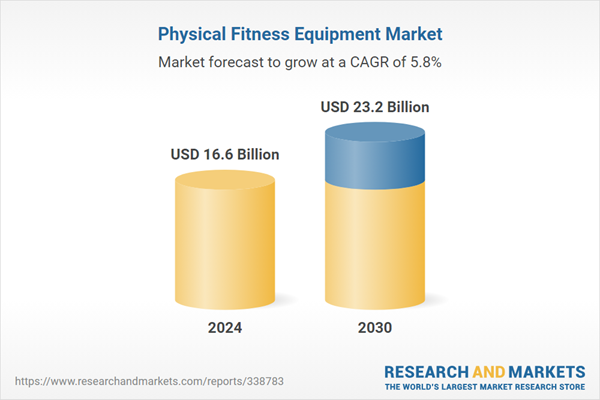

The global market for Physical Fitness Equipment was estimated at US$16.6 Billion in 2024 and is projected to reach US$23.2 Billion by 2030, growing at a CAGR of 5.8% from 2024 to 2030. This comprehensive report provides an in-depth analysis of market trends, drivers, and forecasts, helping you make informed business decisions. The report includes the most recent global tariff developments and how they impact the Physical Fitness Equipment market.

In addition to the traditional fitness equipment, there has been a significant rise in the popularity of technologically advanced fitness devices. Smart fitness equipment, integrated with digital features such as touchscreens, internet connectivity, and compatibility with fitness apps, has revolutionized the way people approach their workouts. These advanced machines offer features like virtual coaching, real-time performance tracking, and customized workout programs, enhancing user engagement and motivation. Wearable fitness technology, including smartwatches and fitness trackers, complements these machines by monitoring vital statistics such as heart rate, calories burned, and activity levels throughout the day. This technology enables users to set fitness goals, track their progress, and make data-driven adjustments to their routines. The integration of artificial intelligence and machine learning in fitness equipment is also emerging, providing users with personalized workout recommendations and adaptive training plans based on their performance data.

The growth in the physical fitness equipment market is driven by several factors. Technological advancements have significantly enhanced the functionality and appeal of fitness equipment, attracting a wider range of users. Innovations such as interactive screens, virtual reality workouts, and AI-driven fitness programs cater to tech-savvy consumers seeking engaging and personalized fitness experiences. The increasing awareness of health and wellness, coupled with rising obesity rates and sedentary lifestyles, has fueled demand for fitness equipment as more individuals recognize the importance of regular exercise. Home fitness has surged in popularity, especially post-pandemic, leading to a higher demand for compact and multifunctional equipment that fits into limited spaces. Additionally, the expansion of the fitness industry into emerging markets, where economic growth and urbanization are driving lifestyle changes, has created new opportunities for market growth. Social media influencers and fitness enthusiasts also play a crucial role in shaping consumer behavior, promoting fitness trends, and endorsing products, thereby driving sales. Finally, corporate wellness programs and government initiatives aimed at promoting physical activity and healthy living contribute to the rising demand for fitness equipment across different sectors.

Global Physical Fitness Equipment Market - Key Trends & Drivers Summarized

Physical fitness equipment has become an integral part of modern lifestyles, catering to a wide range of fitness needs and preferences. This category encompasses a variety of machines and tools designed for different types of workouts, including cardiovascular training, strength training, flexibility exercises, and overall fitness improvement. Key pieces of cardiovascular equipment include treadmills, stationary bikes, ellipticals, and rowing machines, each offering unique benefits such as improved heart health, weight loss, and endurance building. Strength training equipment includes free weights like dumbbells and barbells, resistance machines, and multifunctional home gyms that allow users to perform a variety of exercises targeting different muscle groups. Flexibility and balance tools such as yoga mats, stability balls, and resistance bands are essential for stretching routines and rehabilitation exercises. These items are commonly found in both commercial gyms and home workout spaces, reflecting the growing trend of personalized and convenient fitness solutions.In addition to the traditional fitness equipment, there has been a significant rise in the popularity of technologically advanced fitness devices. Smart fitness equipment, integrated with digital features such as touchscreens, internet connectivity, and compatibility with fitness apps, has revolutionized the way people approach their workouts. These advanced machines offer features like virtual coaching, real-time performance tracking, and customized workout programs, enhancing user engagement and motivation. Wearable fitness technology, including smartwatches and fitness trackers, complements these machines by monitoring vital statistics such as heart rate, calories burned, and activity levels throughout the day. This technology enables users to set fitness goals, track their progress, and make data-driven adjustments to their routines. The integration of artificial intelligence and machine learning in fitness equipment is also emerging, providing users with personalized workout recommendations and adaptive training plans based on their performance data.

The growth in the physical fitness equipment market is driven by several factors. Technological advancements have significantly enhanced the functionality and appeal of fitness equipment, attracting a wider range of users. Innovations such as interactive screens, virtual reality workouts, and AI-driven fitness programs cater to tech-savvy consumers seeking engaging and personalized fitness experiences. The increasing awareness of health and wellness, coupled with rising obesity rates and sedentary lifestyles, has fueled demand for fitness equipment as more individuals recognize the importance of regular exercise. Home fitness has surged in popularity, especially post-pandemic, leading to a higher demand for compact and multifunctional equipment that fits into limited spaces. Additionally, the expansion of the fitness industry into emerging markets, where economic growth and urbanization are driving lifestyle changes, has created new opportunities for market growth. Social media influencers and fitness enthusiasts also play a crucial role in shaping consumer behavior, promoting fitness trends, and endorsing products, thereby driving sales. Finally, corporate wellness programs and government initiatives aimed at promoting physical activity and healthy living contribute to the rising demand for fitness equipment across different sectors.

SCOPE OF STUDY:

The report analyzes the Physical Fitness Equipment market in terms of units by the following Segments, and Geographic Regions/Countries:- Segments: Equipment Type (Cardiovascular Training, Strength Training, Other Equipment Types); End-Use (Health Club/Gym, Home Consumers, Other End-Uses)

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Cardiovascular Training segment, which is expected to reach US$13.4 Billion by 2030 with a CAGR of a 6.3%. The Strength Training segment is also set to grow at 5.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.4 Billion in 2024, and China, forecasted to grow at an impressive 7.5% CAGR to reach $4.0 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Physical Fitness Equipment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Physical Fitness Equipment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Physical Fitness Equipment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Polar Electro Oy, Amer Sports Corporation, Biodex Medical Systems, Inc., Brunswick Corporation, Always-Fit Sports And Fitness Co.,Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 97 companies featured in this Physical Fitness Equipment market report include:

- Polar Electro Oy

- Amer Sports Corporation

- Biodex Medical Systems, Inc.

- Brunswick Corporation

- Always-Fit Sports And Fitness Co.,Ltd.

- Nautilus, Inc.

- Alexandave Industries Company Limited

- Body-Solid, Inc.

- Cybex International, Inc.

- Johnson Health Tech Co., Ltd.

- Life Fitness

- Octane Fitness

- Core Health & Fitness LLC

- OutdoorBody Inc.

- HANBITSOFT INC.

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

I. METHODOLOGYII. EXECUTIVE SUMMARY2. FOCUS ON SELECT PLAYERSIV. COMPETITION

1. MARKET OVERVIEW

3. MARKET TRENDS & DRIVERS

4. GLOBAL MARKET PERSPECTIVE

III. MARKET ANALYSIS

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Polar Electro Oy

- Amer Sports Corporation

- Biodex Medical Systems, Inc.

- Brunswick Corporation

- Always-Fit Sports And Fitness Co.,Ltd.

- Nautilus, Inc.

- Alexandave Industries Company Limited

- Body-Solid, Inc.

- Cybex International, Inc.

- Johnson Health Tech Co., Ltd.

- Life Fitness

- Octane Fitness

- Core Health & Fitness LLC

- OutdoorBody Inc.

- HANBITSOFT INC.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 393 |

| Published | June 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 16.6 Billion |

| Forecasted Market Value ( USD | $ 23.2 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |