Product outlook

Chocolates must be stored in an environment that is extremely sensitive to temperatures and humidity. Chocolates cannot be stored in high temperatures as they can meltdown and fluctuating temperatures can cause fat to bloom. Moreover, chocolates are stocked in a place away from other food items as these could absorb different aromas. Hence, chocolates should be wrapped and kept in a proper place that has correct humid and temperature conditions. The global market for chocolates is driven by extensive utilization of chocolates in confectionery items and flavored food products. Moreover, chocolates are being used as functional goods owing to their nutritional value and aid in relieving stress, leading to increased consumption over the forecast period. However, fluctuations in raw material prices and excessive reliance on unstable economies for the supply of cocoa are restraining market growth.

Dark chocolate is anticipated to witness significant growth over the forecast period

Dark chock has several health benefits like consumption of it reduce anxiety and improve symptoms of clinical depression. Growing awareness regarding dark chocolate as a healthier product is expected to drive the growth of the segment during the forecast period. In addition, various health experts around the globe also recommend that moderate consumption of chocolate boosts serotonin that calms the brain and acts as an anti-depressant. According to the World Health Organization, depression which is a common mental disorder affect more than 264 million people of all ages globally and close to 800 thousand people die every year due to suicide and depression is one of the major causes of it. Furthermore, dark chocolate also reduces the risk of cardiovascular diseases on account of the presence of high flavonoids content.

Growing middle-class population

The middle-class population in developing countries like China, India, and Brazil are growing which is increasing demand for chocolate for especially among millennials and the young population. Rapid urbanization and growing disposable income have also attracted major market players to invest in new product launches, thus propelling the market growth opportunities over the forecast period. Furthermore, the chocolate is often considered as a token of appreciation and is used in giving gifs during the festive seasons which also boosts the demand for chocolate. Major market players frequently launch their new gift packs of chocolates which is quite popular among the middle-class population in the developing economies. Besides, with a growing trend of consumer behavior towards an appreciation for good-quality chocolate and desire for the sophisticated taste profile is further helping the chocolate manufacturers and vendors to grow during the forecast period.

Expanding e-retail business

In recent years, the e-retail business has witnessed a significant increase in sales. The development and growth of online shopping are causally related to economic growth and speed of urbanization which is projected to propel the market growth opportunities over the forecast period. Besides, with the growing number of smartphone users, time spent on the internet also an increase that drives the growth of e-commerce platforms which is also opening the scope of distribution of chocolate. Furthermore, the diversity of features including value-added services, such as discounted prices, cash-on-delivery, and cashback offers, offered by e-retailers are expected to promote the growth of online channel over the forecast period.

Recent update

July 2019, Chocolate and cocoa company Barry Callebaut announced the investment in a new factory in Baramati, India with the annual production capacity of more than 30,000 tons of chocolate. It is the biggest investment by Barry Callebaut in India and is expected to start its operation by the end of 2020.

June 2019, The Government of Ghana announced a partnership deal with China for the construction of a nearly US$100 million chocolate factory at Sefwi-Wiaso district of the North-Western region of Ghana.

The Asia Pacific is holding a significant share in the market

By geography, the chocolate market is segmented as North America, South America, Europe, the Middle East and Africa, and the Asia Pacific. The Asia Pacific is expected to hold a significant share in the market owing to the presence of major players coupled with the growing number of product launches in the region. In addition, rising disposable income coupled with the growing awareness regarding the health benefit of chocolates is further anticipated to boost the growth of the market in the region. The European region is home to major dark chocolate consuming population and with the increasing product launches the market is expected to witness significant growth in the coming years.

Competitive Insights

Prominent key market players in the Chocolate market include Nestle, Barry Callebaut, The Hershey Company, Lindt & Sprüngli AG, The Australian Carob Co, Ferrero Group, Mars, Incorporated, Meiji Holdings Co., Ltd., Arcor, and Mondelez International. The number of players in the chocolate market is large and growing with the opportunity to generate significant revenues because of growing demand. The players in the global Chocolate market are implementing various growth strategies to gain a competitive advantage over its competitors in this market. Major market players in the global chocolate market have been covered along with their relative competitive position and strategies. The report also mentions recent deals and investments of different market players over the last few years. The company profiles section details the business overview, financial performance (public companies) for the past few years, key products and services being offered along with the recent deals and investments of these important players in the global chocolate market.

Segmentation:

By Product

- Dark Chocolate

- Milk and White Chocolate

- Artificial

By Distribution Channel

- Online

- Offline

- Convenience stores

- Others

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Others

- Europe

- Germany

- Spain

- United Kingdom

- Italy

- Netherlands

- Ireland

- Russia

- Poland

- France

- Portugal

- Sweden

- Poland

- Austria

- Belgium

- Bulgaria

- Czech Republic

- Denmark

- Finland

- Hungary

- Romania

- Slovakia

- Slovenia

- Middle East and Africa

- Saudi Arabia

- Israel

- UAE

- South Africa

- Egypt

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Vietnam

- Thailand

- Singapore

- Malaysia

- Philippines

Note: The report will be delivered within 5 business days.

Table of Contents

Companies Mentioned

- Nestle

- Barry Callebaut

- The Hershey Company

- Lindt & Sprüngli AG

- The Australian Carob Co.

- Ferrero Group

- Mars, Incorporated

- Meiji Holdings Co., Ltd.

- Arcor

- Mondelez International

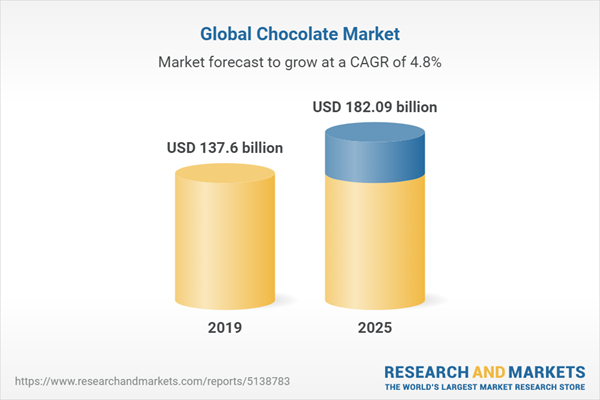

Table Information

| Report Attribute | Details |

|---|---|

| Published | August 2020 |

| Forecast Period | 2019 - 2025 |

| Estimated Market Value ( USD | $ 137.6 billion |

| Forecasted Market Value ( USD | $ 182.09 billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |