Global Drug Discovery Technologies Market - Key Trends & Drivers Summarized

What Are Drug Discovery Technologies and How Do They Propel Pharmaceutical Innovation?

Drug discovery technologies comprise a broad range of methods and tools used in the identification and development of new therapeutic drugs. These technologies are critical in the pharmaceutical industry as they streamline the process of discovering and optimizing new compounds that may become the next generation of medications. Key technologies include high-throughput screening (HTS), genomics, proteomics, bioinformatics, and artificial intelligence (AI). HTS allows researchers to quickly conduct millions of chemical, genetic, or pharmacological tests, dramatically speeding up the discovery of active compounds that could lead to viable drugs. Genomics and proteomics provide insights into the genetic and protein expressions related to diseases, offering new targets for drug therapy.How Is Artificial Intelligence Transforming Drug Discovery?

Artificial intelligence (AI) is revolutionizing the drug discovery process by offering unprecedented data processing capabilities and predictive power. AI algorithms can analyze vast datasets from drug trials, patient records, and genetic information to identify potential drug candidates with higher precision and at a fraction of the time and cost compared to traditional methods. Machine learning models are particularly adept at recognizing complex patterns in data, predicting how different chemicals will interact with the human body, and suggesting modifications to chemical structures to enhance efficacy and reduce side effects. As AI technology continues to evolve, its integration into drug discovery processes is becoming increasingly indispensable, enabling more targeted and effective therapies.What Challenges and Opportunities Exist in the Adoption of New Drug Discovery Technologies?

While the integration of advanced technologies in drug discovery presents significant opportunities for the development of effective treatments, it also introduces challenges. The high cost of new technologies, such as robotics and AI platforms, can be a barrier for smaller pharmaceutical companies and research institutions. Additionally, managing and analyzing the enormous volumes of data generated by these technologies require substantial investments in data management infrastructure and skilled personnel. Despite these challenges, the potential to drastically reduce the time and cost associated with drug development is a compelling incentive for continued investment. Emerging markets are also recognizing the value of these technologies, leading to increased adoption worldwide.What Drives the Growth in the Drug Discovery Technologies Market?

The growth in the drug discovery technologies market is driven by several factors, including the urgent need for new medical treatments, advancements in technology, and increased funding and investment in R&D by pharmaceutical companies and governments. The rising prevalence of chronic and infectious diseases worldwide demands faster and more efficient development of effective drugs. Technological advancements that offer enhanced capabilities and efficiencies in discovering new drugs are critical in meeting these health challenges. Additionally, the pharmaceutical industry's focus on precision medicine tailored to genetic profiles is pushing the boundaries of traditional drug discovery, further fueling the demand for advanced technologies.Report Scope

The report analyzes the Drug Discovery Technologies market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Small Molecule Drugs, Biologics); Technology (High Throughput Screening, Biochips, Bioinformatics, Pharmacogenomics & Pharmacogenetics, Nanotechnology, Other Technologies); End-Use (Research Institutes, Pharmaceutical Companies, Biotechnology Companies, Other End-Uses).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Rest of Europe; Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Small Molecule Drugs segment, which is expected to reach US$92.7 Billion by 2030 with a CAGR of 8.4%. The Biologics segment is also set to grow at 9.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $20.2 Billion in 2024, and China, forecasted to grow at an impressive 10.6% CAGR to reach $19 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Drug Discovery Technologies Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Drug Discovery Technologies Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Drug Discovery Technologies Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Agilent Technologies, Inc., Beckman Coulter, Inc., Bio-Rad Laboratories, Inc., Alnylam Pharmaceuticals, Inc., Antares Pharma, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 129 companies featured in this Drug Discovery Technologies market report include:

- Agilent Technologies, Inc.

- Beckman Coulter, Inc.

- Bio-Rad Laboratories, Inc.

- Alnylam Pharmaceuticals, Inc.

- Antares Pharma, Inc.

- Ambrx, Inc.

- ActivX Biosciences, Inc.

- Alembic Pharmaceuticals Limited

- BioVision, Inc.

- Acadia Pharmaceuticals, Inc.

- Beactica Therapeutics AB

- Atomwise, Inc.

- BeiGene LTD.

- ATXA Therapeutics

- Bayer Pharmaceuticals

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Agilent Technologies, Inc.

- Beckman Coulter, Inc.

- Bio-Rad Laboratories, Inc.

- Alnylam Pharmaceuticals, Inc.

- Antares Pharma, Inc.

- Ambrx, Inc.

- ActivX Biosciences, Inc.

- Alembic Pharmaceuticals Limited

- BioVision, Inc.

- Acadia Pharmaceuticals, Inc.

- Beactica Therapeutics AB

- Atomwise, Inc.

- BeiGene LTD.

- ATXA Therapeutics

- Bayer Pharmaceuticals

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 486 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

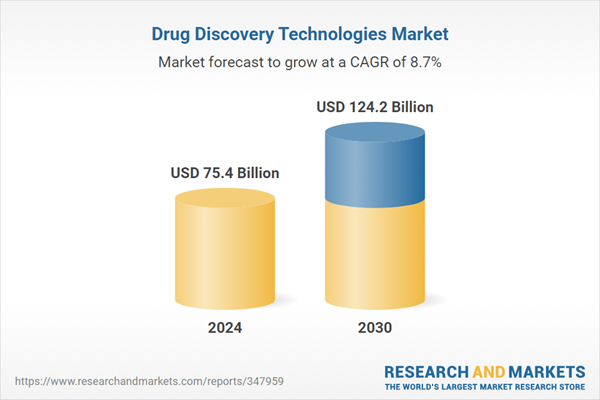

| Estimated Market Value ( USD | $ 75.4 Billion |

| Forecasted Market Value ( USD | $ 124.2 Billion |

| Compound Annual Growth Rate | 8.7% |

| Regions Covered | Global |