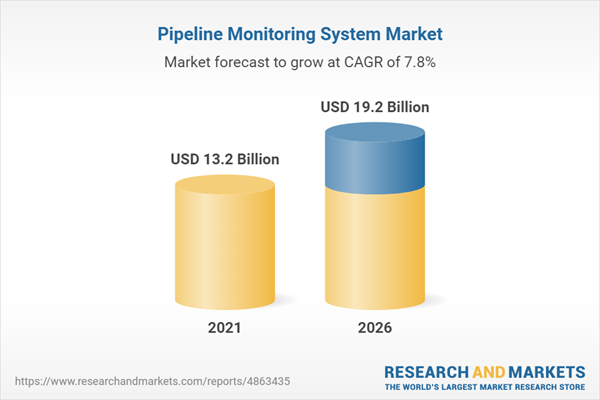

The global pipeline monitoring system market size is projected to grow from USD 13.2 billion in 2021 to USD 19.2 billion by 2026, at a CAGR of 7.8% from 2021 to 2026. Several stringent rules and regulations need to be followed for the maintenance and safety of the environment caused by leaks in oil & gas. Pipeline maintenance includes checking cathodic protection levels for the proper range, surveillance for construction, erosion, or leaks by foot, and running cleaning PIGS when anything is carried in the corrosive pipeline. The Environmental Protection Agency (EPA) (US) has put some performance standards for oil & natural gas emissions for hazardous pollution and explosions caused due to the leakage of oil & gas. These regulations have made the usage of pipeline monitoring systems compulsory to avoid leaks and protect the environment, which, in turn, is driving the market growth.

In terms of value, PIGs segment to be the fastest-growing segment by 2026

The PIGs segment to be the fastest-growing segment in the pipeline monitoring system market. PIGS (pipeline inspection gauges) technology is defined as observing the location of the liquid in a pipeline. In this technology, PIGS detectors are used and are fixed externally on the pipe. Whenever a PIGS passes the detector, the detector picks up the magnetic field to track the PIGS. This is detected with the help of LED detector lights. Detectors are mainly mounted at launch stations and receive stations. These are used to communicate with the outside world due to the distance underground or underwater. Steel pipelines use PIGS tracking to record internal movement. This technology is often associated with oil & gas.

Leak detection to be the fastest-growing solution from 2021 to 2026 for pipeline monitoring systems

Leak detection will be the fastest-growing solution for pipeline monitoring systems during the forecast period. The pipeline leak detection efficiently inspects cracks, leaks, and holes in the vessel's walls. It quickly detects even the smallest leaks with its level of sensitivity and accuracy. Advanced systems to detect minor internal leaks are included in the solution as well. The leak rate of the product has a direct dependency on the nature of the product. Pipeline leakage detection systems help in detecting damages across the pipeline infrastructure. These systems detect leaks based on flow, pressure, temperature, and density.

In terms of value, the APAC pipeline monitoring system market is projected to grow at the highest CAGR during the forecast period

In terms of value and volume, the APAC region is projected to grow at the highest CAGR from 2021 to 2026. Emerging economies in APAC are expected to experience significant demand for pipeline monitoring system as a result of the expansion of the crude & refined petroleum and water & wastewater industries in the region. The key factors driving the growth of the market in this region include expansion of existing pipelines and development of new ones, increased incidents of oil and gas leakages in pipelines and storage tanks at production facilities, and formulation of stringent regulations by the governments for the implementation of leak detection technologies and systems in different countries of APAC. More investment is expected in monitoring and safety spending in this region, owing to the increasing threat of identity and access breaches.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the pipeline monitoring system market.

The distribution of primary interviews is as follows:

- By Department: Sales/Export/Marketing - 62.1%, Production - 25.6%, and R&D - 12.3%

- By Designation: C-level - 54.9%, D-level - 15.5%, and Others - 29.7%

- By Region: North America - 18%, Europe - 14%, APAC - 42%, Middle East & Africa - 22%, and South America - 4%

The global pipeline monitoring system market comprises major manufacturers, such as Siemens AG (US), Honeywell International Inc. (US), Huawei Technologies Co. Ltd. (China), BAE Systems (UK), and TransCanada PipeLines Limited (Canada), among others.

Research Coverage:

The market study covers the pipeline monitoring system market across various segments. It aims at estimating the market size and the growth potential of this market across different segments based on pipe type, solution, technology, end-use industry and region. The study also includes an in-depth competitive analysis of key players in the market, along with their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to enhance their position in the pipeline monitoring system market.

Key Benefits of Buying the Report:

The report is projected to help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers of the overall pipeline monitoring system market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market and gain insights to improve the position of their businesses and plan suitable go-to-market strategies. The report also aims at helping stakeholders understand the pulse of the market and provides them with information on the key market drivers, challenges, and opportunities.

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

Figure 1 Pipeline Monitoring System Market Segmentation

1.3.1 Years Considered

1.3.2 Regional Scope

Figure 2 Pipeline Monitoring System Market, by Region

1.4 Currency Considered

1.5 Unit Considered

1.6 Stakeholders

1.7 Limitations

2 Research Methodology

2.1 Research Data

Figure 3 Pipeline Monitoring System Market: Research Design

2.2 Data Triangulation

2.2.1 Secondary Data

2.2.2 Primary Data

Figure 4 Data Triangulation

Figure 5 List of Stakeholders Involved and Breakdown of Primary Interviews

2.3 Market Size Estimation

Figure 6 Approach 1: Based on Supply-Side Analysis

2.3.1 Approach - 2

Figure 7 Pipeline Monitoring System Market: Top Down Approach

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

Figure 8 Limitations

2.4.2 Risk Assessment

Table 1 Limitations & Associated Risks

Table 2 Risks

3 Executive Summary

Figure 9 Metallic Pipe Type to Have Larger Market Share During Forecast Period

Figure 10 Leak Detection to be Fastest-Growing Solution Segment

Figure 11 APAC to be Fastest-Growing Pipeline Monitoring System Market from 2021-2026

4 Premium Insights

4.1 APAC to Exhibit Higher Growth Rate due to Rapid Industrialization and Increasing End-Use Industries

Figure 12 Increasing Demand from Crude & Refined Petroleum Industry Will Drive Demand for Pipeline Monitoring System

4.2 Pipeline Monitoring System Market, by Technology

Figure 13 Pipeline Inspection Gauges (PIGS) to be Fastest-Growing Segment

4.3 Pipeline Monitoring System Market, by End-Use Industry

Figure 14 Crude & Refined Petroleum Segment to Lead Pipeline Monitoring System Market

4.4 Pipeline Monitoring System Market, by Region and End-Use Industry

Figure 15 Crude & Refined Petroleum and North America Segments Led Pipeline Monitoring System Market in 2020

5 Market Overview

5.1 Introduction

5.2 Pipeline Monitoring System Has Evolved Significantly Since Early 1900s

5.2.1 Evolution of Pipeline Monitoring System Market

5.3 Market Dynamics

Figure 16 Drivers, Restraints, Opportunities, and Challenges in the Pipeline Monitoring System Market

5.3.1 Drivers

5.3.1.1 Sustainable Use of Resources

5.3.1.2 Increased Spending by a Majority of Oil & Gas Companies for Pipeline Infrastructure, Network Monitoring, and Leak Detection

5.3.1.3 Increase in the Number of Oil & Gas LeakAGe Incidences/ Accidents

5.3.1.4 Increasing Maintenance and Government Regulations for Pipeline Safety and Monitoring

5.3.2 Restraints

5.3.2.1 Lack of Apprehensions About Monitoring System Implementation by Operators

5.3.2.2 Cost of Monitoring Systems for Oil & Gas Pipelines Varies with Technology

5.3.3 Opportunities

5.3.3.1 Internet of Things (IoT) Proving to be Attractive in Pipeline Leak Detection

5.3.3.2 Augmented Demand of Pipeline Monitoring due to Increase in Pipeline Infrastructure

5.3.3.3 Rising Oil & Gas Demand in Developing Countries

5.3.4 Challenges

5.3.4.1 Lack of Funds Hampering the Development of AGing Infrastructure

5.3.4.2 Multi-Site Facilities Pose a Challenge for Implementing a Comprehensive Monitoring System

5.4 Range Scenario Analysis

Figure 17 Range Scenario for the Pipeline Monitoring System

5.4.1 Optimistic Scenario

5.4.2 Pessimistic Scenario

5.4.3 Realistic Scenario

5.5 Supply Chain Analysis

Figure 18 Pipeline Monitoring System: Supply Chain

5.6 Yc-Ycc Drivers

Figure 19 Yc-Ycc Drivers

6 Industry Trends

6.1 Porter's Five Forces Analysis

Figure 20 Pipeline Monitoring System Market: Porter's Five Forces Analysis

6.1.1 Threat of Substitutes

6.1.2 Bargaining Power of Suppliers

6.1.3 Bargaining Power of Buyers

6.1.4 Threat of New Entrants

6.1.5 Intensity of Competitive Rivalry

Table 3 Electric Vehicle Fluids Market: Porter's Five Forces Analysis

6.2 Impact of COVID-19

Table 4 Interim Economic Outlook Forecast, 2019-2021 (PercentAGe)

6.2.1 Impact of COVID-19 on Pipeline Monitoring System Market

7 Pipeline Monitoring System Market, by Pipe Type

7.1 Introduction

Figure 21 Pipeline Monitoring System Market Size, by Pipe Type, 2021 Vs. 2026 (USD Million)

Table 5 Pipeline Monitoring System Market Size, by Pipe Type, 2019-2026 (USD Million)

7.2 Metallic Pipes

7.2.1 Demand for Metallic Pipes due to Superior Properties

7.2.1.1 Ductile Iron Pipes

7.2.1.2 Stainless Steel Pipes

7.2.1.3 Aluminum Pipes

7.2.1.4 Other Metal Pipes

7.3 Non-Metallic Pipes

7.3.1 Low Cost and High Corrosion Resistance of Non-Metallic Pipes to Drive Segment

7.3.1.1 Plastic Pipes

7.3.1.2 Glass Pipes

7.4 Others

8 Pipeline Monitoring System Market, by Technology

8.1 Introduction

Figure 22 Pipeline Monitoring System Market Size, by Technology, 2021 Vs. 2026 (USD Million)

Table 6 Pipeline Monitoring System Market Size, by Technology, 2019-2026 (USD Million)

8.2 Ultrasonic

8.2.1 Ultrasonic Segment to Dominate Pipeline Monitoring System Market

8.3 Pigs

8.3.1 Pigs Technology to be Fastest-Growing Segment During Forecast Period

8.4 Smart Ball

8.4.1 Various Applications of Smart Ball Technology in Petroleum Products and Water & Wastewater Pipelines

8.5 MAGnetic Flux LeakAGe

8.5.1 Increasing Applications of Technology to Drive Segment

8.6 Fiber Optic Technology

8.6.1 Rising Demand from Oil & Gas Industry Driving Segment

8.7 Others

8.7.1 Lowest Growth for Pipeline Monitoring Systems for Other Technologies

9 Pipeline Monitoring System Market, by Solution

9.1 Introduction

Figure 23 Pipeline Monitoring System Market Size, by Solution, 2021 Vs. 2026 (USD Million)

Table 7 Pipeline Monitoring System Market Size, by Solution, 2019-2026 (USD Million)

9.2 Leak Detection

9.2.1 Quick Detection Facilitating Leak Detection Segment to Grow

9.2.1.1 Flow

9.2.1.2 Pressure

9.2.1.3 Temperature

9.2.1.4 Density

9.3 Operating Condition

9.3.1 Integrated Back-End It Systems for Pipelines and Other Related Tools to Drive Operating Condition Segment

9.4 Pipeline Break Detection

9.4.1 Pipeline Break Detection Segment to Account for Second-Largest Share in Forecasted Period

9.5 Others

10 Pipeline Monitoring System Market, by End-Use Industry

10.1 Introduction

Figure 24 Pipeline Monitoring System Market Size, by End-Use Industry, 2021 Vs. 2026 (USD Million)

Table 8 Pipeline Monitoring System Market Size, by End-Use Industry, 2019-2026 (USD Million)

10.2 Crude & Refined Petroleum

10.2.1 Natural Occurrence of Crude Oil to Support Growth of Crude & Petroleum Segment

Table 9 Pipeline Monitoring System Market Size, by Crude & Refined Petroleum, 2019-2026 (USD Million)

10.2.1.1 Oil

10.2.1.2 Natural Gas

10.2.1.3 Biofuel

10.3 Water & Wastewater

10.3.1 Transportation of Water for Drinking and Irrigation Purposes Driving Segment

10.4 Others

11 Pipeline Monitoring System Market, by Region

11.1 Introduction

Figure 25 APAC to Record Fastest Growth During Forecast Period

Table 10 Pipeline Monitoring System Market Size, by Region, 2019-2026 (USD Million)

11.2 APAC

Figure 26 APAC: Pipeline Monitoring System Market Snapshot

Table 11 APAC: Pipeline Monitoring System Market Size, by Country, 2019-2026 (USD Million)

Table 12 APAC: Pipeline Monitoring System Market Size, by Technology, 2019-2026 (USD Million)

Table 13 APAC: Pipeline Monitoring System Market Size, by End-Use, 2019-2026 (USD Million)

11.2.1 China

11.2.1.1 Inclination Toward Natural Gas as Major Fuel for Energy Attracting Imports Through Pipelines

Table 14 China: Pipeline Monitoring System Market Size, by Technology, 2019-2026 (USD Million)

Table 15 China: Pipeline Monitoring System Market Size, by End-Use Sector, 2019-2026 (USD Million)

11.2.2 Japan

11.2.2.1 Single Largest Lng Importer to Drive Market

Table 16 Japan: Pipeline Monitoring System Market Size, by Technology, 2019-2026 (USD Million)

Table 17 Japan: Pipeline Monitoring System Market Size, by End-Use Sector, 2019-2026 (USD Million)

11.2.3 India

11.2.3.1 Huge Production Rates of Oil & Gas and Natural Gas to Drive Market

Table 18 India: Pipeline Monitoring System Market Size, by Technology, 2019-2026 (USD Million)

Table 19 India: Pipeline Monitoring System Market Size, by End-Use Sector, 2019-2026 (USD Million)

11.2.4 Australia

11.2.4.1 Growing Industries and Commercial Construction Projects to Support Market

Table 20 Australia: Pipeline Monitoring System Market Size, by Technology, 2019-2026 (USD Million)

Table 21 Australia: Pipeline Monitoring System Market Size, by End-Use Sector, 2015-2018 (Kiloton)

11.2.5 Rest of APAC

Table 22 Rest of APAC: Pipeline Monitoring System Market Size, by Technology, 2019-2026 (USD Million)

Table 23 Rest of APAC: Pipeline Monitoring System Market Size, by End-Use Sector, 2019-2026 (USD Million)

11.3 North America

11.3.1 Impact of COVID-19 in North America

Figure 27 North America: Pipeline Monitoring System Market Snapshot

Table 24 North America: Pipeline Monitoring System Market Size, by Country, 2019-2026 (USD Million)

Table 25 North America: Pipeline Monitoring System Market Size, by Technology, 2019-2026 (USD Million)

Table 26 North America: Pipeline Monitoring System Market Size, by End-Use Industry, 2019-2026 (USD Million)

11.3.2 US

11.3.2.1 Largest Pipeline Monitoring System Market in North America

Table 27 US: Pipeline Monitoring System Market Size, by Technology, 2019-2026 (USD Million)

Table 28 US: Pipeline Monitoring System Market Size, by End-Use Industry, 2019-2026 (USD Million)

11.3.3 Canada

11.3.3.1 Government Regulations to Provide Guidance for Best ManAGement Practices Related to Leak Detection in Pipelines

Table 29 Canada: Pipeline Monitoring System Market Size, by Technology, 2019-2026 (USD Million)

Table 30 Canada: Pipeline Monitoring System Market Size, by End-Use Industry, 2019-2026 (USD Million)

11.3.4 Mexico

11.3.4.1 Ongoing Development of Pipeline Monitoring Infrastructures to Drive Market Growth

Table 31 Mexico: Pipeline Monitoring System Market Size, by Technology, 2019-2026 (USD Million)

Table 32 Mexico: Pipeline Monitoring System Market Size, by End-Use Industry, 2019-2026 (USD Million)

11.4 Europe

11.4.1 Impact of COVID-19 in Europe

Figure 28 Europe: Pipeline Monitoring System Market Snapshot

Table 33 Europe: Pipeline Monitoring System Market Size, by Country, 2019-2026 (USD Million)

Table 34 Europe: Pipeline Monitoring System Market Size, by Technology, 2019-2026 (USD Million)

Table 35 Europe: Pipeline Monitoring System Market Size, by End-Use Industry, 2019-2026 (USD Million)

11.4.2 Germany

11.4.2.1 Import of Petroleum and Other Liquids Through Several Pipelines and Seaports

Table 36 Germany: Pipeline Monitoring System Market Size, by Technology, 2019-2026 (USD Million)

Table 37 Germany: Pipeline Monitoring System Market Size, by End-Use Industry, 2019-2026 (USD Million)

11.4.3 UK

11.4.3.1 Launching of New Oil & Gas Projects to Fuel Demand for Pipeline Monitoring System

Table 38 UK: Pipeline Monitoring System Market Size, by Technology, 2019-2026 (USD Million)

Table 39 UK: Pipeline Monitoring System Market Size, by End-Use Industry, 2019-2026 (USD Million)

11.4.4 Russia

11.4.4.1 Surging Requirement of Pipeline Monitoring Systems in Russia

Table 40 Russia: Pipeline Monitoring System Market Size, by Technology, 2019-2026 (USD Million)

Table 41 Russia: Pipeline Monitoring System Market Size, by End-Use Industry, 2019-2026 (USD Million)

11.4.5 France

11.4.5.1 Stringent Government Regulations Pertaining to Deployment of Leak Detection Systems

Table 42 France: Pipeline Monitoring System Market Size, by Technology, 2019-2026 (USD Million)

Table 43 France: Pipeline Monitoring System Market Size, by End-Use Industry, 2019-2026 (USD Million)

11.4.6 Italy

11.4.6.1 Italy Emerging as Major Transit Country for Crude Oil

Table 44 Italy: Pipeline Monitoring System Market Size, by Technology, 2019-2026 (USD Million)

Table 45 Italy: Pipeline Monitoring System Market Size, by End-Use Industry, 2019-2026 (USD Million)

11.4.7 Rest of Europe

Table 46 Rest of Europe: Pipeline Monitoring System Market Size, by Technology, 2019-2026 (USD Million)

Table 47 Rest of Europe: Pipeline Monitoring System Market Size, by End-Use Industry, 2019-2026 (USD Million)

11.5 Middle East & Africa

Table 48 Middle East & Africa: Pipeline Monitoring System Market Size, by Country, 2019-2026 (USD Million)

Table 49 Middle East & Africa: Pipeline Monitoring System Market Size, by Technology, 2019-2026 (USD Million)

Table 50 Middle East & Africa: Pipeline Monitoring System Market Size, by End-Use, 2019-2026 (USD Million)

11.5.1 UAE

11.5.1.1 Established Economic and Natural Gas Reserves to Drive Market

Table 51 UAE: Pipeline Monitoring System Market Size, by Technology, 2019-2026 (USD Million)

Table 52 UAE: Pipeline Monitoring System Market Size, by End-Use Industry, 2019-2026 (USD Million)

11.5.2 Saudi Arabia

11.5.2.1 World's Largest Crude Oil Exporter

Table 53 Saudi Arabia: Pipeline Monitoring System Market Size, by Technology, 2019-2026 (USD Million)

Table 54 Saudi Arabia: Pipeline Monitoring System Market Size, by End-Use Industry, 2019-2026 (USD Million)

11.5.3 Iran

11.5.3.1 Developments Across Oil and Gas Pipeline Infrastructures to Drive Market

Table 55 Iran: Pipeline Monitoring System Market Size, by Technology, 2019-2026 (USD Million)

Table 56 Iran: Pipeline Monitoring System Market Size, by End-Use Industry, 2019-2026 (USD Million)

11.5.4 South Africa

11.5.4.1 Increasing Import of to Support Market Growth

Table 57 South Africa: Pipeline Monitoring System Market Size, by Technology, 2019-2026 (USD Million)

Table 58 South Africa: Pipeline Monitoring System Market Size, by End-Use Industry, 2019-2026 (USD Million)

11.5.5 Oman

11.5.5.1 Global Strategic Importance and Oil & Gas Expotrs to Drive Market

Table 59 Oman: Pipeline Monitoring System Market Size, by Technology, 2019-2026 (USD Million)

Table 60 Oman: Pipeline Monitoring System Market Size, by End-Use Industry, 2019-2026 (USD Million)

11.5.6 Rest of Middle East & Africa

Table 61 Rest of Middle East & Africa: Pipeline Monitoring System Market Size, by Technology, 2019-2026 (USD Million)

Table 62 Rest of Middle East & Africa: Pipeline Monitoring System Market Size, by End-Use Industry, 2019-2026 (USD Million)

11.6 South America

Table 63 South America: Pipeline Monitoring System Market Size, by Country, 2019-2026 (USD Million)

Table 64 South America: Pipeline Monitoring System Market Size, by Technology, 2019-2026 (USD Million)

Table 65 South America: Pipeline Monitoring System Market Size, by End-Use, 2019-2026 (USD Million)

11.6.1 Brazil

11.6.1.1 Competitive Oil Production and Active Offshore to Drive Market in South America

Table 66 Brazil: Pipeline Monitoring System Market Size, by Technology, 2019-2026 (USD Million)

Table 67 Brazil: Pipeline Monitoring System Market Size, by End-Use Industry, 2019-2026 (USD Million)

11.6.2 Argentina

11.6.2.1 Dry Gas Production to Drive Market

Table 68 Argentina: Pipeline Monitoring System Market Size, by Technology, 2019-2026 (USD Million)

Table 69 Argentina: Pipeline Monitoring System Market Size, by End-Use Industry, 2019-2026 (USD Million)

11.6.3 Chile

11.6.3.1 Economic Freedom to Drive Market

Table 70 Chile: Pipeline Monitoring System Market Size, by Technology, 2019-2026 (USD Million)

Table 71 Chile: Pipeline Monitoring System Market Size, by End-Use Industry, 2019-2026 (USD Million)

11.6.4 Peru

11.6.4.1 Economic Investments in the Oil & Gas Industry to Drive Market

Table 72 Peru: Pipeline Monitoring System Market Size, by Technology, 2019-2026 (USD Million)

Table 73 Peru: Pipeline Monitoring System Market Size, by End-Use Industry, 2019-2026 (USD Million)

11.6.5 Rest of South America

Table 74 Rest of South America: Pipeline Monitoring System Market Size, by Process, 2019-2026 (USD Million)

Table 75 Rest of South America: Pipeline Monitoring System Market Size, by End-Use Industry Y, 2019-2026 (USD Million)

12 Competitive Landscape

12.1 Overview

12.2 Key Player Strategies/Right to Win

Figure 29 Companies Adopted Expansions as the Key Growth Strategy During 2016-202O

12.3 Market Ranking

Figure 30 Market Ranking of Key Players, 2020

12.3.1 Siemens AG

12.3.2 Honeywell International Inc.

12.3.3 Huawei Technologies Co. Ltd.

12.3.4 Bae Systems

12.3.5 TransCanada Pipelines Limited

12.4 Revenue Analysis of Top Market Players

Figure 31 Revenue Analysis for Key Companies in the Pipeline Monitoring System Market

12.5 Market Share Analysis

Table 76 Pipeline Monitoring System Market: Shares of Key Players

Figure 32 Share of Leading Companies in the Pipeline Monitoring System Market

12.6 Company Evaluation Quadrant

12.6.1 Star

12.6.2 Pervasive

12.6.3 Emerging Leader

12.6.4 Participant

Figure 33 Competitive Leadership Mapping: Pipeline Monitoring System Market, 2020

12.7 Competitive Benchmarking

12.7.1 Strength of Product Portfolio

12.7.2 Business Strategy Excellence

Table 77 Company Type Footprint

Table 78 Company Technology Footprint

Table 79 Company Process Footprint

Table 80 Company End-Use Footprint

Table 81 Company Region Footprint

12.8 Competitive Leadership Mapping of SMEs (Small and Medium-Sized Enterprises)

12.8.1 Progressive Companies

12.8.2 Responsive Companies

12.8.3 Starting Blocks

12.8.4 Dynamic Companies

Figure 34 Competitive Leadership Mapping of SMEs (Small and Medium-Sized Enterprises), 2020

12.9 Competitive Scenario and Trends

12.9.1 Deals

Table 82 Pipeline Monitoring System Market: Deals, January 2016-November 2020

12.9.2 Others

Table 83 Pipeline Monitoring System Market: Others, January 2017-August 2021

13 Company Profiles

13.1 Major Players

(Business and Financial Overview, Products/Solutions/Services Offered, Recent Developments, Analyst's View, Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats)*

13.1.1 Orbcomm Inc.

Table 84 Orbcomm Inc.: Business Overview

Figure 35 Orbcomm Inc.: Company Snapshot

Table 85 Orbcomm Inc.: New Product Launches

13.1.2 TransCanada Pipelines Limited

Table 86 TransCanada Pipelines Limited: Business Overview

Figure 36 TransCanada Pipelines Limited: Company Snapshot

13.1.3 Honeywell International Inc.

Table 87 Honeywell International Inc.: Business Overview

Figure 37 Honeywell International Inc.: Company Snapshot

13.1.4 PSI Software AG

Table 88 PSI Software AG: Business Overview

Figure 38 PSI Software AG: Company Snapshot

13.1.5 Siemens AG

Table 89 Siemens AG: Business Overview

Figure 39 Siemens AG: Company Snapshot

13.1.6 Huawei Technologies Co. Ltd.

Table 90 Huawei Technologies Co. Ltd.: Business Overview

Figure 40 Huawei Technologies Co. Ltd.: Company Snapshot

Table 91 Huawei Technologies Co. Ltd.: New Product Launches

13.1.7 BAE Systems

Table 92 BAE Systems: Business Overview

Figure 41 BAE Systems.: Company Snapshot

Table 93 BAE Systems: New Product Launches

13.1.8 Pure Technologies

Table 94 Pure Technologies: Business Overview

13.1.9 C-FER Technologies

Table 95 C-FER Technologies: Business Overview

Table 96 C-FER Technologies: New Product Launches

13.1.10 Perma-Pipe

Table 97 Perma-Pipe: Business Overview

Figure 42 Perma-Pipe: Company Snapshot

13.2 Additional Players

13.2.1 Thales Group

13.2.2 ABB Group

13.2.3 Krohne Group

13.2.4 Atmos International

13.2.5 Clampon AS

13.2.6 Future Fibre Technologies

13.2.7 Senstar Corporation

13.2.8 Syrinix

13.2.9 POlus-St

13.2.10 TTK

*Details on Business and Financial Overview, Products/Solutions/Services Offered, Recent Developments, Analyst's View, Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats Might Not be Captured in Case of Unlisted Companies.

14 Appendix

14.1 Discussion Guide

14.2 Knowledge Store: Publisher Subscription Portal

14.3 Available Customizations

Companies Mentioned

- ABB Group

- Atmos International

- Bae Systems

- C-FER Technologies

- Clampon AS

- Future Fibre Technologies

- Honeywell International Inc.

- Huawei Technologies Co. Ltd.

- Krohne Group

- Orbcomm Inc.

- Perma-Pipe

- POLUS-ST

- PSI Software AG

- Pure Technologies

- Senstar Corporation

- Siemens AG

- Syrinix

- Thales Group

- Transcanada Pipelines Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 167 |

| Published | November 2021 |

| Forecast Period | 2021 - 2026 |

| Estimated Market Value ( USD | $ 13.2 Billion |

| Forecasted Market Value ( USD | $ 19.2 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 19 |