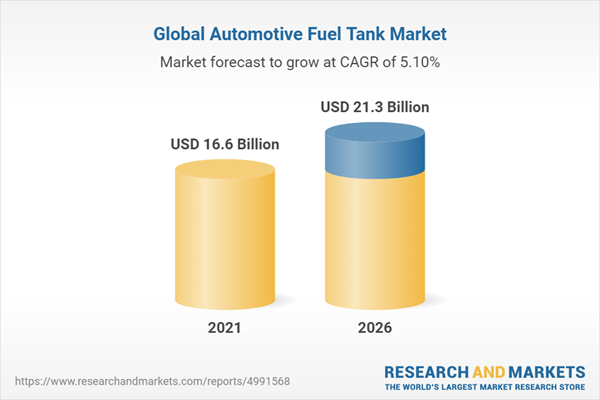

The automotive fuel tank market is estimated to be USD 16.6 billion in 2021 and is projected to reach USD 21.3 billion by 2026, at a CAGR of 5.1%. The market is driven by the increasing production of passenger and commercial vehicles, rising demand for lightweight vehicles for the longer driving range, government support for alternate fuel vehicles, stringent emission norms that require minimum greenhouse gas emissions, and government initiatives pertaining to hydrogen infrastructure. Several governments have increased investments to promote the use of lightweight vehicles. Also, governments are increasingly investing in the development of fuel-efficient vehicles and alternate fuel vehicles. On the other hand, the growing demand for electric vehicles that do not require fuel tanks and the high cost of lightweight composite fuel tanks can restrain the growth of the market. Also, the rising stringency of evaporative emission standards that require fuel tank manufacturers to reduce the permeability of fuel tanks can hamper the growth of the automotive fuel tank market.

The Type 4 CNG tank is projected to be the fastest-growing segment of the automotive fuel tank market, by CNG Tank Type, during the forecast period.

CNG vehicles are similar to gasoline or diesel vehicles in terms of power, acceleration, and cruising speed. CNG has stored onboard a vehicle in a compressed gaseous state within cylinders at a pressure of 3,000-3,600 pounds per square inch. The tanks are basically of four types including Type 1, Type 2, Type 3, and Type 4 and come in different sizes depending on the specific requirements of the vehicle. According to NGV Journal, almost 85 countries across the globe use CNG-powered vehicles with more than 22.4 million vehicles and 25,000 fueling stations spread across 2,900 cities worldwide. CNG-powered vehicles are primarily used for public transport applications. Type 1 Tanks are more economical than other tank types and thus have the largest market. Type 4 tanks are lightweight and have the fastest growing market. These tanks are used in HDVs. Owing to the lightweight of the fuel tank, vehicles equipped with Type 4 tanks have a better fuel efficiency.

Asia Pacific to be the largest market for Selective Catalytic Reduction (SCR) Tank segment of the automotive fuel tank market.

Due to the increasing production of LCVs in countries such as India, Japan, and Thailand to meet the growing requirement of freight and goods transport, Asia Pacific is estimated to be the largest market for automotive SCR tank. Stringent regulations have compelled OEMs to provide factory-fitted SCR systems in light and heavy commercial vehicles.

The SCR system controls the production of NOx from diesel engines while enabling engine manufacturers to minimize PM emissions and optimize fuel consumption. Adhering to the Euro VI regulations that dictate the limits for PM and NOx emissions from passenger cars and commercial vehicles is a pressing challenge for engine and vehicle manufacturers. According to the Diesel Technology Forum, SCR is one of the most cost-effective and fuel-efficient technologies available for emission reduction. It can reduce NOx emissions by up to 90%, hydrocarbon and CO emissions by 50-90%, and PM emissions by 30-50%.

The Asia Pacific is projected to have the highest share in the global automotive fuel tank market.

The Asia Pacific is the largest automobile producer, given the increasing demand for passenger vehicles in countries such as China, India, Japan, and South Korea. China is the largest manufacturer of vehicles in the world. India’s commercial vehicle market has been growing rapidly and contributes a significant share of the national GDP. As of 2020, the adoption of plastic fuel tanks in the Indian and Chinese automotive markets is estimated to be low. However, it is projected to increase rapidly in the future. In recent years, the automotive industry in the Asia Pacific has witnessed a significant increase in vehicle production and sales. The total number of commercial vehicles produced increased by 6.3%. Increased vehicle production is expected to boost the automotive fuel tank market in the Asia Pacific region during the forecast period.

The study contains insights provided by various industry experts, ranging from equipment suppliers to Tier I companies and OEMs.

The break-up of the primaries is as follows:

- By Stakeholder: Supply side - 70%, Demand Side - 30%

- By Designation: C-level Executives -11%, Directors-11%, Others-78%

- By Region: North America-22%, Europe-22%, Asia Pacific-56%

The fuel tank market for automotive is dominated by globally established players such as The Plastic Omnium Group (France), Textron - Kautex (US), Yapp (China), TI Fluid Systems (UK) and Yachiyo (Japan). The study includes an in-depth competitive analysis of these key players in the fuel tank market for automotive with their company profiles, MnM view of the top five companies, recent developments, and key market strategies.

Research Coverage

The automotive fuel tank market has been segmented by material (Aluminum, Plastic, and Steel), capacity (<45L, 45L-70L, and >70L), Selective Catalytic Reduction Tank Type (Asia Pacific, Europe, North America, and Rest of the World), CNG Tank Type (Type 1, Type 2, Type 3, and Type 4), Propulsion Type (Hybrid, Hydrogen, ICE, NGV), region (Asia Pacific, Europe, North America, and Rest of the World), Two-wheeler fuel tank region (Asia Pacific, Europe, North America, and Rest of the World) and Two-wheeler fuel tank type(Motorcycles, Mopeds). The market has been projected, in terms of volume (‘000 units), while the market by component type is projected, in terms of value (USD million).

Key Benefits of Buying the Report:

The report provides insights into the following points:

- Market Penetration: The report provides comprehensive information on the automotive fuel tank market and the top players in the industry.

- Regulatory Framework: The report offers detailed insights into norms leading to the application of automotive fuel tanks and the effect of the regulations on the market.

- Market Development: The report provides comprehensive information on various technologies of the automotive fuel tanks. The report analyzes the markets for various automotive fuel tank technologies across different countries.

- Market Diversification: The report provides exhaustive information on emerging technologies, recent developments, and investments in the global automotive fuel tank market.

- Competitive Assessment: The report offers an in-depth assessment of strategies, services, and manufacturing capabilities of leading players in the global automotive fuel tank market.

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Inclusions & Exclusions

1.4 Market Scope

1.4.1 Markets Covered

Figure 1 Automotive Fuel Tank Market Segmentation

Figure 2 Automotive Fuel Tank Market: by Region

1.5 Summary of Changes

2 Research Methodology

2.1 Research Data

Figure 3 Automotive Fuel Tank Market: Research Design

Figure 4 Research Design Model

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Secondary Sources for Estimating Marketize

2.2.3 Key Data from Secondary Sources

2.3 Primary Data

Figure 5 Breakdown of Primary Interviews

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

Figure 6 Automotive Fuel Tank Market: Market Estimation

Figure 7 Automotive Fuel Tank Market: Bottom-Up Approach

2.5 Market Breakdown and Data Triangulation

Figure 8 Data Triangulation

2.6 Assumptions

Table 1 Parameters and Assumptions

2.7 Limitations

2.8 Risk Assessment & Ranges

Table 2 Risk Assessment & Ranges

3 Executive Summary

3.1 Pre & Post COVID-19 Scenario

Figure 9 Pre- & Post-COVID-19 Scenario: Automotive Fuel Tank Market, 2018-2026 (USD Million)

Table 3 Automotive Fuel Tank Market: Pre- Vs. Post-COVID-19 Scenario, 2018-2026 (USD Million)

Figure 10 Automotive Fuel Tank Market Overview

Figure 11 >75L is Expected to Witness the Highest Growth During the Forecast Period

4 Premium Insights

4.1 Attractive Opportunities in Automotive Fuel Tank Market

Figure 12 Increasing Vehicle Production and Reduction in Vehicle Weight Drive Automotive Fuel Tank Market

4.2 Automotive Fuel Tank Market, by Region

Figure 13 Asia-Pacific Estimated to be Fastest Growing Automotive Fuel Tank Market During Forecast Period

4.3 Asia-Pacific Automotive Fuel Tank Market, by Capacity & Country

Figure 14 45-70 L Segment to Hold Largest Share of Asia-Pacific Automotive Fuel Tank Market in 2021

4.4 Automotive Fuel Tank Market, by Vehicle Type

Figure 15 Passenger Car to be Largest Segment in the Forecast Period

4.5 Scr Tank Market, by Region

Figure 16 Asia-Pacific to Command Largest Share of Scr Tank Market in 2021 due to Stringent Emission Standards and Government Regulations

4.6 Cng Fuel Tank Market, by Type

Figure 17 Type 4 Projected to Grow at Highest CAGR During Forecast Period due to Emission Norms and Need to Reduce Overall Vehicle Weight

4.7 Automotive Fuel Tank Market, by Propulsion

Figure 18 Ice Vehicles to be Largest Segment in 2021 as It Hold the Largest Share in Vehicle Production

4.8 Two-Wheeler Fuel Tank Market, by Region

Figure 19 Asia-Pacific Estimated to be Fastest Growing Two-Wheeler Fuel Tank Market During Forecast Period

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

Figure 20 Automotive Fuel Tank Market: Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Vehicle Production Volume

5.2.1.2 Reduction in Vehicle Weight Leading to Advancements of Materials

Figure 21 Emission Norms for On-Road Vehicles, 2014-2025

5.2.2 Restraints

5.2.2.1 Impact of Electric Vehicle Production

Figure 22 Bev Sales by Region, 2021 Vs. 2026 (‘000 Units)

5.2.2.2 Stringent Evaporative Emission Standards

5.2.3 Opportunities

5.2.3.1 Efforts to Build Economical Fuel Tanks Using Lightweight Materials

5.2.4 Challenges

5.2.4.1 High Cost of Composite Tanks and Regulatory Approvals

5.2.4.2 Regulations Pertaining to Recycling of Shredded Fuel Tank Plastics

5.2.5 Impact of COVID-19 on Fuel Tank Market

5.3 Patent Analysis

5.4 Ecosystem/Market Map

Table 4 Automotive Fuel Tank Market: Ecosystem

5.5 Average Selling Price Analysis

Table 5 Automotive Fuel Tank Market: Average Oe Price Range (USD) Analysis, by Vehicle Type, 2021

5.6 Porter's Five Forces Analysis

5.6.1 Threat of New Entrants

5.6.2 Threat of Substitutes

5.6.3 Bargaining Power of Suppliers

5.6.4 Bargaining Power of Buyers

5.6.5 Rivalry Among Existing Competitors

5.7 Value Chain Analysis

Figure 23 Value Chain Analysis of Automotive Fuel Tank Market

5.8 Automotive Fuel Tank Market, Scenarios (2018-2026)

Figure 24 Automotive Fuel Tank Market: COVID-19 Scenarios Analysis

5.8.1 Automotive Fuel Tank Market, Most Likely Scenario

Table 6 Most Likely Scenario: Automotive Fuel Tank Market, by Region, 2018-2026 (USD Million)

5.8.2 Automotive Fuel Tank Market, Low-Impact Scenario

Table 7 Low-Impact Scenario: Automotive Fuel Tank Market, by Region, 2018-2026 (USD Million)

5.8.3 Automotive Fuel Tank Market, High-Impact Scenario

Table 8 High-Impact Scenario: Automotive Fuel Tank Market, by Region, 2018-2026 (USD Million)

Figure 25 Revenue Shift for Automotive Fuel Tank Manufacturers

6 Automotive Fuel Tank Market, by Material

6.1 Introduction

6.2 Research Methodology

6.3 Key Industry Insights

Figure 26 Automotive Fuel Tank Market, by Material, 2021 Vs. 2026 (Metric Ton)

Table 9 Automotive Fuel Tank Market, by Material, 2018-2020 (‘000 Units)

Table 10 Automotive Fuel Tank Market, by Material, 2018-2020 (Metric Tons)

Table 11 Automotive Fuel Tank Market, by Material, 2021-2026 (‘000 Units)

Table 12 Automotive Fuel Tank Market, by Material, 2021-2026 (Metric Tons)

6.4 Plastic

6.4.1 Plastic Tanks to Lead Market due to Light Weight Advantages Over Metal Tanks

Table 13 Plastic: Fuel Tank Market, by Region, 2018-2020 (‘000 Units)

Table 14 Plastic: Fuel Tank Market, by Region, 2018-2020 (Metric Tons)

Table 15 Plastic: Fuel Tank Market, by Region, 2021-2026 (‘000 Units)

Table 16 Plastic: Fuel Tank Market, by Region, 2021-2026 (Metric Tons)

6.5 Steel

6.5.1 Market for Steel Expected to Decline due to Use of Lightweight Material

Table 17 Steel: Automotive Fuel Tank Market, by Region, 2018-2020 (‘000 Units)

Table 18 Steel: Automotive Fuel Tank Market, by Region, 2018-2020 (Metric Tons)

Table 19 Steel: Automotive Fuel Tank Market, by Region, 2021-2026 (‘000 Units)

Table 20 Steel: Automotive Fuel Tank Market, by Region, 2021-2026 (Metric Tons)

6.6 Aluminum

6.6.1 Aluminum to be Most Widely Used Material in Commercial Vehicles

Table 21 Aluminum: Automotive Fuel Tank Market, by Region, 2018-2020 (‘000 Units)

Table 22 Aluminum: Automotive Fuel Tank Market, by Region, 2018-2020 (Metric Tons)

Table 23 Aluminum: Automotive Fuel Tank Market, by Region, 2021-2026 (‘000 Units)

Table 24 Aluminum: Automotive Fuel Tank Market, by Region, 2021-2026 (Metric Tons)

7 Automotive Fuel Tank Market, by Vehicle Type

7.1 Introduction

7.1.1 Research Methodology

7.1.2 Assumptions/Limitations

7.1.3 Industry Insights

Figure 27 Automotive Fuel Tank Market, by Vehicle Type, 2021 Vs. 2026 (USD Million)

Table 25 Automotive Fuel Tank Market, by Vehicle Type,2018-2020 (‘000 Units)

Table 26 Automotive Fuel Tank Market, by Vehicle Type, 2018-2020 (USD Million)

Table 27 Automotive Fuel Tank Market, by Vehicle Type, 2021-2026 (‘000 Units)

Table 28 Automotive Fuel Tank Market, by Vehicle Type, 2021-2026 (USD Million)

7.2 Passenger Cars

7.2.1 Increasing Popularity of Sedans and SUVs Will Boost Passenger Cars Segment

Table 29 Passenger Cars: Fuel Tank Market, by Region, 2018-2020 (‘000 Units)

Table 30 Passenger Cars: Fuel Tank Market, by Region, 2018-2020 (USD Million)

Table 31 Passenger Cars: Fuel Tank Market, by Region, 2021-2026 (‘000 Units)

Table 32 Passenger Cars: Fuel Tank Market, by Region, 2021-2026 (USD Million)

7.3 Light Commercial Vehicles (Lcv)

7.3.1 Growing Popularity of Pick-Up Trucks and Light Vehicles to Drive Lcv Segment

Table 33 Light Commercial Vehicles: Fuel Tank Market, by Region, 2018-2020 (‘000 Units)

Table 34 Light Commercial Vehicles: Fuel Tank Market, by Region, 2018-2020 (USD Million)

Table 35 Light Commercial Vehicles: Fuel Tank Market, by Region, 2021-2026 (‘000 Units)

Table 36 Light Commercial Vehicle: Fuel Tank Market, by Region, 2021-2026 (USD Million)

7.4 Trucks

7.4.1 Stringent Emission Standards to Boost Gasoline Fuel Tanks in Trucks

Table 37 Trucks: Fuel Tank Market, by Region, 2018-2020 (‘000 Units)

Table 38 Trucks: Fuel Tank Market, by Region, 2018-2020 (USD Million)

Table 39 Trucks: Fuel Tank Market, by Region, 2021-2026 (‘000 Units)

Table 40 Trucks: Fuel Tank Market, by Region, 2021-2026 (USD Million)

7.5 Buses

7.5.1 Increasing Production Volume to Boost Buses Segment

Table 41 Buses: Fuel Tank Market, by Region, 2018-2020 (‘000 Units)

Table 42 Buses: Fuel Tank Market, by Region, 2018-2020 (USD Million)

Table 43 Buses: Fuel Tank Market, by Region, 2021-2026 (‘000 Units)

Table 44 Buses: Fuel Tank Market, by Region, 2021-2026 (USD Million)

8 Automotive Fuel Tank Market, by Capacity

8.1 Introduction

8.2 Research Methodology

8.3 Key Industry Insights

Figure 28 Automotive Fuel Tank Market, by Capacity, 2021 Vs. 2026 (USD Million)

Table 45 Automotive Fuel Tank Market, by Capacity, 2018-2020 (‘000 Units)

Table 46 Automotive Fuel Tank Market, by Capacity, 2018-2020 (USD Million)

Table 47 Automotive Fuel Tank Market, by Capacity, 2021-2026 (‘000 Units)

Table 48 Automotive Fuel Tank Market, by Capacity, 2021-2026 (USD Million)

8.4 <45 Liters

8.4.1 Increasing Production of Mini Passenger Cars in India and Japan to Drive <45L Segment in Asia-Pacific

Table 49 <45L: Automotive Fuel Tank Market, by Region, 2018-2020 (‘000 Units)

Table 50 <45L: Automotive Fuel Tank Market, by Region, 2018-2020 (USD Million)

Table 51 <45L: Automotive Fuel Tank Market, by Region, 2021-2026 (‘000 Units)

Table 52 <45L: Automotive Fuel Tank Market, by Region, 2021-2026 (USD Million)

8.5 45-70 Liters

8.5.1 Increasing Suv Adoption in US and Canada to Drive 45-70L Segment in North America

Table 53 45-70L: Automotive Fuel Tank Market, by Region, 2018-2020 (‘000 Units)

Table 54 45-70 L: Automotive Fuel Tank Market, by Region, 2018-2020 (USD Million)

Table 55 45-70L: Automotive Fuel Tank Market, by Region, 2021-2026 (‘000 Units)

Table 56 45-70 L: Automotive Fuel Tank Market, by Region, 2021-2026 (USD Million)

8.6 >70 Liters

8.6.1 High Truck, Bus, and Lcv Production in Asia-Pacific to Fuel >70L Segment

Table 57 >70L: Automotive Fuel Tank Market, by Region, 2018-2020 (‘000 Units)

Table 58 >70L: Automotive Fuel Tank Market, by Region, 2018-2020 (USD Million)

Table 59 >70L: Automotive Fuel Tank Market, by Region, 2021-2026 (‘000 Units)

Table 60 >70L: Automotive Fuel Tank Market, by Region, 2021-2026 (USD Million)

9 Automotive Selective Catalytic Reduction (SCR) Tank Market, by Region and Vehicle Type

9.1 Introduction

Figure 29 Automotive Selective Catalytic Reduction (SCR) System

9.2 Research Methodology

9.3 Key Industry Insights

Figure 30 Automotive Scr Tank Market, by Region, 2021 Vs. 2026 (USD Million)

Table 61 Automotive Scr Tank Market, by Region, 2018-2020 (‘000 Units)

Table 62 Automotive Scr Tank Market, by Region, 2018-2020 (USD Million)

Table 63 Automotive Scr Tank Market, by Region, 2021-2026 (‘000 Units)

Table 64 Automotive Scr Tank Market, by Region, 2021-2026 (USD Million)

Table 65 Automotive Scr Tank Market, by Vehicle Type, 2018-2020 (‘000 Units)

Table 66 Automotive Scr Tank Market, by Vehicle Type, 2018-2020 (USD Million)

Table 67 Automotive Scr Tank Market, by Vehicle Type, 2021-2026 (‘000 Units)

Table 68 Automotive Scr Tank Market, by Vehicle Type, 2021-2026 (USD Million)

9.4 Asia-Pacific

9.4.1 High Production of Diesel-Powered Vehicles in Region Expected to Drive Market

Table 69 Asia-Pacific: Scr Tank Market, by Vehicle Type, 2018-2020 (‘000 Units)

Table 70 Asia-Pacific: Scr Tank Market, by Vehicle Type, 2018-2020 (USD Million)

Table 71 Asia-Pacific: Scr Tank Market, by Vehicle Type, 2021-2026 (‘000 Units)

Table 72 Asia-Pacific: Scr Tank Market, by Vehicle Type, 2021-2026 (USD Million)

9.5 Europe

9.5.1 Decreasing Adoption of Diesel Passenger Cars Will Have Significant Impact on Market

Table 73 Europe: Scr Tank Market, by Vehicle Type, 2018-2020 (‘000 Units)

Table 74 Europe: Scr Tank Market, by Vehicle Type, 2018-2020 (USD Million)

Table 75 Europe: Scr Tank Market, by Vehicle Type, 2021-2026 (‘000 Units)

Table 76 Europe: Scr Tank Market, by Vehicle Type, 2021-2026 (USD Million)

9.6 North America

9.6.1 Increasing Adoption of Diesel-Powered SUVs and Pickups to Boost Market

Table 77 North America: Scr Tank Market, by Vehicle Type, 2018-2020 (‘000 Units)

Table 78 North America: Scr Tank Market, by Vehicle Type, 2018-2020 (USD Million)

Table 79 North America: Scr Tank Market, by Vehicle Type, 2021-2026 (‘000 Units)

Table 80 North America: Scr Tank Market, by Vehicle Type, 2021-2026 (USD Million)

9.7 Rest of the World (Row)

9.7.1 Increasing Passenger Car Production is Expected to Drive the Market

Table 81 RoW: Scr Tank Market, by Vehicle Type, 2018-2020 (‘000 Units)

Table 82 RoW: Scr Tank Market, by Vehicle Type, 2018-2020 (USD Million)

Table 83 RoW: Scr Tank Market, by Vehicle Type, 2021-2026 (‘000 Units)

Table 84 RoW: Scr Tank Market, by Vehicle Type, 2021-2026 (USD Million)

10 Automotive Cng Tank Market, by Type

10.1 Introduction

10.2 Research Methodology

10.3 Key Industry Insights

Table 85 Types of Compressed Natural Gas (Cng) Cylinders

Table 86 Weight Reduction of Different Types of Cng Cylinders

Table 87 Comparison of Weight and Cost of Cng Cylinders

Table 88 Comparison of Different Parameters for Cng Cylinder Types

Figure 31 Automotive Cng Tank Market, by Type, 2021 Vs. 2026 (USD Million)

Table 89 Automotive Cng Tank Market, by Type, 2018-2020 (‘000 Units)

Table 90 Automotive Cng Tank Market, by Type, 2018-2020 (USD Million)

Table 91 Automotive Cng Tank Market, by Type, 2021-2026 (‘000 Units)

Table 92 Automotive Cng Tank Market, by Type, 2021-2026 (USD Million)

10.4 Type 1

10.4.1 High Demand for Cng Vehicles in Countries Like India to Drive Type 1 Segment

Table 93 Type 1: Automotive Cng Tank Market, by Region, 2018-2020 (‘000 Units)

Table 94 Type 1: Automotive Cng Tank Market, by Region, 2018-2020 (USD Million)

Table 95 Type 1: Automotive Cng Tank Market, by Region, 2021-2026 (‘000 Units)

Table 96 Type 1: Automotive Cng Tank Market, by Region, 2021-2026 (USD Million)

10.5 Type 2

10.5.1 Balance Between Cost and Weight Drives Type 2 Market

Table 97 Type 2: Automotive Cng Tank Market, by Region, 2018-2020 (‘000 Units)

Table 98 Type 2: Automotive Cng Tank Market, by Region, 2018-2020 (USD Million)

Table 99 Type 2: Automotive Cng Tank Market, by Region, 2021-2026 (‘000 Units)

Table 100 Type 2: Automotive Cng Tank Market, by Region, 2021-2026 (USD Million)

10.6 Type 3

10.6.1 Growth in Production of Commercial Vehicles to Drive Type 3 Segment

Table 101 Type 3: Automotive Cng Tank Market, by Region, 2018-2020 (‘000 Units)

Table 102 Type 3: Automotive Cng Tank Market, by Region, 2018-2020 (USD Million)

Table 103 Type 3: Automotive Cng Tank Market, by Region, 2021-2026 (‘000 Units)

Table 104 Type 3: Automotive Cng Tank Market, by Region, 2021-2026 (USD Million)

10.7 Type 4

10.7.1 Increased Demand for Lightweight and Fuel-Efficient Vehicles to Drive Type 4 Segment

Table 105 Type 4: Automotive Cng Tank Market, by Region, 2018-2020 (‘000 Units)

Table 106 Type 4: Automotive Cng Tank Market, by Region, 2018-2020 (USD Million)

Table 107 Type 4: Automotive Cng Tank Market, by Region, 2021-2026 (‘000 Units)

Table 108 Type 4: Automotive Cng Tank Market, by Region, 2021-2026 (USD Million)

11 Automotive Fuel Tank Market, by Propulsion

11.1 Introduction

11.2 Research Methodology

11.3 Key Industry Insights

Figure 32 Automotive Fuel Tank Market, by Propulsion, 2021 Vs. 2026 (USD Million)

Table 109 Automotive Fuel Tank Market, by Propulsion, 2018-2020 (‘000 Units)

Table 110 Automotive Fuel Tank Market, by Propulsion, 2018-2020 (USD Million)

Table 111 Automotive Fuel Tank Market, by Propulsion, 2021-2026 (‘000 Units)

Table 112 Automotive Fuel Tank Market, by Propulsion, 2021-2026 (USD Million)

11.4 Ice

11.4.1 Large Production Capacities in China and India Expected to Drive Ice Market

Table 113 Ice Vehicle Fuel Tank Market, by Region, 2018-2020 (‘000 Units)

Table 114 Ice Vehicle Fuel Tank Market, by Region, 2018-2020 (USD Million)

Table 115 Ice Vehicle Fuel Tank Market, by Region, 2021-2026 (‘000 Units)

Table 116 Ice Vehicle Fuel Tank Market, by Region, 2021-2026 (USD Million)

11.5 Natural Gas Vehicle (Ngv)

Table 117 Refueling Infrastructure for Methane Powered Transport in EU$

Table 118 Ghg Performance of Cng Cars Compared to Petrol and Diesel

Table 119 Comparison of Emissions for Most Sold Cng Vehicles in EU in 2017 (Volkswagen Golf Vii) to Equivalent Models (G Co2Eq./Km)

Table 120 Real-World Tailpipe Emissions of Euro 6 Vehicles

11.5.1 Growing Demand for Cng/Lng Vehicles in India to Boost Ngv Market

Table 121 Ngv Fuel Tank Market, by Region, 2018-2020 (‘000 Units)

Table 122 Ngv Fuel Tank Market, by Region, 2018-2020 (USD Million)

Table 123 Ngv Fuel Tank Market, by Region, 2021-2026 (‘000 Units)

Table 124 Ngv Fuel Tank Market, by Region, 2021-2026 (USD Million)

11.6 Hydrogen

11.6.1 Increasing Emission Norms Across Countries to Drive Market

Table 125 Hydrogen Fuel Tank Market, by Region, 2018-2020 (‘000 Units)

Table 126 Hydrogen Fuel Tank Market, by Region, 2018-2020 (USD Million)

Table 127 Hydrogen Fuel Tank Market, by Region, 2021-2026 (‘000 Units)

Table 128 Hydrogen Fuel Tank Market, by Region, 2021-2026 (USD Million)

11.7 Hybrid

11.7.1 Tax Rebates and Incentives on Purchase of Hybrid Cars to Boost Market

Table 129 Hybrid: Automotive Fuel Tank Market, by Region, 2018-2020 (‘000 Units)

Table 130 Hybrid: Automotive Fuel Tank Market, by Region,2018-2020 (USD Million)

Table 131 Hybrid: Automotive Fuel Tank Market, by Region, 2021-2026 (‘000 Units)

Table 132 Hybrid: Automotive Fuel Tank Market, by Region, 2021-2026 (USD Million)

12 Automotive Fuel Tank Market, by Region

12.1 Introduction

Figure 33 Automotive Fuel Tank Market, by Region, 2021 Vs. 2026 (USD Million)

Table 133 Automotive Fuel Tank Market, by Region, 2018-2020 (‘000 Units)

Table 134 Automotive Fuel Tank Market, by Region, 2018-2020 (USD Million)

Table 135 Automotive Fuel Tank Market, by Region, 2021-2026 (‘000 Units)

Table 136 Automotive Fuel Tank Market, by Region, 2021-2026 (USD Million)

12.2 Asia-Pacific

Figure 34 Asia-Pacific: Automotive Fuel Tank Market Snapshot

Table 137 Asia-Pacific: Automotive Fuel Tank Market, by Capacity, 2018-2020 (‘000 Units)

Table 138 Asia-Pacific: Automotive Fuel Tank Market, by Capacity, 2018-2020 (USD Million)

Table 139 Asia-Pacific: Automotive Fuel Tank Market, by Capacity, 2021-2026 (‘000 Units)

Table 140 Asia-Pacific: Automotive Fuel Tank Market, by Capacity, 2021-2026 (USD Million)

Table 141 Asia-Pacific: Automotive Fuel Tank Market, by Country, 2018-2020 (‘000 Units)

Table 142 Asia-Pacific: Automotive Fuel Tank Market, by Country, 2018-2020 (USD Million)

Table 143 Asia-Pacific: Automotive Fuel Tank Market, by Country, 2021-2026 (‘000 Units)

Table 144 Asia-Pacific: Automotive Fuel Tank Market, by Country, 2021-2026 (USD Million)

12.2.1 China

12.2.1.1 Large Production Capability Expected to Drive Chinese Market

Table 145 China: Details of Automotive Fuel Tank and Component Suppliers by Vehicle Model

Table 146 China: Automotive Fuel Tank Market, by Capacity2018-2020 (‘000 Units)

Table 147 China: Automotive Fuel Tank Market, by Capacity, 2018-2020 (USD Million)

Table 148 China: Automotive Fuel Tank Market, by Capacity, 2021-2026 (‘000 Units)

Table 149 China: Automotive Fuel Tank Market, by Capacity, 2021-2026 (USD Million)

12.2.2 Japan

12.2.2.1 Consumer Preference for Mini and Mid Segment Cars to Fuel Japanese Market

Table 150 Japan: Details of Automotive Fuel Tank and Component Suppliers by Vehicle Models

Table 151 Japan: Automotive Fuel Tank Market, by Capacity, 2018-2020 (‘000 Units)

Table 152 Japan: Automotive Fuel Tank Market, by Capacity, 2018-2020 (USD Million)

Table 153 Japan: Automotive Fuel Tank Market, by Capacity, 2021-2026 (‘000 Units)

Table 154 Japan: Automotive Fuel Tank Market, by Capacity, 2021-2026 (USD Million)

12.2.3 South Korea

12.2.3.1 Government Policies on Lightweight and Eco-Friendly Vehicles to Drive South Korean Market

Table 155 South Korea: Details of Automotive Fuel Tank and Component Suppliers by Vehicle Models

Table 156 South Korea: Automotive Fuel Tank Market, by Capacity, 2018-2020 (‘000 Units)

Table 157 South Korea: Automotive Fuel Tank Market, by Capacity,2018-2020 (USD Million)

Table 158 South Korea: Automotive Fuel Tank Market, by Capacity,2021-2026 (‘000 Units)

Table 159 South Korea: Automotive Fuel Tank Market, by Capacity, 2021-2026 (USD Million)

12.2.4 India

12.2.4.1 High Production of Commercial Vehicles to Boost Indian Market

Table 160 India: Details of Automotive Fuel Tank and Component Suppliers by Vehicle Models

Table 161 India: Automotive Fuel Tank Market, by Capacity, 2018-2020 (‘000 Units)

Table 162 India: Automotive Fuel Tank Market, by Capacity, 2018-2020 (USD Million)

Table 163 India: Automotive Fuel Tank Market, by Capacity, 2021-2026 (‘000 Units)

Table 164 India: Automotive Fuel Tank Market, by Capacity, 2021-2026 (USD Million)

12.2.5 Indonesia

12.2.5.1 Government Subsidies for Automobile Manufacturers Boost Indonesian Market

Table 165 Indonesia: Automotive Fuel Tank Market, by Capacity, 2018-2020 (‘000 Units)

Table 166 Indonesia: Automotive Fuel Tank Market, by Capacity, 2018-2020 (USD Million)

Table 167 Indonesia: Automotive Fuel Tank Market, by Capacity, 2021-2026 (‘000 Units)

Table 168 Indonesia: Automotive Fuel Tank Market, by Capacity, 2021-2026 (USD Million)

12.2.6 Thailand

12.2.6.1 Government Schemes to Drive Market in Thailand

Table 169 Thailand: Details of Automotive Fuel Tank and Component Suppliers by Vehicle Models

Table 170 Thailand: Automotive Fuel Tank Market, by Capacity, 2018-2020 (‘000 Units)

Table 171 Thailand: Automotive Fuel Tank Market, by Capacity, 2018-2020 (USD Million)

Table 172 Thailand: Automotive Fuel Tank Market, by Capacity, 2021-2026 (‘000 Units)

Table 173 Thailand: Automotive Fuel Tank Market, by Capacity, 2021-2026 (USD Million)

12.2.7 Rest of Asia-Pacific

12.2.7.1 Presence of Large Manufacturing Companies in Australia to Drive the Fuel Tank Market

Table 174 Rest of Asia-Pacific: Automotive Fuel Tank Market, by Capacity, 2018-2020 (‘000 Units)

Table 175 Rest of Asia-Pacific: Automotive Fuel Tank Market, by Capacity, 2018-2020 (USD Million)

Table 176 Rest of Asia-Pacific: Automotive Fuel Tank Market, by Capacity, 2021-2026 (‘000 Units)

Table 177 Rest of Asia-Pacific: Automotive Fuel Tank Market, by Capacity, 2021-2026 (USD Million)

12.3 North America

Figure 35 North America: Automotive Fuel Tank Market Snapshot

Table 178 North America: Automotive Fuel Tank Market, by Capacity, 2018-2020 (‘000 Units)

Table 179 North America: Automotive Fuel Tank Market, by Capacity, 2018-2020 (USD Million)

Table 180 North America: Automotive Fuel Tank Market, by Capacity, 2021-2026 (‘000 Units)

Table 181 North America: Automotive Fuel Tank Market, by Capacity, 2021-2026 (USD Million)

Table 182 North America: Automotive Fuel Tank Market, by Country, 2018-2020 (‘000 Units)

Table 183 North America: Automotive Fuel Tank Market, by Country, 2018-2020 (USD Million)

Table 184 North America: Automotive Fuel Tank Market, by Country, 2021-2026 (‘000 Units)

Table 185 North America: Automotive Fuel Tank Market, by Country, 2021-2026 (USD Million)

12.3.1 US

12.3.1.1 Increasing Lcv & Hcv Production due to Growth of Trucking to Drive Us Market

Table 186 US: Details of Automotive Fuel Tank and Component Suppliers by Vehicle Model

Table 187 US: Automotive Fuel Tank Market, by Capacity, 2018-2020 (‘000 Units)

Table 188 US: Automotive Fuel Tank Market, by Capacity, 2018-2020 (USD Million)

Table 189 US: Automotive Fuel Tank Market, by Capacity,2021-2026 (‘000 Units)

Table 190 US: Automotive Fuel Tank Market, by Capacity, 2021-2026 (USD Million)

12.3.2 Mexico

12.3.2.1 Collaboration with US and Canada for Free Trade to Boost Mexican Market

Table 191 Mexico: Details of Automotive Fuel Tank and Component Suppliers by Vehicle Model

Table 192 Mexico: Automotive Fuel Tank Market, by Capacity, 2018-2020 (‘000 Units)

Table 193 Mexico: Automotive Fuel Tank Market, by Capacity, 2018-2020 (USD Million)

Table 194 Mexico: Automotive Fuel Tank Market, by Capacity, 2021-2026 (‘000 Units)

Table 195 Mexico: Automotive Fuel Tank Market, by Capacity, 2021-2026 (USD Million)

12.3.3 Canada

12.3.3.1 Presence of Prominent OEMs to Drive Canadian Market

Table 196 Canada: Details of Automotive Fuel Tank and Component Suppliers by Vehicle Model

Table 197 Canada: Automotive Fuel Tank Market, by Capacity, 2018-2020 (‘000 Units)

Table 198 Canada: Automotive Fuel Tank Market, by Capacity, 2018-2020 (USD Million)

Table 199 Canada: Automotive Fuel Tank Market, by Capacity,2021-2026 (‘000 Units)

Table 200 Canada: Automotive Fuel Tank Market, by Capacity, 2021-2026 (USD Million)

12.4 Europe

Table 201 Europe: Details of Fuel Tank and Component Suppliers by Vehicle Model

Figure 36 Europe: Automotive Fuel Tank Market Snapshot

Table 202 Europe: Automotive Fuel Tank Market, by Capacity, 2018-2020 (‘000 Units)

Table 203 Europe: Automotive Fuel Tank Market, by Capacity,2018-2020 (USD Million)

Table 204 Europe: Automotive Fuel Tank Market, by Capacity, 2021-2026 (‘000 Units)

Table 205 Europe: Automotive Fuel Tank Market, by Capacity, 2021-2026 (USD Million)

Table 206 Europe: Automotive Fuel Tank Market, by Country, 2018-2020 (‘000 Units)

Table 207 Europe: Automotive Fuel Tank Market, by Country,2018-2020 (USD Million)

Table 208 Europe: Automotive Fuel Tank Market, by Country, 2021-2026 (‘000 Units)

Table 209 Europe: Automotive Fuel Tank Market, by Country, 2021-2026 (USD Million)

12.4.1 Germany

12.4.1.1 R&D on Composite Fiber Fuel Tanks to Drive German Market

Table 210 Germany: Automotive Fuel Tank Market, by Capacity, 2018-2020 (‘000 Units)

Table 211 Germany: Automotive Fuel Tank Market, by Capacity, 2018-2020 (USD Million)

Table 212 Germany: Automotive Fuel Tank Market, by Capacity, 2021-2026 (‘000 Units)

Table 213 Germany: Automotive Fuel Tank Market, by Capacity, 2021-2026 (USD Million)

12.4.2 France

12.4.2.1 Government Policies for Use of Alternate Fuel Vehicles to Drive French Market

Table 214 France: Automotive Fuel Tank Market, by Capacity, 2018-2020 (‘000 Units)

Table 215 France: Automotive Fuel Tank Market, by Capacity, 2018-2020 (USD Million)

Table 216 France: Automotive Fuel Tank Market, by Capacity, 2021-2026 (‘000 Units)

Table 217 France: Automotive Fuel Tank Market, by Capacity, 2021-2026 (USD Million)

12.4.3 UK

12.4.3.1 Stringent Emission Norms to Boost UK Market

Table 218 UK: Automotive Fuel Tank Market, by Capacity, 2018-2020 (‘000 Units)

Table 219 UK: Automotive Fuel Tank Market, by Capacity, 2018-2020 (USD Million)

Table 220 UK: Automotive Fuel Tank Market, by Capacity, 2021-2026 (‘000 Units)

Table 221 UK: Automotive Fuel Tank Market, by Capacity, 2021-2026 (USD Million)

12.4.4 Spain

12.4.4.1 Technological Investments in Alternate Fuels to Drive Spanish Market

Table 222 Spain: Automotive Fuel Tank Market, by Capacity, 2018-2020 (‘000 Units)

Table 223 Spain: Automotive Fuel Tank Market, by Capacity, 2018-2020 (USD Million)

Table 224 Spain: Automotive Fuel Tank Market, by Capacity, 2021-2026 (‘000 Units)

Table 225 Spain: Automotive Fuel Tank Market, by Capacity, 2021-2026 (USD Million)

12.4.5 Russia

12.4.5.1 Presence of Major Fuel Tank Manufacturers to Drive Russian Market

Table 226 Russia: Automotive Fuel Tank Market, by Capacity, 2018-2020 (‘000 Units)

Table 227 Russia: Automotive Fuel Tank Market, by Capacity, 2018-2020 (USD Million)

Table 228 Russia: Automotive Fuel Tank Market, by Capacity, 2021-2026 (‘000 Units)

Table 229 Russia: Automotive Fuel Tank Market, by Capacity, 2021-2026 (USD Million)

12.4.6 Italy

12.4.6.1 Government Projects and Initiatives Drive Italian Market

Table 230 Italy: Automotive Fuel Tank Market, by Capacity, 2018-2020 (‘000 Units)

Table 231 Italy: Automotive Fuel Tank Market, by Capacity, 2018-2020 (USD Million)

Table 232 Italy: Automotive Fuel Tank Market, by Capacity, 2021-2026 (‘000 Units)

Table 233 Italy: Automotive Fuel Tank Market, by Capacity, 2021-2026 (USD Million)

12.4.7 Turkey

12.4.7.1 High Production Volume of Passenger Cars to Drive Turkish Market

Table 234 Turkey: Automotive Fuel Tank Market, by Capacity, 2018-2020 (‘000 Units)

Table 235 Turkey: Automotive Fuel Tank Market, by Capacity, 2018-2020 (USD Million)

Table 236 Turkey: Automotive Fuel Tank Market, by Capacity, 2021-2026 (‘000 Units)

Table 237 Turkey: Automotive Fuel Tank Market, by Capacity, 2021-2026 (USD Million)

12.4.8 Rest of Europe

12.4.8.1 Increasing Presence of Vehicle Manufacturers to Drive Market in Rest of Europe

Table 238 Rest of Europe: Automotive Fuel Tank Market, by Capacity,2018-2020 (‘000 Units)

Table 239 Rest of Europe: Automotive Fuel Tank Market, by Capacity, 2018-2020 (USD Million)

Table 240 Rest of Europe: Automotive Fuel Tank Market, by Capacity, 2021-2026 (‘000 Units)

Table 241 Rest of Europe: Automotive Fuel Tank Market, by Capacity, 2021-2026 (USD Million)

12.5 Rest of the World (Row)

Figure 37 RoW: Automotive Fuel Tank Market, 2021 Vs. 2026 (USD Million)

Table 242 RoW: Automotive Fuel Tank Market, by Capacity, 2018-2020 (‘000 Units)

Table 243 RoW: Automotive Fuel Tank Market, by Capacity, 2018-2020 (USD Million)

Table 244 RoW: Automotive Fuel Tank Market, by Capacity, 2021-2026 (‘000 Units)

Table 245 RoW: Automotive Fuel Tank Market, by Capacity, 2021-2026 (USD Million)

Table 246 RoW: Automotive Fuel Tank Market, by Country, 2018-2020 (‘000 Units)

Table 247 RoW: Automotive Fuel Tank Market, by Country,2018-2020 (USD Million)

Table 248 RoW: Automotive Fuel Tank Market, by Country, 2021-2026 (‘000 Units)

Table 249 RoW: Automotive Fuel Tank Market, by Country, 2021-2026 (USD Million)

12.5.1 Brazil

12.5.1.1 Growing Vehicle Production to Drive Brazilian Market

Table 250 Brazil: Automotive Fuel Tank Market, by Capacity, 2018-2020 (‘000 Units)

Table 251 Brazil: Automotive Fuel Tank Market, by Capacity, 2018-2020 (USD Million)

Table 252 Brazil: Automotive Fuel Tank Market, by Capacity, 2021-2026 (‘000 Units)

Table 253 Brazil: Automotive Fuel Tank Market, by Capacity, 2021-2026 (USD Million)

12.5.2 South Africa

12.5.2.1 Declining Vehicle Sales May Have Negative Impact on South African Market

Table 254 South Africa: Automotive Fuel Tank Market, by Capacity, 2018-2020 (‘000 Units)

Table 255 South Africa: Automotive Fuel Tank Market, by Capacity, 2018-2020 (USD Million)

Table 256 South Africa: Automotive Fuel Tank Market, by Capacity, 2021-2026 (‘000 Units)

Table 257 South Africa: Automotive Fuel Tank Market, by Capacity, 2021-2026 (USD Million)

12.5.3 Argentina

12.5.3.1 Sharp Decline in Vehicle Demand Would Negatively Impact Argentinian Market

Table 258 Argentina: Automotive Fuel Tank Market, by Capacity, 2018-2020 (‘000 Units)

Table 259 Argentina: Automotive Fuel Tank Market, by Capacity, 2018-2020 (USD Million)

Table 260 Argentina: Automotive Fuel Tank Market, by Capacity, 2021-2026 (‘000 Units)

Table 261 Argentina: Automotive Fuel Tank Market, by Capacity, 2021-2026 (USD Million)

12.5.4 Iran

12.5.4.1 Upcoming Government Plans for Domestic Parts Production to Drive Iranian Market

Table 262 Iran: Automotive Fuel Tank Market, by Capacity, 2018-2020 (‘000 Units)

Table 263 Iran: Automotive Fuel Tank Market, by Capacity, 2018-2020 (USD Million)

Table 264 Iran: Automotive Fuel Tank Market, by Capacity, 2021-2026 (‘000 Units)

Table 265 Iran: Automotive Fuel Tank Market, by Capacity, 2021-2026 (USD Million)

13 Two-Wheeler Fuel Tank Market, by Region

13.1 Introduction

13.1.1 Research Methodology

13.1.2 Assumptions/Limitations

Figure 38 Two-Wheeler Fuel Tank Market, by Region, 2021 Vs. 2026 (USD Million)

Table 266 Two-Wheeler Fuel Tank Market, by Region, 2018-2020 (‘000 Units)

Table 267 Two-Wheeler Fuel Tank Market, by Region, 2018-2020 (USD Million)

Table 268 Two-Wheeler Fuel Tank Market, by Region, 2021-2026 (‘000 Units)

Table 269 Two-Wheeler Fuel Tank Market, by Region, 2021-2026 (USD Million)

13.2 Asia-Pacific

Figure 39 Asia-Pacific: Two-Wheeler Fuel Tank Market Snapshot

Table 270 Asia-Pacific: Two-Wheeler Fuel Tank Market, by Country, 2018-2020 (‘000 Units)

Table 271 Asia-Pacific: Two-Wheeler Fuel Tank Market, by Country, 2018-2020 (USD Million)

Table 272 Asia-Pacific: Two-Wheeler Fuel Tank Market, by Country, 2021-2026 (‘000 Units)

Table 273 Asia-Pacific: Two-Wheeler Fuel Tank Market, by Country, 2021-2026 (USD Million)

13.2.1 China

Table 274 China: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (‘000 Units)

Table 275 China: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (USD Million)

Table 276 China: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (‘000 Units)

Table 277 China: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (USD Million)

13.2.2 India

Table 278 India: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (‘000 Units)

Table 279 India: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (USD Million)

Table 280 India: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (‘000 Units)

Table 281 India: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (USD Million)

13.2.3 Japan

Table 282 Japan: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (‘000 Units)

Table 283 Japan: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (USD Million)

Table 284 Japan: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (‘000 Units)

Table 285 Japan: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (USD Million)

13.2.4 Indonesia

Table 286 Indonesia: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (‘000 Units)

Table 287 Indonesia: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (USD Million)

Table 288 Indonesia: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (‘000 Units)

Table 289 Indonesia: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (USD Million)

13.2.5 Thailand

Table 290 Thailand: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (‘000 Units)

Table 291 Thailand: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (USD Million)

Table 292 Thailand: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (‘000 Units)

Table 293 Thailand: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (USD Million)

13.3 Europe

Figure 40 Europe: Two-Wheeler Fuel Tank Market, by Country, 2021 Vs. 2026

Table 294 Europe: Two-Wheeler Fuel Tank Market, by Country, 2018-2020 (‘000 Units)

Table 295 Europe: Two-Wheeler Fuel Tank Market, by Country, 2018-2020 (USD Million)

Table 296 Europe: Two-Wheeler Fuel Tank Market, by Country, 2021-2026 (‘000 Units)

Table 297 Europe: Two-Wheeler Fuel Tank Market, by Country, 2021-2026 (USD Million)

13.3.1 Germany

Table 298 Germany: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (‘000 Units)

Table 299 Germany: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (USD Million)

Table 300 Germany: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (‘000 Units)

Table 301 Germany: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (USD Million)

13.3.2 France

Table 302 France: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (‘000 Units)

Table 303 France: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (USD Million)

Table 304 France: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (‘000 Units)

Table 305 France: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (USD Million)

13.3.3 UK

Table 306 UK: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (‘000 Units)

Table 307 UK: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (USD Million)

Table 308 UK: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (‘000 Units)

Table 309 UK: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (USD Million)

13.3.4 Italy

Table 310 Italy: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (‘000 Units)

Table 311 Italy: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (USD Million)

Table 312 Italy: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (‘000 Units)

Table 313 Italy: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (USD Million)

13.3.5 Spain

Table 314 Spain: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (‘000 Units)

Table 315 Spain: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (USD Million)

Table 316 Spain: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (‘000 Units)

Table 317 Spain: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (USD Million)

13.3.6 Poland

Table 318 Poland: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (‘000 Units)

Table 319 Poland: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (USD Million)

Table 320 Poland: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (‘000 Units)

Table 321 Poland: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (USD Million)

13.3.7 Russia

Table 322 Russia: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (‘000 Units)

Table 323 Russia: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (USD Million)

Table 324 Russia: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (‘000 Units)

Table 325 Russia: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (USD Million)

13.4 North America

Figure 41 North America: Two-Wheeler Fuel Tank Market Snapshot

Table 326 North America: Two-Wheeler Fuel Tank Market, by Country, 2018-2020 (‘000 Units)

Table 327 North America: Two-Wheeler Fuel Tank Market, by Country,2018-2020 (USD Million)

Table 328 North America: Two-Wheeler Fuel Tank Market, by Country, 2021-2026 (‘000 Units)

Table 329 North America: Two-Wheeler Fuel Tank Market, by Country, 2021-2026 (USD Million)

13.4.1 US

Table 330 US: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (‘000 Units)

Table 331 US: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (USD Million)

Table 332 US: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (‘000 Units)

Table 333 US: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (USD Million)

13.4.2 Canada

Table 334 Canada: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (‘000 Units)

Table 335 Canada: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (USD Million)

Table 336 Canada: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (‘000 Units)

Table 337 Canada: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (USD Million)

13.5 Rest of the World (Row)

Figure 42 RoW: Two-Wheeler Fuel Tank Market, 2021 Vs. 2026 (USD Million)

Table 338 RoW: Two-Wheeler Fuel Tank Market, by Country, 2018-2020 (‘000 Units)

Table 339 RoW: Two-Wheeler Fuel Tank Market, by Country, 2018-2020 (USD Million)

Table 340 RoW: Two-Wheeler Fuel Tank Market, by Country, 2021-2026 (‘000 Units)

Table 341 RoW: Two-Wheeler Fuel Tank Market, by Country, 2021-2026 (USD Million)

13.5.1 Brazil

Table 342 Brazil: Two-Wheeler Fuel Tank Market, by Type,2018-2020 (‘000 Units)

Table 343 Brazil: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (USD Million)

Table 344 Brazil: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (‘000 Units)

Table 345 Brazil: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (USD Million)

13.5.2 Colombia

Table 346 Colombia: Two-Wheeler Fuel Tank Market, by Type,2018-2020 (‘000 Units)

Table 347 Colombia: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (USD Million)

Table 348 Colombia: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (‘000 Units)

Table 349 Colombia: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (USD Million)

13.5.3 South Africa

Table 350 South Africa: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (‘000 Units)

Table 351 South Africa: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (USD Million)

Table 352 South Africa: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (‘000 Units)

Table 353 South Africa: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (USD Million)

13.5.4 Israel

Table 354 Israel: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (‘000 Units)

Table 355 Israel: Two-Wheeler Fuel Tank Market, by Type, 2018-2020 (USD Million)

Table 356 Israel: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (‘000 Units)

Table 357 Israel: Two-Wheeler Fuel Tank Market, by Type, 2021-2026 (USD Million)

14 Analyst's Recommendations

14.1 Asia-Pacific: a Potential Market for Automotive Fuel Tank

14.2 Aluminum to Create New Revenue Pockets in Fuel Tank Manufacturing

14.3 Increasing Investment and Developments of FCEVs is Expected to Create Opportunities

14.4 Conclusion

15 Competitive Landscape

15.1 Overview

15.2 Revenue Analysis of Top Five Players, 2018-2020

15.3 Market Share Analysis

Table 358 Market Structure, 2020

Figure 43 Market Share Analysis, 2020

15.4 Competitive Leadership Mapping

15.4.1 Terminology

15.4.2 Visionary Leaders

15.4.3 Innovators

15.4.4 Dynamic Differentiators

15.4.5 Emerging Companies

Figure 44 Automotive Fuel Tank Manufacturers: Competitive Leadership Mapping (2020)

15.5 Strength of Product Portfolio

Figure 45 Automotive Fuel Tank Manufacturers: Company-Wise Product Offering Analysis

15.6 Business Strategy Excellence

Figure 46 Automotive Fuel Tank Manufacturers: Company-Wise Business Strategy Analysis

Figure 47 Companies Adopted New Product Development & Partnerships/ Agreements/Supply Contracts/Collaborations/Joint Ventures as the Key Growth Strategy, 2018-2021

15.7 Competitive Scenario

15.7.1 New Product Developments/Launch

Table 359 New Product Developments/Launch, 2021

15.7.2 Expansions

Table 360 Expansions, 2018-2020

15.7.3 Acquisitions

Table 361 Acquisitions, 2017-2018

15.7.4 Partnerships/Contracts

Table 362 Partnerships/Contracts, 2019-20

15.8 Right to Win

16 Company Profiles

16.1 The Plastic Omnium Group

Figure 48 The Plastic Omnium Group: Company Snapshot

16.1.2 The Plastic Omnium Group: Products Offered

16.1.3 The Plastic Omnium Group: Major Customers

Table 363 The Plastic Omnium Group: Organic Developments

16.2 Textron (Kautex)

Figure 49 Textron: Company Snapshot

16.2.2 Kautex: Products Offered

16.2.3 Kautex: Major Customers

Table 364 Kautex: Product Launches

Table 365 Kautex: Deals

16.3 Yapp

Figure 50 Yapp: Company Snapshot

16.3.2 Yapp: Products Offered

16.3.3 Yapp: Major Customers

16.4 Ti Fluid Systems

Figure 51 Ti Fluid Systems: Company Snapshot

16.4.2 Ti Fluid Systems: Products Offered

16.4.3 Ti Fluid Systems: Major Customers

Table 366 Ti Fluid Systems: Product Launches

Table 367 Ti Fluid Systems: Deals

16.5 Yachiyo

Figure 52 Yachiyo: Company Snapshot

16.5.2 Yachiyo: Products Offered

16.5.3 Yachiyo: Major Customers

Table 368 Yachiyo: Deals

16.6 Unipres Corporation

Figure 53 Unipres Corporation: Company Snapshot

16.6.2 Unipres Corporation: Products Offered

16.6.3 Unipres Corporation: Major Customers

Table 369 Unipres Corporation: Deals

16.7 Magna International

Figure 54 Magna International: Company Snapshot

16.7.2 Magna International: Products Offered

16.7.3 Magna International: Major Customers

Table 370 Magna International: Deals

16.8 FTS

Table 371 FTS: Deals

16.9 Sma Serbatoi S.P.A.

16.10 SRD Holdings Ltd.

16.11 Asia-Pacific

16.11.1 Metal Tech Co., Ltd.

16.11.2 Hwashin Co., Ltd.

16.11.3 Dali & Samir Engineering Pvt. Ltd

16.11.4 Bellsonic Corporation

16.11.5 Crefact Corporation

16.12 Europe

16.12.1 Donghee

16.12.2 Kongsberg Automotive

16.13 North America

16.13.1 Westport Fuel Systems

16.13.2 Boyd Welding

17 Appendix

17.1 Currency & Pricing

Table 372 Currency Exchange Rates (Wrt Per Usd)

17.2 Insights of Industry Experts

17.3 Discussion Guide

17.4 Knowledge Store: The Subscription Portal

17.5 Available Customizations

Companies Mentioned

- Bellsonic Corporation

- Boyd Welding

- Crefact Corporation

- Dali & Samir Engineering Pvt. Ltd

- Donghee

- FTS

- Hwashin Co., Ltd.

- Kongsberg Automotive

- Magna International

- Metal Tech Co., Ltd.

- SMA Serbatoi S.P.A.

- SRD Holdings Ltd.

- Textron (Kautex)

- The Plastic Omnium Group

- TI Fluid Systems

- Unipres Corporation

- Westport Fuel Systems

- Yachiyo

- Yapp

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 282 |

| Published | November 2021 |

| Forecast Period | 2021 - 2026 |

| Estimated Market Value ( USD | $ 16.6 Billion |

| Forecasted Market Value ( USD | $ 21.3 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 19 |