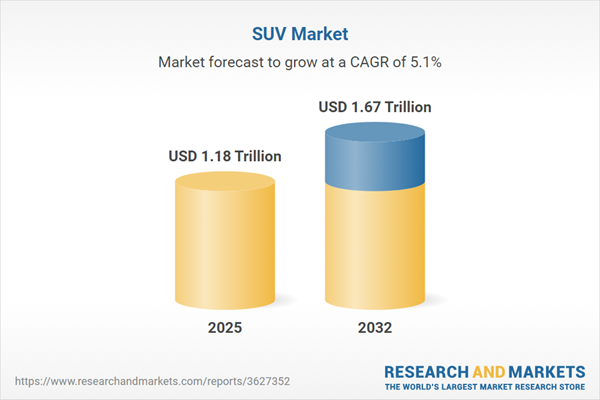

The SUV market is expected to grow from USD 1.18 trillion in 2025 to USD 1.67 trillion in 2032, registering a CAGR of 5.1%.Mid-Size SUV Segment to Hold Largest Market

In the US and Europe, SUV demand is increasingly driven by advanced chassis architectures, where OEMs are integrating adaptive air suspensions, active roll control, and terrain-calibrated torque management systems to enhance both on-road dynamics and off-road articulation. Premium SUV growth is supported by the shift to zonal E/E architectures, enabling real-time damping control, predictive ADAS functions, and improved NVH isolation through active noise cancellation. Electrification is accelerating due to consumer demand for high-performance e-SUVs, pushing OEMs toward 800V platforms, high-density NMC battery packs, and multi-motor e-axles that deliver higher towing capacity and thermal robustness, critical performance differentiators in the Western market.

In China, India, and Japan, the momentum for compact and mid-size SUVs is being shaped by modular skateboard and multi-energy platforms that enable OEMs to package hybrid, turbo-petrol, and BEV powertrains without requiring redesign of the vehicle architecture. The shift toward 1.0-1.5L turbocharged GDI engines, strong-hybrid systems with e-CVTs, and localized battery modules has made SUVs more efficient and cost-competitive than sedans. Chinese and Indian manufacturers are also deploying lightweight multilink rear suspensions, high-strength steel cages, and compact e-drive units to improve handling and crash safety while maintaining aggressive pricing.

The 5-seater segment is expected to hold a larger market share during the forecast period.

Mini, compact, and select mid-size SUVs in Asia Pacific and Europe continue to gain traction due to their optimized 2-row configurations, which balance urban maneuverability with enhanced cabin ergonomics. In Asia Pacific, increased disposable income and rapid urban expansion are pushing young buyers toward SUVs that integrate advanced infotainment domains, ADAS Level 1-2 features, and high-efficiency turbo-hybrid powertrains, delivering premium functionality without the pricing burden of larger segments. Automakers are also leveraging localized modular platforms (e.g., CMP, TNGA-B, BMA) to engineer roomier 5-seater layouts and maximize interior volume despite compact exterior footprints, directly appealing to dense-city use cases.In Europe, the surge in premium 5-seater mid-size SUVs is driven by the demand for vehicles that combine long-distance comfort, upgraded multilink rear suspensions, and enhanced cargo capacity while remaining compliant with stringent EU emissions and safety norms. European OEMs, such as Volkswagen, BMW, Mercedes-Benz, Škoda, and Audi, are expanding their portfolios with models featuring 48V mild-hybrid integration, advanced chassis domain control units, and high-strength, lightweight structures to improve both efficiency and dynamic capability. These engineering advancements, combined with consumer preferences for spacious yet city-suitable vehicles, are reinforcing the growth of the 5-seater SUV segment.

Class D is expected to be the largest segment during the forecast period.

Class D continues to dominate global SUV demand, as India, China, and Thailand shift toward larger, multi-row vehicles built on scalable architectures like MQB, TNGA-K, SPA, and CLAR, which enable higher wheelbases and improved cabin packaging. These models increasingly feature electrified AWD (e-axles), 2.0-3.0L turbocharged powertrains, and multilink rear suspensions, providing superior tractability and high-speed stability compared to smaller classes.Rising consumer preference for 3-row flexibility, higher towing capacity, and long-distance ride comfort continues to make Class-D SUVs attractive in both ICE and hybrid categories. Premium OEMs, including BMW, Mercedes-Benz, Lexus, Land Rover, and Cadillac, are upgrading this segment with 48V systems, advanced ADAS L2+/L3 preparation, and lightweight aluminum subframes, further driving market growth. As emerging markets upscale and infrastructure improves, Class-D SUVs are becoming the default choice for families seeking larger footprint vehicles with premium mechanical and software capabilities.

The Americas is expected to be the second-largest market during the forecast period.

The Americas remain the second-largest SUV market, driven by strong demand for premium D- and E-segment SUVs equipped with high-output turbo/V6 engines, electrified AWD systems, and advanced ADAS L2+ suites. In the US, luxury OEMs now generate 70 - 80% of their premium volumes from SUVs, supported by consumer preference for high ground clearance, tow ratings above 3,500-5,000 lbs, multi-terrain drive modes, and long-wheelbase comfort.The shift toward hybrid and extended-range SUV architectures is accelerating as CAFE and EPA standards tighten, pushing Ford, GM, and Stellantis to expand battery-electric body-on-frame platforms. Full-size and three-row SUVs remain dominant due to their superior cabin space and payload/towing capability, making them the preferred choice across the US and Canada. Mexico contributes to strong growth in compact and mid-size SUVs, driven by cost-sensitive buyers and the expansion of local manufacturing by Asian OEMs. The competitive landscape is intensifying as Tesla, Hyundai-Kia, BMW, and Toyota scale up regional production of electric and hybrid SUVs, reshaping the powertrain mix and supply chain localization.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: Automotive OEMs - 90%, Tier 1 - 10%

- By Designation: C-level - 35%, Director Level - 55%, Others - 10%

- By Region: North America - 20%, Europe - 45%, Asia Pacific - 30%, Rest of the World - 5%

Research Coverage:

The study segments the SUV market and forecasts the market size based on type (mini, compact, mid-size, full-size, MPV/MUV), seating capacity (5-seater, >5-seater), propulsion (diesel, gasoline, electric), class (B, C, D, E), electric & hybrid vehicle type (BEV, PHEV, FCEV), and region (Asia Pacific, Europe, Americas).Key Benefits of Purchasing this Report

The study provides a comprehensive competitive analysis of key market players, including their company profiles, key insights into product and business offerings, recent developments, and primary market strategies. The report will assist market leaders and new entrants with estimates of revenue figures for the overall SUV market and its subsegments. It helps stakeholders understand the competitive landscape and gain additional insights to better position their businesses and develop effective go-to-market strategies. Additionally, the report provides information on key market drivers, restraints, challenges, and opportunities, enabling stakeholders to stay informed about market dynamics.The report provides insights into the following points:

- Analysis of key drivers (demand for premium vehicles with advanced features and consumer inclination toward compact and mid-size SUVs), restraints (high cost of SUVs), opportunities (trend of electrification), and challenges (Adherence to fuel economy and emission limits and range limitations of electric SUVs) influencing the growth of the SUV market

- Product Development/Innovation: Detailed insights on upcoming technologies, R&D activities, and product launches in the SUV market

- Market Development: Comprehensive information about lucrative markets; the report analyzes the SUV across various regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the SUV market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Toyota Motor Corporation (Japan), Hyundai Motor Company (South Korea), Honda Motor (Japan), General Motors (US), Ford Motor Company (US), and Stellantis (Netherlands)

Table of Contents

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Stakeholders

1.7 Summary of Changes

Companies Mentioned

- Toyota Motor Corporation

- Honda Motor Co. Ltd.

- Hyundai Motor Company

- General Motors

- Stellantis N.V.

- Volkswagen Group

- Ford Motor Company

- Mercedes-Benz

- BMW Group

- Nissan Motors

- Renault Group

- Suzuki Motor Corporation

- Subaru Corporation

- Tata Motors

- Mitsubishi Motors Corporation

- Mahindra & Mahindra Limited

- Volvo Car Corporation

- Tesla, Inc.

- Mazda Motor Corporation

- Byd Company Ltd.

- Isuzu Motors Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 307 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 1.18 Trillion |

| Forecasted Market Value ( USD | $ 1.67 Trillion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |