Speak directly to the analyst to clarify any post sales queries you may have.

A concise orientation to the personal care wipes category highlighting convergence of consumer demands, product innovation, and operational complexity

The personal care wipes category sits at the intersection of daily hygiene, convenience-driven retail behavior, and rapidly evolving consumer expectations. Over recent years, product innovation and expanding channel options have transformed how users select and rely on wipes for facial cleansing, infant care, sanitization, feminine hygiene, and wound management. As sensory preferences, ingredient transparency, and environmental considerations intensify, manufacturers and retailers must balance performance, safety, and sustainability while navigating a more complex supply architecture.

This introduction frames the essential trends shaping strategic priorities for brand managers, procurement teams, and channel leaders. It emphasizes the need to reconcile cost pressures with premiumization, to align packaging formats with use occasions and channel requirements, and to embed regulatory and compliance readiness into product development cycles. Importantly, the category’s breadth-ranging from single-use convenience formats to medical-grade wound care wipes-necessitates differentiated go-to-market approaches that respect both consumer expectations and clinical standards.

In sum, stakeholders benefit from a disciplined, cross-functional perspective that integrates product portfolio design, materials science, and channel economics. A clear diagnostic of these forces positions organizations to capitalize on growth pockets, mitigate operational risk, and accelerate time-to-market for high-impact innovations.

How shifting consumer priorities, supply chain redesign, and stricter regulatory expectations are jointly reshaping strategy across the personal care wipes industry

The landscape for personal care wipes has shifted fundamentally across three interrelated dimensions: consumer behavior, supply chain architecture, and regulatory expectations. On the demand side, shoppers increasingly seek formulations that deliver efficacy while minimizing perceived health and environmental risk, prompting reformulation toward cleaner ingredients and alternative substrates. Concurrently, premium and purpose-built formats-such as moisturizing facial wipes and antiseptic wound care wipes-are creating pockets of higher perceived value that require targeted marketing and different margin dynamics.

Supply chain transformation has accelerated as manufacturers diversify sourcing to reduce dependency on single suppliers and to adapt to volatility in key inputs like nonwoven fabrics and specialty additives. This has led to broader supplier qualification processes, nearshoring considerations, and increased attention to packaging resilience. As distribution channels fragment, omnichannel strategies that blend direct-to-consumer engagement with traditional retail presence are becoming essential. Digital-first programs and subscription models are changing replenishment behavior and increasing expectations for consistent quality and traceability.

Regulatory and compliance shifts, particularly around ingredient disclosure, biodegradability claims, and flushability standards, have raised the bar for technical documentation and testing. Together, these transformative shifts demand coordinated investments in R&D, quality systems, and commercial capabilities to sustain brand trust and to unlock growth in differentiated segments.

Assessment of the cumulative operational and commercial implications from the United States tariff changes in 2025 on sourcing, pricing, and supplier strategy

In 2025, changes to United States tariff policy introduced a new set of operational considerations for firms participating in personal care wipes supply chains. Tariff adjustments affected key components such as nonwoven materials, flexible packaging substrates, and certain chemical inputs, prompting immediate reassessments of cost-to-serve and sourcing footprints. For many manufacturers, the short-term reaction involved reallocating production, qualifying alternative suppliers outside affected trade lanes, and revisiting inventory strategies to bridge timing gaps.

Over the medium term, the tariff environment has altered commercial negotiations between brands and retailers. Cost pressure stemming from higher landed input prices has led to elevated attention on net pricing, promotional cadence, and private label competition. Some companies absorbed incremental costs to maintain shelf pricing and positioning, while others implemented calibrated price adjustments tied to product features or channel-specific assortments. Importantly, tariff-driven shifts also accelerated supplier consolidation in some tiers as buyers sought partners capable of absorbing compliance complexity and delivering scale efficiencies.

From a strategic perspective, companies are responding by strengthening supplier risk management, increasing transparency in procurement contracts, and investing in flexible manufacturing that can pivot raw material inputs without compromising product performance. Additionally, the tariff landscape catalyzed a re-evaluation of sustainability investments; firms are weighing the trade-offs between near-term cost exposure and longer-term differentiation tied to sustainable fibers and recyclable packaging. Ultimately, the cumulative impact of the 2025 tariff changes underscores the need for agile commercial playbooks and resilient sourcing strategies to preserve margin and service levels across channels.

Integrated segmentation analysis explaining how product types, channels, end users, packaging formats, and material choices determine strategic product and go-to-market priorities

A rigorous segmentation lens reveals how product design, channels, end-user needs, packaging, and material choice intersect to define strategic priorities across the category. When examining product type, the category spans adult wipes including sensitive incontinence and standard incontinence variants, baby wipes with distinctions between organic, sensitive, and standard formulations, facial wipes that include cleansing, makeup remover, moisturizing, and toner formats, feminine wipes split between daily and flushable options, hand wipes available in moisturizing and sanitizing types, and wound care wipes that range from antiseptic to moist wound healing varieties. This diversity requires product development roadmaps that align formulation, functional claims, and safety testing to each use case.

Distribution channel segmentation shows that offline channels remain critical, with convenience stores, pharmacy and drug stores, specialty stores, and supermarket hypermarket channels offering high visibility and impulse purchase opportunities, while online channels-comprised of direct-to-consumer models and e-commerce retailers-demand deeper engagement, content-driven conversion strategies, and logistics capabilities that support recurring orders. End-user segmentation further refines targeting: adult consumers split by gender, children categorized by boys and girls, elderly users differentiated between assisted living and independent scenarios, and infants segmented into babies under one year and toddlers aged one to three. These distinctions have meaningful implications for formulation robustness, allergen management, and package ergonomics.

Packaging types such as canisters, flow packs, refillable packs, travel packs, and tube packs influence consumption patterns, shelf presence, and sustainability profiles, while material choices-bamboo fiber, cotton, nonwoven fabric, and tissue paper-drive both tactile performance and environmental positioning. By integrating these segmentation dimensions, companies can prioritize SKUs, optimize channel assortments, and design claims that resonate with specific cohorts while managing complexity in manufacturing and distribution.

Geographic differentiation and region-specific strategic levers across the Americas, Europe Middle East & Africa, and Asia-Pacific that influence product, channel, and sourcing choices

Regional dynamics in the personal care wipes sector vary according to regulatory context, retail structure, and consumer preferences across major geographies. In the Americas, demand patterns are shaped by strong retail concentration, an established private label presence, and a consumer emphasis on convenience formats and premium facial and hand wipes. This market also reflects robust innovation pipelines for sustainable materials and concentrated efforts to meet stringent safety and labeling requirements.

Across Europe, Middle East & Africa, regulatory harmonization and heightened scrutiny of biodegradability and flushability claims are prominent drivers. Consumers in many parts of this region demonstrate a pronounced willingness to pay for demonstrable sustainability credentials, while complex retail ecosystems necessitate tailored channel strategies that account for both modern trade and traditional outlets. In addition, certain subregions emphasize clinical-grade wound care and specialized feminine hygiene solutions, reflecting diverse healthcare and cultural needs.

In Asia-Pacific, rapid urbanization, expanding digital commerce, and younger demographic segments are accelerating adoption of novel formats and direct-to-consumer business models. Innovation is frequently localized, with formulations and packaging adapted to regional skin types, climatic conditions, and usage occasions. Meanwhile, supply chain integration and proximity to key raw material suppliers impact sourcing decisions and support responsive manufacturing capacity. Collectively, regional nuances demand bespoke product roadmaps, targeted marketing approaches, and supply strategies that align with local regulatory and consumer realities.

Company-level competitive strategies and capability investments that separate market leaders from private label and digital-first challengers across product innovation and supply partnerships

Competitive dynamics within the personal care wipes category are characterized by a mix of global legacy manufacturers, regional specialists, growing private label programs, and agile direct-to-consumer challengers. Leading firms differentiate through multi-dimensional strategies that combine premiumization, sustainability claims, and clinical validation for specialized segments such as wound care or incontinence products. These companies are investing in technical capabilities to reformulate products with cleaner ingredient lists while preserving functional performance and shelf life.

Retailers and large-format grocers are leveraging own-brand ranges to secure margin and control shelf adjacency, creating additional pressure on branded manufacturers to demonstrate clear differentiation. At the same time, D2C brands are capturing consumer data and using subscription and personalization tactics to build loyalty, forcing incumbents to refine digital engagement and fulfillment models. Partnering trends have emerged where manufacturers collaborate with nonwoven producers, packaging innovators, and ingredient suppliers to accelerate time-to-market and to de-risk transitions to alternative materials.

Mergers, acquisitions, and strategic alliances continue to be pragmatic levers for capability acquisition-especially in areas such as biodegradable substrates, antimicrobial technologies, and closed-loop packaging solutions. Across these company-level moves, execution focus centers on integrating R&D pipelines, scaling validated sustainable technologies, and aligning go-to-market teams to capture value from differentiated product propositions.

Operationally focused steps and strategic investments that manufacturers and retailers can take to secure margin resilience and accelerate sustainable product innovation

Industry leaders should prioritize a set of pragmatic actions that align technical capability with commercial execution to protect margins and accelerate growth. First, invest in material science and formulation development that enables substitution of high-risk inputs without sacrificing tactile performance or safety. This should be complemented by accelerated validation programs-both laboratory and in-market-to ensure claims are defensible across regulatory regimes. Second, redesign packaging and fulfillment strategies to support circularity objectives and to reduce total cost of ownership through refillable formats and lighter-weight substrates.

Third, strengthen supplier networks through multi-sourcing, contractual flexibility, and closer collaboration on quality and traceability. Strategic supplier partnerships and selective nearshoring can mitigate tariff and logistics volatility while enabling faster product iterations. Fourth, refine channel strategies by differentiating assortments between offline display-driven SKUs and online-first, subscription-suited SKUs; investing in content and sampling techniques will improve conversion in digital channels. Fifth, bolster clinical and regulatory capabilities for segments such as wound care and incontinence where documentation and testing materially impact purchase decisions in institutional settings.

Finally, align commercial analytics and customer insights to prioritize SKUs with the highest strategic value and to streamline the innovation pipeline. Together, these actions create a pragmatic roadmap for conserving margin, accelerating sustainable innovation, and improving time-to-market in a category defined by both everyday utility and rising consumer expectations.

Description of a multi-method research approach combining executive interviews, product audits, regulatory review, and materials assessment to produce defensible strategic insights

The research underpinning this report combined primary qualitative engagement with quantitative validation and triangulation to ensure robust, actionable findings. Primary research included structured interviews with senior leaders across manufacturing, retail buying, and procurement functions, along with technical dialogues with ingredient and nonwoven suppliers. These interviews focused on sourcing strategies, formulation constraints, packaging innovations, and channel economics to capture real-world decision drivers and operational trade-offs.

Secondary research included a comprehensive review of regulatory publications, standards for biodegradability and flushability, patent filings, and public filings from relevant corporate actors to contextualize primary insights. Field-level observations and product audits across brick-and-mortar and online assortments provided empirical perspective on packaging formats, claim language, and price positioning. Where appropriate, laboratory analyses and materials assessments informed evaluations of alternative substrates and compatibility with standard manufacturing processes.

Data synthesis applied triangulation techniques to reconcile interview evidence with documented regulatory requirements and product-level observations. Quality controls included cross-validation of supplier statements, corroboration of retailer assortment data, and peer review of conclusions by subject matter experts to ensure the findings are defensible and relevant for strategic decision-making.

Synthesis of strategic priorities and concluding perspective on the essential capabilities required to capture lasting advantage in the personal care wipes category

The personal care wipes category is at a strategic inflection point driven by consumer expectations for efficacy and responsibility, evolving distribution models, and supply chain dynamics that reward agility. Companies that successfully navigate this environment will be those that integrate product innovation with sustainable materials choices, that invest in flexible supply networks, and that tailor channel-specific assortments supported by clear, verifiable claims. Market success will hinge on the ability to translate technical advances in substrate and formulation into clear consumer benefits while maintaining operational discipline.

As environmental claims and regulatory scrutiny increase, the margin for error narrows; therefore, proactive testing, transparent documentation, and honest marketing will become essential differentiators. Simultaneously, channel orchestration that balances the reach of traditional retail with the data-driven advantages of direct-to-consumer models will unlock recurring revenue and deeper consumer relationships. In short, strategic clarity, technical rigor, and disciplined execution are the core prerequisites for capturing value in the evolving wipes landscape.

Organizations that adopt a coordinated approach across R&D, procurement, and commercial teams will be best positioned to convert the category’s disruption into sustainable advantage.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Personal Care Wipes Market

Companies Mentioned

The key companies profiled in this Personal Care Wipes market report include:- Albaad Massuot Yitzhak Ltd. by Moshav Massuot Yitzhak

- American Hygienics Corporation

- Artsana SpA

- Boogie Brands by Eleeo Brands, LLC

- Comark International Corporation

- Cotton Babies, Inc

- Diamond Wipes International, Inc.

- Edgewell Personal Care Company

- Essity Aktiebolag

- Farlin Corporation

- Fujian Hengan Group Ltd

- GAMA Healthcare

- Guy & O'Neill Inc.

- Hengan International Group Company Limited

- InSpec Solutions, LLC

- Johnson & Johnson Services, Inc.

- Kimberly-Clark Corporation

- Linette Hellas SA

- Medline Industries, LP

- Neva Global Group

- Nice-Pak International Ltd.

- OX BELLCOW Cosmetics Co., Ltd.

- Premier Care Industries

- Procter & Gamble Company

- Quanzhou Unicare Hygiene Products Co., Ltd.

- Rael, Inc.

- Reckitt Benckiser Group plc

- Rockline Industries

- Shaoxing Elite Bio-Tech Co., Ltd.

- Svenska Cellulosa Aktiebolaget (SCA)

- SweetSpot Labs Inc.

- The Honest Company, Inc.

- Unicharm Corporation

- Unilever PLC

- Young Living Essential Oils, LC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 198 |

| Published | January 2026 |

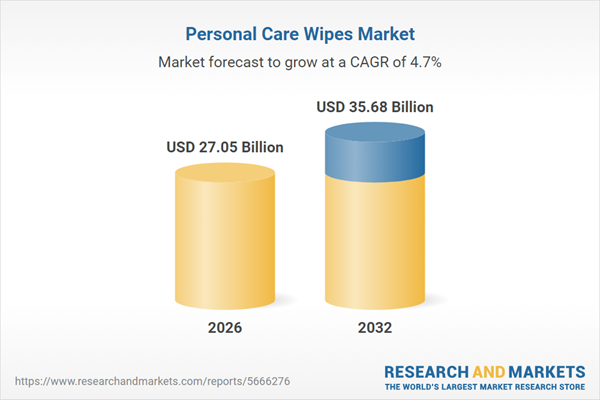

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 27.05 Billion |

| Forecasted Market Value ( USD | $ 35.68 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 36 |