Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the widespread implementation of these devices faces a significant challenge regarding data privacy and employee surveillance concerns. The continuous collection of sensitive biometric and location data often triggers legal and ethical compliance issues, leading to workforce resistance and hesitance among organizations to fully integrate these systems into their operational infrastructure. Consequently, the potential for seamless integration into corporate infrastructure is often hindered by the complex balance between maintaining safety and respecting individual privacy rights.

Market Drivers

The growing utilization of wearable technology within the defense and law enforcement sectors serves as a major driver for market expansion, fundamentally transforming procurement approaches across public safety organizations. Contemporary police and military units increasingly depend on advanced body-worn cameras and interconnected sensors to guarantee accountability, improve evidence handling, and boost situational awareness during high-stakes events. This sector-specific drive is reflected in strong financial results from major industry leaders; for instance, Axon Enterprise’s 'Q3 2025 Shareholder Letter' in November 2025 revealed a 31% year-over-year revenue rise to $711 million, largely fueled by high demand for next-generation cameras and related cloud software. Similarly, Motorola Solutions reported ending its third quarter in 2025 with a record backlog of $14.6 billion, highlighting the enduring global demand for integrated security ecosystems.Concurrently, the rapid assimilation of IoT, 5G, and Artificial Intelligence is reshaping the operational potential of wearable security devices. The transition toward broad 5G usage enables the high-bandwidth, low-latency data transfer necessary for supporting real-time video streaming and AI-powered threat detection directly on devices without delay. As noted by the GSMA in its 'The Mobile Economy North America 2025' report from October 2025, 60% of mobile internet users in the region now utilize 5G networks, creating the essential infrastructure for deploying data-heavy security wearables. These technological strides ensure that such devices evolve beyond passive recording roles into active instruments that facilitate immediate emergency responses and preventative monitoring in challenging environments.

Market Challenges

The widespread issue of data privacy and apprehension regarding employee surveillance serves as a major barrier to the commercial scaling of the Global Wearable Security Device Market. Although these devices are acquired to enhance safety, their capacity to constantly monitor location and biometric statistics fosters a significant lack of trust between management and staff. This tension often prolongs adoption timelines, as companies encounter resistance from unions and workers who view such measures as invasive monitoring rather than protective support. As a result, organizations must navigate intricate legal compliance terrains and internal disputes, which ultimately delays procurement processes and restricts the operational deployment of these security measures.This reluctance is further supported by an increasing call for regulatory supervision concerning workplace technology. Data from the Trades Union Congress in 2024 indicates that 69% of workers felt employers should be legally required to consult with staff prior to introducing new technologies, such as monitoring tools, into the work environment. This statistic highlights the profound level of workforce opposition, suggesting that security wearables cannot be mandated without causing substantial discord. Consequently, the market faces reduced growth rates as many enterprises choose to postpone investments to prevent potential legal disputes or morale issues, thereby directly hindering the sector's revenue development.

Market Trends

The extension of body-worn camera utilization from law enforcement into the retail sector marks a notable market evolution, propelled by increasing workplace violence and the necessity to protect employees. Retail businesses are progressively adopting these devices not merely for gathering evidence, but as visible deterrents against aggression toward frontline workers, effectively bringing personal security tools into commercial settings. This shift moves away from reliance on static surveillance, equipping staff with mobile technology that assists in de-escalating volatile situations in real-time. The National Retail Federation’s 'National Retail Security Survey' from 2024 highlights this trend, revealing that 35% of retailers were investigating body-worn cameras for their staff or loss prevention teams to address these growing safety concerns.At the same time, the industry is experiencing a swift move toward subscription-based Safety-as-a-Service business models, which decreases dependence on one-off hardware transactions. Manufacturers are combining wearable trackers and panic buttons with premium cloud-based services that provide features such as 24/7 emergency dispatch, real-time location tracking, and family monitoring. This approach guarantees recurring revenue channels and improves customer retention by consistently delivering value through software enhancements and broader safety networks. For example, Life360 reported in its 'Q3 2024 Earnings' report in November 2024 that subscription revenue increased by 27% year-over-year to $71.8 million, emphasizing the profitability of monetizing continuous safety connectivity and making advanced security accessible to the general consumer market.

Key Players Profiled in the Wearable Security Device Market

- Apple Inc.

- Alphabet Inc.

- Samsung Electronics Co., Ltd.

- Y Combinator Management, LLC

- BearTech Dev Ltd.

- Carre Technologies Inc.

- EMOTIV, Inc.

- Epson America, Inc.

- EVERFI, Inc.

- Intel Corporation

Report Scope

In this report, the Global Wearable Security Device Market has been segmented into the following categories:Wearable Security Device Market, by Product Type:

- Smart Watches

- Smart Jewellery

- Smart Shoes

Wearable Security Device Market, by Operating System:

- iOS

- Android

Wearable Security Device Market, by Connectivity:

- Bluetooth

- Wi-Fi

- RFID

Wearable Security Device Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Wearable Security Device Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Wearable Security Device market report include:- Apple Inc.

- Alphabet Inc.

- Samsung Electronics Co., Ltd.

- Y Combinator Management, LLC

- BearTech Dev Ltd.

- Carre Technologies Inc.

- EMOTIV, Inc.

- Epson America, Inc.

- EVERFI, Inc.

- Intel Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

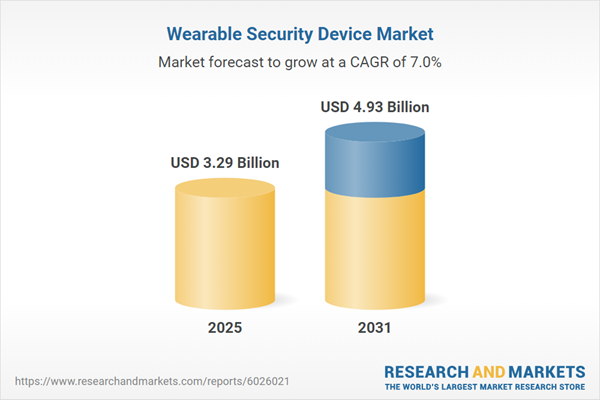

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 3.29 Billion |

| Forecasted Market Value ( USD | $ 4.93 Billion |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |