Global Microwavable Foods Market - Key Trends and Drivers Summarized

Microwavable foods have become a staple in modern households, reflecting the growing demand for convenience and quick meal solutions. These ready-to-eat or easy-to-prepare foods are designed for microwave cooking, catering to the fast-paced lifestyles of today's consumers. The market for microwavable foods includes a diverse range of products such as frozen meals, snacks, breakfast items, and even gourmet dishes. This sector has seen significant innovation, with manufacturers continuously developing new recipes and enhancing the nutritional value of their offerings to meet evolving consumer preferences. The availability of microwavable foods in various flavors, dietary options, and portion sizes has made them an attractive choice for individuals seeking hassle-free meal solutions without compromising on taste or health.Consumer behavior plays a crucial role in the dynamics of the microwavable foods market. With the increase in dual-income households, single-person dwellings, and busy lifestyles, the demand for quick and easy meal options has surged. Microwavable foods provide a practical solution for those who lack the time or energy to cook traditional meals. Furthermore, advancements in packaging technology have improved the shelf life and quality of microwavable products, ensuring they remain fresh and appealing. The integration of eco-friendly and sustainable packaging materials also aligns with the growing consumer awareness about environmental impact, further boosting the appeal of these products. Additionally, the expansion of online grocery shopping and home delivery services has made it more convenient for consumers to access a wide variety of microwavable foods, thereby expanding their market reach.

The growth in the microwavable foods market is driven by several factors. Technological advancements in food processing and preservation have enabled manufacturers to produce high-quality microwavable meals that retain their nutritional value and taste. Innovations such as steamable bags and dual-compartment trays have enhanced the cooking experience, allowing for better texture and flavor. The increasing health consciousness among consumers has led to the development of microwavable options that cater to specific dietary needs, such as low-calorie, gluten-free, and organic meals. Additionally, the rise of urbanization and the increasing number of single-person households have spurred the demand for single-serve and portion-controlled microwavable foods. The influence of global cuisines and the desire for diverse culinary experiences have also prompted manufacturers to introduce a variety of international flavors and gourmet microwavable dishes. These trends, combined with strategic marketing efforts and competitive pricing, have significantly contributed to the robust growth of the microwavable foods market.

Report Scope

The report analyzes the Microwavable Foods market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Segment (Frozen Microwavable Foods, Chilled Microwavable Foods, Shelf Stable Microwavable Foods); Packaging Technology (Patterned Susceptors Technology, New Tray-Lidding Methods, New Cook Bag Technique).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

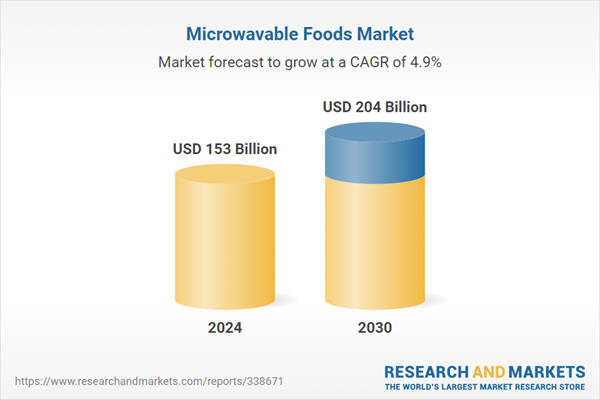

- Market Growth: Understand the significant growth trajectory of the Frozen Microwavable Foods segment, which is expected to reach US$169.4 Billion by 2030 with a CAGR of a 5%. The Chilled Microwavable Foods segment is also set to grow at 4.5% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Microwavable Foods Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Microwavable Foods Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Microwavable Foods Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ajinomoto Foods North America, Inc., Bellisio Foods, Inc., Birds Eye Group, Inc., BRF S.A., Campbell Soup Company and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Microwavable Foods market report include:

- Ajinomoto Foods North America, Inc.

- Bellisio Foods, Inc.

- Birds Eye Group, Inc.

- BRF S.A.

- Campbell Soup Company

- Conagra Brands, Inc.

- Cremonini S.p.A.

- Dawn Farm Foods Limited

- General Mills, Inc.

- Gunnar Dafgård AB

- Hormel Foods Corporation

- Itoham Foods, Inc.

- Kellogg Company

- Maple Leaf Foods Inc.

- McCain Foods Limited

- Nestlé S.A.

- Pinnacle Foods, Inc.

- Schwan's Company

- the Kraft Heinz Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ajinomoto Foods North America, Inc.

- Bellisio Foods, Inc.

- Birds Eye Group, Inc.

- BRF S.A.

- Campbell Soup Company

- Conagra Brands, Inc.

- Cremonini S.p.A.

- Dawn Farm Foods Limited

- General Mills, Inc.

- Gunnar Dafgård AB

- Hormel Foods Corporation

- Itoham Foods, Inc.

- Kellogg Company

- Maple Leaf Foods Inc.

- McCain Foods Limited

- Nestlé S.A.

- Pinnacle Foods, Inc.

- Schwan's Company

- the Kraft Heinz Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 280 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 153 Billion |

| Forecasted Market Value ( USD | $ 204 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |