systems

- Contec Medical Systems

- CellaVision

- Dialab

- Dexcom

- Diagon

- Diatron

- Dirui

- Drucker Diagnostics

- EDAN Instruments

- EKF Diagnostics Holding

- ELITechGroup

- Erba Diagnostics

- Genrui Biotech

- High Technology

- Horiba

- Linear Chemicals

- INTEC

- J. Mitra & Co.

- Maccura Biotechnology

- Medsource ozone Biomedicals

- Meril Life Sciences

- MP Biomedicals

- NIHON KOHDEN

- Norma

- NOWDiagnostics

- OPKO Health

- OraSure Technologies

- Perkin Elmer

- Prestige Diagnostics

- Seasun Biomaterials

- Sekisui Diagnostics

- SFRI

- Shenzhen Dymind Biotechnology

- Shenzhen Landwind Medical

- Sinocare

- Spinreact

- The Binding Site Group

- Trinity Biotech

- Trivitron Healthcare

- Trividia Health

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

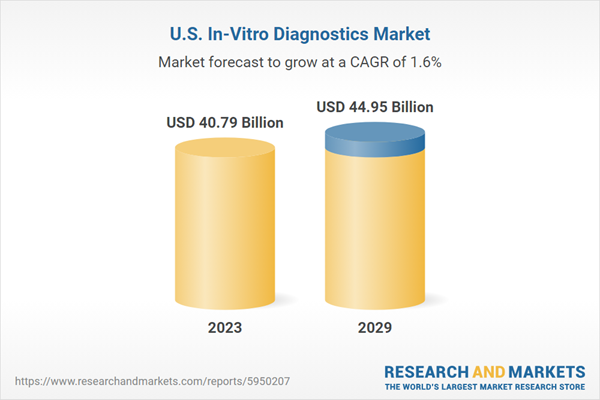

| Report Attribute | Details |

|---|---|

| No. of Pages | 115 |

| Published | April 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 40.79 Billion |

| Forecasted Market Value ( USD | $ 44.95 Billion |

| Compound Annual Growth Rate | 1.6% |

| Regions Covered | United States |

| No. of Companies Mentioned | 83 |