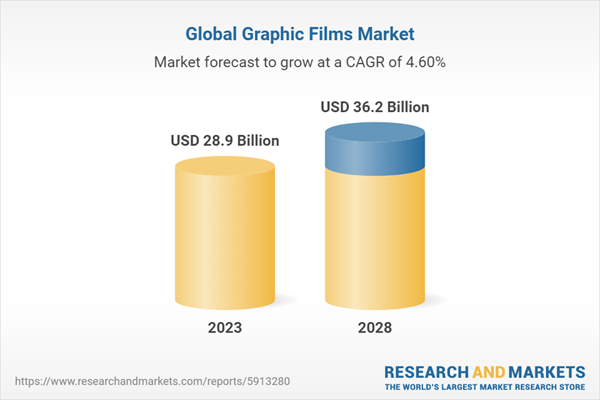

The graphic film market size is estimated to be USD 28.9 billion in 2023, and it is projected to reach USD 36.2 billion by 2028 at a CAGR of 4.6%. The market of global graphic film is on an upward trajectory due to the increasing promotional and advertising activities which help in providing information about the products & services. Apart from this, the market growth is attributed to the rising automotive industry, where these films are used to wrap the vehicles. However, the progress of the market may face hindrances due to the fluctuations in the prices of raw materials.

Graphic film, a versatile layers or sheets that are composed of polymer compounds, plays a pivotal role in storing diverse information and serves as an effective means of communication. Hence as a result of this, it is widely used to notify and guide the customers about the services and products. Apart from this, It is also used to provide a protective coating while simultaneously enhancing the aesthetic appeal of products.

Opaque films is the biggest film type segment of the graphic films market.

The opaque films segment within the graphic film market is anticipated to exhibit the most substantial compound annual growth rate (CAGR), particularly in terms of value, during the forecast period. Opaque graphic films are versatile and can be used in various applications. They are suitable for both indoor and outdoor use, making them adaptable to different environments. Opaque films provide excellent coverage, ensuring that the graphics or information displayed on them are not affected by background elements. This makes them highly visible and impactful, particularly in situations where clarity and legibility are crucial.

Polyvinyl Chloride is the largest by-product type segment of the graphic film market.

The polyvinyl chloride by-product type segment is going to take the lead in the graphic film market from 2023 to 2028, in terms of value. PVC-type graphic film may be chosen for its qualities, such as being resistant to moisture, chemicals, and weathering, making it suitable for both indoor and outdoor applications. The use of PVC-type graphic films contributes to their versatility and ability to withstand different environmental conditions, making them a popular choice in the signage and printing industries.

Automotive is the second-fastest end-use industry segment of the graphic films market.

In the graphic film market, the automotive industry emerged as the second fastest segment during the forecast period. The graphic film used in the automotive industry, particularly vehicle wrap films, offers a combination of aesthetic appeal, customization, and protective functionality. It is a popular choice for businesses and individuals looking to enhance the visual impact of vehicles. It is designed to withstand outdoor elements, including UV exposure, harsh weather conditions, and road debris. It also helps in providing protection to the underlying paint and can extend the life of the vehicle's finish.

Digital is the second-fastest printing technology segment of the graphic films market.

In the graphic film market, digital printing technology emerged as the second-fastest segment during the forecast period. Unlike traditional printing methods, digital printing allows for shorter print runs, reduced setup times, and the ability to produce high-quality, vibrant images with intricate details. This versatility has captured the attention of businesses across various sectors, driving the demand for graphic film that can be seamlessly integrated into diverse applications such as advertising, decoration, signage, and others.

Calendered is the most preferable manufacturing process in the graphic films market.

The calendered process has gained traction due to its cost-effectiveness and efficiency in large-scale production, making it an attractive choice for a diverse range of applications in several end-use industries such as automotive, promotional & advertisement, industrial, and others. From outdoor signage and banners to vehicle wraps and architectural graphics, the calendered process offers versatility and durability, meeting the demands of various end-users. As technology continues to enhance the performance of calendered films, providing improved printability and color retention, its prominence in the graphic film market is set to grow even further.

APAC is the fastest-growing market for graphic films.

The Asia-Pacific graphic film market is anticipated to achieve the highest Compound Annual Growth Rate (CAGR) in terms of value from 2023 to 2028. This outstanding growth of the market in the region is attributed to several factors such as increasing industrialization, and rising urbanization which leads to a higher demand for various products and services, including those that utilize graphic films for branding, advertising, and product enhancement. Apart from the region also witnesses extensive construction and infrastructure development, and the rising automotive industry which helps in growing the market of graphic film.

The breakdown of primary interviews is given below:

- By Company Type: Tier 1 - 35%, Tier 2 - 30%, and Tier 3 -35%

- By Designation: C-Level - 50%, Manager-Level - 30%, and Others - 20%

- By Region: North America - 23%, Europe - 23%, APAC - 40%, Middle East & Africa - 10%, and South America - 5%

The key companies profiled in this report on the graphic films market include 3M (US), Avery Dennison Corporation (US), DuPont de Nemours Inc. (US), CCL Industries (Canada), Fedrigoni S.P.A. (Italy), ORAFOL Europe GmbH (Germany), HEXIS S.A.S. (France), Arlon Graphics, LLC (US), Achilles USA Inc.(US), Dunmore (US), Drytac (US), LX Hausys (South Korea), and others are the key players operating in the graphic film market.

Research Coverage

The graphic film market has been segmented based on product type, film type, end-use industry, printing technology, manufacturing process, and region. This report covers the graphic film market and forecasts its market size until 2028. It also provides detailed information on company profiles and competitive strategies adopted by the key players to strengthen their position in the graphic film market. The report also provides insights into the drivers and restraints in the graphic film market along with opportunities and challenges. The report also includes profiles of top manufacturers in the graphic film market.

Reasons to Buy the Report

The report is expected to help market leaders/new entrants in the following ways:

- This report segments the graphic film market and provides the closest approximations of revenue numbers for the overall market and its segments across different verticals and regions.

- This report is expected to help stakeholders understand the pulse of the graphic film market and provide information on key market drivers, restraints, challenges, and opportunities influencing the market growth.

- This report is expected to help stakeholders obtain an in-depth understanding of the competitive landscape of the graphic films market and gain insights to improve the position of their businesses. The competitive landscape section includes detailed information on strategies, such as acquisitions, expansions, new product developments, and partnerships/collaborations/agreements.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising construction industry and improved living standards, low installation & maintenance cost, rising demand for wrap advertisements), restraints (Volatile raw material prices, and stringent government regulations regarding raw materials used for graphic film manufacturing), opportunities (Increase in demand for bioplastic polymers, and continuous advancements in digital printing techniques), and challenges (limited recycling options) influencing the growth of the graphic films market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the graphic film market

- Market Development: Comprehensive information about lucrative markets - the report analyses the graphic film market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the graphic film market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like 3M (US), Avery Dennison Corporation (US), DuPont de Nemours Inc. (US), CCL Industries (Canada), Fedrigoni S.P.A. (Italy), ORAFOL Europe GmbH (Germany), HEXIS S.A.S. (France), Arlon Graphics, LLC (US), Achilles USA Inc.(US), Dunmore (US), Drytac (US), LX Hausys (South Korea), and others.

Table of Contents

Companies Mentioned

- 3M

- Acco Brands

- Achilles Usa Inc.

- Arlon Graphics, LLC

- Avery Dennison Corporation

- Bridgehead Co., Ltd.

- CCL Industries

- Celadon Technology Company Ltd.

- Continental Grafix Usa, Inc.

- Contra Vision Limited

- Cosmo Films Limited

- Drytac

- Dunmore

- Dupont De Nemours, Inc.

- Fedrigoni S.P.A.

- Garware Hi-Tech Films Limited

- Hexis S.A.S.

- Jessup Manufacturing Company

- Jiangsu Aoli New Materials Co., Ltd.

- Lintec Corporation

- LX Hausys

- Mativ

- Nekoosa

- Orafol Europe GmbH

- Taghleef Industries

- The Griff Network

- Ultraflex Systems Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 231 |

| Published | December 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 28.9 Billion |

| Forecasted Market Value ( USD | $ 36.2 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |