Global Toluene Market - Key Trends and Drivers Summarized

Toluene is a clear, colorless liquid with a distinctive smell, widely used as an industrial solvent and chemical intermediate. Derived mainly from crude oil through catalytic reforming and toluene disproportionation processes, it plays a critical role in the manufacture of various chemical products. One of its primary uses is in the production of benzene and xylene, which are key building blocks for a range of chemicals including polymers, plastics, resins, and synthetic fibers. Toluene is also utilized in the production of toluene diisocyanate (TDI), a precursor for polyurethane foams used in furniture, automotive seats, and insulation materials. Additionally, toluene is employed as a solvent in paints, coatings, adhesives, inks, and cleaning agents, owing to its ability to dissolve a wide variety of chemical compounds effectively.Technological advancements have significantly impacted the production and application of toluene, enhancing its efficiency and expanding its utility. Innovations in catalytic processes have improved the yield and purity of toluene extraction, making production more cost-effective and environmentally friendly. The development of advanced separation techniques, such as pressure swing adsorption and extractive distillation, has optimized the separation of toluene from complex mixtures, further improving its availability and quality. Moreover, the growing integration of renewable feedstocks and sustainable practices in the chemical industry has influenced the production of toluene, aligning it with global sustainability goals. These advancements not only improve the overall efficiency of toluene production but also reduce its environmental footprint, contributing to more sustainable industrial practices.

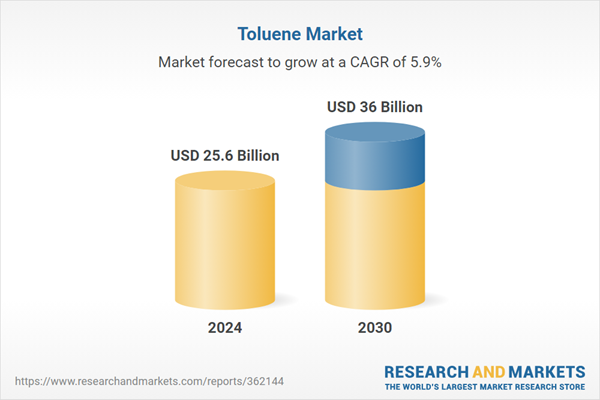

The growth in the toluene market is driven by several factors. The increasing demand for polyurethane foams in the construction and automotive industries has significantly boosted the need for toluene diisocyanate (TDI), a primary derivative of toluene. The expansion of the petrochemical industry, particularly in emerging economies, has further fueled the demand for toluene as a chemical intermediate for benzene and xylene production. Technological advancements in production processes and the development of efficient separation techniques have enhanced the availability and quality of toluene, supporting its widespread industrial application. Additionally, the rising focus on sustainability and the integration of renewable feedstocks in toluene production have driven the market towards more eco-friendly practices. The growth of the paints, coatings, and adhesives industries, driven by increasing construction and infrastructure activities, has also contributed to the increased demand for toluene. These factors, combined with ongoing research and development efforts, ensure the robust expansion and diversification of the toluene market, making it a vital component in various industrial applications.

Report Scope

The report analyzes the Toluene market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Derivative (Benzene & Xylene, Gasoline Additives, Toluene Diisocyanates, Solvents, Other Derivatives); Application (Drugs, Dyes, Blending, Cosmetic Nail Products, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Benzene & Xylene Derivative segment, which is expected to reach US$21.7 Billion by 2030 with a CAGR of a 6.2%. The Gasoline Additives Derivative segment is also set to grow at 5.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $6.6 Billion in 2024, and China, forecasted to grow at an impressive 9.1% CAGR to reach $8.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Toluene Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Toluene Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Toluene Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BASF SE, China National Petroleum Corporation (CNPC), China Petroleum & Chemical Corporation (SINOPEC), ConocoPhillips Company, Exxon Mobil Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 12 companies featured in this Toluene market report include:

- BASF SE

- China National Petroleum Corporation (CNPC)

- China Petroleum & Chemical Corporation (SINOPEC)

- ConocoPhillips Company

- Exxon Mobil Corporation

- Mitsui Chemicals, Inc.

- Reliance Industries Ltd.

- Royal Dutch Shell PLC

- Valero Energy Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BASF SE

- China National Petroleum Corporation (CNPC)

- China Petroleum & Chemical Corporation (SINOPEC)

- ConocoPhillips Company

- Exxon Mobil Corporation

- Mitsui Chemicals, Inc.

- Reliance Industries Ltd.

- Royal Dutch Shell PLC

- Valero Energy Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 261 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 25.6 Billion |

| Forecasted Market Value ( USD | $ 36 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |