Global Electronic Warfare Systems Market - Key Trends & Drivers Summarized

Electronic Warfare Systems are critical components in modern military operations, designed to disrupt, deceive, and deny the adversary's use of the electromagnetic spectrum while protecting friendly systems. These systems encompass a range of technologies and techniques, including electronic attack (EA), electronic protection (EP), and electronic support (ES). Electronic attack involves jamming enemy communications and radar, launching cyber-attacks, and deploying electromagnetic pulses (EMP) to incapacitate electronic equipment. Electronic protection focuses on safeguarding friendly forces from these same tactics, employing countermeasures such as frequency hopping and stealth technology to evade detection and interference. Electronic support, on the other hand, involves monitoring the electromagnetic spectrum to gather intelligence, detect enemy signals, and provide situational awareness, thereby informing strategic decisions and tactical responses.Technological advancements have significantly enhanced the capabilities of Electronic Warfare Systems, making them more sophisticated and effective. Innovations in signal processing, artificial intelligence (AI), and machine learning (ML) have enabled more precise and rapid identification of threats, allowing for real-time adaptive responses. The development of more powerful and compact electronic components has facilitated the integration of EWS into a wider array of platforms, including unmanned aerial vehicles (UAVs), ships, and ground vehicles. Additionally, the advent of cyber-electronic warfare has expanded the scope of traditional EW, merging cyber operations with electronic attacks to create more versatile and potent threats. The use of directed energy weapons, such as high-powered microwaves and lasers, represents another significant advancement, offering new means to disrupt or destroy enemy electronics from a distance.

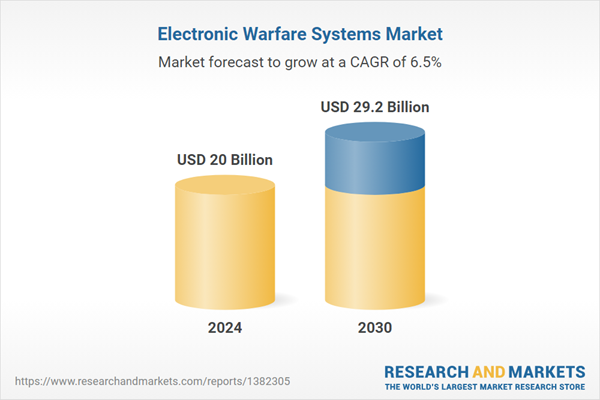

The growth in the Electronic Warfare Systems market is driven by several factors. The war front-stance of the defense industry on modernization of military capabilities, high uptake of UAVs, and increasing incident of geopolitical conflicts, terrorist attacks and security breaches are driving market growth. Geopolitical tensions and the modernization of military forces globally are spurring investments in advanced EWS to maintain strategic and tactical advantages. The increasing complexity and proliferation of electronic threats, including advancements in enemy radar and communication technologies, necessitate continuous improvements in EW capabilities. Government's focus on air defense and radar systems along with high uptake of military robots is buoying the global market. Increasing use of advanced platforms for detecting and intercepting enemy weapons is set to fuel global demand for these systems. Technological advancements along with the resulting transition toward multilayered defense systems are bound to augur well for electronic warfare. In addition, broader uptake of UAVs, ground surveillance solutions and communication jamming are key factors responsible for growing preference of electronic warfare platforms. These factors, combined with ongoing technological innovations and the evolving nature of electronic warfare, are propelling robust growth in the Electronic Warfare Systems market, ensuring its pivotal role in modern and future combat operations.

Report Scope

The report analyzes the Electronic Warfare Systems market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Capability (Electronic Support, Electronic Protection, Electronic Attack); Platform (Airborne Platform, Ground Platform, Naval Platform, Space Platform).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Rest of Europe; Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Airborne Platform segment, which is expected to reach US$14 Billion by 2030 with a CAGR of 6.9%. The Ground Platform segment is also set to grow at 6.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $7.5 Billion in 2024, and China, forecasted to grow at an impressive 8% CAGR to reach $4.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Electronic Warfare Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Electronic Warfare Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Electronic Warfare Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ASELSAN AS, BAE Systems Plc, Elbit Systems Ltd., ELT Group, General Dynamics Mission Systems, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 150 companies featured in this Electronic Warfare Systems market report include:

- ASELSAN AS

- BAE Systems Plc

- Elbit Systems Ltd.

- ELT Group

- General Dynamics Mission Systems, Inc.

- Hensoldt AG

- Israel Aerospace Industries Ltd.

- L3Harris Technologies, Inc.

- Leonardo Electronics US Inc.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- RTX Corporation

- SAAB AB

- Thales Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ASELSAN AS

- BAE Systems Plc

- Elbit Systems Ltd.

- ELT Group

- General Dynamics Mission Systems, Inc.

- Hensoldt AG

- Israel Aerospace Industries Ltd.

- L3Harris Technologies, Inc.

- Leonardo Electronics US Inc.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- RTX Corporation

- SAAB AB

- Thales Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 20 Billion |

| Forecasted Market Value ( USD | $ 29.2 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |