Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The United States oilfield equipment rental market plays a vital role in supporting the country's dynamic oil and gas industry. This market encompasses a wide range of equipment essential for various stages of exploration, drilling, completion, and production processes. With the resurgence of oil prices and increasing domestic production, particularly in shale formations, demand for rental equipment has surged. Companies prefer renting over purchasing equipment to maintain operational flexibility, minimize capital expenditure, and adapt to fluctuating market conditions.

One of the primary drivers of growth in the U.S. oilfield equipment rental market is the rising activity in shale oil and gas production. Regions like the Permian Basin, Bakken, and Eagle Ford have attracted substantial investment, creating a robust demand for drilling rigs, completion tools, and production equipment. Rental services provide operators with access to the latest technologies without the burden of high capital costs associated with purchasing equipment. This trend is particularly pronounced among small to mid-sized operators who may lack the financial resources to invest in expensive machinery.

Technological advancements are also reshaping the oilfield equipment rental landscape. The integration of smart technologies, such as remote monitoring and automation, has enhanced the efficiency and safety of drilling operations. Rental companies are increasingly adopting innovative solutions that optimize equipment utilization and streamline maintenance processes, providing clients with improved service offerings. As environmental regulations tighten, the demand for advanced and eco-friendly equipment solutions is rising, prompting rental companies to invest in sustainable technologies that reduce environmental impact.

Geographically, the U.S. oilfield equipment rental market is heavily concentrated in oil-producing regions, particularly in the Gulf Coast, Southwest, and Northern Plains. The growth of offshore drilling in the Gulf of Mexico presents additional opportunities, as companies seek rental solutions for specialized offshore equipment.

However, challenges persist in the market, including price volatility in oil and gas, which can impact investment decisions and rental activity. Furthermore, labor shortages and supply chain disruptions may affect equipment availability and rental operations. Despite these challenges, the outlook for the U.S. oilfield equipment rental market remains positive, driven by continued exploration and production activities, technological innovations, and the need for cost-effective operational solutions in a competitive energy landscape. As companies navigate the evolving energy landscape, the rental market is poised to play a critical role in supporting their operational needs and enhancing overall efficiency.

Key Market Drivers

Rising Demand for Oil and Natural Gas

The increasing global demand for oil and natural gas is a primary driver of the United States oilfield equipment rental market. As the world continues to rely on fossil fuels for energy, U.S. production has ramped up, particularly in shale-rich areas like the Permian Basin and Bakken Formation. The U.S. aims to maintain its position as a leading oil and gas producer, and to achieve this, exploration and production activities must be sustained.The preference for rental equipment over outright purchase allows companies to quickly scale operations in response to market fluctuations without committing significant capital upfront. This flexibility is particularly attractive to independent operators and smaller firms that may not have the financial capacity to invest in expensive drilling and production equipment. As domestic production increases, so does the need for specialized equipment such as drilling rigs, completion tools, and support machinery. This trend is expected to continue, propelling the growth of the oilfield equipment rental market.

Technological Advancements

Technological innovations are significantly influencing the U.S. oilfield equipment rental market. Advances in drilling technologies, such as horizontal drilling and hydraulic fracturing, have enhanced the efficiency of oil and gas extraction, leading to greater output from existing wells. Equipment rental companies are increasingly adopting smart technologies, including remote monitoring systems and automation, which improve operational efficiency and safety. These innovations enable real-time data analysis, allowing operators to optimize drilling performance and reduce downtime.Additionally, the incorporation of eco-friendly technologies, such as energy-efficient rigs and equipment that minimizes environmental impact, is becoming essential as regulations tighten. The continuous evolution of technology ensures that rental companies can offer state-of-the-art solutions, catering to the needs of exploration and production firms seeking to enhance their competitive edge while managing operational costs. As these advancements reshape drilling practices, the demand for modern, specialized rental equipment will likely increase.

Cost-Effectiveness and Operational Flexibility

Cost-effectiveness is a significant driver behind the growth of the U.S. oilfield equipment rental market. Renting equipment allows companies to avoid large capital expenditures associated with purchasing machinery, which is particularly advantageous in an industry characterized by price volatility and fluctuating demand. Rental agreements provide operators with access to the latest equipment without the financial burden of ownership, including maintenance and storage costs.This model is especially beneficial for small to mid-sized companies that may lack the resources to invest heavily in equipment. Additionally, the operational flexibility offered by rental services enables companies to adapt quickly to changing market conditions, such as shifts in demand or project requirements. Operators can easily scale their equipment needs up or down based on current projects, allowing for agile responses to market fluctuations. This flexibility not only reduces financial risk but also enhances overall operational efficiency, making equipment rental an increasingly attractive option in the oil and gas sector.

Increasing Offshore Exploration Activities

The growth of offshore exploration activities in the U.S. is a significant driver of the oilfield equipment rental market. The Gulf of Mexico remains a key area for offshore drilling, offering substantial reserves of oil and natural gas. As energy companies seek to tap into these resources, the demand for specialized offshore drilling equipment, including rigs, subsea production systems, and support vessels, has surged. Rental companies are uniquely positioned to meet this demand, providing operators with access to the latest technologies without the capital costs associated with purchasing.The complexity and high cost of offshore operations make rental services an appealing choice for companies looking to minimize financial risk while maximizing exploration and production efficiency. Furthermore, advancements in offshore drilling technologies and techniques, such as floating production storage and offloading (FPSO) units, have enhanced operational capabilities, leading to increased investments in offshore projects. As exploration in the Gulf of Mexico and other offshore regions expands, the rental market is set to benefit significantly from this trend.

Key Market Challenges

Price Volatility of Oil and Gas

One of the primary challenges facing the United States oilfield equipment rental market is the inherent price volatility of oil and gas. Fluctuations in commodity prices can significantly impact exploration and production budgets, leading operators to adjust their rental needs accordingly. When prices fall, companies may reduce drilling activity or delay projects, directly affecting the demand for rented equipment.This cyclical nature creates uncertainty in the rental market, as equipment providers must navigate the highs and lows of the industry. Additionally, prolonged periods of low prices can drive smaller operators out of business, reducing the overall customer base for rental services. To mitigate this challenge, rental companies often implement flexible pricing strategies and service offerings, allowing them to remain competitive even during downturns. However, sustaining profitability while adapting to these fluctuations remains a key concern.

Labor Shortages and Skills Gap

The oilfield equipment rental market faces significant challenges related to labor shortages and a skills gap within the industry. As the oil and gas sector grows, there is a heightened demand for skilled workers to operate advanced drilling equipment and technologies. However, an aging workforce combined with a lack of interest from younger generations has created a talent deficit.This shortage affects not only operators but also rental companies that require skilled personnel for equipment maintenance and operation. The skills gap poses risks to safety, efficiency, and operational continuity, as inexperienced workers may struggle to manage complex equipment. To address this challenge, companies must invest in training programs, partnerships with educational institutions, and recruitment efforts aimed at attracting talent. However, the time and resources required for these initiatives can strain budgets, particularly for smaller rental firms.

Regulatory Compliance and Environmental Concerns

Navigating regulatory compliance and addressing environmental concerns are significant challenges for the U.S. oilfield equipment rental market. The industry is subject to stringent federal and state regulations aimed at ensuring safety and minimizing environmental impact. Compliance with these regulations requires rental companies to invest in high-quality, environmentally friendly equipment and technologies, which can increase operational costs.Additionally, changes in regulations can create uncertainty, prompting companies to adapt quickly to new requirements, further straining resources. Environmental concerns, such as greenhouse gas emissions and water usage, have led to increased scrutiny from stakeholders, including investors, customers, and communities. Rental companies must demonstrate a commitment to sustainable practices and invest in eco-friendly equipment to maintain their market position. Balancing regulatory compliance with cost-effectiveness is an ongoing challenge that requires proactive management and strategic planning.

Supply Chain Disruptions

The U.S. oilfield equipment rental market is increasingly susceptible to supply chain disruptions, which can significantly impact the availability of essential equipment. Various factors, including geopolitical tensions, trade disputes, and natural disasters, can lead to delays in equipment delivery, shortages of critical components, and increased costs.These disruptions hinder rental companies' ability to fulfill customer orders promptly, potentially leading to lost business opportunities and diminished customer satisfaction. Additionally, fluctuations in material costs and production timelines can complicate inventory management and pricing strategies. To mitigate supply chain risks, rental companies must diversify their supplier base, invest in local sourcing, and enhance inventory management practices. However, these strategies require careful planning and may involve higher initial costs, posing a challenge for companies seeking to maintain competitive pricing while ensuring a reliable supply of equipment.

Technological Advancements and Competition

Rapid technological advancements present both opportunities and challenges for the U.S. oilfield equipment rental market. While innovation can enhance operational efficiency and safety, it also increases competition among rental providers. Companies must continuously invest in upgrading their fleets with the latest technologies, such as automated drilling systems, telemetry, and data analytics tools, to remain competitive.However, these investments can strain financial resources, particularly for smaller rental companies that may struggle to keep pace with larger competitors. Furthermore, the need to train personnel on new technologies adds another layer of complexity and cost. As customers increasingly demand more advanced and efficient solutions, rental companies must strike a balance between investing in innovation and maintaining profitability. Failure to adapt to technological advancements can result in losing market share to more agile competitors, underscoring the need for ongoing evaluation and strategic planning in an evolving industry landscape.

Key Market Trends

Increased Demand for Advanced Technologies

The United States oilfield equipment rental market is witnessing a significant trend toward the adoption of advanced technologies. Operators are increasingly opting for equipment that incorporates smart technologies, such as IoT sensors, real-time data analytics, and automated systems. These advancements enhance operational efficiency by providing real-time insights into equipment performance, enabling predictive maintenance, and reducing downtime. By leveraging data analytics, companies can optimize their drilling and production processes, leading to improved safety and cost-effectiveness. Moreover, advanced technologies also facilitate compliance with stringent regulatory requirements by enhancing monitoring and reporting capabilities. As the market continues to evolve, rental companies that invest in innovative equipment and technologies will gain a competitive edge, attracting clients seeking to optimize their operations and reduce costs.Growing Preference for Equipment Rental Over Purchase

A notable trend in the U.S. oilfield equipment rental market is the growing preference among operators to rent rather than purchase equipment. This shift is driven by several factors, including the need for cost management, flexibility, and reduced financial risk. Renting equipment allows companies to avoid significant capital expenditures associated with purchasing, which is particularly appealing in a volatile oil price environment. Additionally, renting provides access to the latest technologies and equipment without long-term commitments, enabling operators to adapt quickly to changing project requirements and market conditions. This trend is particularly prevalent among small to mid-sized operators who may lack the financial resources to invest in expensive machinery. As the market matures, the emphasis on rental solutions is expected to intensify, leading to a more diverse range of rental offerings.Expansion of Offshore Drilling Activities

The U.S. oilfield equipment rental market is experiencing growth due to the expansion of offshore drilling activities, particularly in the Gulf of Mexico. As operators seek to tap into deepwater reserves and maximize production, the demand for specialized offshore equipment rental services is rising. Companies are increasingly relying on rental providers to supply advanced drilling rigs, subsea equipment, and support vessels tailored for offshore operations. This trend is supported by technological advancements that enhance the safety and efficiency of offshore drilling processes. Furthermore, as oil prices stabilize and the regulatory environment becomes more favorable, investments in offshore projects are expected to increase, further driving the demand for rental equipment. The expansion of offshore drilling activities is poised to create significant opportunities for rental companies specializing in offshore solutions.Segmental Insights

Application Insights

Onshore segment dominates in the United States Oilfield Equipment Rental market in 2023, primarily due to the significant activity in shale oil and gas production. Key regions such as the Permian Basin, Bakken, and Eagle Ford are driving this trend, characterized by a high concentration of drilling and production operations. These areas are rich in hydrocarbons and have become focal points for exploration and extraction, leading to an increased demand for a variety of rental equipment, including drilling rigs, completion tools, and production systems.One of the main factors contributing to the dominance of the onshore segment is the economic advantages it offers. Onshore operations generally incur lower costs compared to offshore drilling, including reduced logistics, infrastructure, and operational expenses. This cost-effectiveness makes onshore projects more appealing, especially in a fluctuating market environment where operators seek to maximize returns on investment.

Technological advancements also play a crucial role in boosting the onshore segment. Innovations such as hydraulic fracturing and horizontal drilling have revolutionized onshore production, allowing operators to access previously untapped reserves efficiently. These technologies have increased recovery rates and enhanced the overall economics of shale plays, further propelling demand for rental equipment tailored for these operations.

Additionally, the increasing focus on energy independence and domestic production is driving investment in onshore projects. With the U.S. government promoting policies that favor energy production, operators are more inclined to invest in onshore drilling activities. This strategic focus has led to a surge in exploration and production activities, directly impacting the demand for rental equipment.

Furthermore, the onshore segment benefits from a well-established supply chain and infrastructure, facilitating quicker mobilization and deployment of rental equipment. As operators look to streamline their operations, the availability of reliable rental solutions for onshore activities continues to solidify its dominance in the U.S. oilfield equipment rental market in 2023.

Regional Insights

Northeast dominates the United States Oilfield Equipment Rental market in 2023, primarily due to its significant oil and natural gas production, particularly from the Marcellus and Utica shale formations. These regions are among the largest sources of natural gas in the U.S., driving robust demand for rental equipment as operators seek to capitalize on the region’s abundant resources.One of the key factors contributing to this dominance is the increasing activity in shale gas extraction. The Marcellus Shale, located primarily in Pennsylvania and West Virginia, has become a focal point for major oil and gas companies, leading to heightened drilling and completion activities. As a result, there is a corresponding demand for various equipment, including drilling rigs, completion tools, and production equipment. Rental services are particularly attractive in this context, allowing operators to access the latest technologies without incurring the high capital costs associated with purchasing.

Moreover, the Northeast's established infrastructure, including pipelines and processing facilities, enhances its position in the oilfield equipment rental market. This infrastructure not only facilitates the efficient movement of resources but also supports a more integrated supply chain for rental services. Companies can quickly mobilize equipment to meet the demands of ongoing projects, thereby reducing downtime and increasing operational efficiency. The regulatory environment in the Northeast has evolved to support the expansion of oil and gas activities. As the demand for cleaner energy sources increases, the focus on natural gas as a transition fuel has further bolstered production in the region, creating a favorable market for equipment rentals.

Key Players Profiled in this United States Oilfield Equipment Rental Market Report

- Transocean Ltd.

- Noble Corporation

- Halliburton Company

- Schlumberger Limited

- Baker Hughes Holdings LLC

- Cactus, Inc.

- Weatherford International plc

- National Oilwell Varco, Inc.

- Precision Drilling Corporation

- Key Energy Services, Inc.

Report Scope:

In this report, the United States Oilfield Equipment Rental Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:United States Oilfield Equipment Rental Market, By Equipment Type:

- Drilling Equipment

- Pressure & Flow Control Equipment

- Other Equipment

United States Oilfield Equipment Rental Market, By Application:

- Onshore

- Offshore

United States Oilfield Equipment Rental Market, By Region:

- Northeast

- Southwest

- West

- Southeast

- Midwest

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the United States Oilfield Equipment Rental Market.Available Customizations:

United States Oilfield Equipment Rental Market report with the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies in the United States Oilfield Equipment Rental market, which are profiled in this report include:- Transocean Ltd.

- Noble Corporation

- Halliburton Company

- Schlumberger Limited

- Baker Hughes Holdings LLC

- Cactus, Inc.

- Weatherford International plc

- National Oilwell Varco, Inc.

- Precision Drilling Corporation

- Key Energy Services, Inc.

Table Information

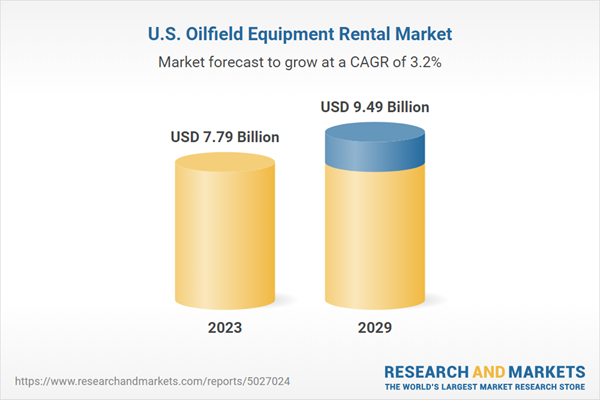

| Report Attribute | Details |

|---|---|

| No. of Pages | 88 |

| Published | November 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 7.79 Billion |

| Forecasted Market Value ( USD | $ 9.49 Billion |

| Compound Annual Growth Rate | 3.1% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |