Global Diabetes Diagnostics Market - Key Trends & Drivers Summarized

What Is the Scope of Diabetes Diagnostics and Why Is It Crucial?

Diabetes diagnostics encompass a range of tests and technologies used to detect and monitor the metabolic disorder characterized by high blood glucose levels, commonly referred to as diabetes. Early and accurate diagnosis is crucial to managing diabetes effectively and preventing a plethora of associated health complications such as heart disease, kidney failure, and vision impairment. Traditional diagnostic tools include fasting blood sugar tests, HbA1c tests, which measure glucose levels over two to three months, and oral glucose tolerance tests. Recent advancements have expanded the scope to include continuous glucose monitoring systems (CGMS) and flash glucose monitors, which provide real-time insights into glucose levels, enabling more dynamic management of the disease. The increasing prevalence of diabetes globally necessitates widespread access to these diagnostic tools to mitigate the substantial health and economic burdens posed by the disease.How Are Technological Innovations Transforming Diabetes Diagnostics?

Technological innovations are significantly transforming diabetes diagnostics, making it easier, faster, and less invasive to monitor blood glucose levels. Modern developments in sensor technology and digital health platforms have led to the creation of wearable devices that track glucose levels continuously without the need for frequent finger-pricking. These devices use tiny sensors inserted under the skin to measure glucose levels in interstitial fluid and provide data to smartphones or dedicated readers, allowing for immediate feedback on glucose trends and variability. Additionally, the integration of artificial intelligence (AI) in diabetes care is enhancing the predictive capabilities of monitoring devices, helping to anticipate and prevent hyperglycemic and hypoglycemic events by analyzing user data and external factors such as diet and exercise. These advancements not only improve individual outcomes but also contribute to broader public health strategies by facilitating the early detection and ongoing management of diabetes in diverse populations.Emerging Trends Influencing Diabetes Diagnostic Practices

Several emerging trends are reshaping practices within the diabetes diagnostics field. Personalized medicine is becoming increasingly prevalent, with diagnostics tailored to individual genetic profiles to predict disease risk and tailor treatments accordingly. This approach is supported by the growth in data analytics and machine learning, which help in interpreting large datasets to uncover patterns that can inform better treatment protocols. Additionally, there is a growing shift towards integrated care models, where diagnostic tools are part of a holistic approach to diabetes management that includes diet, exercise, and mental health. The consumer health technology trend is also significant, with more patients using mobile health applications and connected devices to manage their condition independently. These trends underscore a move towards more patient-centered and data-driven care, which empowers patients and enhances the efficiency of healthcare delivery.What Drives the Growth of the Diabetes Diagnostics Market?

The growth in the diabetes diagnostics market is driven by several factors, including the rising global prevalence of diabetes due to aging populations and increasing rates of obesity. Enhanced awareness and better screening programs are leading to higher diagnosis rates, thereby increasing the demand for monitoring and diagnostic products. Technological advancements that offer improved accuracy, convenience, and connectivity are also pivotal, as they address patient demands for devices that fit seamlessly into their lifestyles and provide instant feedback to manage their health effectively. Furthermore, healthcare providers are continuously seeking cost-effective ways to manage and treat chronic diseases, including diabetes, which supports ongoing investment in innovative diagnostic solutions. Additionally, regulatory support for novel medical devices and the expansion of healthcare infrastructure in emerging markets contribute to the robust growth of this sector. These dynamics highlight the critical role of innovation and adaptation in meeting the expanding needs within the global healthcare landscape.Report Scope

The report analyzes the Diabetes Diagnostics market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Test Strips, Lancets, Analog Glucose Monitors, Continuous Glucose Monitors, Syringes, Pens, Pumps, Injectors); End-Use (Hospitals, Home Care, Diagnostic Centers, Other End-Uses).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Test Strips segment, which is expected to reach US$14.7 Billion by 2030 with a CAGR of 8.7%. The Lancets segment is also set to grow at 7.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $13.7 Billion in 2024, and China, forecasted to grow at an impressive 10.1% CAGR to reach $7.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Diabetes Diagnostics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Diabetes Diagnostics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Diabetes Diagnostics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott Laboratories, Inc., B. Braun Melsungen AG, Becton, Dickinson and Company, Bio-Rad Laboratories, Inc., Danaher Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 91 companies featured in this Diabetes Diagnostics market report include:

- Abbott Laboratories, Inc.

- B. Braun Melsungen AG

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- ACON Laboratories, Inc.

- ARKRAY, Inc.

- A. Menarini Diagnostics Srl

- AgaMatrix, Inc.

- BIONIME Corporation

- Ascensia Diabetes Care Holdings AG

- American Laboratory Products Company (ALPCO)

- AmbiMedInc

- Companion Medical, Inc.

- Ciga Healthcare Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories, Inc.

- B. Braun Melsungen AG

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- ACON Laboratories, Inc.

- ARKRAY, Inc.

- A. Menarini Diagnostics Srl

- AgaMatrix, Inc.

- BIONIME Corporation

- Ascensia Diabetes Care Holdings AG

- American Laboratory Products Company (ALPCO)

- AmbiMedInc

- Companion Medical, Inc.

- Ciga Healthcare Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 346 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

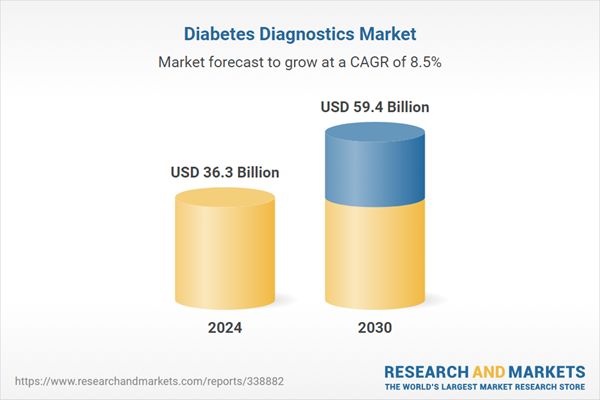

| Estimated Market Value ( USD | $ 36.3 Billion |

| Forecasted Market Value ( USD | $ 59.4 Billion |

| Compound Annual Growth Rate | 8.5% |

| Regions Covered | Global |