Global Workwear Market - Key Trends and Drivers Summarized

Workwear refers to specialized clothing designed to provide comfort, safety, and durability for individuals engaged in manual labor or other physically demanding jobs. This category of apparel includes items such as coveralls, overalls, high-visibility vests, flame-resistant clothing, and steel-toe boots. Workwear is crafted to meet specific industry requirements and standards, offering protection against various hazards such as chemicals, extreme temperatures, and mechanical risks. The materials used in workwear, such as heavy-duty cotton, polyester blends, and technical fabrics, are chosen for their ability to withstand harsh conditions and frequent washing.The workwear market has evolved considerably, driven by advancements in textile technology and a growing emphasis on employee safety and comfort. Innovations in fabric treatment and garment design have led to the development of workwear that is not only protective but also lightweight and breathable, enhancing wearer comfort during long hours of use. Furthermore, the rise of ergonomic design principles has resulted in workwear that offers better mobility and reduces fatigue. Workwear is increasingly being tailored to specific job roles and environments, ensuring that workers have the appropriate gear for their tasks. Additionally, there has been a notable shift towards aesthetic considerations in workwear, with modern designs incorporating style elements that make the clothing more appealing and acceptable in various work settings.

The growth in the workwear market is driven by several factors. One major driver is the stringent regulations and standards set by occupational safety authorities, which mandate the use of protective clothing in various industries, such as construction, manufacturing, and mining. The rising awareness of workplace safety and the importance of reducing accident rates have also spurred demand for high-quality workwear. Technological advancements have enabled the production of innovative materials that offer enhanced protection and comfort, appealing to both employers and employees. Additionally, the increasing trend of branding and customization in workwear, where companies invest in uniforms that reflect their corporate identity, contributes to market expansion. Consumer behavior trends, such as the growing preference for sustainable and ethically produced clothing, are influencing the workwear market as well, with manufacturers adopting eco-friendly materials and practices.

Report Scope

The report analyzes the Workwear market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Apparel, Footwear); Application (Chemical, Power, Biological, Food & Beverage, Other Applications).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

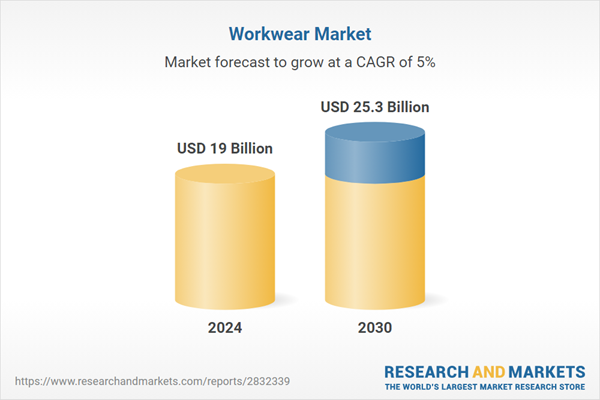

- Market Growth: Understand the significant growth trajectory of the Apparel segment, which is expected to reach US$19.5 Billion by 2030 with a CAGR of 4.7%. The Footwear segment is also set to grow at 5.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.1 Billion in 2024, and China, forecasted to grow at an impressive 8.3% CAGR to reach $5.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Workwear Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Workwear Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Workwear Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alexandra, ALSICO NV, Asatex AG, A. Ronai LLC, Alfredo Grassi SpA and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 375 companies featured in this Workwear market report include:

- Alexandra

- ALSICO NV

- Asatex AG

- A. Ronai LLC

- Alfredo Grassi SpA

- Amco Apparel Mfg., Co.

- APC Workwear Ltd.

- APEX Medical Corporation

- AIRWAIR Intl. Ltd. - Dr. Martens

- Arbesko AB

- A.LAFONT SAS

- Anbu Safety Industrial Co., Ltd. (China)

- Armor General Trading

- Anchortex Corporation

- Aimmax Medical

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alexandra

- ALSICO NV

- Asatex AG

- A. Ronai LLC

- Alfredo Grassi SpA

- Amco Apparel Mfg., Co.

- APC Workwear Ltd.

- APEX Medical Corporation

- AIRWAIR Intl. Ltd. - Dr. Martens

- Arbesko AB

- A.LAFONT SAS

- Anbu Safety Industrial Co., Ltd. (China)

- Armor General Trading

- Anchortex Corporation

- Aimmax Medical

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 872 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 19 Billion |

| Forecasted Market Value ( USD | $ 25.3 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |