Magnet Market Analysis:

- Market Growth and Size: The market is witnessing stable growth, driven by the expanding requirements of various industries and diverse product applications, such as consumer electronics and renewable energy sectors.

- Major Market Drivers: Key drivers influencing the market growth include the rising demand in the automotive industry, particularly for electric vehicles, and the growing adoption of high-efficiency magnets in consumer electronics and renewable energy sectors, such as wind turbines.

- Technological Advancements: Recent innovations in magnetic materials, such as improvements in neodymium iron boron (NdFeB) magnets and the development of environmentally sustainable magnetic solutions are supporting the market growth.

- Industry Applications: The market is experiencing high product demand in automotive sector, consumer electronics like hard disk drives (HDD), and renewable energy technologies, such as wind turbines.

- Key Market Trends: The key market trends involve the ongoing shift towards sustainable and energy-efficient technologies, which an increasing focus on developing recyclable and more environmentally friendly magnetic materials.

- Geographical Trends: China leads the market due to its sustainable manufacturing capabilities and rare earth element resources. Other countries are also showing significant growth, fueled by technological advancements and rising product demand across various industries.

- Competitive Landscape: The market is characterized by the presence of several players that are focusing on strategic mergers, acquisitions, and partnerships, alongside significant investments in research and development (R&D) to innovate and improve product offerings.

- Challenges and Opportunities: The market faces various challenges, such as geopolitical and supply chain dynamics related to rare earth elements, and environmental concerns. However, recent innovations in alternative magnetic materials and rapid expansion into new and emerging markets is creating new opportunities for the market growth.

Magnet Market Trends:

The increasing product demand in the automotive industry

The significant growth in the automotive industry, particularly with the surge in electric vehicle (EV) production, is contributing to the market growth. Magnets are essential for various applications, including electric motors, sensors, and speakers. Additionally, the ongoing shift towards electric mobility, fueled by global efforts to reduce carbon emissions and improve energy efficiency, leading to an increased demand for high-performance magnets, is supporting the market growth. These magnets are crucial in achieving the efficiency and performance standards required in modern electric vehicles. Additionally, the shifting trend towards autonomous and connected vehicles, which utilize sensors and actuators that rely heavily on magnets, is positively impacting the market growth.Recent advancements in electronics and consumer goods

The widespread utilization of electronic gadgets like smartphones, laptops, tablets, and wearables, which utilize small yet powerful magnets, is bolstering the market growth. These magnets are integral in various components, such as micro-motors, loudspeakers, and magnetic sensors. Furthermore, the emerging miniaturization trend in electronics, which necessitates the use of small, efficient magnets that can fit into increasingly compact devices, is contributing to the market growth. Moreover, the expanding consumer goods sector, encompassing products like refrigerators, air conditioners, and other household appliances that rely heavily on magnets for their motors and electronic components, is supporting the market growth. Additionally, the continual innovation in consumer electronics, coupled with the growing global demand for these products, is favoring the market growth.Significant growth in the wind energy sector

Wind turbines use large, powerful magnets in their generators to convert wind energy into electricity efficiently. Furthermore, the ongoing global push towards sustainable and renewable energy sources, leading to increased investment in wind power infrastructure, is boosting the market growth. It has escalated the demand for high-performance magnets, especially those used in direct-drive generators, which are simpler, more reliable, and require less maintenance compared to geared alternatives. Besides this, magnets used in wind turbines exhibit exceptional performance characteristics, including resistance to demagnetization and the ability to operate in harsh environmental conditions. Moreover, the ongoing advancements in wind turbine technology, aiming to increase energy output and reduce costs, prompting the development of innovative magnetic solutions, is positively influencing the market growth.Rapid technological innovations

Technological innovations in magnet manufacturing and design are pivotal in driving the market growth. Continuous research and development (R&D) efforts are focused on enhancing the efficiency, performance, and cost-effectiveness of magnets. It includes developing new materials and improving existing ones, such as neodymium-iron-boron (NdFeB) and samarium-cobalt (SmCo) magnets, to achieve higher magnetic strengths and better temperature stability. Additionally, recent innovations aiming to reduce reliance on rare earth elements, which are critical but often geopolitically sensitive and expensive, are fostering the market growth. Besides this, advances in manufacturing techniques, such as additive manufacturing (3D printing) of magnetic materials, which opens new possibilities for custom and complex magnet shapes, are driving the market growth.Rising adoption of automation and robotics

The increasing adoption of industrial automation and robotics is a crucial factor driving the demand for magnets. They are essential components in electric motors, sensors, and actuators, which are integral components of robotics and automation. Furthermore, the significant growth of Industry 4.0, characterized by the integration of automation technologies, smart manufacturing, and the Internet of Things (IoT), leading to an increased reliance on precise and efficient magnetic components, is supporting the market growth. Apart from this, magnets are widely used in robotics to enhance motion control, sensing capabilities, and energy efficiency. Moreover, the expanding application of robotics in manufacturing, healthcare, logistics, and service industries, which further escalates the demand for high-quality magnets, is fueling the market growth.Magnet Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on magnet type and application.Breakup by Magnet Type:

- Ferrite

- Neodymium Iron Boron (NdFeB)

- Aluminium Nickel Cobalt (AlNiCo)

- Samarium Cobalt (SmCo)

Neodymium iron boron (NdFeB) accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the magnet type. This includes ferrite, neodymium iron boron (NdFeB), aluminium nickel cobalt (AlNiCo), and samarium cobalt (SmCo). According to the report, neodymium iron boron (NdFeB) represented the largest segment.Neodymium Iron Boron (NdFeB) magnets hold the largest market segment owing to their exceptional magnetic strength and performance. They are a type of rare earth magnet made from an alloy of neodymium, iron, and boron. NdFeB magnets have the highest magnetic field strength and energy product among all permanent magnets, making them ideal for applications requiring compact size and strong magnetic fields, such as in electric vehicles, wind turbines, and hard disk drives. Furthermore, their superior properties drive their widespread adoption in advanced technological applications. Besides this, the increasing emphasis on high-efficiency, compact, and powerful magnetic solutions in various industries, is supporting the market growth.

Ferrite magnets, also known as ceramic magnets, are widely used due to their cost-effectiveness and moderate magnetic strength. They are composed of iron oxide and barium or strontium carbonate, offering good resistance to demagnetization and corrosion. Ferrite magnets are popular in applications where a strong magnetic field is not essential, such as in small motors, speakers, and magnetic resonance imaging (MRI) equipment.

Aluminium nickel cobalt (AlNiCo) magnets are known for their excellent temperature stability and resistance to demagnetization. They are commonly used in applications where a stable performance over a wide temperature range is essential, such as in aerospace, military, and automotive sensors. AlNiCo magnets are also popular in the manufacturing of electric guitar pickups due to their unique magnetic field characteristics.

Samarium cobalt (SmCo) magnets are known for their high magnetic strength and exceptional thermal stability. They are particularly suited for applications in extreme working temperatures or where space is limited. SmCo magnets are highly resistant to oxidation and typically do not require a protective coating. They are commonly used in aerospace, military, and high-performance motors.

Breakup by Application:

- Computer Hard Disk Drives (HDD), CD, DVD

- Hybrid Electric Vehicles

- Electric Bicycles

- Heating, Ventilating and Air Conditioners (HVAC)

- Wind Turbines

- Other Applications

- Transducers and Loudspeakers

- Magnetic Separation Equipment and Sorters

- Magnetic Resonance Imaging (MRI)

- Magnetic Braking Systems

- Magnetically Levitated Transportation Systems

- Medicine and Health

- Credit Cards and other ID Cards

- Traveling Waves Tubes (TWT)

- Advertising and Promotional Products

- Magnetic Refrigeration system

- Nanotechnology

- Military and Aerospace

- Energy Storage Systems

Computer hard disk drives (HDD), CD, DVD holds the largest share in the industry

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes computer hard disk drives (HDD), CD, DVD, hybrid electric vehicles, electric bicycles, heating, ventilating and air conditioners (HVAC), wind turbines, and other applications (transducers and loudspeakers, magnetic separation equipment and sorters, magnetic resonance imaging (MRI), magnetic braking systems, magnetically levitated transportation systems, medicine and health, credit cards and other ID Cards, traveling waves tubes (TWT), advertising and promotional products, magnetic refrigeration system, nanotechnology, military and aerospace, and energy storage systems). According to the report, computer hard disk drives (HDD), CD, DVD accounted for the largest market share.Computer hard disk drives (HDD), CDs, and DVDs represent the largest market share, as magnets are crucial in their functioning. They are widely used in the actuator of HDDs that position the read/write head over the spinning disks. In optical media, such as CDs and DVDs, magnets are integral to the drives that read and write data. Magnets used in these applications must be precise, reliable, and capable of maintaining their magnetic properties over a long period. Furthermore, the growing demand for reliable data storage systems, such as HDDs, CDs, and DVDs, across various sectors is positively influencing the market growth.

Hybrid electric vehicles (HEVs) use magnets in electric motors and generators that form the core of HEVs. Additionally, the growing need for compact, efficient, and powerful motors in these vehicles is facilitating the demand for high-performance magnets, such as NdFeB. Besides this, the global push towards more environmentally friendly transportation options and the increasing adoption of HEVs are supporting the market growth.

Electric bicycles use magnets in electric motors to provide the necessary propulsion. Additionally, the rising popularity of e-bikes for urban commuting and recreational purposes, driven by a growing awareness of health and environmental benefits, is facilitating the demand for efficient and compact magnet-based motors.

Heating, ventilating, and air conditioning (HVAC) systems use magnets in various components, including compressors, fans, and actuators. Additionally, the surge in demand for energy-efficient and reliable HVAC systems in residential, commercial, and industrial settings, driving the need for high-quality magnets, is favoring the market growth. Moreover, these magnets are instrumental in improving the performance and energy efficiency of HVAC systems, making them more cost-effective and environmentally friendly.

Wind turbines represent a key application segment for magnets, particularly in the context of renewable energy generation. High-performance magnets are used in the generators of wind turbines to convert kinetic wind energy into electrical energy efficiently. These magnets must withstand harsh environmental conditions and maintain their performance over long periods.

Breakup by Country:

- China

- Japan

- USA

- Europe

- Other Regions

China leads the market, accounting for the largest magnet market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include China, Japan, USA, Europe, and other regions. According to the report, China accounted for the largest market share.China holds the largest market share due to its expansive manufacturing sector and significant investments in technology and infrastructure. Furthermore, it is a major producer of rare earth elements, which are crucial for high-performance magnets. Additionally, the significant growth in the automotive sector, particularly in electric vehicles, along with its growing renewable energy initiatives in the country, is driving the demand for various types of magnets. Besides this, China's large electronics manufacturing industry, which produces a wide range of consumer electronics and appliances, is further bolstering the market growth.

Japan is known for its technological innovation and high-quality manufacturing standards. The country is a leader in the production of advanced magnets used in various high-tech applications, including electronics, automotive, and robotics. Furthermore, Japanese companies are at the forefront of developing new magnetic materials and technologies, particularly in the realm of miniaturization and energy efficiency.

The magnet market in the USA is driven by its advanced technology sectors and substantial investments in renewable energy and electric vehicles. Furthermore, the country hosts a diverse range of industries that require high-quality magnets, including defense, aerospace, healthcare, and consumer electronics. Additionally, the growing emphasis on sustainable technologies, particularly in wind power and electric transportation, is supporting the market growth.

The magnet market in Europe is characterized by its focus on sustainability, innovation, and quality. European countries are actively involved in the transition to renewable energy sources, particularly wind energy, driving the demand for efficient magnets in wind turbines. Additionally, Europe's strong emphasis on environmental regulations and recycling initiatives, influencing the development of sustainable and recyclable magnetic materials, is contributing to the market growth.

Leading Key Players in the Magnet Industry:

The leading players are engaging in a variety of strategic activities to strengthen their positions and capitalize on the growing market demand. They are heavily investing in research and development (R&D) to innovate and improve the performance of magnetic materials. Additionally, several companies are focusing on making magnets more environmentally sustainable, both in terms of manufacturing processes and recyclability. Besides this, several major players are acquiring smaller companies or forming strategic partnerships to access new technologies and markets, particularly in emerging regions and sectors, such as renewable energy and electric vehicles.Key Questions Answered in This Report

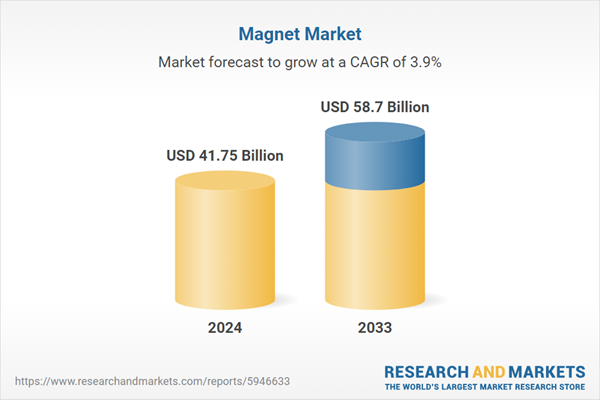

1. What was the size of the global magnet market in 2024?2. What is the expected growth rate of the global magnet market during 2025-2033?

3. What are the key factors driving the global magnet market?

4. What has been the impact of COVID-19 on the global magnet market?

5. What is the breakup of the global magnet market based on the magnet type?

6. What is the breakup of the global magnet market based on the application?

7. What are the key regions in the global magnet market?

8. Who are the key players/companies in the global magnet market?

Table of Contents

Companies Mentioned

- Arnold Magnetic Technologies

- Adams Magnetic Products Co. Inc.

- Hitachi Metals Ltd.

- BGRIMM Magnetic Materials & Technology Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 133 |

| Published | January 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 41.75 Billion |

| Forecasted Market Value ( USD | $ 58.7 Billion |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 4 |