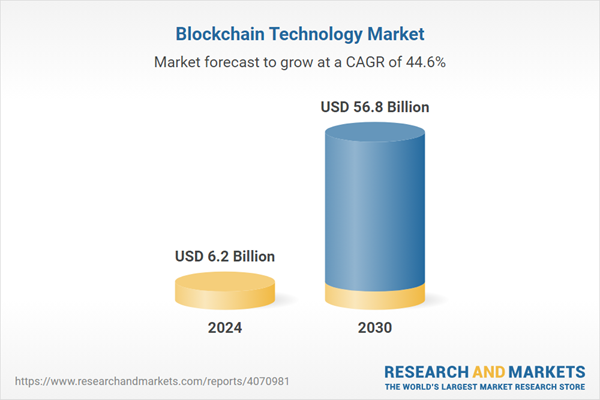

The global market for Blockchain Technology was estimated at US$6.2 Billion in 2024 and is projected to reach US$56.8 Billion by 2030, growing at a CAGR of 44.6% from 2024 to 2030. This comprehensive report provides an in-depth analysis of market trends, drivers, and forecasts, helping you make informed business decisions. The report includes the most recent global tariff developments and how they impact the Blockchain Technology market.

In the financial sector, blockchain is revolutionizing the way transactions are conducted, offering faster, more secure, and cost-effective alternatives to traditional banking systems. Smart contracts, which are self-executing contracts with the terms directly written into code, are one of the significant innovations brought by blockchain, enabling automated and trustless transactions. In supply chain management, blockchain provides end-to-end visibility and traceability of goods, ensuring product authenticity and reducing the risk of counterfeiting. The healthcare industry is leveraging blockchain to secure patient data, improve data interoperability, and ensure the integrity of medical records.

The growth in the blockchain technology market is driven by several factors. Firstly, the increasing adoption of blockchain in the financial sector for secure and efficient transactions is a major driver. Secondly, the demand for transparency and traceability in supply chains is boosting the adoption of blockchain solutions. Thirdly, advancements in blockchain platforms and the development of scalable and interoperable solutions are enhancing the technology`s capabilities and usability. Additionally, the rise of decentralized finance (DeFi) applications is expanding the use cases for blockchain beyond traditional finance. Furthermore, the integration of blockchain with emerging technologies like IoT and AI is creating new opportunities for innovation. Lastly, supportive regulatory frameworks and increasing investments in blockchain research and development are further driving the growth of the blockchain technology market.

Global Blockchain Technology Market - Key Trends & Drivers Summarized

Blockchain technology is a decentralized and distributed ledger system that securely records transactions across multiple computers. It is best known as the underlying technology behind cryptocurrencies like Bitcoin and Ethereum, but its applications extend far beyond digital currencies. Blockchain offers transparency, security, and immutability, making it suitable for various industries, including finance, supply chain management, healthcare, and real estate. By enabling secure and transparent record-keeping, blockchain can streamline processes, reduce fraud, and enhance trust among participants in a network.In the financial sector, blockchain is revolutionizing the way transactions are conducted, offering faster, more secure, and cost-effective alternatives to traditional banking systems. Smart contracts, which are self-executing contracts with the terms directly written into code, are one of the significant innovations brought by blockchain, enabling automated and trustless transactions. In supply chain management, blockchain provides end-to-end visibility and traceability of goods, ensuring product authenticity and reducing the risk of counterfeiting. The healthcare industry is leveraging blockchain to secure patient data, improve data interoperability, and ensure the integrity of medical records.

The growth in the blockchain technology market is driven by several factors. Firstly, the increasing adoption of blockchain in the financial sector for secure and efficient transactions is a major driver. Secondly, the demand for transparency and traceability in supply chains is boosting the adoption of blockchain solutions. Thirdly, advancements in blockchain platforms and the development of scalable and interoperable solutions are enhancing the technology`s capabilities and usability. Additionally, the rise of decentralized finance (DeFi) applications is expanding the use cases for blockchain beyond traditional finance. Furthermore, the integration of blockchain with emerging technologies like IoT and AI is creating new opportunities for innovation. Lastly, supportive regulatory frameworks and increasing investments in blockchain research and development are further driving the growth of the blockchain technology market.

SCOPE OF STUDY:

The report analyzes the Blockchain Technology market in terms of units by the following Segments, and Geographic Regions/Countries:- Segments: Type (Public, Private, Hybrid); Component (Infrastructure & Protocols, Application & Solutions, Middleware); End-Use (Financial Services, Healthcare, Transportation & Logistics, Government, Retail, Media & Entertainment, Other End-Uses)

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Rest of Europe; Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Public segment, which is expected to reach US$41.5 Billion by 2030 with a CAGR of a 46.4%. The Private segment is also set to grow at 39.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.8 Billion in 2024, and China, forecasted to grow at an impressive 51.5% CAGR to reach $6.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Blockchain Technology Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Blockchain Technology Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Blockchain Technology Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Accenture PLC, Amazon Web Services, Inc., Aleo Systems Inc., Altoros, 4IRE labs and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 317 companies featured in this Blockchain Technology market report include:

- Accenture PLC

- Amazon Web Services, Inc.

- Aleo Systems Inc.

- Altoros

- 4IRE labs

- Adbank

- ANX International

- APPII

- Applover Software House

- ARK Ecosystem, SCIC (ARK.io)

- Artory

- AlphaPoint

- Antier Solutions Pvt Ltd

- Accubits

- Andersen Lab

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

I. METHODOLOGYII. EXECUTIVE SUMMARY2. FOCUS ON SELECT PLAYERSIV. COMPETITION

1. MARKET OVERVIEW

3. MARKET TRENDS & DRIVERS

4. GLOBAL MARKET PERSPECTIVE

III. MARKET ANALYSIS

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Accenture PLC

- Amazon Web Services, Inc.

- Aleo Systems Inc.

- Altoros

- 4IRE labs

- Adbank

- ANX International

- APPII

- Applover Software House

- ARK Ecosystem, SCIC (ARK.io)

- Artory

- AlphaPoint

- Antier Solutions Pvt Ltd

- Accubits

- Andersen Lab

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 802 |

| Published | July 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.2 Billion |

| Forecasted Market Value ( USD | $ 56.8 Billion |

| Compound Annual Growth Rate | 44.6% |

| Regions Covered | Global |