The future of the marine engine market is poised for significant change, driven by a confluence of environmental concerns, technological advancements, and a growing focus on sustainability. Stricter environmental regulations and a global push for cleaner shipping will lead to a continued decline in the use of Heavy Fuel Oil (HFO). Cleaner alternatives like Liquefied Natural Gas (LNG) are expected to gain significant market share, particularly for new vessels. Biofuels and synthetic fuels derived from renewable sources are also emerging as promising options, although infrastructure development and cost competitiveness will be crucial factors.

Manufacturers will focus on developing engines with improved fuel efficiency, lower emissions, and the capability to operate on multiple fuel types. Engines designed to seamlessly switch between traditional fuels like MGO and cleaner alternatives like LNG or biofuels will offer ship operators greater flexibility and adaptability to evolving regulations and fuel availability. Technologies that capture and utilize waste heat from engine operation for additional power generation or other onboard processes will improve overall energy efficiency. Integration of sensors, advanced controls, and remote monitoring systems will optimize engine performance, enable predictive maintenance, and improve operational efficiency.

The entire maritime industry, including engine manufacturers, shipbuilders, and fuel suppliers, will collaborate towards achieving sustainability goals. This could involve the development of carbon-neutral fuels, investment in shore-side power infrastructure for ports, and the creation of regulations that incentivize the adoption of cleaner technologies. The future of the marine engine market is bright with innovation. The industry is on a trajectory towards cleaner, more efficient, and sustainable operations. As technology advances, regulations evolve, and the focus on environmental responsibility intensifies, we can expect to see significant changes in the types of engines powering the vessels that traverse our oceans.

Oil tankers segment, by Vessel, to hold second-largest market share from 2024 to 2029.

Oil tankers are designed to transport vast quantities of crude oil and refined petroleum products. These behemoths, particularly Ultra Large Crude Carriers (ULCCs) and Very Large Crude Carriers (VLCCs), require immensely powerful engines to overcome drag and efficiently navigate long distances across oceans. Oil tankers undertake long journeys, often spanning weeks, to transport oil from production sites to refineries or storage facilities.This necessitates engines built for continuous operation and exceptional reliability. Unlike some other vessel types that might prioritize fuel efficiency over raw power, oil tankers prioritize the ability to efficiently propel massive loads over long distances. This translates to a significant demand for high-horsepower, two-stroke engines that remain the dominant choice for these vessels. In conclusion, the immense size, cargo capacity, long-distance operation, and reliance on high-power engines make oil tankers the primary driver of the marine engine market, likely holding the second-largest market share in this sector.

Auxiliary segment, by engine, to be the second-largest market from 2024 to 2029.

Auxiliary engines hold the second-largest market share in the marine engine market. Auxiliary engines come in a range of power outputs, catering to the specific needs of different onboard systems. From smaller engines powering lighting systems to larger ones driving powerful pumps or winches, the versatility in auxiliary engine power contributes to their widespread use. Auxiliary engines play a critical role in ensuring the overall reliability of a vessel. They often operate in a redundant configuration, meaning there might be multiple auxiliary engines on board. This redundancy ensures that a malfunction in one engine doesn't cripple vital onboard systems.Their reliable operation is essential for uninterrupted power supply and safe vessel operations. The increasing automation of onboard systems and the growing demand for amenities on passenger vessels necessitates a reliable source of power. This translates to a continued demand for auxiliary engines to support these evolving needs. Manufacturers are constantly developing auxiliary engines with improved fuel efficiency, lower emissions, and better noise reduction capabilities.

These advancements make auxiliary engines a more environmentally friendly and cost-effective solution for onboard power generation. The extensive application across various vessel types, diverse power requirements, focus on redundancy and reliability, advancements in technology, and the growing complexity of onboard systems all contribute to auxiliary engines holding the second-largest market share in the marine engine sector. They are the workhorses behind the scenes, ensuring the smooth and efficient operation of a vessel, even if they aren't directly responsible for propulsion.

Europe to be second-largest region in marine engines market.

Europe's position as the second-largest market share holder in the marine engine market can be attributed to a confluence of factors that make it a hub for shipbuilding, technological innovation, and stringent environmental regulations. Europe boasts a long and rich history in shipbuilding, with renowned shipyards at the forefront of technological innovation. These shipyards often collaborate with engine manufacturers to develop and integrate cutting-edge engines into their vessels. This focus on advanced technology positions Europe as a leader in the high-power engine segment, particularly for large container ships and cruise liners. Europe enforces some of the world's strictest environmental regulations for maritime emissions.This focus on clean air and water quality incentivizes the development and adoption of cleaner burning engines that comply with regulations in Emission Control Areas (ECAs), designated areas with stricter emission controls. European manufacturers are at the forefront of developing engines that utilize cleaner fuels like LNG and exploring alternative options like biofuels. European ship owners and maritime companies are increasingly prioritizing sustainability in their operations. This translates to a demand for cleaner and more efficient engines that meet not only current but also anticipated future environmental regulations.

Engine manufacturers in Europe are actively developing future-proof technologies like dual-fuel engines capable of operating on cleaner alternatives alongside traditional fuels. Europe has a vast and diverse maritime fleet encompassing large container ships, cruise liners, ferries, offshore service vessels, and specialized research vessels. This diversity necessitates a wide range of engine types and powers, contributing to the overall market share held by European manufacturers catering to these varied needs. Europe's strong shipbuilding tradition, focus on technological innovation, stringent environmental regulations, diverse maritime fleet, and robust after-sales infrastructure all contribute to its position as the second-largest market share holder in the marine engine market. However, competition from Asia and the high initial investment costs of cleaner technologies are challenges that European manufacturers need to navigate to maintain their leadership position.

Breakdown of Primaries:

In-depth interviews with key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, were conducted to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The primary interviews were distributed as follows:- By Company Type: Tier 1 - 30%, Tier 2 - 55%, and Tier 3 - 15%

- By Designation: C-Level - 30%, D-Level - 20%, and Others - 50%

- By Region: North America - 18%, Europe - 8%, Asia Pacific - 60%, South America - 4% and Middle East & Africa - 10%

The tiers of the companies are defined based on their total revenue as of 2021: Tier 1: More than USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: Less than USD 500 million.

The marine engines market is predominantly governed by well-established global leaders. Notable players in the marine engines market include Caterpillar (US), Wärtsilä (Finland), AB Volvo Penta (Sweden), Man Energy Solutions (Germany), Rolls-Royce Plc (UK), Mitsubishi Heavy Industries, Ltd. (Japan), HDHyundai Heavy Industries Co., Ltd. (South Korea), Cummins Inc. (US), Daihatsu Diesel Mfg. Co., Ltd. (Japan), Deutz AG (Germany), and several others.Research Coverage:

The report provides a comprehensive definition, description, and forecast of the marine engines market based on various parameters, including engine (Propulsion and Auxiliary), type (Four Stroke and Two Stroke), Power Range (Up to 1,000 hp, 1,001-5,000 hp, 5,001-10,000 hp, 10,001-20,000 hp, Above 20,000 hp), Fuel (Marine Diesel Oil, Others, Heavy Fuel Oil, and Marine Gas Oil), Vessel (Bulk Carrier, Oil Tankers, Offshore Support Vessels, General Cargo, Others, Container Ships, Tugs, and Product Tankers), and region (Asia Pacific, North America, Europe, Middle East and Africa, South America).The report also offers a thorough qualitative and quantitative analysis of the marine engines market, encompassing a comprehensive examination of the key market drivers, limitations, opportunities, and challenges. Additionally, it covers critical facets of the market, such as an assessment of the competitive landscape, an analysis of market dynamics, value-based market estimates, and future trends in the marine engines market. The report provides investment and funding information of key players in the marine engines market.

Key Benefits of Buying the Report

The report is thoughtfully designed to benefit both established industry leaders and newcomers in the marine engines market. It provides reliable revenue forecasts for the entire market as well as its individual sub-segments. This data is a valuable resource for stakeholders, enabling them to gain a comprehensive understanding of the competitive landscape and formulate effective market strategies for their businesses. Furthermore, the report serves as a channel for stakeholders to grasp the current state of the market, providing essential insights into market drivers, limitations, challenges, and growth opportunities. By incorporating these insights, stakeholders can make well-informed decisions and stay informed about the constantly evolving dynamics of the marine engines industry.- Analysis of key drivers: (Growth in international marine freight transport, Aging fleet, Adoption of smart engines for performance and safety), restraints (Stringent environmental regulations, Soaring freight rates and fees, Dependce on heavy liquid fluids), opportunities (Rise of e-commerce and online trade, Rising demand for duel fuel and hybrid engines), and challenges (Structural factors increasing maritime transport costs, Volatile oil & gas prices) influencing the growth of the marine engines market.

- Product Development/ Innovation: The marine engines market is in a constant state of evolution, with a primary focus on product development and innovation. Leading industry players like Caterpillar, Wärtsilä, Man Energy Solutions, and AB Volvo Penta are at the forefront of advancing their product offerings to address shifting demands and environmental considerations. There is a notable shift towards enhancing the intelligence of recloser.

- Market Development: The marine engine market is on an exciting trajectory, driven by a confluence of environmental concerns, technological advancements, and a growing emphasis on sustainability. Stricter environmental regulations and a global push for cleaner shipping are leading to a decline in the use of Heavy Fuel Oil (HFO). Liquefied Natural Gas (LNG) is emerging as a significant contender, particularly for new vessels. Biofuels and synthetic fuels derived from renewable sources are also gaining traction, although infrastructure development and cost competitiveness will be crucial factors in their wider adoption. Manufacturers are constantly innovating to develop engines with improved fuel efficiency, lower emissions, and the capability to operate on multiple fuel types. Dual-Fuel and Multi-Fuel Engines can seamlessly switch between traditional fuels like MGO and cleaner alternatives like LNG or biofuels, offering ship owners greater flexibility and adaptability to evolving regulations and fuel availability. Waste Heat Recovery Systems Technologies capture waste heat from engine operation for additional power generation or other onboard processes will improve overall energy efficiency. While internal combustion engines will likely remain dominant in the near future, alternative propulsion technologies like electric and hybrid systems are gaining traction, particularly for smaller vessels and harbor operations. Advancements in battery technology and efficient charging infrastructure will be crucial for wider adoption of electric propulsion in larger vessels. The entire maritime industry, including engine manufacturers, shipbuilders, fuel suppliers, and regulatory bodies, are increasingly collaborating towards achieving sustainability goals. This could involve the development of carbon-neutral fuels, investment in shore-side power infrastructure for ports, and the creation of regulations that incentivize the adoption of cleaner technologies. The development of the marine engine market is exciting and dynamic. As technology advances, regulations evolve, and the focus on environmental responsibility intensifies, we can expect to see a continued shift towards cleaner, more efficient, and sustainable marine propulsion solutions.

- Market Diversification: The marine engine market is undergoing significant diversification driven by a confluence of factors, including stricter environmental regulations, technological advancements, and the pursuit of sustainable practices. This diversification manifests in several key areas. Traditionally, the marine engine market relied heavily on Heavy Fuel Oil (HFO) due to its cost-effectiveness. However, stricter regulations aimed at reducing air and water pollution are driving a shift towards cleaner burning fuels. LNG is emerging as a significant alternative, particularly for new vessels. It offers lower emissions of sulfur oxides (SOx) and nitrogen oxides (NOx) compared to HFO. However, infrastructure development for LNG bunkering facilities is crucial for wider adoption. Derived from renewable sources like biomass or waste products, these fuels offer a carbon-neutral alternative. While still in their early stages of development, advancements in production methods and cost reduction could make them more viable options in the future. New engine technologies aim to reduce fuel consumption and operating costs while maintaining power output. This can involve advancements in combustion processes, waste heat recovery systems, and engine optimization software. Cleaner burning technologies like exhaust gas aftertreatment systems and selective catalytic reduction (SCR) are being developed to comply with stricter emission regulations. The marine engine market is no longer a one-size-fits-all solution. Market diversification is fostering innovation across fuel options, engine technologies, and after-sales services. This caters to the diverse needs of different vessel types and operational requirements. As environmental concerns intensify and the focus on sustainability grows, we can expect further diversification in the marine engine market with the development of even cleaner, more efficient, and future-proof propulsion solutions for the global maritime industry.

- Competitive Assessment: A comprehensive evaluation has been conducted to scrutinize the market presence, growth strategies, and service offerings of key players in the marine engines market. These prominent companies include Caterpillar (US), Wärtsilä (Finland), Man Energy Solutions (Germany), AB Volvo Penta (Sweden), Rolls-Royce Plc (UK), HDHyundai Heavy Industries Co., Ltd. (South Korea), Mitsubishi Heavy Industries, Ltd. (Japan), Cummins Inc. (US), Daihatsu Diesel Mfg. Co., Ltd. (Japan), Deutz AG (Germany), and others. This analysis provides in-depth insights into the competitive positions of these major players, their approaches to driving market growth, and the range of services they offer within the marine engines segment.

Table of Contents

Companies Mentioned

- Caterpillar

- Wärtsilä

- Man Energy Solutions

- Ab Volvo Penta

- Rolls-Royce PLC

- Hd Hyundai Heavy Industries Co. Ltd.

- Mitsubishi Heavy Industries, Ltd.

- Cummins Inc.

- Daihatsu Diesel Mfg. Co. Ltd.

- Deutz AG

- Wingd

- Fairbanks Morse Defense

- Wabtec Corporation

- Yanmar Marine International

- Isotta Fraschini Motori S.P.A.

- Cnpc Jichai Power Company Limited

- Bergen Engines

- Mahindra Powerol

- Ihi Power Systems Co. Ltd.

- Weichai Holding Group Co. Ltd.

- Agco Power

- Perkins Engines Company Limited

- Kawasaki Heavy Industries, Ltd.

- Scania

- Cooper Corp.

Table Information

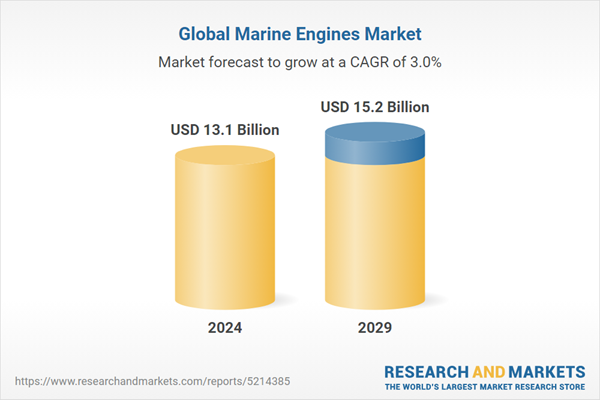

| Report Attribute | Details |

|---|---|

| No. of Pages | 323 |

| Published | April 2024 |

| Forecast Period | 2024 - 2029 |

| Estimated Market Value ( USD | $ 13.1 Billion |

| Forecasted Market Value ( USD | $ 15.2 Billion |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |