Global Employment Services Market - Key Trends and Drivers Summarized

What Are Employment Services and How Do They Function?

Employment services play a crucial role in connecting job seekers with potential employers, facilitating workforce development, and ensuring smooth transitions within the job market. These services encompass a range of activities, including job matching, recruitment, temporary staffing, and career counseling. Employment agencies operate by understanding the needs of employers and job seekers, utilizing databases and networks to find suitable matches. They also offer support services like resume building, interview preparation, and skills training, which enhance the employability of job seekers. Temporary staffing agencies provide workers for short-term projects, allowing businesses to manage workload fluctuations without long-term commitments. By bridging the gap between supply and demand in the labor market, employment services contribute significantly to economic stability and growth.How Have Technological Advancements Transformed Employment Services?

Technological advancements have dramatically transformed the landscape of employment services, introducing new tools and platforms that enhance efficiency and reach. The rise of online job portals and professional networking sites like LinkedIn has revolutionized the job search process, making it easier for job seekers to find opportunities and for employers to identify potential candidates. Artificial Intelligence (AI) and machine learning algorithms are now widely used to match job seekers with relevant job postings, analyze resumes, and even conduct initial candidate screenings. These technologies help streamline recruitment processes, reduce bias, and improve the overall quality of matches. Additionally, the advent of remote work technology has expanded the geographic boundaries of employment services, enabling agencies to connect employers with talent from around the globe. Virtual job fairs and online interviews have also become commonplace, reflecting the increasing digitization of the job market.What Are the Emerging Trends and Challenges in Employment Services?

The employment services sector is witnessing several emerging trends that are shaping its future. One notable trend is the growing demand for gig and freelance work, driven by the rise of the gig economy. Platforms like Upwork and Fiverr are facilitating this shift, offering a wide range of short-term and project-based opportunities. Another significant trend is the increasing emphasis on diversity and inclusion in hiring practices. Companies are seeking to build more diverse workforces, and employment services are playing a pivotal role in supporting these initiatives through targeted recruitment and training programs. However, the sector also faces challenges, such as the need to adapt to rapid technological changes and address the skills gap in the workforce. The continuous evolution of job requirements means that employment services must constantly update their training and support offerings to remain relevant and effective.What Drives the Growth in the Employment Services Market?

The growth in the employment services market is driven by several factors, including technological innovations, changing workforce dynamics, and evolving employer needs. The increasing adoption of AI and machine learning in recruitment processes is enhancing the efficiency and effectiveness of employment services, allowing for better candidate-job matching and streamlined operations. The shift towards remote work and the gig economy is expanding the scope of employment services, as agencies adapt to provide support for flexible and non-traditional work arrangements. Additionally, the ongoing emphasis on diversity and inclusion in the workplace is generating demand for specialized recruitment services that can help companies achieve their DEI (Diversity, Equity, and Inclusion) goals. Economic factors, such as low unemployment rates and the need for skilled labor in various industries, are also propelling market growth. Furthermore, the rising awareness of the importance of career development and continuous learning is driving demand for services that offer training and upskilling opportunities. These factors, combined with the continuous evolution of the labor market, are fostering robust growth in the employment services sector.Report Scope

The report analyzes the Employment Services market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Employment Placement Agencies, Executive Search Services, Professional Employer Organizations, Temporary Help Services); End-Use (Information & Technology End-Use, Banking & Financial End-Use, Engineering End-Use, Medical End-Use, Professional Services End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Employment Placement Agencies segment, which is expected to reach US$1.1 Trillion by 2030 with a CAGR of 7.6%. The Executive Search Services segment is also set to grow at 9.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $513.3 Billion in 2024, and China, forecasted to grow at an impressive 12.3% CAGR to reach $657.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Employment Services Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Employment Services Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Employment Services Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 51job, ADP LLC, Allegis Group Inc., Beijing Foreign Enterprise Human Resource Service Co. Ltd, CDI Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 247 companies featured in this Employment Services market report include:

- 51job

- ADP LLC

- Allegis Group Inc.

- Beijing Foreign Enterprise Human Resource Service Co. Ltd

- CDI Corporation

- China International Talent Development Center

- Cielo Inc.

- Hays Plc

- Kelly Services Inc.

- Korn/Ferry International

- ManpowerGroup Inc.

- Poolia AB

- Randstad Holding NV

- Recruit Holdings Co. Ltd.

- Robert Half International Inc.

- Synergie SA

- The Adecco Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 51job

- ADP LLC

- Allegis Group Inc.

- Beijing Foreign Enterprise Human Resource Service Co. Ltd

- CDI Corporation

- China International Talent Development Center

- Cielo Inc.

- Hays Plc

- Kelly Services Inc.

- Korn/Ferry International

- ManpowerGroup Inc.

- Poolia AB

- Randstad Holding NV

- Recruit Holdings Co. Ltd.

- Robert Half International Inc.

- Synergie SA

- The Adecco Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 376 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

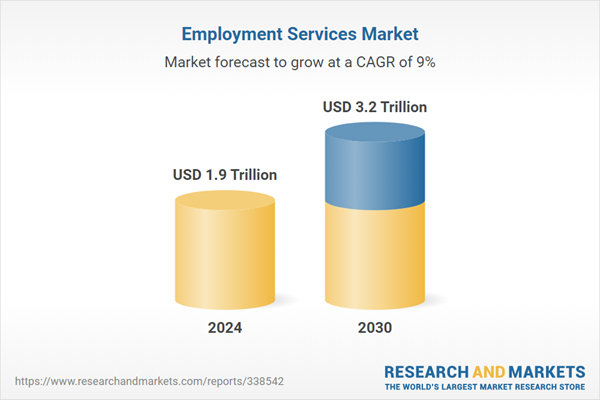

| Estimated Market Value ( USD | $ 1.9 Trillion |

| Forecasted Market Value ( USD | $ 3.2 Trillion |

| Compound Annual Growth Rate | 9.0% |

| Regions Covered | Global |