Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Dust from renovation or construction activities, cleaning products, pesticides, and other airborne chemicals can all contribute to poor indoor air quality. To address these issues, the U.S. Occupational Safety and Health Administration (OSHA) has established standards regarding ventilation and air contaminants, which can help improve indoor air quality overall.

These regulations are expected to drive the demand for air purifiers to provide cleaner air. For example, both California and New Jersey have implemented regulations for indoor air quality. The New Jersey Indoor Air Quality Standard, N.J.A.C. 12:100-13 (2007), sets guidelines for maintaining indoor air quality during working hours in public employee-occupied buildings. Meanwhile, California's state-level indoor air quality program focuses on identifying and addressing public health issues related to indoor environments while promoting healthier indoor spaces throughout the state.

Key Market Drivers

Increasing Air Pollution and Environmental Awareness

One of the primary drivers of the U.S. air purifier market is the increasing levels of air pollution in urban and industrial areas, coupled with growing environmental awareness. Cities like Los Angeles, New York, and Chicago frequently experience high levels of particulate matter (PM), nitrogen dioxide (NO2), and volatile organic compounds (VOCs), all of which can significantly degrade air quality and pose serious health risks. Pollutants from traffic emissions, industrial activities, and wildfires, especially in recent years, have exacerbated this issue.Studies have shown a direct link between poor air quality and respiratory illnesses such as asthma, bronchitis, and cardiovascular diseases, driving more consumers to invest in air purification solutions to reduce their exposure to harmful pollutants. Alongside this environmental concern, the U.S. population has become increasingly aware of the long-term health risks associated with indoor pollution. Poor indoor air quality, often caused by allergens, dust, pet dander, or mold, can lead to health issues even in seemingly clean environments. This rising awareness about the importance of air quality, combined with a more proactive approach toward personal health, is driving the adoption of air purifiers in households, offices, and public spaces. Furthermore, government initiatives and regulatory measures aimed at reducing air pollution have created a conducive environment for the growth of air purifier sales.

Growing Health and Wellness Trends

The rising interest in health and wellness, which emphasizes physical well-being, mental health, and preventive healthcare, is another significant driver of the air purifier market in the U.S. In recent years, consumers have become more health-conscious, seeking products and solutions that contribute to a cleaner and healthier living environment. This shift has led to a heightened focus on indoor air quality, as people are increasingly aware of how poor air can contribute to various health problems. For individuals with allergies or respiratory conditions, such as asthma, air purifiers are no longer seen as a luxury but as a necessary tool for maintaining health.Air purifiers equipped with advanced filtration systems like HEPA (High-Efficiency Particulate Air) filters can effectively remove airborne allergens, dust, pollen, and other particulate matter, thus improving air quality and reducing allergic reactions. Additionally, the rise of chronic respiratory conditions, particularly among children and the elderly, has fueled demand for air purifiers as a preventive measure. Moreover, the COVID-19 pandemic has further amplified interest in air purifiers, as consumers became more aware of airborne viruses and bacteria and their potential to spread through indoor spaces. This heightened awareness of airborne contaminants, in conjunction with a growing trend of health-conscious living, has resulted in increased demand for air purifiers in both residential and commercial sectors.

Technological Advancements and Innovation

Technological advancements in air purifier design and functionality have also played a pivotal role in driving the growth of the U.S. air purifier market. Modern air purifiers are equipped with a range of innovative features that improve both performance and user experience. Advanced filtration technologies, such as HEPA filters, activated carbon filters, and ultraviolet (UV) light sterilization, are becoming more common, providing superior filtration capabilities for capturing harmful particles, allergens, and microorganisms in the air. This not only makes air purifiers more effective but also increases consumer confidence in their ability to improve indoor air quality.Smart technology integration is another key factor driving market growth. Today’s air purifiers often come with Wi-Fi connectivity, allowing users to monitor air quality and control the devices remotely through smartphone apps. Smart sensors are now able to detect air quality in real-time, automatically adjusting the purifier’s settings based on pollutant levels, which optimizes energy consumption and ensures more efficient operation. Furthermore, many air purifiers are designed to be energy-efficient and quieter, making them more user-friendly and suitable for a variety of living environments.

Key Market Challenges

High Cost of Air Purifiers

One of the major challenges in the U.S. air purifier market is the high cost of quality units. Many of the best-performing air purifiers, especially those with advanced features like HEPA filters, activated carbon filters, and UV-C light sterilization, can be expensive, with prices often ranging from hundreds to over a thousand dollars. In addition to the initial investment, there are ongoing maintenance costs, such as replacing filters regularly, which can add up over time. This makes air purifiers a significant financial commitment, potentially discouraging many consumers, especially in lower-income households, from purchasing them. While lower-cost models exist, they may not offer the same level of filtration and performance, which could undermine consumer confidence in their effectiveness. The high costs associated with air purifiers, both initially and over time, present a barrier to broader adoption, limiting their accessibility for many households.Lack of Consumer Awareness

Many consumers are still unaware of the importance of indoor air quality and the health risks associated with poor air. While outdoor pollution is often recognized as a significant concern, indoor air pollution caused by allergens, pet dander, dust, mold, and VOCs - often goes unnoticed. This lack of awareness leads to lower demand for air purifiers, as people may not recognize the need for them. In addition, there is limited understanding of the specific features and benefits that different air purifiers offer, making it difficult for consumers to choose the right product for their needs. Educating the public on the importance of clean indoor air and the role of air purifiers in preventing respiratory issues and allergies is crucial for market growth.Inconsistent Product Quality and Standards

Another challenge in the U.S. air purifier market is the inconsistency in product quality and performance. While some air purifiers effectively clean indoor air, others may not live up to their claims or meet industry standards. Without comprehensive and standardized regulations governing air purifier performance, manufacturers have wide leeway in design and claims.This can result in poor-quality products entering the market, potentially disappointing consumers. The absence of uniform certification standards, such as one universally accepted testing process for filtration efficacy, makes it difficult for consumers to differentiate between products. As a result, many consumers may end up purchasing subpar devices that fail to meet their expectations. Establishing clear, standardized regulations for air purifiers would help ensure more reliable, effective products and improve consumer trust in the market.

Key Market Trends

Increasing Adoption of Smart Air Purifiers

A major trend in the U.S. air purifier market is the growing demand for smart air purifiers. As technology continues to evolve, consumers are seeking more convenient and efficient ways to monitor and control their indoor air quality. Smart air purifiers are equipped with features such as Wi-Fi connectivity, allowing users to control and monitor the devices remotely via smartphone apps. Many smart air purifiers are also integrated with sensors that detect air quality in real time and adjust settings automatically based on the level of pollutants in the environment. Additionally, some models can sync with other smart home devices, such as voice-controlled assistants like Amazon Alexa or Google Assistant, providing hands-free control.This trend toward smart technology is driven by the increasing desire for automation, convenience, and energy efficiency in home appliances. Smart air purifiers offer consumers greater control over their indoor air quality while also enabling real-time monitoring of pollutant levels. For example, in October 2023, AirDoctor introduced its next-generation air purifiers equipped with Wi-Fi connectivity. This smart air purifier offers real-time updates on air quality and notifications for filter replacement. The integration of such advanced technologies is fueling the growth of the air purifier market in the U.S.

Focus on Health and Wellness

The rising focus on health and wellness is another significant trend in the U.S. air purifier market. With growing awareness of the impact of air quality on overall health, consumers are more inclined to invest in air purifiers as part of a broader wellness lifestyle. Air purifiers are now seen not only as a tool for improving air quality but also as an essential item for improving respiratory health, preventing allergies, and reducing the risk of exposure to harmful pollutants.The COVID-19 pandemic further accelerated this trend by heightening concerns about airborne viruses and bacteria, leading to an increase in demand for air purifiers with added sterilization features, such as UV-C light or ionization. Additionally, consumers are increasingly looking for air purifiers that can address specific health concerns, such as asthma, allergies, or sensitivities to pet dander. This trend has led manufacturers to develop air purifiers with specialized filters and functions that cater to these needs, contributing to the overall growth of the market. As more people focus on creating healthier living environments, the demand for air purifiers is expected to continue to grow.

Sustainability and Energy Efficiency

Sustainability and energy efficiency are becoming key trends within the U.S. air purifier market, as consumers are increasingly concerned about the environmental impact of their products. Air purifiers are often used continuously, which can lead to high energy consumption. To address this concern, manufacturers are incorporating energy-efficient technologies into their products, allowing consumers to reduce their carbon footprint while maintaining a clean indoor environment. Many modern air purifiers are designed to use less power, even when operating at higher settings, by utilizing low-energy fans or optimizing filtration processes to reduce overall energy usage.In addition, there is a growing trend toward the use of environmentally friendly materials in air purifier construction and the development of recyclable or reusable filters, which further appeals to eco-conscious consumers. The rising awareness around climate change and environmental sustainability has led to an increased demand for products that are both effective in improving air quality and aligned with sustainability goals. For example, the U.S. Department of Energy has set standards for quality assurance and specifications concerning HEPA filters. Likewise, the Association of Home Appliance Manufacturers (AHAM) has developed the Clean Air Delivery Rate (CADR) as a standard to evaluate the effectiveness of air purifiers. This allows consumers to compare the performance of air purifiers in removing dust, pollen, and tobacco smoke.

Segmental Insights

Filter Type Insights

In the United States Air Purifier Market, HEPA (High-Efficiency Particulate Air) filters and activated carbon filters was the dominant segments due to their proven effectiveness in improving indoor air quality. HEPA filters are widely recognized for their ability to capture 99.97% of airborne particles as small as 0.3 microns, including dust, pollen, mold spores, and pet dander. This makes them an ideal choice for individuals with allergies, asthma, or other respiratory conditions, driving their popularity in both residential and commercial spaces. Activated carbon filters are also crucial in the market for their ability to absorb odors, volatile organic compounds (VOCs), and harmful gases.They are particularly effective at removing unpleasant smells, such as smoke, cooking odors, and pet odors, making them a preferred option for consumers seeking a more pleasant indoor environment. Often, air purifiers combine both HEPA and activated carbon filters to address a wide range of air quality issues, offering comprehensive purification by filtering out particles and neutralizing odors simultaneously. Together, HEPA and activated carbon filters dominate the market because of their complementary roles in addressing both particulate matter and gaseous pollutants. This combination ensures that air purifiers equipped with these filters can effectively improve air quality, making them the top choice for consumers concerned with health, comfort, and air cleanliness.

Regional Insights

The South region of the United States holds the dominant share in the air purifier market due to several key factors. First, the region faces unique environmental challenges, such as high levels of pollen, humidity, and seasonal allergens, which contribute to poor indoor air quality. Cities in the South, such as Atlanta, Houston, and Miami, frequently experience high pollen counts, which can trigger allergic reactions and asthma, driving demand for air purifiers. Additionally, the region often suffers from air pollution due to industrial activity, traffic congestion, and weather patterns that trap pollutants, further increasing the need for effective air purification solutions.The growing awareness of the importance of clean indoor air, particularly in areas with high levels of allergens and pollutants, has fueled the adoption of air purifiers in homes, schools, and workplaces. The South also has a large population of families and individuals with health concerns such as respiratory issues, allergies, and asthma. As health and wellness trends continue to grow, the demand for air purifiers in this region remains strong. Moreover, warmer climates mean that people often spend more time indoors, which further boosts the need for cleaner air within homes and offices. This combination of environmental factors, health concerns, and increased awareness makes the South region a key driver of the U.S. air purifier market.

Key Market Players

- Daikin Industries, Ltd.

- Sharp Electronics Corporation

- Honeywell International, Inc.

- Panasonic Corporation

- AprilAire

- LG Electronics

- Koninklijke Philips N.V.

- Samsung Electronics Co., Ltd.

- Unilever (Blueair)

- Dyson Direct Inc.

Report Scope:

In this report, the United States Air Purifier Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:United States Air Purifier Market, By Filter Type:

- HEPA & Activated Carbon

- HEPA, Activated Carbon & Ion Ozone Generator

- HEPA

- Activated Carbon

- Ion & Ozone Generator

- Electrostatic Precipitator

United States Air Purifier Market, By End User:

- Commercial

- Residential

- Industrial

United States Air Purifier Market, By Region:

- South

- West

- Midwest

- Northeast

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the United States Air Purifier Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Daikin Industries, Ltd.

- Sharp Electronics Corporation

- Honeywell International, Inc.

- Panasonic Corporation

- AprilAire

- LG Electronics

- Koninklijke Philips N.V.

- Samsung Electronics Co., Ltd.

- Unilever (Blueair)

- Dyson Direct Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 82 |

| Published | February 2025 |

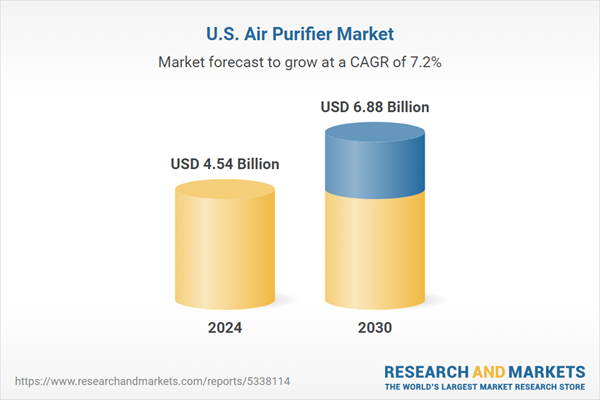

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.54 Billion |

| Forecasted Market Value ( USD | $ 6.88 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |