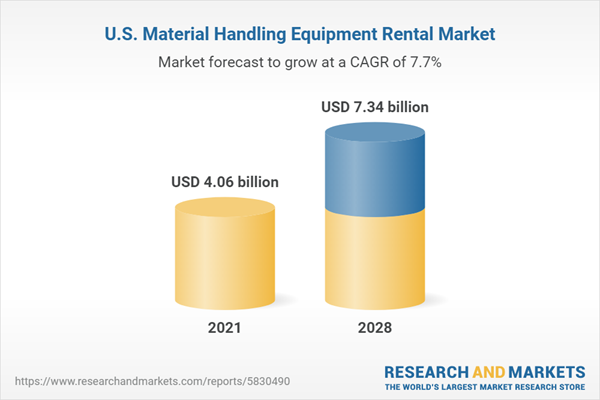

The United States material handling equipment rental market is estimated to grow at a CAGR of 7.68% from US$4.062 billion in 2020 to US$7.342 billion by 2028.

The market expansion is anticipated to be fueled by increasing construction and mining activities and industrial growth throughout the course of the forecast timeframe. In order to reduce the size of their fleets and the complexity of their organizations, which could otherwise have an impact on operations like asset disposal, transportation, maintenance, and procurement, contractors and dealers are choosing to rent instead of buy, which has resulted in a significant increase in the number of companies using rental services. The need for these services is growing as infrastructure projects are undertaken, which is fostering the expansion of the equipment rental market in the country.Additionally, the development of cutting-edge technology and the adoption of automation systems are anticipated to fuel growth. The widespread use of drum lifters, crown pallet cranes, electric pallet trucks, and other well-liked lifting accessories in a number of end-use industries, like engineering, machining, and car lifts, is anticipated to drive the U.S. material handling equipment rental market. Due to the high rate of technological developments among regional producers, such as automated processes, AI, and machine learning, which are quickly advancing the industry, the nation's modern industrial facilities rely on new inventions and technologies to manufacture goods of greater quality. However, the high equipment cost makes renting equipment a suitable alternative that leads to cost management. For instance, a 65% decrease in emissions by 2030 and a net-zero emissions goal by 2050 were announced by the US government in 2022. In response to the announcement, industries are switching to zero-emission power. In an effort to lessen the harmful effects of its operations and assist clients in lowering their carbon footprints, United Rentals, the largest rental firm in the world, announced its cooperation with Turner. In order to allow customers to assess the environmental impact, United Rental also installed total control emission tracking devices in the equipment they were renting.

Further, government spending on public infrastructure is driving up demand for construction equipment rentals in the United States.

The Federal Aviation Administration (FAA) announced a 3 billion USD investment to upgrade terminals at 3,075 airports across the United States. The U.S. Army Corps of Engineers (USACE), on the other hand, floated USD 3.9 billion to reinforce ports and waterways and improve supply chains. It spans ten states and more than 16 construction projects for which the rental conveyors will be used. 800 miles of rail and up to 24 stations would be built as part of California's high-speed rail system. The undertaking will link Sacramento and San Diego to Los Angeles and San Francisco.The increase in retail sales has emerged as a significant growth factor for warehouse management in the material handling equipment rental market in the country.

The retail industry has been experiencing significant growth, with e-commerce sales in the United States reaching USD 791.7 billion in 2020, up by 32.4% compared to the previous year, according to the U.S. Census Bureau. This surge in online retail has led to an increased need for efficient warehouse management to handle the growing volume of orders, manage inventory, and ensure timely order fulfillment. As retailers strive to meet customer demands for faster delivery times and seamless online shopping experiences, the importance of efficient warehouse operations has grown significantly. As the retail sector continues to expand, driven by factors such as e-commerce, changing consumer behaviors, and economic expansion, the demand for efficient warehouse management solutions will continue to rise.BY EQUIPMENT

- Cranes & Hoists

- Conveyors

- Industrial Trucks and Lifts

- Others

BY APPLICATION

- Warehouse Management

- Assembly

- Bulk Handling

- Others

BY END-USER INDUSTRY

- Manufacturing

- E-commerce

- Mining

- Food & Beverage

- Others

BY STATE

- California

- Texas

- Illinois

- Pennsylvania

- Others

Table of Contents

Companies Mentioned

- United Rentals Inc.

- Ashtead Group plc

- MH Equipment

- MacAllister Rentals

- Herc Rentals Inc.

- H&E Equipment Services

- Maxim Crane Works, L.P.

- LiftOne

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 115 |

| Published | June 2023 |

| Forecast Period | 2021 - 2028 |

| Estimated Market Value ( USD | $ 4.06 billion |

| Forecasted Market Value ( USD | $ 7.34 billion |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | United States |

| No. of Companies Mentioned | 8 |