Major Vendors in the Market Include IBM, Hewlett Packard Enterprise, Accenture, Cisco and Cognizant

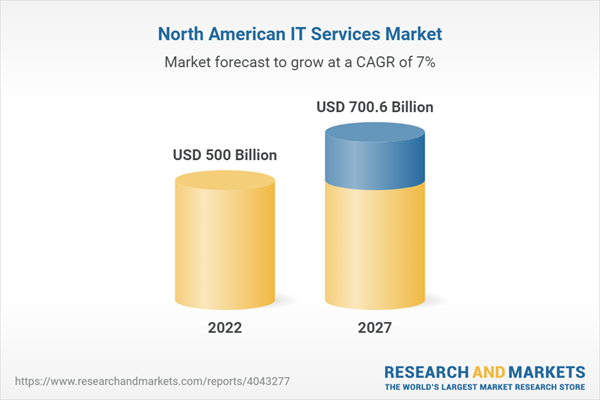

The North America IT services market size is expected to grow from USD 500.0 billion in 2022 to USD 700.6 billion by 2027 at a Compound Annual Growth Rate (CAGR) of 7.0% during the forecast period. IT services are the application of technical and business expertise to help firms create, manage, and access information and business processes. The North America IT services market is primarily driven by the rising demand for cloud-based IT services across industries. It gives all organizational units remote access to data and applications storage and retrieval. Additionally, the market benefits from the Internet of Things (IoT) and Artificial Intelligence (AI) integration with connected devices and fast digitization. Through the use of business analytics and operational optimization, IT services enable precise forecasting.

As per managed services, managed data center and IT infrastructure to hold the largest market size during the forecast period.

The managed services segment is sub-segmented into managed security service, managed network service, managed data center and IT infrastructure, managed communication and collaboration, managed mobility service, and managed information service. As per managed services, managed data center and IT infrastructure market size is expected to grow from USD 43.1 billion in 2022 to USD 62.0 billion by 2027 at a Compound Annual Growth Rate (CAGR) of 7.6% during the forecast period. To fully embrace digitalization, a company's IT infrastructure must be matched with business needs. Greater security and compliance, agile infrastructure, increased staff productivity, and improved customer experiences are all benefits of IT infrastructure. The servicing and maintenance of all hardware and network equipment, such as installation, upgrading, and patching of Operating Systems (OS) and other software, storage and backups, and fault tolerance, are all typically the responsibility of service providers and are based on the service level agreement. Further, a managed data center is a particular kind of data center model that is set up, run, and supervised by a third-party data center service provider. It offers capabilities and features similar to those of a typical data center but via a Managed Service Platform (MSP).

As per infrastructure integration, the network segment is to hold the largest market size during the forecast period.

The infrastructure integration segment is further sub-segmented into the data center, network, security, mobility, and others. As per infrastructure integration, the network segment holds the largest market size and is expected to grow from USD 40.6 billion in 2022 to USD 48.9 billion by 2027 at a Compound Annual Growth Rate (CAGR) of 3.8%% during the forecast period. Network service providers offer various services to monitor, maintain, and protect the network infrastructure of organizations while reducing network operating costs. New network business tools are released by vendors to link users in various locations and improve communication efficiency. To operate tasks, such as data transfers and switches, network technology requires network management software. Infrastructure is still not complete without network administration, which ensures that the servers, cabling, and switches are coordinated and achieve the required outcomes. For every industry, reliable and secure network infrastructure has become essential. To guarantee zero network outages and streamline network operations, organizations of all sizes, including SMEs and large corporations, invest extensively in network performance and monitoring solutions and services.

As per application integration, application testing to grow at the highest CAGR during the forecast period.

The application integration segment is further sub-segmented into application development, application testing, and application lifecycle management. As per application integration, application testing is

expected to grow at the highest CAGR of 12.7% during the forecast period. Applications are checked for accuracy, usability, and consistency during the application testing process, which helps find flaws throughout the entire program. Applications need to be tested for improved functionality after development and before implementation. It involves a set of programmed manual, automated, or both techniques to reveal software application flaws. It covers every stage of a software program's functional testing. Such testing helps the team assess and enhance the program's quality while also reducing the organization's costs connected with software development and testing. Application testing can take many various forms, including unit testing, integration testing, performance testing, and acceptability testing.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the North America IT services market.

- By Company: Tier I: 20%, Tier II: 34%, and Tier III: 46%

- By Designation: C-Level Executives: 35%, Directors: 25%, and Others: 40%

- By Region: Asia Pacific: 22%, Europe: 11%, North America: 62%, Rest of World: 5%

The report includes a study of key players offering North American IT services. It profiles major vendors in the North America IT services market. Some of the major North America IT services market vendors are IBM (US), Hewlett Packard Enterprise (US), Accenture (Ireland), Cisco (US), Wipro (India), HCL Technologies (India), Cognizant (US), Infosys (US), Rackspace (US), TCS (India), Fujitsu (Japan), Capgemini (France), Ericsson (Sweden), Huawei Technologies Co. Ltd. (US), Nokia Networks (Finland), GTT Communications (US), SAP (Germany), DXC Technology (US), NTT Data (Japan), and NEC Corporation (US).

Research Coverage

The market study covers the North America IT services market across segments. It aims at estimating the market size and the growth potential of this market across different segments, such as service type, deployment mode, organization size, business function, vertical, and country. It includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key benefits of buying report

The report would provide the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall North America IT services market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the market's pulse and provides them with information on key market drivers, restraints, challenges, and opportunities.

Table of Contents

1 Introduction

1.1 Objectives of Study

1.2 Market Definition

1.2.1 Inclusions & Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Years Considered

1.4 Currency Considered

Table 1 USD Exchange Rate, 2019-2021

1.5 Stakeholders

1.6 Summary of Changes

2 Research Methodology

2.1 Research Data

Figure 1 North America It Services Market: Research Design

2.1.1 Secondary Data

2.1.1.1 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Breakdown of Primary Interviews

Figure 2 Breakdown of Primary Interviews: by Company Type, Designation, and Region

2.1.2.2 Key Data from Primary Sources

Table 2 Primary Respondents: Market

2.1.2.3 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

2.2.2 Top-Down Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

2.3 Market Breakdown and Data Triangulation

Figure 5 Data Triangulation Methodology

2.4 Market Forecast

Table 3 Factor Analysis

2.5 Research Assumptions

2.6 Limitations & Risk Assessment

3 Executive Summary

Figure 6 North America It Services Market Snapshot, 2020-2027

Figure 7 Top Segments in Market

Figure 8 Professional Services Segment to Lead Market by 2027

Figure 9 System Integration Services Segment to Lead Market by 2027

Figure 10 Infrastructure Integration Services Segment to Dominate Market by 2027

Figure 11 Application Lifecycle Management Segment to Lead Market by 2027

Figure 12 Network Segment to be Largest Market by 2027

Figure 13 Managed Data Center and It Infrastructure Service Segment to be Largest Market by 2027

Figure 14 Operation and Support Segment to Lead Market by 2027

Figure 15 Cloud Segment to be Larger Market by 2027

Figure 16 Smes Segment to be Larger Market by 2027

Figure 17 North America It Services Market, by Vertical, 2022-2027 (USD Billion)

Figure 18 Us to Account for Larger Market Share by 2027

4 Premium Insights

4.1 Attractive Growth Opportunities for Players in North America It Services Market

Figure 19 Drastic Demographic Change and Technological Evolution to Drive Market Growth

4.2 Market, by Service Type (2022 Vs. 2027)

Figure 20 Professional Services Segment to Account for Largest Market Share by 2027

4.3 Market, by Deployment Mode (2022 Vs. 2027)

Figure 21 Cloud Segment to Account for Largest Market Share by 2027

4.4 Market, by Organization Size (2022 Vs. 2027)

Figure 22 Large Enterprises Segment to Account for Larger Market Share by 2027

4.5 Market, by Business Function (2022 Vs. 2027)

Figure 23 Operations and Support Business Segment to Account for Largest Market Share by 2027

4.6 Market, by Vertical (2022 Vs. 2027)

Figure 24 Government and Defense Segment to Account for Largest Market Share by 2027

4.7 Market: Investment Scenario

Figure 25 Us to Emerge as Best Market for Investments in Next Five Years

5 Market Overview and Industry Trends

5.1 Introduction

5.2 Market Evolution

Figure 26 Evolution of North America It Services Market

5.3 Market Dynamics

Figure 27 Market: Drivers, Restraints, Opportunities, and Challenges

5.3.1 Drivers

5.3.1.1 Increased Demand for Cloud Services

Figure 28 Benefits of Cloud Service

5.3.1.2 Rising Digitization Among Enterprises

5.3.1.3 Rising Complications in Connectivity

5.3.1.4 Growing Need for Risk Mitigation

5.3.2 Restraints

5.3.2.1 Privacy and Security Concerns

Figure 29 Ransomware and Phishing Incidents on Various Channels

5.3.2.2 Increasing Number of Regulations and Compliance

5.3.3 Opportunities

5.3.3.1 Increasing Demand for Managed Services Among Smes

5.3.3.2 Exponential Growth in Ip and Cloud Traffic

5.3.3.3 Growing Demand for System Integrators

5.3.3.4 Growing Scope for Exploring Next-Generation It Technology in Bfsi and Healthcare Sectors

5.3.4 Challenges

5.3.4.1 Lack of Skilled Workforce

5.3.4.2 Increase in Vendor Lock-In Risks

5.3.4.3 Complexities Involved in Integrating It Infrastructure

5.4 Case Study Analysis

5.4.1 Ericsson Helped Newport Utilities Bring High-Speed Broadband to Rural Communities

5.4.2 Dxc Technology Helped Inail Fight Cyber Threats with Automation and Ml

5.4.3 Lumen Technologies Provided Refinitiv's Clients with Suite of Fully Managed Trading and Data Propositions

5.4.4 Citrix Enabled Autodesk Increase Digitization

5.4.5 Rackspace Technology Provided Zachry Corporation with Expertise and Support

5.5 Patent Analysis

Figure 30 Number of Patents Published, 2011-2021

Figure 31 Top Ten Patent Applicants (Global), 2021

Table 4 Top Patent Owners

5.6 Supply Chain Analysis

Figure 32 Supply Chain Analysis

5.7 Ecosystem Analysis

Figure 33 Ecosystem Analysis

5.8 Technology Analysis

5.8.1 Artificial Intelligence and Machine Learning

5.8.2 Big Data and Analytics

5.8.3 Cybersecurity

5.8.4 Cloud Computing

5.9 Regulatory Landscape

5.9.1 Regulatory Bodies, Government Agencies, and Other Organizations in North America

Table 5 List of Regulatory Bodies, Government Agencies, and Other Organizations

5.9.2 Regulatory Implications and Industry Standards

5.9.2.1 General Data Protection Regulation (Eu) (2016/679)

5.9.2.2 Sec Rule 17A-4

5.9.2.3 Iso/Iec 27001

5.9.2.4 System and Organization Controls 2 Type Ii Compliance

5.9.2.5 Financial Industry Regulatory Authority

5.9.2.6 Freedom of Information Act

5.9.2.7 Health Insurance Portability and Accountability Act

5.10 Porter's Five Forces Analysis

Figure 34 Porter's Five Forces Analysis

Table 6 Porter's Five Forces Analysis

5.10.1 Threat from New Entrants

5.10.2 Threat from Substitutes

5.10.3 Bargaining Power of Suppliers

5.10.4 Bargaining Power of Buyers

5.10.5 Intensity of Competitive Rivalry

5.11 Key Conferences & Events, 2022-2023

Table 7 Key Conferences & Events, 2022-2023

5.12 Pricing Analysis

5.12.1 North America It Services Market: Price Trends

Table 8 Market: Price Levels

5.12.2 Average Selling Price Trends

Table 9 Market: Average Selling Price Levels (USD)

5.13 Trends/Disruptions Impacting Buyers

Figure 35 Trends/Disruptions Impacting Buyers

5.14 Key Stakeholders & Buying Criteria

5.14.1 Key Stakeholders in Buying Process

Figure 36 Influence of Stakeholders on Buying Process for End-users

Table 10 Influence of Stakeholders on Buying Process for End-users

5.14.2 Buying Criteria

Figure 37 Key Buying Criteria for End-users

Table 11 Key Buying Criteria for End-users

6 North America It Services Market, by Service Type

6.1 Introduction

Figure 38 Managed Services Segment to Grow at Highest CAGR by 2027

6.1.1 Service Types: Market Drivers

Table 12 Market, by Service Type, 2017-2021 (USD Billion)

Table 13 Market, by Service Type, 2022-2027 (USD Billion)

6.2 Professional Services

Figure 39 Consulting Services Segment to Grow at Highest CAGR by 2027

Table 14 Market, by Professional Service, 2017-2021 (USD Billion)

Table 15 Market, by Professional Service, 2022-2027 (USD Billion)

6.2.1 System Integration Services

Figure 40 Application Integration Services Segment to Grow at Higher CAGR by 2027

Table 16 Market, by System Integration Service, 2017-2021 (USD Billion)

Table 17 Market, by System Integration Service, 2022-2027 (USD Billion)

6.2.1.1 Application Integration Services

6.2.1.1.1 Rising Need to Bridge Gap Between Existing On-Premises Systems and Cloud-Based Enterprise Applications

Figure 41 Application Testing Segment to Grow at Highest CAGR by 2027

Table 18 North America It Services Market Market, by Application Integration Service, 2017-2021 (USD Billion)

Table 19 Market, by Application Integration Service, 2022-2027 (USD Billion)

6.2.1.1.2 Application Development

6.2.1.1.3 Application Testing

6.2.1.1.4 Application Lifecycle Management

6.2.1.2 Infrastructure Integration Services

6.2.1.2.1 Growing Demand for It Platforms

Figure 42 Mobility Segment to Grow at Highest CAGR by 2027

Table 20 Market, by Infrastructure Integration Service, 2017-2021 (USD Billion)

Table 21 Market, by Infrastructure Integration Service, 2022-2027 (USD Billion)

6.2.1.2.2 Data Center

6.2.1.2.3 Mobility

6.2.1.2.4 Network

6.2.1.2.5 Security

6.2.1.2.6 Other Infrastructure Integration Services

6.2.2 Training and Education Services

6.2.2.1 Rising Need to Ensure Hassle-Free Implementation of It Services

6.2.3 Consulting Services

6.2.3.1 Increasing Need to Decrease Complexity

6.3 Managed Services

Figure 43 Managed Mobility Service to Grow at Highest CAGR by 2027

6.3.1 Managed Services: Market Drivers

Table 22 Market, by Managed Service, 2017-2021 (USD Billion)

Table 23 Market, by Managed Service, 2022-2027 (USD Billion)

6.3.2 Managed Security Service

6.3.2.1 Rising Need to Protect Critical Assets from Cyberattacks

6.3.3 Managed Network Service

6.3.3.1 Increasing Demand for Managed Network Services Among Smes

6.3.4 Managed Data Center and It Infrastructure Service

6.3.4.1 Rising Demand for Better Storage and Processing Capabilities

6.3.5 Managed Communication and Collaboration Service

6.3.5.1 Growing Need for Transparent, Co-Managed Services for Cloud Collaboration

6.3.6 Managed Mobility Service

6.3.6.1 Rising Need to Assist It Decision-Makers in Selecting Hardware and Applications

6.3.7 Managed Information Service

6.3.7.1 Increasing Complexity in Business Processes

6.4 Telecom Services

6.4.1 Rising Demand for Accessibility and Reliability

7 North America It Services Market, by Deployment Mode

7.1 Introduction

Figure 44 Cloud Segment to Account for Larger Market Size by 2027

7.1.1 Deployment Modes: Market Drivers

Table 24 Market, by Deployment Mode, 2017-2021 (USD Billion)

Table 25 Market, by Deployment Mode, 2022-2027 (USD Billion)

7.2 On-Premises

7.2.1 On-Premises Deployment Mode Enables Organizations Maintain Data Security

7.3 Cloud

7.3.1 Increasing Reliance of Organizations on It Assets to Enhance Productivity

8 North America It Services Market, by Organization Size

8.1 Introduction

Figure 45 Smes Segment to Grow at Higher CAGR by 2027

8.1.1 Organization Sizes: Market Drivers

Table 26 Market, by Organization Size, 2017-2021 (USD Billion)

Table 27 Market, by Organization Size, 2022-2027 (USD Billion)

8.2 Small and Medium-Sized Enterprises

8.2.1 Increasing It Spending to Manage Business Operations

8.3 Large Enterprises

8.3.1 Growing Need to Digitalize and Upgrade Business Processes

9 North America It Services Market, by Business Function

9.1 Introduction

Figure 46 Sales and Marketing Segment to Grow at Highest CAGR by 2027

9.1.1 Business Functions: Market Drivers

Table 28 Market, by Business Function, 2017-2021 (USD Billion)

Table 29 Market, by Business Function, 2022-2027 (USD Billion)

9.2 Human Resource

9.2.1 Rising Need to Improve Employee Engagement and Optimize Hr Processes

9.3 Finance and Accounting

9.3.1 Efficient It Services Help Remove Redundant Tasks

9.4 Sales and Marketing

9.4.1 Growing Demand for Appropriate Tools to Achieve Outcome

9.5 Supply Chain Management

9.5.1 It Services Enable Timely Procurement

9.6 Operations and Support

9.6.1 Rising Need to Improve Productivity and Quality

9.7 Manufacturing

9.7.1 Growing Demand to Analyze, Access, and Share Large Amount of Information

9.8 Other Business Functions

10 North America It Services Market, by Vertical

10.1 Introduction

Figure 47 Healthcare Segment to Grow at Highest CAGR During Forecast Period

10.1.1 Verticals: Market Drivers

Table 30 Market, by Vertical, 2017-2021 (USD Billion)

Table 31 Market, by Vertical, 2022-2027 (USD Billion)

10.2 Government and Defense

10.2.1 Rising Demand for Transformation of Government Infrastructure

10.3 Banking, Financial Services, and Insurance (Bfsi)

10.3.1 Rising Need for Digital Transformation and Improved Customer Experience

10.4 Healthcare

10.4.1 Growing Demand for Tools to Support User Security

10.5 Media and Entertainment

10.5.1 Technological Innovations to Facilitate Personalized Services

10.6 Consumer Goods and Retail

10.6.1 Rising Use of Technology to Address Market Volatility

10.7 It and Telecom

10.7.1 Increased Use of Smartphones to Drive Mobility Solutions

10.8 Other Verticals

11 North America It Services Market, by Country

11.1 Introduction

11.1.1 Market Drivers

11.1.2 North America: Recession Impact

Figure 48 North America: Market Snapshot

Table 32 Market, by Country, 2017-2021 (USD Billion)

Table 33 Market, by Country, 2022-2027 (USD Billion)

11.1.3 US

11.1.3.1 Increasing Number of It Cloud Service Providers

Table 34 US: North America It Services Market, by Service Type, 2017-2021 (USD Billion)

Table 35 US: Market, by Service Type, 2022-2027 (USD Billion)

Table 36 US: Market, by Professional Service, 2017-2021 (USD Billion)

Table 37 US: Market, by Professional Service, 2022-2027 (USD Billion)

Table 38 US: Market, by System Integration Service, 2017-2021 (USD Billion)

Table 39 US: Market, by System Integration Service, 2022-2027 (USD Billion)

Table 40 US: Market, by Application Integration Service, 2017-2021 (USD Billion)

Table 41 US: Market, by Application Integration Service, 2022-2027 (USD Billion)

Table 42 US: Market, by Infrastructure Integration Service, 2017-2021 (USD Billion)

Table 43 US: Market, by Infrastructure Integration Service, 2022-2027 (USD Billion)

Table 44 US: North America It Services Market, by Managed Service, 2017-2021 (USD Billion)

Table 45 US: Market, by Managed Service, 2022-2027 (USD Billion)

Table 46 US: Market, by Deployment Mode, 2017-2021 (USD Billion)

Table 47 US: Market, by Deployment Mode, 2022-2027 (USD Billion)

Table 48 US: Market, by Organization Size, 2017-2021 (USD Billion)

Table 49 US: Market, by Organization Size, 2022-2027 (USD Billion)

Table 50 US: Market, by Business Function, 2017-2021 (USD Billion)

Table 51 US: Market, by Business Function, 2022-2027 (USD Billion)

Table 52 US: Market, by Vertical, 2017-2021 (USD Billion)

Table 53 US: Market, by Vertical, 2022-2027 (USD Billion)

11.1.4 Canada

11.1.4.1 Rising Adoption of Cloud by It Service Vendors

Table 54 Canada: North America It Services Market, by Service Type, 2017-2021 (USD Billion)

Table 55 Canada: Market, by Service Type, 2022-2027 (USD Billion)

Table 56 Canada: Market, by Professional Service, 2017-2021 (USD Billion)

Table 57 Canada: Market, by Professional Service, 2022-2027 (USD Billion)

Table 58 Canada: Market, by System Integration Service, 2017-2021 (USD Billion)

Table 59 Canada: Market, by System Integration Service, 2022-2027 (USD Billion)

Table 60 Canada: Market, by Application Integration Service, 2017-2021 (USD Billion)

Table 61 Canada: Market, by Application Integration Service, 2022-2027 (USD Billion)

Table 62 Canada: Market, by Infrastructure Integration Service, 2017-2021 (USD Billion)

Table 63 Canada: North America It Services Market, by Infrastructure Integration Service, 2022-2027 (USD Billion)

Table 64 Canada: Market, by Managed Service, 2017-2021 (USD Billion)

Table 65 Canada: Market, by Managed Service, 2022-2027 (USD Billion)

Table 66 Canada: Market, by Deployment Mode, 2017-2021 (USD Billion)

Table 67 Canada: Market, by Deployment Mode, 2022-2027 (USD Billion)

Table 68 Canada: Market, by Organization Size, 2017-2021 (USD Billion)

Table 69 Canada: Market, by Organization Size, 2022-2027 (USD Billion)

Table 70 Canada: Market, by Business Function, 2017-2021 (USD Billion)

Table 71 Canada: Market, by Business Function, 2022-2027 (USD Billion)

Table 72 Canada: Market, by Vertical, 2017-2021 (USD Billion)

Table 73 Canada: Market, by Vertical, 2022-2027 (USD Billion)

12 Competitive Landscape

12.1 Introduction

12.2 North America It Services Market Evaluation Framework

Figure 49 Market Evaluation Framework

12.3 Market Share of Top Vendors

Figure 50 Market: Vendor Share Analysis

12.4 Historical Revenue Analysis of Top Vendors

Figure 51 Historical Revenue Analysis, 2017-2021 (USD Million)

12.5 Evaluation Quadrant for Key Players, 2022

Figure 52 Company Evaluation Matrix for Key Players: Criteria Weightage

12.5.1 Stars

12.5.2 Emerging Leaders

12.5.3 Pervasive Players

12.5.4 Participants

Figure 53 Company Evaluation Quadrant for Key Players

12.5.5 Competitive Benchmarking of Key Players

Table 74 Company Footprint, by Service Type

Table 75 Company Footprint, by Country

Table 76 Overall Company Footprint

12.6 Evaluation Quadrant for Startups/Smes, 2022

Figure 54 Evaluation Matrix for Startups/Smes: Criteria Weightage

12.6.1 Responsive Companies

12.6.2 Progressive Companies

12.6.3 Dynamic Companies

12.6.4 Starting Blocks

Figure 55 Evaluation Quadrant for Startups/Smes

Table 77 Company Footprint for Startups/Smes, by Service Type

Table 78 Company Footprint for Startups/Smes, by Country

Table 79 Overall Company Footprint for Startups/Smes

12.6.5 Competitive Benchmarking of Startups/Smes

Table 80 Detailed List of Key Startups/Smes

12.7 Competitive Scenario

Table 81 North America It Services Market: Product Launches, 2019-2022

Table 82 Market: Deals, 2019-2022

13 Company Profiles

13.1 Introduction

13.2 Key Players

(Business Overview, Services Offered, Recent Developments, Analyst's View)*

13.2.1 IBM

Table 83 IBM: Business Overview

Figure 56 IBM: Company Snapshot

Table 84 IBM: Services Offered

Table 85 IBM: Service Launches and Business Expansions

Table 86 IBM: Deals

13.2.2 Hewlett Packard Enterprise

Table 87 Hpe: Business Overview

Figure 57 Hpe: Company Snapshot

Table 88 Hpe: Services Offered

Table 89 Hpe: Service Launches and Business Expansions

Table 90 Hpe: Deals

13.2.3 Accenture

Table 91 Accenture: Business Overview

Figure 58 Accenture: Company Snapshot

Table 92 Accenture: Services Offered

Table 93 Accenture: Service Launches and Business Expansions

Table 94 Accenture: Deals

13.2.4 Cisco

Table 95 Cisco: Business Overview

Figure 59 Cisco: Company Snapshot

Table 96 Cisco: Services Offered

Table 97 Cisco: Service Launches and Business Expansions

Table 98 Cisco: Deals

13.2.5 Wipro

Table 99 Wipro: Business Overview

Figure 60 Wipro: Company Snapshot

Table 100 Wipro: Services Offered

Table 101 Wipro: Service Launches & Business Expansions

Table 102 Wipro: Deals

13.2.6 Hcl Technologies

Table 103 Hcl Technologies: Business Overview

Figure 61 Hcl Technologies: Company Snapshot

Table 104 Hcl: Services Offered

Table 105 Hcl: Service Launches and Business Expansions

Table 106 Hcl: Deals

13.2.7 Cognizant

Table 107 Cognizant: Business Overview

Figure 62 Cognizant: Company Snapshot

Table 108 Cognizant: Services Offered

Table 109 Cognizant: Service Launches and Business Expansions

Table 110 Cognizant: Deals

13.2.8 Infosys

Table 111 Infosys: Business Overview

Figure 63 Infosys: Company Snapshot

Table 112 Infosys: Services Offered

Table 113 Infosys: Service Launches and Business Expansions

Table 114 Infosys: Deals

13.2.9 Rackspace

Table 115 Rackspace: Business Overview

Figure 64 Rackspace: Company Snapshot

Table 116 Rackspace: Services Offered

Table 117 Rackspace: Service Launches and Business Expansions

Table 118 Rackspace: Deals

13.2.10 Tcs

Table 119 Tcs: Business Overview

Figure 65 Tcs: Company Snapshot

Table 120 Tcs: Services Offered

Table 121 Tcs: Service Launches and Business Expansions

Table 122 Tcs: Deals

13.3 Other Players

13.3.1 Fujitsu

13.3.2 Capgemini

13.3.3 Ericsson

13.3.4 Huawei Technologies Co. Ltd.

13.3.5 Nokia Networks

13.3.6 Gtt Communications

13.3.7 Sap

13.3.8 Dxc Technology

13.3.9 NTT Data

13.3.10 Nec

13.3.11 Deloitte

13.3.12 Virtustream

13.3.13 Digitalocean

13.3.14 Bluelock

13.3.15 Navisite

13.3.16 Lumen Technologies

13.3.17 Infor

13.3.18 Opentext

13.3.19 Citrix

13.3.20 Ifs

13.4 SMEs/Startups

13.4.1 Inventive Works

13.4.2 Techmatrix

13.4.3 Mission Cloud Services

13.4.4 Optanix

13.4.5 Securekloud

13.4.6 Ascend Technologies

13.4.7 Essintial

13.4.8 Aunalytics

13.4.9 2nd Watch

13.4.10 Cloudnow

*Details on Business Overview, Services Offered, Recent Developments, Analyst's View Might Not be Captured in Case of Unlisted Companies.

14 Adjacent/Related Markets

14.1 Introduction

14.1.1 Related Markets

14.1.2 Limitations

14.2 Cloud Managed Services Market

Table 123 Cloud Managed Services Market, by Vertical, 2018-2021 (USD Million)

Table 124 Cloud Managed Services Market, by Vertical, 2022-2027 (USD Million)

14.3 Managed Services Market

Table 125 Managed Services Market, by Region, 2016-2020 (USD Million)

Table 126 Managed Services Market, by Region, 2021-2026 (USD Million)

15 Appendix

15.1 Discussion Guide

15.2 Knowledgestore: The Subscription Portal

15.3 Customization Options

Companies Mentioned

- 2nd Watch

- Accenture

- Ascend Technologies

- Aunalytics

- Bluelock

- Capgemini

- Cisco

- Citrix

- Cloudnow

- Cognizant

- Deloitte

- Digitalocean

- DXC Technology

- Ericsson

- Essintial

- Fujitsu

- GTT Communications

- HCL Technologies

- Hewlett Packard Enterprise

- Huawei Technologies Co. Ltd.

- IBM

- IFS

- Infor

- Infosys

- Inventive Works

- Lumen Technologies

- Mission Cloud Services

- Navisite

- NEC

- Nokia Networks

- NTT Data

- Opentext

- Optanix

- Rackspace

- SAP

- Securekloud

- TCS

- Techmatrix

- Virtustream

- Wipro

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 242 |

| Published | January 2023 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value ( USD | $ 500 Billion |

| Forecasted Market Value ( USD | $ 700.6 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | North America |

| No. of Companies Mentioned | 40 |