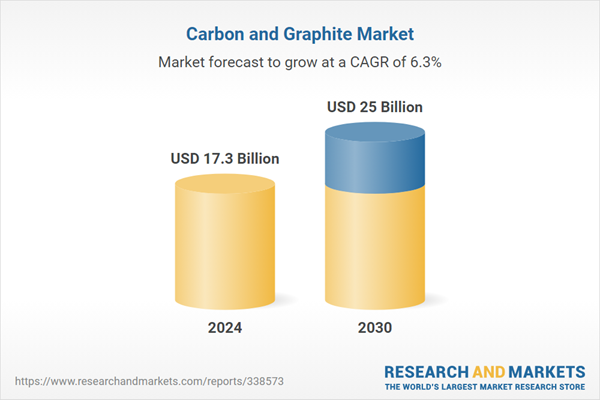

The global market for Carbon and Graphite was estimated at US$17.3 Billion in 2024 and is projected to reach US$25.0 Billion by 2030, growing at a CAGR of 6.3% from 2024 to 2030. This comprehensive report provides an in-depth analysis of market trends, drivers, and forecasts, helping you make informed business decisions. The report includes the most recent global tariff developments and how they impact the Carbon and Graphite market.

Technological advancements have further broadened the applications of carbon and graphite, particularly in high-tech and emerging industries. The development of synthetic graphite has allowed for consistent quality and tailored properties, catering to specific industrial needs. In the energy sector, graphite is a key material in lithium-ion batteries, which power a wide range of devices from smartphones to electric vehicles. Its high energy density and long cycle life are crucial for battery performance and efficiency. The advent of graphene, a single layer of carbon atoms derived from graphite, has revolutionized materials science. Graphene’s extraordinary strength, flexibility, and electrical conductivity open up new possibilities in electronics, composites, and biomedical devices. The continued research into carbon nanomaterials is expanding the potential applications of graphite and other carbon forms, driving innovation across multiple fields.

The growth in the carbon and graphite market is driven by several factors, reflecting the evolving demands and technological advancements across various industries. One significant driver is the increasing demand for lithium-ion batteries, spurred by the rapid growth of the electric vehicle market and the need for efficient energy storage solutions. The expansion of the electronics industry, which relies on high-quality graphite for heat dissipation and conductivity, also contributes to market growth. Additionally, the steelmaking industry’s reliance on graphite electrodes for electric arc furnaces underscores the material’s importance in modern metallurgy. Environmental regulations promoting cleaner energy sources and sustainable practices are boosting the adoption of graphite in renewable energy technologies, such as fuel cells and solar panels. Furthermore, the burgeoning field of graphene research is paving the way for new applications and markets, enhancing the material’s value proposition. The ongoing advancements in nanotechnology and materials science continue to drive demand for high-performance carbon and graphite products, ensuring sustained growth and innovation in the market.

Global Carbon and Graphite Market - Key Trends & Drivers Summarized

Carbon and graphite, two closely related forms of the same element, play pivotal roles in a multitude of industries due to their unique physical and chemical properties. Carbon, in its various allotropes, includes graphite, diamond, and amorphous carbon, each possessing distinct characteristics. Graphite, specifically, is renowned for its excellent electrical conductivity, high thermal stability, and lubricating properties, making it invaluable in numerous applications. It is widely used in the production of electrodes, batteries, and refractory materials. Graphite’s ability to withstand extreme temperatures and its inertness also make it a critical component in the nuclear industry, where it serves as a moderator and reflector. Additionally, the material is essential in the manufacture of brake linings, lubricants, and pencils, highlighting its versatility.Technological advancements have further broadened the applications of carbon and graphite, particularly in high-tech and emerging industries. The development of synthetic graphite has allowed for consistent quality and tailored properties, catering to specific industrial needs. In the energy sector, graphite is a key material in lithium-ion batteries, which power a wide range of devices from smartphones to electric vehicles. Its high energy density and long cycle life are crucial for battery performance and efficiency. The advent of graphene, a single layer of carbon atoms derived from graphite, has revolutionized materials science. Graphene’s extraordinary strength, flexibility, and electrical conductivity open up new possibilities in electronics, composites, and biomedical devices. The continued research into carbon nanomaterials is expanding the potential applications of graphite and other carbon forms, driving innovation across multiple fields.

The growth in the carbon and graphite market is driven by several factors, reflecting the evolving demands and technological advancements across various industries. One significant driver is the increasing demand for lithium-ion batteries, spurred by the rapid growth of the electric vehicle market and the need for efficient energy storage solutions. The expansion of the electronics industry, which relies on high-quality graphite for heat dissipation and conductivity, also contributes to market growth. Additionally, the steelmaking industry’s reliance on graphite electrodes for electric arc furnaces underscores the material’s importance in modern metallurgy. Environmental regulations promoting cleaner energy sources and sustainable practices are boosting the adoption of graphite in renewable energy technologies, such as fuel cells and solar panels. Furthermore, the burgeoning field of graphene research is paving the way for new applications and markets, enhancing the material’s value proposition. The ongoing advancements in nanotechnology and materials science continue to drive demand for high-performance carbon and graphite products, ensuring sustained growth and innovation in the market.

SCOPE OF STUDY:

The report analyzes the Carbon and Graphite market in terms of units by the following Segments, and Geographic Regions/Countries:- Segments: Product Type (Carbon & Graphite Electrodes, Carbon & Graphite Fibers, Carbon & Graphite Powders, Other Product Types)

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Carbon & Graphite Electrodes segment, which is expected to reach US$11.1 Billion by 2030 with a CAGR of a 5.2%. The Carbon & Graphite Fibers segment is also set to grow at 9.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.9 Billion in 2024, and China, forecasted to grow at an impressive 7.4% CAGR to reach $10.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Carbon and Graphite Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Carbon and Graphite Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Carbon and Graphite Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Cabot Corporation, GrafTech International Ltd., Hazer Group Ltd, HEG Ltd, Hexcel Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 124 companies featured in this Carbon and Graphite market report include:

- Cabot Corporation

- GrafTech International Ltd.

- Hazer Group Ltd

- HEG Ltd

- Hexcel Corporation

- Mersen S.A.

- Mitsubishi Chemical Corporation

- Mitsubishi Chemical Carbon Fiber and Composites, Inc.

- Morgan Advanced Materials Plc

- Nippon Carbon Co., Ltd.

- Orion Engineered Carbons GmbH

- SGL CARBON SE

- Solvay SA

- Superior Graphite

- Teijin Limited

- Toray Industries, Inc.

- ZOLTEK Corporation

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

I. METHODOLOGYII. EXECUTIVE SUMMARY2. FOCUS ON SELECT PLAYERSIV. COMPETITION

1. MARKET OVERVIEW

3. MARKET TRENDS & DRIVERS

4. GLOBAL MARKET PERSPECTIVE

III. MARKET ANALYSIS

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Cabot Corporation

- GrafTech International Ltd.

- Hazer Group Ltd

- HEG Ltd

- Hexcel Corporation

- Mersen S.A.

- Mitsubishi Chemical Corporation

- Mitsubishi Chemical Carbon Fiber and Composites, Inc.

- Morgan Advanced Materials Plc

- Nippon Carbon Co., Ltd.

- Orion Engineered Carbons GmbH

- SGL CARBON SE

- Solvay SA

- Superior Graphite

- Teijin Limited

- Toray Industries, Inc.

- ZOLTEK Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 478 |

| Published | June 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 17.3 Billion |

| Forecasted Market Value ( USD | $ 25 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |