Global Plywood Market - Key Trends & Drivers Summarized

How Has the Manufacturing Landscape for Plywood Evolved in Recent Years?

The global plywood industry has undergone a substantial transformation over the past decade, driven by innovations in production technologies, rising demand from end-use sectors, and increasing environmental awareness. Traditional plywood manufacturing, which once relied heavily on manual labor and basic veneer pressing, has now been supplemented with precision-engineered automation systems, enabling consistent quality and higher production efficiency. The integration of advanced CNC (computer numerical control) machines and digital measurement tools has not only reduced human error but also accelerated customization across plywood panel formats and finishes. Another major evolution lies in adhesive technologies; formaldehyde-based resins, once dominant, are increasingly being replaced by low-emission or formaldehyde-free alternatives in response to stricter global emission regulations. Manufacturers are now investing in bio-based adhesives and nanotechnology-enhanced resins, which improve bonding strength while minimizing environmental impact. The shift toward sustainable raw materials - such as plantation-grown hardwoods, softwoods, and fast-growing tropical species - has also emerged as a focal point, especially as deforestation and illegal logging draw increasing scrutiny. These transformations have enabled greater operational efficiency while aligning production with green building standards like LEED, BREEAM, and FSC-certified forestry. With the cost of raw wood materials becoming volatile in global markets, manufacturers are strategically shifting to more abundant, cost-effective substitutes like poplar and eucalyptus, especially in Asia-Pacific and parts of Latin America.Why Is Plywood Becoming Increasingly Integral to Construction and Interior Design?

The adoption of plywood in the construction and interior design segments has accelerated due to its unique combination of strength, versatility, cost-efficiency, and sustainability. In residential and commercial construction, plywood is increasingly favored over traditional solid wood or metal frameworks due to its ability to bear loads effectively while remaining lightweight and easy to work with. The rising popularity of prefabricated housing and modular construction - especially in North America, Scandinavia, and Southeast Asia - has significantly fueled demand for engineered wood products like plywood that offer structural reliability without excessive bulk. Furthermore, the aesthetic flexibility of plywood, which allows it to be finished with laminates, veneers, or paints, makes it a preferred choice for cabinetry, wall panels, and custom furniture. In emerging markets such as India, Indonesia, and Brazil, affordability and ease of availability have made plywood the material of choice for mass housing projects and low-income urban housing developments. Its moisture resistance, termite resistance (with proper treatment), and acoustic insulation properties have also contributed to its popularity in acoustic paneling and flooring applications in educational institutions, corporate offices, and entertainment facilities. Plywood's integral role in the green building movement cannot be overstated - it serves as a key material in eco-conscious design due to its lower carbon footprint compared to concrete and steel. Moreover, a new wave of architects and designers are increasingly embracing plywood for minimalist, sustainable interiors, often showcasing its grain patterns as a deliberate design element.What Role Does Regional Dynamics and Export Competitiveness Play in Shaping the Market?

The plywood market is deeply influenced by regional production capacities, trade dynamics, and shifting regulatory frameworks. China remains the undisputed global leader in plywood production and exports, benefiting from economies of scale, an expansive industrial base, and government subsidies for forest product industries. However, recent anti-dumping duties imposed by the U.S. and the EU on Chinese plywood have reshaped global trade flows, creating opportunities for other countries like Vietnam, Indonesia, and Russia to increase their share in the global export landscape. In contrast, developed markets such as the United States, Germany, and Japan have increasingly focused on importing certified and environmentally compliant plywood, placing pressure on global suppliers to meet higher compliance benchmarks, including CARB Phase 2 and EPA TSCA Title VI certifications. Additionally, ASEAN countries and parts of Eastern Europe are witnessing a surge in plywood mill expansions, fueled by domestic housing booms and rising exports to neighboring countries. The Middle East and Africa are also seeing heightened imports, largely driven by rapid urbanization, infrastructure development, and tourism-related construction. Meanwhile, in Latin America, Brazil is evolving into a key player in the softwood plywood segment, aided by its vast forest resources and proximity to North American and European markets. These regional variations not only determine price competitiveness but also shape market segmentation, with local preferences dictating plywood grade, thickness, and surface treatments. Trade policies, currency fluctuations, and geopolitical tensions continue to be pivotal in influencing import-export decisions, making it crucial for stakeholders to closely monitor regional policy changes and bilateral trade agreements.What Are the Underlying Forces Powering the Growth in the Global Plywood Market?

The growth in the global plywood market is driven by several factors related to shifting construction paradigms, technological advancements, evolving end-use applications, and changing consumer behavior. Firstly, the rise in multi-story wooden buildings, particularly in North America and parts of Europe, has led to greater structural use of high-grade plywood, replacing more traditional materials due to its superior strength-to-weight ratio. Secondly, the surge in DIY home improvement projects - especially post-pandemic - has increased retail-level plywood sales, with consumers opting for it in furniture making, shelving, and cabinetry due to its workability and affordability. Third, automation and digitization in plywood manufacturing, including the adoption of AI-driven quality control systems and real-time monitoring of veneer defects, have enhanced product consistency, thereby boosting its appeal in precision-demanding applications like marine and aircraft interiors. Fourth, regulatory pressures favoring low-emission building materials are leading developers to choose plywood over synthetic panels, particularly in environmentally sensitive projects. Fifth, the proliferation of smart homes and energy-efficient buildings has expanded plywood usage in insulating flooring systems and energy-saving panel designs. Additionally, the use of treated plywood in vehicle bodies and refrigerated containers is growing, especially in Asia-Pacific and Europe, driven by logistics industry expansion. Finally, the increasing penetration of branded and customizable plywood products, often accompanied by digital marketing and e-commerce channels, is transforming the B2C plywood landscape, making it more consumer-centric and quality-assured than ever before. These multifaceted growth drivers, anchored in both supply-side innovations and demand-side shifts, are collectively positioning plywood as an indispensable material in modern construction and design ecosystems.Report Scope

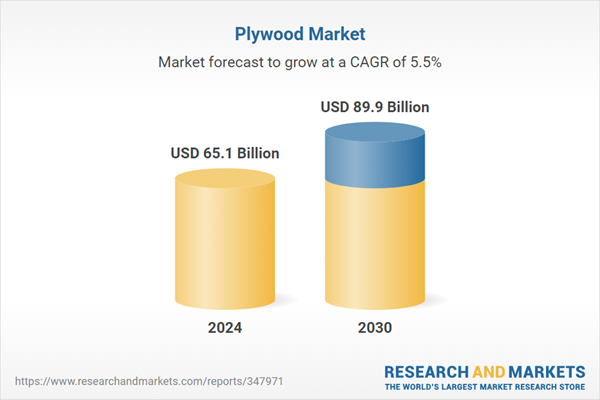

The report analyzes the Plywood market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Softwood Type, Hardwood Type); Application (New Construction Application, Replacement Application); End-Use (Construction End-Use, Furniture End-Use, Industrial End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Softwood Type segment, which is expected to reach US$56 Billion by 2030 with a CAGR of 5.4%. The Hardwood Type segment is also set to grow at 5.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $8.4 Billion in 2024, and China, forecasted to grow at an impressive 6.8% CAGR to reach $23.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Plywood Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Plywood Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Plywood Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Affiliated Resources, Inc., Amit Plywood Industries, Andamans Timber Industries Ltd., Anika Global, Apollo Flooring Center and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 158 companies featured in this Plywood market report include:

- Affiliated Resources, Inc.

- Amit Plywood Industries

- Andamans Timber Industries Ltd.

- Anika Global

- Apollo Flooring Center

- Archela Contrachapados, S.L.

- Archidply Industries Ltd.

- Artoni E Fadani Srl

- Au-Mex spol. s r.o.

- Ausen Wood Products Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Affiliated Resources, Inc.

- Amit Plywood Industries

- Andamans Timber Industries Ltd.

- Anika Global

- Apollo Flooring Center

- Archela Contrachapados, S.L.

- Archidply Industries Ltd.

- Artoni E Fadani Srl

- Au-Mex spol. s r.o.

- Ausen Wood Products Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 1067 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 65.1 Billion |

| Forecasted Market Value ( USD | $ 89.9 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |