HIV Drugs - Key Trends and Drivers

HIV drugs have revolutionized the management and treatment of Human Immunodeficiency Virus (HIV), transforming what was once a fatal diagnosis into a manageable chronic condition for many individuals. The development of antiretroviral therapy (ART) has been a significant milestone, enabling patients to maintain low viral loads, reduce transmission risks, and improve their quality of life. ART typically involves a combination of medications from different drug classes, including nucleoside reverse transcriptase inhibitors (NRTIs), non-nucleoside reverse transcriptase inhibitors (NNRTIs), protease inhibitors (PIs), integrase strand transfer inhibitors (INSTIs), and entry inhibitors. This multi-drug approach helps to prevent the virus from developing resistance, which is a critical aspect of effective HIV management. Over the past few decades, significant advancements have been made in developing new drug formulations that offer better efficacy, fewer side effects, and improved adherence through simplified dosing regimens.One of the most notable trends in the HIV drugs market is the development of long-acting injectable antiretrovirals, which provide a convenient alternative to daily oral medications. These injectables, administered monthly or bi-monthly, help to improve adherence and reduce the stigma associated with daily pill intake. Additionally, there is a growing focus on personalized medicine, with treatments tailored to individual genetic profiles and viral characteristics, enhancing therapeutic outcomes. Innovations in drug delivery systems, such as nanoparticle-based formulations, are also being explored to improve the pharmacokinetics and biodistribution of HIV drugs. Furthermore, the integration of HIV treatment with other healthcare services, such as pre-exposure prophylaxis (PrEP) for high-risk populations and comprehensive sexual health services, is expanding the reach and effectiveness of HIV care.

The growth in the HIV drugs market is driven by several factors, including technological advancements in drug development, the increasing prevalence of HIV, and expanding access to treatment in low- and middle-income countries. Advances in molecular biology and virology have facilitated the discovery of new therapeutic targets and the development of drugs with novel mechanisms of action. The rising global burden of HIV, particularly in sub-Saharan Africa and other high-prevalence regions, underscores the need for continued innovation and accessibility in HIV treatment. Government initiatives and international programs, such as the President's Emergency Plan for AIDS Relief (PEPFAR) and the Global Fund to Fight AIDS, Tuberculosis and Malaria, play a pivotal role in increasing the availability of HIV drugs in resource-limited settings. Additionally, the growing awareness and acceptance of HIV treatment, coupled with improved diagnostic capabilities, are driving higher treatment uptake. The pharmaceutical industry's commitment to research and development, along with strategic partnerships and collaborations, continues to fuel progress in the HIV drugs market, ensuring that patients have access to the latest and most effective treatments.

Report Scope

The report analyzes the HIV Drugs market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Drug Class (Combination HIV Medicines, Integrase Inhibitors (INIs), Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs), Other Drug Classes); Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Other Distribution Channels).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

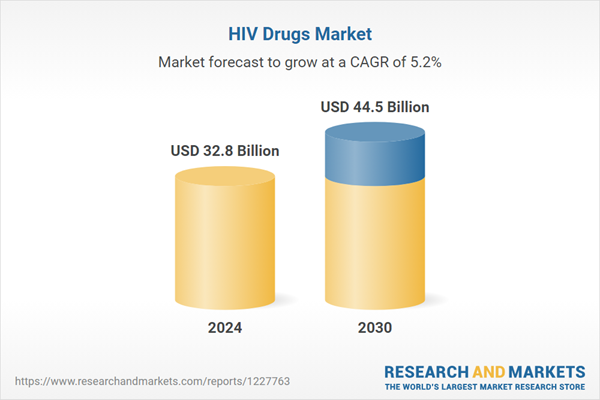

- Market Growth: Understand the significant growth trajectory of the Combination Medicines segment, which is expected to reach US$29.0 Billion by 2030 with a CAGR of a 5.2%. The Integrase Inhibitors (INIs) segment is also set to grow at 5.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $8.7 Billion in 2024, and China, forecasted to grow at an impressive 8.7% CAGR to reach $9.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global HIV Drugs Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global HIV Drugs Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global HIV Drugs Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AECI Limited, Air Products and Chemicals, Inc., ArrMaz, Ashland Global Holdings, Inc., BASF SE and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 52 companies featured in this HIV Drugs market report include:

- AbbVie, Inc.

- AstraZeneca PLC

- Boehringer Ingelheim GmbH

- Bristol-Myers Squibb Company

- Cipla Ltd.

- Daiichi Sankyo Co., Ltd.

- Emcure Pharmaceuticals Pvt., Ltd.

- F. Hoffmann-La Roche AG

- Gilead Sciences, Inc.

- Hetero Drugs Ltd.

- Johnson & Johnson

- Merck & Co., Inc.

- Teva Pharmaceutical Industries Ltd.

- ViiV Healthcare

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AbbVie, Inc.

- AstraZeneca PLC

- Boehringer Ingelheim GmbH

- Bristol-Myers Squibb Company

- Cipla Ltd.

- Daiichi Sankyo Co., Ltd.

- Emcure Pharmaceuticals Pvt., Ltd.

- F. Hoffmann-La Roche AG

- Gilead Sciences, Inc.

- Hetero Drugs Ltd.

- Johnson & Johnson

- Merck & Co., Inc.

- Teva Pharmaceutical Industries Ltd.

- ViiV Healthcare

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 295 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 32.8 Billion |

| Forecasted Market Value ( USD | $ 44.5 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |