Global Ethanol Market - Key Trends & Drivers Summarized

What Is Ethanol and Why Is It a Key Player in Sustainable Energy?

Ethanol, commonly known as ethyl alcohol, is a biofuel derived primarily from plant materials like corn, sugarcane, and wheat. As an alcohol-based fuel, it has gained prominence as a renewable alternative to petroleum-based fuels, primarily used to increase octane levels and improve the emissions quality of gasoline. The production of ethanol involves fermenting the sugar components of plant materials, which is then distilled to increase its purity and concentration. One of the key benefits of ethanol is its environmental friendliness compared to traditional fossil fuels; it burns cleaner, reducing pollutants such as nitrogen oxides and particulate matter from exhaust gases. Additionally, as a biofuel, it helps reduce the dependence on oil imports, providing energy security for countries investing in its production. The adaptability of ethanol to current engine designs and fuel distribution infrastructures has facilitated its integration into the energy mix, making it a cornerstone of many national strategies for achieving long-term sustainability goals.How Has Technology Enhanced Ethanol Production and Efficiency?

Advancements in biotechnology have significantly improved the efficiency and sustainability of ethanol production. Through the development of genetically modified crops that yield more sugar per acre, producers are able to extract more ethanol from the same amount of land, thus increasing production without expanding agricultural land. Moreover, innovations in fermentation technology have streamlined the conversion of sugars to ethanol, making the process faster and less energy-intensive. The industry has also seen improvements in the distillation process through the integration of energy-efficient systems that reduce the overall carbon footprint of production. These technological advancements are critical as they address the twin challenges of energy efficiency and environmental sustainability, ensuring that ethanol remains a viable and competitive alternative to conventional fuels.What Are the Current Trends Influencing the Ethanol Industry?

Several trends are currently shaping the global ethanol market. The growing global emphasis on reducing carbon emissions is driving the demand for cleaner fuel alternatives, positioning ethanol as a favorable option due to its lower environmental impact. Additionally, the economic development in emerging markets is leading to increased energy demand, where ethanol is becoming an integral part of energy policy due to its renewable nature and potential for local production, boosting rural economies and reducing urban pollution. Furthermore, there is a significant trend towards the development of second-generation biofuels, which are derived from non-food biomass sources such as agricultural waste, wood chips, and grasses. This not only alleviates the food vs. fuel debate associated with first-generation biofuels but also enhances the sustainability profile of biofuels like ethanol.What Drives the Growth in the Ethanol Market?

The growth in the ethanol market is driven by several factors that are crucial to understanding its expanding role in the global energy landscape. Technological innovations in production processes that increase yield and reduce costs are essential for making ethanol more competitive against traditional fuels and other renewable alternatives. Additionally, the shift in consumer behavior towards more sustainable and environmentally friendly products is increasing the demand for green fuels like ethanol. Government policies and subsidies play a pivotal role as well, incentivizing the production and consumption of ethanol through various supports such as blending mandates and tax incentives. Moreover, the increasing recognition of ethanol's role in reducing greenhouse gas emissions and improving air quality continues to support its adoption in new markets around the world. Lastly, ongoing research into optimizing ethanol blends for better fuel efficiency and engine performance is helping to integrate ethanol more deeply into the mainstream fuel supply, further driving market growth. These factors collectively contribute to the robust growth and continued relevance of ethanol in meeting today's energy and environmental challenges.Report Scope

The report analyzes the Ethanol market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Feedstock Type (Coarse-Grain based, Sugar-based, and Other Feedstock Types); End-Use (Fuel, Industrial Solvents, Beverages, Cosmetics, and Other End-Uses).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Fuel End-Use segment, which is expected to reach US$67.6 Billion by 2030 with a CAGR of 5.6%. The Industrial Solvents End-Use segment is also set to grow at 5.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $43.7 Billion in 2024, and China, forecasted to grow at an impressive 7.8% CAGR to reach $13.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Ethanol Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Ethanol Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Ethanol Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ACE Ethanol LLC, Archer-Daniels-Midland Company, AGRANA Beteiligungs-AG, Bajaj Hindusthan Sugar Ltd., Cargill, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 100 companies featured in this Ethanol market report include:

- ACE Ethanol LLC

- Archer-Daniels-Midland Company

- AGRANA Beteiligungs-AG

- Bajaj Hindusthan Sugar Ltd.

- Cargill, Inc.

- Cremer Oleo GmbH & Co. KG

- Poet LLC

- Praj Industries Ltd.

- Sasol Ltd.

- Raizen

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ACE Ethanol LLC

- Archer-Daniels-Midland Company

- AGRANA Beteiligungs-AG

- Bajaj Hindusthan Sugar Ltd.

- Cargill, Inc.

- Cremer Oleo GmbH & Co. KG

- Poet LLC

- Praj Industries Ltd.

- Sasol Ltd.

- Raizen

Table Information

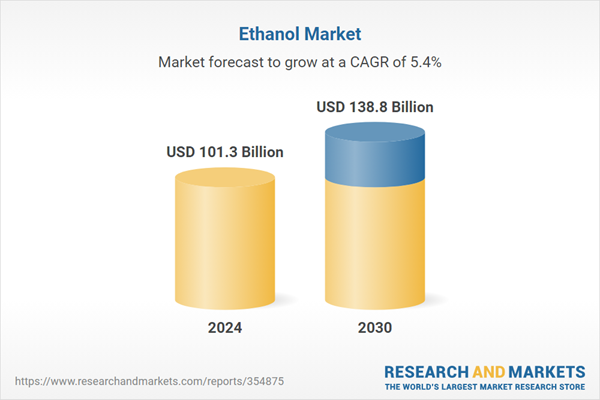

| Report Attribute | Details |

|---|---|

| No. of Pages | 319 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 101.3 Billion |

| Forecasted Market Value ( USD | $ 138.8 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |