Global Orthobiologics Market - Key Trends & Drivers Summarized

What Are Orthobiologics, and Why Are They Critical in Orthopedic Medicine?

Orthobiologics are biologically derived substances used to enhance the healing of bones, muscles, tendons, and ligaments in orthopedic procedures. These substances, which include platelet-rich plasma (PRP), bone grafts, stem cells, and hyaluronic acid, are designed to improve the body's natural healing processes by reducing inflammation, promoting tissue regeneration, and accelerating recovery. Orthobiologics are widely used in treatments for sports injuries, degenerative joint diseases, and spinal conditions, offering patients a minimally invasive option to surgery or, in some cases, improving surgical outcomes when used as an adjunct therapy. By leveraging the body's natural regenerative capacity, orthobiologics represent a promising advancement in musculoskeletal care, providing faster healing and reducing complications associated with traditional treatments. Their growing adoption is being driven by increased patient demand for non-surgical treatment options and the rise of biologics in orthopedic surgery.How Are Technological Advancements Shaping the Orthobiologics Industry?

Technological innovations are propelling the orthobiologics market forward, particularly in the areas of regenerative medicine and tissue engineering. Advances in stem cell research have expanded the possibilities for regenerative treatments, with stem cell-based therapies showing promise in repairing cartilage, bone, and soft tissues in orthopedic patients. The refinement of platelet-rich plasma (PRP) therapies, where concentrated platelets are injected into damaged tissue to promote healing, has also increased the effectiveness of non-surgical treatments for a variety of musculoskeletal injuries. Furthermore, developments in synthetic bone graft substitutes, which mimic the properties of natural bone, are offering orthopedic surgeons more options for bone regeneration in spinal fusion and trauma cases. Additionally, innovations in the delivery systems for orthobiologics, such as the use of scaffolds or hydrogels, are improving the precision and efficacy of these therapies. These technological advancements are enhancing the scope of orthobiologics, making them more versatile and applicable to a wider range of conditions, from joint repair to spinal deformities.Where Are Orthobiologics Being Used Most Extensively?

Orthobiologics are primarily used in orthopedic surgeries, sports medicine, and trauma care, with increasing applications in spinal fusion, joint repair, and soft tissue regeneration. In sports medicine, PRP and stem cell therapies are widely used to treat injuries such as tendonitis, ligament tears, and cartilage damage, helping athletes recover faster and avoid surgery. In orthopedic surgery, orthobiologics are frequently used in procedures like spinal fusion, where bone grafts or bone substitutes are needed to promote bone growth and stabilize the spine. Joint reconstruction, particularly in the knee and shoulder, is another area where orthobiologics are commonly employed to enhance tissue repair and reduce recovery times. Moreover, orthobiologics are gaining traction in treating degenerative joint diseases such as osteoarthritis, where they help alleviate pain and restore joint function. Their use in trauma care is also expanding, particularly for complex fractures that require enhanced bone healing.What Is Driving the Growth of the Orthobiologics Market?

The growth in the orthobiologics market is driven by several factors, including the rising prevalence of musculoskeletal disorders, an increasing demand for minimally invasive procedures, and advancements in regenerative medicine. One of the primary drivers is the aging global population, which is leading to a higher incidence of orthopedic conditions such as osteoarthritis and osteoporosis, both of which benefit from orthobiologic treatments. The growing demand for minimally invasive and non-surgical treatment options is another significant driver, as patients increasingly seek alternatives to traditional surgery for faster recovery and fewer complications. Technological advancements in stem cell therapies, platelet-rich plasma (PRP), and bone graft substitutes are further expanding the range of conditions that can be treated with orthobiologics, making them more effective and accessible. Additionally, the increasing adoption of orthobiologics in sports medicine, driven by professional athletes and active individuals looking for cutting-edge treatments, is contributing to market growth. Lastly, the rising awareness of the benefits of biologics in orthopedic care, coupled with ongoing research and development in the field, is driving the broader use of these therapies in both clinical and surgical settings.Report Scope

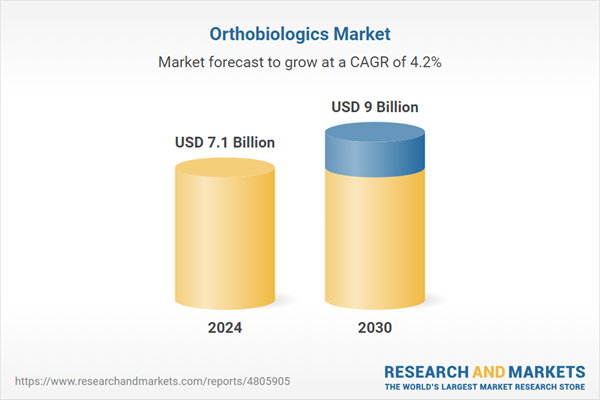

The report analyzes the Orthobiologics market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Viscosupplementation, Synthetic Orthobiologics, DBM, BMP, Other Products); Application (Osteoarthritis & Degenerative Arthritis, Fracture Recovery, Spinal Fusion, Soft Tissue Injuries, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Viscosupplementation segment, which is expected to reach US$4.1 Billion by 2030 with a CAGR of 5.1%. The Synthetic Orthobiologics segment is also set to grow at 3.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.9 Billion in 2024, and China, forecasted to grow at an impressive 3.8% CAGR to reach $1.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Orthobiologics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Orthobiologics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Orthobiologics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Arthrex, Inc., Bioventus LLC, DePuy Synthes, Globus Medical, Inc., K2M Group Holdings, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Orthobiologics market report include:

- Arthrex, Inc.

- Bioventus LLC

- DePuy Synthes

- Globus Medical, Inc.

- K2M Group Holdings, Inc.

- Kuros Biosciences AG

- Medtronic PLC

- NuVasive, Inc.

- Orthofix International NV

- RTI Surgical, Inc.

- SeaSpine Holdings Corporation

- Stryker Corporation

- XTANT Medical Holdings, Inc.

- Zimmer Biomet Holdings, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Arthrex, Inc.

- Bioventus LLC

- DePuy Synthes

- Globus Medical, Inc.

- K2M Group Holdings, Inc.

- Kuros Biosciences AG

- Medtronic PLC

- NuVasive, Inc.

- Orthofix International NV

- RTI Surgical, Inc.

- SeaSpine Holdings Corporation

- Stryker Corporation

- XTANT Medical Holdings, Inc.

- Zimmer Biomet Holdings, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 193 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 7.1 Billion |

| Forecasted Market Value ( USD | $ 9 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |