Global Coding and Marking Systems and Solutions Market - Key Trends & Drivers Summarized

Coding and marking systems and solutions are integral to modern manufacturing and packaging processes, providing essential information such as batch numbers, expiration dates, barcodes, and traceability details on products and packaging. These systems ensure compliance with industry regulations, enhance supply chain transparency, and facilitate efficient product recalls when necessary. Various technologies are employed in coding and marking, including continuous inkjet (CIJ), thermal inkjet (TIJ), laser marking, and thermal transfer overprinting (TTO). Each technology offers distinct advantages depending on the application; for example, CIJ is favored for high-speed printing on various substrates, while laser marking is prized for its permanence and precision on materials like metals and plastics. The versatility of these systems allows them to be used across diverse industries, including food and beverage, pharmaceuticals, electronics, and automotive.Technological advancements have significantly transformed the coding and marking landscape, leading to more efficient, reliable, and versatile solutions. Modern systems boast improved print quality and speed, enabling manufacturers to keep up with high production demands without compromising accuracy. The integration of smart technologies, such as IoT and automation, has further enhanced the functionality of coding and marking systems. These advancements enable real-time monitoring, predictive maintenance, and remote troubleshooting, thereby minimizing downtime and optimizing operational efficiency. Environmentally friendly options are also becoming more prevalent, with developments in solvent-free inks and energy-efficient laser systems that reduce the ecological footprint of coding and marking operations. Additionally, advancements in software have improved data management capabilities, allowing for seamless integration with enterprise resource planning (ERP) systems and other digital platforms to streamline production workflows.

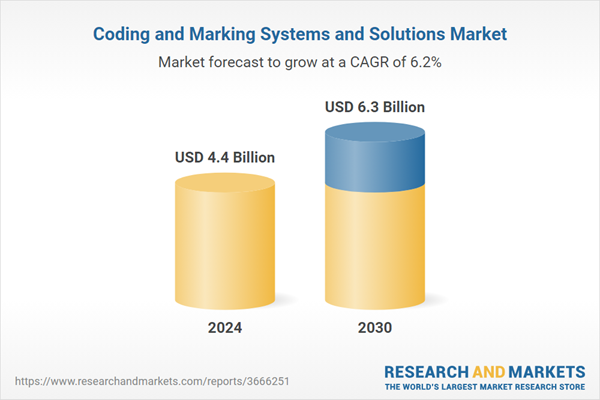

The growth in the coding and marking systems and solutions market is driven by several factors. The increasing need for product traceability and regulatory compliance across various industries is a significant driver. The growth outlook is significantly impacted by the outlook in the retail sector and the level of demand in the key end-use sectors such as food and beverage, cosmetic, chemical, pharmaceutical, and construction and building material among others. Increasing use of coding and marking systems for printing of batch numbers, government identification codes, and printing labels among others on both primary and secondary packaging materials in industries such as automotive, healthcare, chemical, construction, semiconductor and electronics, and food and beverage among others presents considerable opportunities for growth. Stringent regulations in the food, beverage, and pharmaceutical sectors mandate detailed and accurate labeling, which fuels the demand for advanced coding and marking solutions. Technological advancements in printing and marking technologies, such as high-resolution and high-speed systems, are attracting manufacturers seeking to enhance their production capabilities. The rise of smart manufacturing and Industry 4.0 initiatives is also contributing to market growth, as companies invest in integrated and automated solutions to improve efficiency and data management. Furthermore, the expansion of global supply chains and the growing importance of anti-counterfeiting measures are bolstering the adoption of sophisticated coding and marking technologies. These factors, combined with continuous innovation and the development of eco-friendly options, are expected to drive sustained growth in the coding and marking systems and solutions market in the coming years.

Report Scope

The report analyzes the Coding and Marking Systems and Solutions market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Technology (Continuous Inkjet, Laser, Thermal Inkjet, Thermal Transfer Overprinting, Other Technologies); End-Use (Food & Beverage, Electrical & Electronics, Automotive & Aerospace, Healthcare, Other End-Uses).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Continuous Inkjet Technology segment, which is expected to reach US$2.3 Billion by 2030 with a CAGR of 4.9%. The Laser Technology segment is also set to grow at 8.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $860.3 Million in 2024, and China, forecasted to grow at an impressive 7.9% CAGR to reach $922.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Coding and Marking Systems and Solutions Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Coding and Marking Systems and Solutions Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Coding and Marking Systems and Solutions Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Canon, Inc., Agfa-Gevaert NV, Brother Industries Ltd., FUJIFILM Holdings Corporation, Konica Minolta, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 113 companies featured in this Coding and Marking Systems and Solutions market report include:

- Canon, Inc.

- Agfa-Gevaert NV

- Brother Industries Ltd.

- FUJIFILM Holdings Corporation

- Konica Minolta, Inc.

- Electronics For Imaging, Inc.

- KEYENCE Corporation of America

- Domino Printing Sciences PLC

- Atlantic Zeiser GmbH

- Durst Phototechnik AG

- FoxJet an ITW Company

- Gem Gravure

- ATD Ltd.

- Control Micro Systems (CMS)

- Inca Digital Printers Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Canon, Inc.

- Agfa-Gevaert NV

- Brother Industries Ltd.

- FUJIFILM Holdings Corporation

- Konica Minolta, Inc.

- Electronics For Imaging, Inc.

- KEYENCE Corporation of America

- Domino Printing Sciences PLC

- Atlantic Zeiser GmbH

- Durst Phototechnik AG

- FoxJet an ITW Company

- Gem Gravure

- ATD Ltd.

- Control Micro Systems (CMS)

- Inca Digital Printers Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 486 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.4 Billion |

| Forecasted Market Value ( USD | $ 6.3 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |