1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Market Scope

1.3.1 Markets Covered

Figure 1 Motion Control Market Segmentation

1.3.2 Regional Scope

1.3.3 Years Considered

1.4 Currency Considered

1.5 Stakeholders

1.6 Summary of Changes

1.6.1 Recession Impact Analysis

2 Research Methodology

2.1 Research Data

Figure 2 Motion Control Market: Research Design

2.1.1 Secondary Data

2.1.1.1 List of Major Secondary Sources

2.1.1.2 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Breakdown of Primary Interviews

2.1.2.2 Primary Interviews with Experts

2.1.2.3 Key Data from Primary Sources

2.1.3 Secondary and Primary Research

2.1.3.1 Key Industry Insights

2.2 Market Size Estimation

Figure 3 Market Size Estimation Methodology: Approach 1 (Supply Side): Revenue of Products/Solutions/Services in Motion Control Market

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Arriving at Market Share by Bottom-Up Analysis (Demand Side)

Figure 4 Motion Control Market: Bottom-Up Approach

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing Market Share by Top-Down Analysis (Supply Side)

Figure 5 Motion Control Market: Top-Down Approach

2.3 Market Breakdown and Data Triangulation

Figure 6 Data Triangulation

2.4 Research Assumptions

2.5 Parameters Considered to Analyze Impact of Recession on Motion Control Market

2.6 Research Limitations

2.7 Risk Assessment

Figure 7 Risk Assessment of Research Study

3 Executive Summary

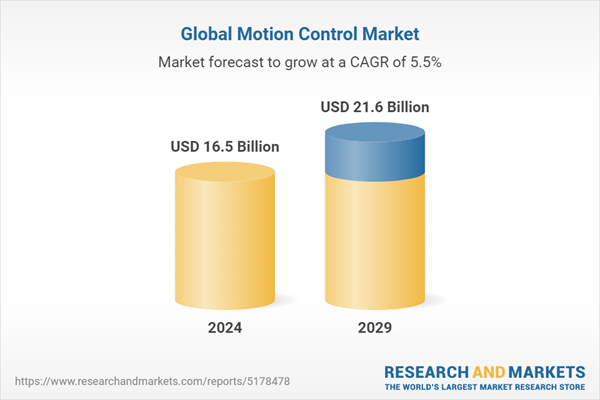

Figure 8 Motion Control Market, 2020-2029 (USD Million)

Figure 9 Motors to Lead Market During Forecast Period

Figure 10 Closed-Loop Systems to Dominate Market During Forecast Period

Figure 11 Pharmaceuticals & Cosmetics to Display Highest CAGR During Forecast Period

Figure 12 Asia-Pacific to Account for Largest Market Share During Forecast Period

4 Premium Insights

4.1 Attractive Growth Opportunities for Players in Motion Control Market

Figure 13 Growing Adoption of Automation Across Various Manufacturing Processes to Drive Market

4.2 Motion Control Market, by Offering

Figure 14 Drives Segment to Exhibit Highest CAGR Between 2024 and 2029

4.3 Motion Control Market, by System

Figure 15 Closed-Loop Systems to Account for Largest Market Share During Forecast Period

4.4 Motion Control Market, by Industry

Figure 16 Automotive Segment to Command Largest Market Share During Forecast Period

4.5 Motion Control Market, by Country

Figure 17 Motion Control Market in India to Register Highest CAGR During Forecast Period

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

Figure 18 Motion Control Market: Drivers, Restraints, Opportunities, and Challenges

5.2.1 Drivers

5.2.1.1 Rising Need for High-End Automation Across Industries

5.2.1.2 Government Initiatives to Promote Workplace Safety

5.2.1.3 Growing Use of Industrial Robots by Manufacturers

5.2.1.4 Increasing Integration of AI and IoT with Motion Control Systems

Figure 19 Motion Control Market: Impact Analysis of Drivers

5.2.2 Restraints

5.2.2.1 Heavy Maintenance and Replacement Costs Associated with Motion Control Systems

5.2.2.2 Susceptibility of Motion Control Systems to Cyberattacks

Figure 20 Motion Control Market: Impact Analysis of Restraints

5.2.3 Opportunities

5.2.3.1 Adoption of Industry 4.0 Principles for Manufacturing

5.2.3.2 Integration of Emerging Technologies with Motion Control Systems

5.2.3.3 Implementation of Integrated Communication Systems Across Various Sectors

Figure 21 Motion Control Market: Impact Analysis of Opportunities

5.2.4 Challenges

5.2.4.1 Designing Flexible, Scalable, and Low-Cost Motion Control Systems

5.2.4.2 Shortage of Skilled and Experienced Workforce

Figure 22 Motion Control Market: Impact Analysis of Challenges

5.3 Trends and Disruptions Impacting Customer Business

Figure 23 Motion Control Market: Trends and Disruptions Impacting Customer Business

5.4 Pricing Analysis

Table 1 Average Selling Price of Motion Control Devices, by Type

Figure 24 Average Selling Price Trend of Servo Motors, 2020-2029 (USD)

5.4.1 Average Selling Price Trend of Servo Motors for Key Players, by Power Rating

Figure 25 Average Selling Price of Servo Motors, by Power Rating for Key Players (USD)

Table 2 Average Selling Price of Servo Motors, by Power Rating for Key Players (USD)

5.4.2 Average Selling Price Trend, by Region

Table 3 Average Selling Price Trend of Servo Motors, by Region

5.5 Supply Chain Analysis

Figure 26 Motion Control Market: Supply Chain Analysis

5.6 Ecosystem Mapping

Figure 27 Motion Control Market: Ecosystem Map

Table 4 Companies and Their Role in Motion Control Ecosystem

5.7 Technology Analysis

5.7.1 Artificial Intelligence

5.7.2 Simulation & Digital Twinning

5.7.3 Frameless Motors

5.7.4 Predictive Maintenance

5.7.5 IIoT Sensors

5.7.6 Motion Out-Of-The-Box

5.8 Patent Analysis

Figure 28 Motion Control Market: Top 10 Companies with Highest Number of Patent Applications, 2014-2023

Figure 29 Motion Control Market: Number of Granted Patents Related to Motion Control Systems, 2014-2023

Table 5 Motion Control Market: Top 20 Patent Owners, 2014-2023

Table 6 List of Patents Related to Motion Control Systems

5.9 Trade Analysis

5.9.1 Import Scenario

Figure 30 Motion Control Market: Import Data for HS Code 8501, by Key Country, 2018-2022 (USD Million)

5.9.2 Export Scenario

Figure 31 Motion Control Market: Export Data for HS Code 8501, by Key Country, 2018-2022 (USD Million)

5.10 Key Conferences and Events, 2024-2025

Table 7 Motion Control Market: List of Conferences and Events, 2024-2025

5.11 Case Study Analysis

Table 8 Nidec Motor Provides Improved Temperature Control, with Savings of Nearly 7,500 kWh

Table 9 Mitsubishi Electric Offers Improved Reliability, Expanded Customer Features, and Overwrapping Accuracy Without Label Distortion

Table 10 Motion Control Motors and Drives Designed with Cutting-Edge Technology Accelerate Bottle Labeling

Table 11 Troubleshooting Motion Control Systems Using Moog Animatics Smartmotor Data

5.12 Tariff and Regulatory Landscape

5.12.1 Regulatory Bodies, Government Agencies, and Other Organizations

Table 12 North America: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 13 Europe: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 14 Asia-Pacific: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 15 Rest of the World: List of Regulatory Bodies, Government Agencies, and Other Organizations

5.12.2 Regulatory Standards

5.12.3 Iec 61508

5.12.4 Iec 61511

5.12.5 Iec 62061

5.12.6 Iec 62443

5.13 Porter's Five Forces Analysis

Figure 32 Motion Control Market: Porter's Five Forces Analysis

Table 16 Motion Control Market: Porter's Five Forces Analysis

5.14 Key Stakeholders and Buying Criteria

5.14.1 Key Stakeholders in Buying Process

Figure 33 Influence of Stakeholders on Buying Process for Top 3 Industries

Table 17 Influence of Stakeholders on Buying Process for Top 3 Industries (%)

5.14.2 Buying Criteria

Figure 34 Motion Control Market: Key Buying Criteria for Top 3 Industries

Table 18 Motion Control Market: Key Buying Criteria for Top 3 Industries

6 Trends and Emerging Applications Related to Motion Control Technology

6.1 Introduction

6.2 Trends Related to Motion Control Technology

6.2.1 Advanced Robotics and Cobots

6.2.2 Human-Machine Interface (Hmi)

6.2.3 Autonomous Vehicles and Drones

6.2.4 3D Printing and Additive Manufacturing

6.3 Emerging Applications Related to Motion Control Technology

6.3.1 Rehabilitation Robotics

6.3.2 Digital Twin Technology

6.3.3 Autonomous Underwater Vehicles (Auvs)

6.3.4 Advanced Packaging and Material Handling

7 Emerging Implementation Areas of Motion Control Systems

7.1 Introduction

7.2 Metal Cutting

7.3 Metal Forming

7.4 Material Handling

7.5 Packaging & Labelling

7.6 Robotics

7.7 Other Implementation Areas

8 Motion Control Market, by Offering

8.1 Introduction

Figure 35 Motion Control Market Segmentation, by Offering

Figure 36 Motors to Hold Largest Market Share During Forecast Period

Table 19 Motion Control Market, by Offering, 2020-2023 (USD Million)

Table 20 Motion Control Market, by Offering, 2024-2029 (USD Million)

8.2 Actuators and Mechanical Systems

8.2.1 Increasing Use due to Greater Efficiency to Drive Market

8.2.2 Electric

8.2.3 Hydraulic

8.2.4 Pneumatic

8.2.5 Others

Table 21 Actuators and Mechanical Systems: Motion Control Market, by Industry, 2020-2023 (USD Million)

Table 22 Actuators and Mechanical Systems: Motion Control Market, by Industry, 2024-2029 (USD Million)

Table 23 Actuators and Mechanical Systems: Motion Control Market, by Region, 2020-2023 (USD Million)

Table 24 Actuators and Mechanical Systems: Motion Control Market, by Region, 2024-2029 (USD Million)

8.3 Drives

8.3.1 Automation in Manufacturing Industry to Drive Market

Table 25 Drives: Motion Control Market, by Industry, 2020-2023 (USD Million)

Table 26 Drives: Motion Control Market, by Industry, 2024-2029 (USD Million)

Figure 37 Asia-Pacific to Lead Market for Drives During Forecast Period

Table 27 Drives: Motion Control Market, by Region, 2020-2023 (USD Million)

Table 28 Drives: Motion Control Market, by Region, 2024-2029 (USD Million)

8.4 Motors

Table 29 Motors: Motion Control Market, by Type, 2020-2023 (USD Million)

Table 30 Motors: Motion Control Market, by Type, 2024-2029 (USD Million)

Table 31 Motors: Motion Control Market, by Industry, 2020-2023 (USD Million)

Table 32 Motors: Motion Control Market, by Industry, 2024-2029 (USD Million)

Table 33 Motors: Motion Control Market, by Region, 2020-2023 (USD Million)

Table 34 Motors: Motion Control Market, by Region, 2024-2029 (USD Million)

8.4.1 Servo Motors

8.4.1.1 High Torque and Acceleration to Drive Market

Table 35 Servo Motors: Motion Control Market, 2020-2023 (Thousand Units)

Table 36 Servo Motors: Motion Control Market, 2024-2029 (Thousand Units)

8.4.2 Stepper Motors

8.4.2.1 Compact Design to Drive Market

Table 37 Stepper Motors: Motion Control Market, 2020-2023 (Thousand Units)

Table 38 Stepper Motors: Motion Control Market, 2024-2029 (Thousand Units)

8.5 Motion Controllers

8.5.1 Rapid Real-Time Response and Minimized Errors to Drive Market

Table 39 Motion Controllers: Motion Control Market, by Industry, 2020-2023 (USD Million)

Table 40 Motion Controllers: Motion Control Market, by Industry, 2024-2029 (USD Million)

Figure 38 Asia-Pacific to Account for Largest Market Share of Motion Controllers During Forecast Period

Table 41 Motion Controllers: Motion Control Market, by Region, 2020-2023 (USD Million)

Table 42 Motion Controllers: Motion Control Market, by Region, 2024-2029 (USD Million)

8.6 Sensors and Feedback Devices

8.6.1 Contactless Switching, Position Detection, and Pressure Detection Applications to Drive Market

Table 43 Sensors and Feedback Devices: Motion Control Market, by Industry, 2020-2023 (USD Million)

Table 44 Sensors and Feedback Devices: Motion Control Market, by Industry, 2024-2029 (USD Million)

Table 45 Sensors and Feedback Devices: Motion Control Market, by Region, 2020-2023 (USD Million)

Table 46 Sensors and Feedback Devices: Motion Control Market, by Region, 2024-2029 (USD Million)

8.7 Software and Services

8.7.1 Utilization in Networking Management Software to Drive Market

Table 47 Software and Services: Motion Control Market, by Industry, 2020-2023 (USD Million)

Table 48 Software and Services: Motion Control Market, by Industry, 2024-2029 (USD Million)

Table 49 Software and Services: Motion Control Market, by Region, 2020-2023 (USD Million)

Table 50 Software and Services: Motion Control Market, by Region, 2024-2029 (USD Million)

9 Motion Control Market, by System

9.1 Introduction

Figure 39 Closed-Loop Systems to Hold Largest Market During Forecast Period

Table 51 Motion Control Market, by System, 2020-2023 (USD Million)

Table 52 Motion Control Market, by System, 2024-2029 (USD Million)

9.2 Open-Loop Systems

9.2.1 Low Maintenance Cost to Drive Market

9.3 Closed-Loop Systems

9.3.1 Capabilities to Reduce Sensitivity and Improve Stability of Systems to Drive Market

10 Motion Control Market, by Industry

10.1 Introduction

Figure 40 Motion Control Market, by Industry

Figure 41 Automotive Industry to Hold Largest Share of Motion Control Market During Forecast Period

Table 53 Motion Control Market, by Industry, 2020-2023 (USD Million)

Table 54 Motion Control Market, by Industry, 2024-2029 (USD Million)

10.2 Aerospace

10.2.1 Need for Precise Aircraft Component Manufacturing to Drive Market

Table 55 Aerospace: Motion Control Market, by Offering, 2020-2023 (USD Million)

Table 56 Aerospace: Motion Control Market, by Offering, 2024-2029 (USD Million)

Table 57 Aerospace: Motion Control Market, by Region, 2020-2023 (USD Million)

Table 58 Aerospace: Motion Control Market, by Region, 2024-2029 (USD Million)

10.3 Automotive

10.3.1 Advanced Driver Assistance Systems to Drive Market

Figure 42 Europe to Account for Largest Market Share of Automotive Industry During Forecast Period

Table 59 Automotive: Motion Control Market, by Offering, 2020-2023 (USD Million)

Table 60 Automotive: Motion Control Market, by Offering, 2024-2029 (USD Million)

Table 61 Automotive: Motion Control Market, by Region, 2020-2023 (USD Million)

Table 62 Automotive: Motion Control Market, by Region, 2024-2029 (USD Million)

10.4 Semiconductor & Electronics

10.4.1 Inspection, Wafer Test, and Dicing Applications to Drive Market

Table 63 Semiconductor & Electronics: Motion Control Market, by Offering, 2020-2023 (USD Million)

Table 64 Semiconductor & Electronics: Motion Control Market, by Offering, 2024-2029 (USD Million)

Table 65 Semiconductor & Electronics: Motion Control Market, by Region, 2020-2023 (USD Million)

Table 66 Semiconductor & Electronics: Motion Control Market, by Region, 2024-2029 (USD Million)

10.5 Metals & Machinery

10.5.1 Need for Efficient Assembly Lines and Automation in Manufacturing Hubs to Drive Market

Table 67 Metals & Machinery: Motion Control Market, by Offering, 2020-2023 (USD Million)

Table 68 Metals & Machinery: Motion Control Market, by Offering, 2024-2029 (USD Million)

Table 69 Metals & Machinery: Motion Control Market, by Region, 2020-2023 (USD Million)

Table 70 Metals & Machinery: Motion Control Market, by Region, 2024-2029 (USD Million)

10.6 Food & Beverages

10.6.1 Filling, Capping, Labeling, Packing, and Palletizing Activities to Drive Market

Figure 43 Asia-Pacific to Account for Largest Market Share of Food & Beverages Industry During Forecast Period

Table 71 Food & Beverages: Motion Control Market, by Offering, 2020-2023 (USD Million)

Table 72 Food & Beverages: Motion Control Market, by Offering, 2024-2029 (USD Million)

Table 73 Food & Beverages: Motion Control Market, by Region, 2020-2023 (USD Million)

Table 74 Food & Beverages: Motion Control Market, by Region, 2024-2029 (USD Million)

10.7 Medical Devices

10.7.1 Diagnostic Imaging and Surgical Robotics to Drive Market

Table 75 Medical Devices: Motion Control Market, by Offering, 2020-2023 (USD Million)

Table 76 Medical Devices: Motion Control Market, by Offering, 2024-2029 (USD Million)

Table 77 Medical Devices: Motion Control Market, by Region, 2020-2023 (USD Million)

Table 78 Medical Devices: Motion Control Market, by Region, 2024-2029 (USD Million)

10.8 Printing & Paper

10.8.1 3D Printing Technology to Drive Market

Table 79 Printing & Paper: Motion Control Market, by Offering, 2020-2023 (USD Million)

Table 80 Printing & Paper: Motion Control Market, by Offering, 2024-2029 (USD Million)

Table 81 Printing & Paper: Motion Control Market, by Region, 2020-2023 (USD Million)

Table 82 Printing & Paper: Motion Control Market, by Region, 2024-2029 (USD Million)

10.9 Pharmaceuticals & Cosmetics

10.9.1 Retrieval, Placement, and Filling of Containers to Drive Market

Table 83 Pharmaceuticals & Cosmetics: Motion Control Market, by Offering, 2020-2023 (USD Million)

Table 84 Pharmaceuticals & Cosmetics: Motion Control Market, by Offering, 2024-2029 (USD Million)

Table 85 Pharmaceuticals & Cosmetics: Motion Control Market, by Region, 2020-2023 (USD Million)

Table 86 Pharmaceuticals & Cosmetics: Motion Control Market, by Region, 2024-2029 (USD Million)

10.10 Other Industries

Table 87 Other Industries: Motion Control Market, by Offering, 2020-2023 (USD Million)

Table 88 Other Industries: Motion Control Market, by Offering, 2024-2029 (USD Million)

Table 89 Other Industries: Motion Control Market, by Region, 2020-2023 (USD Million)

Table 90 Other Industries: Motion Control Market, by Region, 2024-2029 (USD Million)

11 Motion Control Market, by Region

11.1 Introduction

Figure 44 Motion Control Market in India to Exhibit Highest CAGR During Forecast Period

Table 91 Motion Control Market, by Region, 2020-2023 (USD Million)

Table 92 Motion Control Market, by Region, 2024-2029 (USD Million)

11.2 North America

11.2.1 North America: Recession Impact Analysis

Figure 45 North America: Motion Control Market Snapshot

Table 93 North America: Motion Control Market, by Country, 2020-2023 (USD Million)

Table 94 North America: Motion Control Market, by Country, 2024-2029 (USD Million)

Table 95 North America: Motion Control Market, by Industry, 2020-2023 (USD Million)

Table 96 North America: Motion Control Market, by Industry, 2024-2029 (USD Million)

11.2.2 US

11.2.2.1 Smart Manufacturing and Industry 4.0 Initiatives to Drive Market

11.2.3 Canada

11.2.3.1 Integration of Robotics with Collaborative Technologies and Other Smart Safety Products and Appliances to Drive Market

11.2.4 Mexico

11.2.4.1 Association for Advancing Automation to Drive Market

11.3 Europe

11.3.1 Europe: Recession Impact Analysis

Figure 46 Europe: Motion Control Market Snapshot

Table 97 Europe: Motion Control Market, by Country, 2020-2023 (USD Million)

Table 98 Europe: Motion Control Market, by Country, 2024-2029 (USD Million)

Table 99 Europe: Motion Control Market, by Industry, 2020-2023 (USD Million)

Table 100 Europe: Motion Control Market, by Industry, 2024-2029 (USD Million)

11.3.2 UK

11.3.2.1 Made Smarter Initiative and Government Funding to Drive Market

11.3.3 France

11.3.3.1 Industrie Du Futur Initiative and Industrial Plants of the Future Plan to Drive Market

11.3.4 Germany

11.3.4.1 Growing Use of Industrial Robots in Assembling, Machine Tending, Painting, and Welding to Drive Market

11.3.5 Rest of Europe

11.4 Asia-Pacific

11.4.1 Asia-Pacific: Recession Impact Analysis

Figure 47 Asia-Pacific: Motion Control Market Snapshot

Table 101 Asia-Pacific: Motion Control Market, by Country, 2020-2023 (USD Million)

Table 102 Asia-Pacific: Motion Control Market, by Country, 2024-2029 (USD Million)

Table 103 Asia-Pacific: Motion Control Market, by Industry, 2020-2023 (USD Million)

Table 104 Asia-Pacific: Motion Control Market, by Industry, 2024-2029 (USD Million)

11.4.2 China

11.4.2.1 Made in China 2025 Initiative to Drive Market

11.4.3 Japan

11.4.3.1 Shift Toward EV and Adoption of Motion Control Solutions in Assembly Lines to Drive Market

11.4.4 India

11.4.4.1 Samarth Udyog Bharat 4.0 Initiative and Improved Infrastructure to Drive Market

11.4.5 South Korea

11.4.5.1 Increased Adoption of Hybrid Electric Vehicles to Drive Market

11.4.6 Rest of Asia-Pacific

11.5 Rest of the World

11.5.1 Rest of the World: Recession Impact Analysis

Table 105 Rest of the World: Motion Control Market, by Region, 2020-2023 (USD Million)

Table 106 Rest of the World: Motion Control Market, by Region, 2024-2029 (USD Million)

Table 107 Rest of the World: Motion Control Market, by Industry, 2020-2023 (USD Million)

Table 108 Rest of the World: Motion Control Market, by Industry, 2024-2029 (USD Million)

11.5.2 South America

11.5.2.1 Growing Mining Sector and Rising Demand for AI and IIoT-based Solutions and Software to Drive Market

11.5.3 GCC

11.5.3.1 Expansion of Oil & Gas and Automotive Sectors to Drive Market

11.5.4 Africa & Rest of Middle East

11.5.4.1 Assistance from International Monetary Fund to Drive Market

12 Competitive Landscape

12.1 Overview

12.2 Strategies Adopted by Key Players, 2020-2023

Table 109 Strategies Adopted by Key Players, 2020-2023

12.3 Revenue Analysis, 2018-2022

Figure 48 Revenue Analysis of Key Players, 2018-2022

12.4 Market Share Analysis, 2023

Table 110 Motion Control Market: Degree of Competition

Figure 49 Market Share Analysis, 2023

12.5 Company Evaluation Matrix, 2023

12.5.1 Stars

12.5.2 Emerging Leaders

12.5.3 Pervasive Players

12.5.4 Participants

Figure 50 Company Evaluation Matrix, 2023

12.5.5 Company Footprint

Table 111 Key Companies: Company Footprint

Table 112 Key Companies: Offering Footprint

Table 113 Key Companies: Industry Footprint

Table 114 Key Companies: Region Footprint

12.6 Start-Up/SME Evaluation Matrix, 2023

12.6.1 Progressive Companies

12.6.2 Responsive Companies

12.6.3 Dynamic Companies

12.6.4 Starting Blocks

Figure 51 Start-Up/SME Evaluation Matrix, 2023

12.6.5 Competitive Benchmarking

Table 115 Key Start-Ups/SMEs

Table 116 Start-Ups/SMEs: Offering Footprint

Table 117 Start-Ups/SMEs: Industry Footprint

Table 118 Start-Ups/SMEs: Region Footprint

12.7 Competitive Scenario

Table 119 Product Launches, 2020-2023

Table 120 Deals, 2020-2023

Table 121 Others, 2020-2023

13 Company Profiles

(Business Overview, Products Offered, Recent Developments, and Analyst's View (Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

*Details on Business Overview, Products Offered, Recent Developments, and Analyst's View (Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) Might Not be Captured in Case of Unlisted Companies

13.1 Key Players

13.1.1 ABB

Table 122 ABB: Company Overview

Figure 52 ABB: Company Snapshot

Table 123 ABB: Products Offered

Table 124 ABB: Product Launches

Table 125 ABB: Others

13.1.2 Fanuc Corporation

Table 126 Fanuc Corporation: Company Overview

Figure 53 Fanuc Corporation: Company Snapshot

Table 127 Fanuc Corporation: Products Offered

13.1.3 Mitsubishi Electric Corporation

Table 128 Mitsubishi Electric Corporation: Company Overview

Figure 54 Mitsubishi Electric Corporation: Company Snapshot

Table 129 Mitsubishi Electric Corporation: Products Offered

Table 130 Mitsubishi Electric Corporation: Product Launches

Table 131 Mitsubishi Electric Corporation: Deals

Table 132 Mitsubishi Electric Corporation: Others

13.1.4 Siemens

Table 133 Siemens: Company Overview

Figure 55 Siemens: Company Snapshot

Table 134 Siemens: Products Offered

Table 135 Siemens: Product Launches

Table 136 Siemens: Deals

13.1.5 Yaskawa Electric Corporation

Table 137 Yaskawa Electric Corporation: Company Overview

Figure 56 Yaskawa Electric Corporation: Company Snapshot

Table 138 Yaskawa Electric Corporation: Products Offered

Table 139 Yaskawa Electric Corporation: Product Launches

Table 140 Yaskawa Electric Corporation: Others

13.1.6 Regal Rexnord Corporation

Table 141 Regal Rexnord Corporation: Company Overview

Figure 57 Regal Rexnord Corporation: Company Snapshot

Table 142 Regal Rexnord Corporation: Products Offered

Table 143 Regal Rexnord: Product Launches

Table 144 Regal Rexnord: Deals

13.1.7 Robert Bosch GmbH

Table 145 Robert Bosch GmbH: Company Overview

Figure 58 Robert Bosch GmbH: Company Snapshot

Table 146 Robert Bosch GmbH: Products Offered

13.1.8 Parker Hannifin Corp

Table 147 Parker Hannifin Corp: Company Overview

Figure 59 Parker Hannifin Corp: Company Snapshot

Table 148 Parker Hannifin Corp: Products Offered

Table 149 Parker Hannifin Corp: Product Launches

13.1.9 Rockwell Automation

Table 150 Rockwell Automation: Company Overview

Figure 60 Rockwell Automation: Company Snapshot

Table 151 Rockwell Automation: Products Offered

Table 152 Rockwell Automation: Product Launches

Table 153 Rockwell Automation: Deals

13.1.10 Novanta Inc.

Table 154 Novanta Inc.: Company Overview

Figure 61 Novanta Inc.: Company Snapshot

Table 155 Novanta Inc.: Products Offered

Table 156 Novanta Inc.: Deals

13.2 Other Players

13.2.1 Dover Motion

13.2.2 Omron Corporation

13.2.3 Allied Motion, Inc.

13.2.4 Ametek, Inc.

13.2.5 Adtech (Shenzhen) Technology Co. Ltd.

13.2.6 Powertec

13.2.7 Delta Electronics, Inc.

13.2.8 Baumüller

13.2.9 Moons’

13.2.10 Elmo Motion Control Ltd.

13.2.11 Absolute Machine Tools

13.2.12 Iq Motion Control

13.2.13 Apptronik

13.2.14 Galil

13.2.15 Analog Devices, Inc.

*Details on Business Overview, Products Offered, Recent Developments, and Analyst's View (Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) Might Not be Captured in Case of Unlisted Companies

14 Adjacent Market

14.1 Encoder Market

14.2 Introduction

Figure 62 Encoder Market, by Application, 2023-2028 (USD Million)

Table 157 Encoder Market, by Application, 2019-2022 (USD Million)

Table 158 Encoder Market, by Application, 2023-2028 (USD Million)

14.3 Industrial

14.3.1 Increasing Use of Encoders in Robotics and Factory Automation to Drive Market

Table 159 Industrial: Encoder Market, by Type, 2019-2022 (USD Million)

Table 160 Industrial: Encoder Market, by Type, 2023-2028 (USD Million)

Table 161 Industrial: Encoder Market, by Region, 2019-2022 (USD Million)

Table 162 Industrial: Encoder Market, by Region, 2023-2028 (USD Million)

14.4 Healthcare

14.4.1 Adoption of Surgical Robots in Medical Applications to Drive Market

Table 163 Healthcare: Encoder Market, by Type, 2019-2022 (USD Million)

Table 164 Healthcare: Encoder Market, by Type, 2023-2028 (USD Million)

Table 165 Healthcare: Encoder Market, by Region, 2019-2022(USD Million)

Table 166 Healthcare: Encoder Market, by Region, 2023-2028 (USD Million)

14.5 Consumer Electronics

14.5.1 Proliferation of Linear Motor Encoders in Electrical Appliances to Drive Market

Table 167 Consumer Electronics: Encoder Market, by Type, 2019-2022 (USD Million)

Table 168 Consumer Electronics: Encoder Market, by Type, 2023-2028 (USD Million)

Table 169 Consumer Electronics: Encoder Market, by Region, 2019-2022 (USD Million)

Table 170 Consumer Electronics: Encoder Market, by Region, 2023-2028 (USD Million)

14.6 Automotive

14.6.1 Trend of Automation in Automobiles to Drive Market

Table 171 Automotive: Encoder Market, by Type, 2019-2022 (USD Million)

Table 172 Automotive: Encoder Market, by Type, 2023-2028 (USD Million)

Table 173 Automotive: Encoder Market, by Region, 2019-2022 (USD Million)

Table 174 Automotive: Encoder Market, by Region, 2023-2028 (USD Million)

14.7 Power

14.7.1 Complexities in Solar and Wind Energy Applications to Drive Market

Table 175 Power: Encoder Market, by Type, 2019-2022 (USD Million)

Table 176 Power: Encoder Market, by Type, 2023-2028 (USD Million)

Table 177 Power: Encoder Market, by Region, 2019-2022 (USD Million)

Table 178 Power: Encoder Market, by Region, 2023-2028 (USD Million)

14.8 Food & Beverage

14.8.1 Integration of Io-Link Technology into Encoders to Drive Market

Table 179 Food & Beverage: Encoder Market, by Type, 2019-2022 (USD Million)

Table 180 Food & Beverage: Encoder Market, by Type, 2023-2028 (USD Million)

Table 181 Food & Beverage: Encoder Market, by Region, 2019-2022 (USD Million)

Table 182 Food & Beverage: Encoder Market, by Region, 2023-2028 (USD Million)

14.9 Aerospace

14.9.1 Need for Precision Control Technology in Airborne Systems to Drive Market

Table 183 Aerospace: Encoder Market, by Type, 2019-2022 (USD Million)

Table 184 Aerospace: Encoder Market, by Type, 2023-2028 (USD Million)

Table 185 Aerospace: Encoder Market, by Region, 2019-2022 (USD Million)

Table 186 Aerospace: Encoder Market, by Region, 2023-2028 (USD Million)

14.10 Printing

14.10.1 High Demand for Rotary Encoders in Printing Applications and Office Equipment to Drive Market

Table 187 Printing: Encoder Market, by Type, 2019-2022 (USD Million)

Table 188 Printing: Encoder Market, by Type, 2023-2028 (USD Million)

Table 189 Printing: Encoder Market, by Region, 2019-2022 (USD Million)

Table 190 Printing: Encoder Market, by Region, 2023-2028 (USD Million)

14.11 Textile

14.11.1 Integration of Encoders in Weaving & Knitting Processes to Drive Market

Table 191 Textile: Encoder Market, by Type, 2019-2022 (USD Million)

Table 192 Textile: Encoder Market, by Type, 2023-2028 (USD Million)

Table 193 Textile: Encoder Market, by Region, 2019-2022 (USD Million)

Table 194 Textile: Encoder Market, by Region, 2023-2028(USD Million)

14.12 Other Applications

Table 195 Other Applications: Encoder Market, by Type, 2019-2022 (USD Million)

Table 196 Other Applications: Encoder Market, by Type, 2023-2028 (USD Million)

Table 197 Other Applications: Encoder Market, by Region, 2019-2022 (USD Million)

Table 198 Other Applications: Encoder Market, by Region, 2023-2028 (USD Million)

15 Appendix

15.1 Insights from Industry Experts

15.2 Discussion Guide

15.3 Knowledgestore: The Subscription Portal

15.4 Customization Options