Global Bicycles Market - Key Trends & Drivers Summarized

Why Are Bicycles Experiencing a Resurgence in Popularity Across Urban and Recreational Segments?

Bicycles are experiencing a significant resurgence in popularity as they offer a sustainable, cost-effective, and health-promoting mode of transportation for a wide range of users. Urban commuters, recreational cyclists, and fitness enthusiasts are increasingly turning to bicycles as a versatile solution for commuting, exercise, and leisure activities. The growing awareness of environmental sustainability and the need to reduce carbon emissions are major factors driving the adoption of bicycles as an eco-friendly transportation alternative. In urban areas, bicycles are gaining traction as a practical solution for short-distance commuting, especially as cities implement bike lanes, bike-sharing programs, and other infrastructure enhancements to promote cycling. The convenience of avoiding traffic congestion, reducing transportation costs, and achieving health benefits has made cycling an appealing choice for city dwellers seeking greener and healthier lifestyles.The demand for bicycles is also being driven by the rising interest in fitness and outdoor activities, particularly in the wake of the COVID-19 pandemic, which led many people to seek alternatives to indoor gyms and fitness centers. Cycling offers a low-impact form of exercise that can be easily integrated into daily routines and provides cardiovascular, muscular, and mental health benefits. With the availability of various types of bicycles - ranging from road and mountain bikes to hybrids, gravel bikes, and electric bicycles (e-bikes) - consumers have more options than ever to find a bicycle that suits their specific needs and preferences. As more individuals embrace cycling for fitness, recreation, and transportation, the bicycle market is poised for continued growth, supported by evolving consumer preferences, improved cycling infrastructure, and a global push toward sustainable urban mobility.

What Technological Advancements Are Shaping the Development of Modern Bicycles?

Technological advancements are playing a pivotal role in transforming the bicycle market, enhancing the performance, safety, and versatility of bicycles across different segments. One of the most notable innovations in recent years is the development and widespread adoption of electric bicycles (e-bikes). E-bikes are equipped with an electric motor and battery, providing pedal assistance that makes cycling easier, especially on inclines or over long distances. This technology is making cycling more accessible to a broader demographic, including older adults and individuals with physical limitations, by reducing the physical strain associated with traditional bicycles. E-bikes are becoming increasingly popular for urban commuting, leisure rides, and even adventure cycling, as they offer a convenient and eco-friendly alternative to cars and public transportation. The growing popularity of e-bikes is driving demand for high-capacity batteries, efficient motor systems, and integrated smart features such as speed monitoring and GPS navigation.Another significant advancement is the use of lightweight and durable materials in bicycle manufacturing. Modern bicycles are being constructed from advanced materials such as carbon fiber, titanium, and aluminum alloys, which offer an optimal balance between strength, weight, and performance. Carbon fiber frames, in particular, are prized for their lightweight properties and ability to absorb road vibrations, making them ideal for high-performance road and mountain bikes. These materials are enabling the production of bicycles that are lighter, faster, and more comfortable to ride, enhancing the overall cycling experience. Additionally, the use of innovative frame designs and suspension systems is improving the handling and stability of bicycles, making them suitable for a wide range of terrains and riding styles.

The integration of digital technologies and smart features is further revolutionizing the bicycle market. Smart bicycles equipped with sensors, connectivity, and digital interfaces are offering new functionalities such as real-time ride data, performance tracking, and turn-by-turn navigation. Some bicycles now come with integrated displays or companion smartphone apps that provide riders with information on speed, distance, battery status (in the case of e-bikes), and route planning. The integration of Internet of Things (IoT) technology is enabling advanced features such as theft protection, remote diagnostics, and personalized ride settings, making bicycles more secure and user-friendly. Furthermore, the development of smart helmets and wearable devices that communicate with bicycles is enhancing rider safety and connectivity. These technological innovations are expanding the capabilities of bicycles, supporting their adoption among tech-savvy consumers and enhancing the overall appeal of cycling.

How Are Market Dynamics and Consumer Preferences Shaping the Bicycle Market?

The global bicycle market is shaped by a complex interplay of market dynamics, evolving consumer preferences, and industry trends that are influencing product development, adoption, and strategic priorities. One of the primary market drivers is the growing emphasis on sustainability and the need for environmentally friendly transportation options. Bicycles produce zero emissions and have a minimal environmental footprint compared to motor vehicles, making them an attractive option for individuals and governments seeking to reduce carbon emissions and promote cleaner urban mobility. Many cities around the world are implementing policies and infrastructure improvements, such as dedicated bike lanes, bike-sharing schemes, and cycling-friendly urban planning, to encourage bicycle use. These initiatives are making cycling safer and more convenient, thereby boosting the adoption of bicycles for daily commuting and reducing the dependence on cars.Consumer preferences are also shifting toward healthier and more active lifestyles, which is driving the demand for bicycles as a means of exercise and recreation. The COVID-19 pandemic accelerated this trend as people sought ways to stay active while adhering to social distancing guidelines. Bicycles, particularly mountain bikes, hybrids, and gravel bikes, have become popular choices for outdoor activities and exploration, providing a sense of adventure and freedom. The rising interest in cycling as a fitness activity is encouraging manufacturers to develop bicycles with specialized features, such as enhanced suspension systems, ergonomic designs, and fitness tracking capabilities. Additionally, the trend toward personalized experiences is driving the demand for customized bicycles, where consumers can choose frame colors, component specifications, and accessories to match their individual style and needs.

Market dynamics such as competition among manufacturers, technological innovation, and pricing strategies are also influencing the bicycle market. The competitive landscape is characterized by the presence of both established bicycle brands and innovative startups, each offering a range of products designed for different customer segments and use cases. Companies are differentiating themselves through product innovation, brand reputation, and the ability to offer value-added services such as maintenance and financing options. The emergence of direct-to-consumer (DTC) business models is changing the way bicycles are marketed and sold, enabling companies to reach customers more efficiently and offer competitive pricing. Additionally, the growing popularity of subscription services and rental models is providing consumers with flexible and affordable access to bicycles, supporting the broader adoption of cycling.

The increasing use of digital marketing and e-commerce platforms is also shaping the bicycle market, making it easier for consumers to research, compare, and purchase bicycles online. E-commerce is enabling manufacturers and retailers to reach a global audience, expand their product offerings, and provide a seamless shopping experience. The availability of online reviews, detailed product descriptions, and virtual fitting tools is helping consumers make informed purchasing decisions, driving the shift toward online bicycle sales. As these market dynamics and consumer preferences continue to evolve, they are shaping the development and competitiveness of the bicycle market, influencing product design, distribution strategies, and market positioning.

What Are the Key Growth Drivers Fueling the Expansion of the Bicycle Market?

The growth in the global bicycle market is driven by several key factors, including the increasing focus on sustainability, the rising demand for e-bikes, and the growing emphasis on health and fitness. One of the primary growth drivers is the shift toward sustainable transportation and the adoption of bicycles as a means of reducing carbon emissions and promoting cleaner mobility. As cities around the world face challenges related to traffic congestion, air pollution, and limited parking space, bicycles are being embraced as an effective solution for short-distance travel. Government initiatives to promote cycling, such as subsidies for e-bike purchases, investment in cycling infrastructure, and bike-sharing programs, are supporting the growth of the market. The integration of bicycles into multimodal transportation networks is also enabling commuters to combine cycling with other forms of public transit, further enhancing the appeal of bicycles as a sustainable transportation option.Another significant growth driver is the rising popularity of electric bicycles (e-bikes), which are transforming the bicycle market by making cycling more accessible and enjoyable for a broader audience. E-bikes are equipped with an electric motor that provides pedal assistance, reducing the effort required to ride and enabling users to travel longer distances and tackle hilly terrain with ease. The convenience and versatility of e-bikes are attracting a diverse range of users, from urban commuters and delivery personnel to recreational cyclists and older adults. The increasing availability of high-quality, feature-rich e-bikes at various price points is further boosting their adoption. The e-bike segment is expected to witness substantial growth in the coming years, driven by technological advancements, improved battery performance, and growing consumer acceptance.

The increasing focus on health and fitness is also fueling the expansion of the bicycle market. Cycling is widely recognized as an effective form of cardiovascular exercise that promotes physical fitness, weight management, and mental well-being. As more people prioritize their health and seek outdoor activities that provide both exercise and recreation, the demand for fitness-oriented bicycles such as road bikes, mountain bikes, and gravel bikes is on the rise. The popularity of cycling events, races, and social cycling clubs is fostering a sense of community and encouraging more people to take up cycling as a hobby. The use of fitness tracking technology and digital platforms is enabling cyclists to monitor their performance, set goals, and share their progress with others, enhancing the overall appeal of cycling as a fitness activity.

Lastly, the expansion of bicycle markets in emerging economies is contributing to the growth of the global bicycle market. In regions such as Asia-Pacific, Latin America, and Africa, the growing middle class, urbanization, and increasing disposable income are driving the demand for bicycles as both a means of transportation and a leisure activity. The rise of bicycle-sharing programs and the development of cycling infrastructure in these regions are supporting the broader adoption of bicycles. As more consumers in emerging markets embrace cycling for its cost-effectiveness, health benefits, and environmental advantages, the demand for bicycles is expected to rise. Additionally, the increasing focus on smart city initiatives and sustainable urban mobility is creating new opportunities for bicycle manufacturers and service providers. As demand from key sectors such as urban commuting, fitness, and recreation continues to rise, and as manufacturers innovate to meet evolving consumer needs, the global bicycle market is expected to witness sustained growth, driven by advancements in technology, expanding applications, and the increasing emphasis on sustainable and healthy lifestyles.

Report Scope

The report analyzes the Bicycles market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Road Bikes, Mountain Bikes, Hybrid Bikes, Other Types); End-Use (Transportation, Recreation, Racing, Physical Training, Other End-Uses).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Netherlands; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Road Bikes segment, which is expected to reach US$30.4 Billion by 2030 with a CAGR of 5.9%. The Mountain Bikes segment is also set to grow at 6.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $11.5 Billion in 2024, and China, forecasted to grow at an impressive 8% CAGR to reach $21.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Bicycles Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Bicycles Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Bicycles Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Accell Group B.V., Avon Cycles Ltd., Cycleurope AB, Cycling Sports Group, Inc., Fox Factory, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 232 companies featured in this Bicycles market report include:

- Accell Group B.V.

- Avon Cycles Ltd.

- Cycleurope AB

- Cycling Sports Group, Inc.

- Fox Factory, Inc.

- Giant Manufacturing Co. Ltd.

- Hamilton Industries Pvt. Ltd.

- Hero Cycles Ltd.

- Huffy Corporation

- Merida Industry Co., Ltd.

- Montague Corporation

- Pacific Cycle

- Raleigh UK Limited

- Santa Cruz Bicycles

- Specialized Bicycle Components, Inc.

- Tandem Group plc

- TI Cycles of India

- Trek Bicycle Corporation

- Winora Staiger GmbH

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Accell Group B.V.

- Avon Cycles Ltd.

- Cycleurope AB

- Cycling Sports Group, Inc.

- Fox Factory, Inc.

- Giant Manufacturing Co. Ltd.

- Hamilton Industries Pvt. Ltd.

- Hero Cycles Ltd.

- Huffy Corporation

- Merida Industry Co., Ltd.

- Montague Corporation

- Pacific Cycle

- Raleigh UK Limited

- Santa Cruz Bicycles

- Specialized Bicycle Components, Inc.

- Tandem Group plc

- TI Cycles of India

- Trek Bicycle Corporation

- Winora Staiger GmbH

Table Information

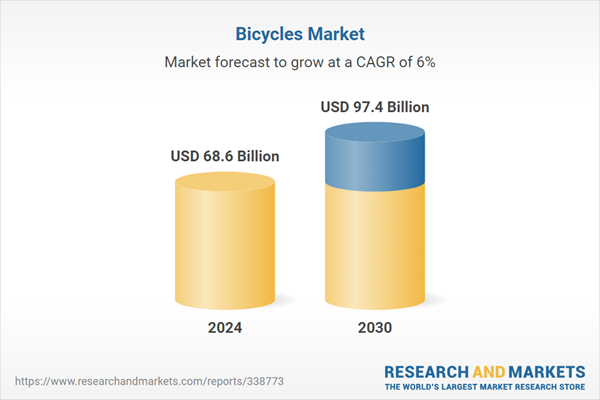

| Report Attribute | Details |

|---|---|

| No. of Pages | 484 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 68.6 Billion |

| Forecasted Market Value ( USD | $ 97.4 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |