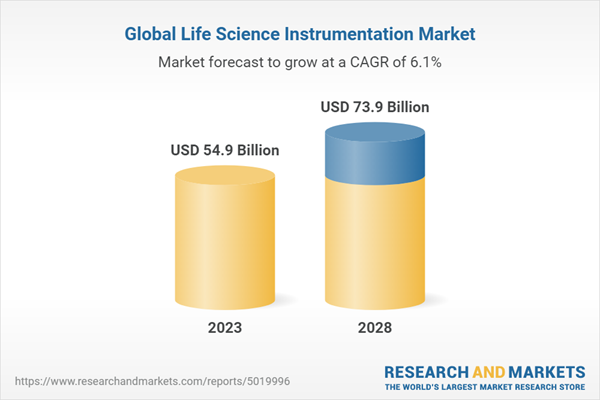

The global life science instrumentation market is projected to reach USD 73.9 billion by 2028 from USD 54.9 billion in 2023, at a CAGR of 6.1% from 2023 to 2028. Factors such as increasing funding and grants supporting research and development, rising proteomics research, and increasing prevalence of life-threatening diseases are responsible for the increasing growth of this market.

The spectroscopy segment held the largest share of the market in 2022

Based on technology, the life science instrumentation market is segmented into spectroscopy chromatography, PCR, immunoassays, lyophilization, liquid handling systems, clinical chemistry analyzers, microscopy, flow cytometry, NGS, centrifuges, electrophoresis, cell counting, and other technologies. The spectroscopy segment held the largest market share in 2022. The large share of this segment can be attributed to the launch of technologically advanced products and rising application in F&B to ensure quality of food products.

The research applications segment is projected to register the highest CAGR during the forecast period

Based on application, the life science instrumentation market is segmented into research applications, clinical & diagnostic applications, and other applications. The research applications segment is projected to register the highest CAGR from 2023 to 2028. Factors such as the rising use of life science equipment for disease diagnosis, cancer research, and increasing fundings to support research are driving the market growth.

The market in the Asia Pacific region is expected to witness the highest growth during the forecast period

The life science instrumentation market in the APAC region is expected to register a CAGR during the forecast period, primarily due to the rising use of life science instruments by the applied industries and increasing focus of major players in the region.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1 - 48%, Tier 2 - 36%, and Tier 3 - 16%

- By Designation: C-level - 10%, Director-level - 14%, and Others - 76%

- By Region: North America - 40%, Europe - 32%, Asia Pacific - 20%, Latin America - 5%, and the Middle East & Africa - 3%

The prominent players in the life science instrumentation market are Thermo Fisher Scientific Inc. (US), Danaher Corporation (US), Agilent Technologies, Inc. (US), Waters Corporation (US), Shimadzu Corporation (Japan), Becton, Dickinson and Company (US), PerkinElmer Inc. (US), Bio-Rad Laboratories, Inc. (US), Bruker (US), and Hitachi High-Technologies Corporation (Japan).

Research Coverage

This report studies the life science instrumentation market based on technology, application, end user, and region. It also covers the factors affecting market growth, analyzes the various opportunities and challenges in the market, and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micromarkets with respect to their growth trends and forecasts the revenue of the market segments with respect to five main regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall life science instrumentation market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

This report provides insights on the following pointers:

- Analysis of key drivers (rising food safety concerns, growing investments in pharmaceutical R&D, increasing prevalence of infectious diseases), restraints (shortage of skilled professionals, high cost of instruments), opportunities (increasing demand for analytical tools in emerging countries, growing pharmaceutical and biotechnology industries, and rising opportunities in emerging countries), and challenges (inadequate infrastructure in emerging countries for research, ethical issues related to privacy of data generated from instruments/software) influencing the growth of the life science instrumentation market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the life science instrumentation market

- Market Development: Comprehensive information about lucrative markets - the report analyses the life science instrumentation market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the life science instrumentation market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Thermo Fisher Scientific Inc. (US), Danaher Corporation (US), Agilent Technologies, Inc. (US), Waters Corporation (US), Shimadzu Corporation (Japan).

Table of Contents

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Market Segmentation

1.3.1 Markets Covered

1.3.2 Geographical Scope

1.4 Years Considered

1.5 Currency Considered

1.6 Research Limitations

1.7 Stakeholders

1.8 Summary of Changes

Figure 1 Life Science Instrumentation Market: Research Design Methodology

2.1.1 Secondary Research

2.1.2 Primary Research

2.1.2.1 Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

Figure 2 Breakdown of Primary Interviews: Supply-Side and Demand-Side Participants

Figure 3 Breakdown of Primary Interviews: by Company Type, Designation, and Region

2.2 Market Size Estimation

Figure 4 Research Methodology: Hypothesis Building

2.2.1 Bottom-Up Approach

2.2.1.1 Approach 1: Company Revenue Estimation

2.2.1.2 Approach 2: Customer-Based Market Estimation

Figure 5 Bottom-Up Approach for Market Size Estimation: Life Science Instrumentation Market

2.2.1.3 Growth Forecast

2.2.1.4 CAGR Projection Analysis

Figure 6 CAGR Projection: Supply-Side Analysis

2.3 Data Triangulation Approach

Figure 7 Data Triangulation Methodology

2.4 Market Share Estimation

2.5 Study Assumptions and Risk Assessment Analysis

Table 1 Impact of Research Assumptions

2.6 Risk Assessment

2.6.1 Impact of Risk Analysis

2.7 Growth Rate Assumptions

2.8 Recession Impact Analysis

Figure 9 Life Science Instrumentation Market, by Application, 2023 Vs. 2028 (USD Million)

Figure 10 Life Science Instrumentation Market, by End-user, 2023 Vs. 2028 (USD Million)

Figure 11 Asia-Pacific to Dominate Market During Forecast Period

Figure 12 Rising Investments in Pharmaceutical R&D and Increasing Technological Advancements to Drive Market

4.2 North America: Life Science Instrumentation Market, by Technology

Figure 13 Spectroscopy Segment to Dominate Market During Forecast Period

4.3 Asia-Pacific: Life Science Instrumentation Market, by Application, 2023 Vs. 2028

Figure 14 Research Applications Segment to Dominate Market During Study Period

4.4 Geographical Snapshot of Life Science Instrumentation Market

Figure 15 China to Account for Highest CAGR During Forecast Period

5.2 Market Dynamics

Figure 16 Life Science Instrumentation Market: Key Drivers, Restraints, Opportunities, and Challenges

5.2.1 Drivers

5.2.1.1 Rising Investments in Pharmaceutical R&D

5.2.1.2 Growing Concerns Regarding Food Contamination

5.2.1.3 Increasing Public-Private Investments in Life Science Research

5.2.1.4 Rising Incidence of Infectious Diseases and Genetic Disorders

5.2.1.5 Technological Advancements in Ngs Platforms

5.2.1.6 Growing Significance of Biomolecular Analysis

5.2.1.7 Growing Use of Capillary Electrophoresis with Mass Spectroscopy

5.2.1.8 Increasing Adoption of Flow Cytometry Techniques in Research Laboratories

5.2.1.9 Rising Incidence of Hospital-Acquired Infections

5.2.2 Restraints

5.2.2.1 Premium Product Pricing for Instruments

5.2.2.2 Shortage of Skilled Professionals

5.2.2.3 Technical Limitations Associated with Qpcr and Dpcr Techniques

5.2.2.4 High Cost of Advanced Microscopes

5.2.3 Opportunities

5.2.3.1 Growth Opportunities in Emerging Economies

5.2.3.1.1 Rising Focus of Key Players on Emerging Markets

5.2.3.1.2 Rising Growth in Pharmaceutical & Biotechnology Industries

5.2.3.2 Broad Applications of Analytical Instruments Across Industries

5.2.3.3 Application of Ngs in Precision Medicine and Molecular Diagnostics

5.2.3.4 Growing Preference for Personalized Medicine

5.2.4 Challenges

5.2.4.1 Inadequate Healthcare Infrastructure in Emerging Economies

5.2.4.2 Data Privacy Concerns Associated with Ngs Software

5.3 Industry Trends

5.3.1 Rising Focus on Development of Miniature Instruments

5.3.2 Increasing Adoption of Hyphenated Technologies

5.3.3 Collaborations Between Analytical Instrument Manufacturers and Research-Academia

5.4 Porter's Five Forces Analysis

Table 2 Life Science Instrumentation Market: Porter's Five Forces Analysis

5.4.1 Threat of New Entrants

5.4.2 Threat of Substitutes

5.4.3 Bargaining Power of Suppliers

5.4.4 Bargaining Power of Buyers

5.4.5 Intensity of Competitive Rivalry

5.5 Trade Analysis

Table 3 Import Data for Instruments and Apparatus for Physical & Chemical Analysis, by Country, 2018-2022 (USD Thousand)

Table 4 Export Data for Instruments and Apparatus for Physical & Chemical Analysis, by Country, 2018-2022 (USD Thousand)

Table 5 Import Data for Electron Microscopes, Proton Microscopes, and Diffraction Apparatus, by Country, 2018-2022 (USD Thousand)

Table 6 Export Data for Electron Microscopes, Proton Microscopes, and Diffraction Apparatus, by Country, 2018-2022 (USD Thousand)

Table 7 Import Data for Centrifuges, by Country, 2018-2022 (USD Thousands)

Table 8 Export Data for Centrifuges, by Country, 2018-2022 (USD Thousands)

Table 9 Import Data for Lyophilization, by Country, 2018-2022 (USD Thousand)

Table 10 Export Data for Lyophilization, by Country, 2018-2022 (USD Thousands)

Table 11 Import Data for Liquid Handling, by Country, 2018-2022 (USD Thousands)

Table 12 Export Data for Liquid Handling, by Country, 2018-2022 (USD Thousands)

Table 13 Import Data for Cell Sorting, by Country, 2018-2022 (USD Thousands)

Table 14 Export Data for Cell Sorting, by Country, 2018-2022 (USD Thousands)

Table 15 Import Data for Cell Counting, by Country, 2018-2022 (USD Thousands)

Table 16 Export Data for Cell Counting, by Country, 2018-2022 (USD Thousands)

Table 17 Import Data for Flow Cytometry, by Country, 2018-2022 (USD Thousands)

Table 18 Export Data for Flow Cytometry, by Country, 2018-2022 (USD Thousands)

5.6 Patent Analysis

Figure 17 Top 10 Patent Applicants for Chromatography (January 2012-December 2022)

Figure 18 Top 10 Patent Applicants for Spectroscopy (January 2012-December 2022)

Figure 19 Top 10 Patent Applicants for Microscopy (January 2012-December 2022)

Figure 20 Top 10 Patent Applicants for Pcr (January 2012-December 2022)

Figure 21 Top 10 Patent Applicants for Liquid Handling (January 2012-December 2022)

Figure 22 Top 10 Patent Applicants for Next-Generation Sequencing (January 2012-December 2022)

Figure 23 Top 10 Patent Applicants for Electrophoresis (January 2012-December 2022)

5.7 Ecosystem Analysis

5.8 Value Chain Analysis

Figure 24 Value Chain Analysis

5.9 Supply Chain Analysis

5.9.1 Prominent Companies

5.9.2 Small & Medium-Sized Enterprises

5.9.3 End-users

Figure 25 Supply Chain Analysis

5.10 Pricing Trend Analysis

Table 19 Average Selling Price of Life Science Instruments

5.11 Technology Analysis

5.11.1 Hplc Technology

5.11.2 Spectroscopy

5.11.3 Microscopy

5.11.4 Pcr Technology

5.12 Case Study Analysis

5.12.1 Technological Challenges in Case 1

Table 20 Case 1: Getting Acquainted with Innovative Technologies

5.12.2 Technological Challenges in Case 2

Table 21 Case-2: Building a New and Automated Diagnostic Testing Laboratory

5.12.3 Increasing Sales Model in Case 3

Table 22 Case 3: Dependence on Contract Manufacturing and Outsourcing of Activities

5.13 Regulatory Analysis

5.13.1 US

5.13.2 Europe

5.13.3 Asia-Pacific

5.13.4 Rest of the World

5.14 Key Conferences and Events (2023-2024)

Table 23 Life Science Instrumentation Market: Major Conferences and Events (2023-2024)

Table 24 Life Science Instrumentation Market, by Technology, 2021-2028 (USD Million)

6.2 Spectroscopy

Table 25 Life Science Instrumentation Market for Spectroscopy, by Type, 2021-2028 (USD Million)

Table 26 Life Science Instrumentation Market for Spectroscopy, by Region, 2021-2028 (USD Million)

Table 27 Life Science Instrumentation Market for Spectroscopy, by Application, 2021-2028 (USD Million)

Table 28 Life Science Instrumentation Market for Spectroscopy, by End-user, 2021-2028 (USD Million)

6.2.1 Mass Spectrometers

6.2.1.1 Rising Analytical Applications in Laboratories to Drive Segment

Table 29 Life Science Instrumentation Market for Mass Spectrometers, by Region, 2021-2028 (USD Million)

6.2.2 Molecular Spectrometers

6.2.2.1 Applications in Pathology Detection and Protein Quantification to Propel Segment

Table 30 Life Science Instrumentation Market for Molecular Spectrometers, by Region, 2021-2028 (USD Million)

6.2.3 Atomic Spectrometers

6.2.3.1 Utilization in Environmental Testing and Industrial Chemistry to Support Segment

Table 31 Life Science Instrumentation Market for Atomic Spectrometers, by Region, 2021-2028 (USD Million)

6.3 Chromatography

Table 32 Life Science Instrumentation Market for Chromatography, by Type, 2021-2028 (USD Million)

Table 33 Life Science Instrumentation Market for Chromatography, by Region, 2021-2028 (USD Million)

Table 34 Life Science Instrumentation Market for Chromatography, by Application, 2021-2028 (USD Million)

Table 35 Life Science Instrumentation Market for Chromatography, by End-user, 2021-2028 (USD Million)

6.3.1 Liquid Chromatography Systems

6.3.1.1 Rising Use of Lc Systems in Pharmaceutical Processes to Drive Market

Table 36 Differentiation of Liquid Chromatography Systems

Table 37 Life Science Instrumentation Market for Liquid Chromatography Systems, by Region, 2021-2028 (USD Million)

6.3.2 Gas Chromatography Systems

6.3.2.1 Separation of Volatile Organic Compounds in Pharmaceutical and Food & Beverage Industries to Boost Market

Table 38 Life Science Instrumentation Market for Gas Chromatography Systems, by Region, 2021-2028 (USD Million)

6.3.3 Supercritical Fluid Chromatography Systems

6.3.3.1 Advantages of Low Viscosity and High Diffusivity to Support Market

Table 39 Life Science Instrumentation Market for Supercritical Fluid Chromatography Systems, by Region, 2021-2028 (USD Million)

6.3.4 Thin-Layer Chromatography Systems

6.3.4.1 Rising Use of Tlc to Separate Several Samples Concurrently to Aid Market

Table 40 Life Science Instrumentation Market for Thin-Layer Chromatography Systems, by Region, 2021-2028 (USD Million)

6.4 Polymerase Chain Reaction (Pcr)

Table 41 Life Science Instrumentation Market for Polymerase Chain Reaction, by Type, 2021-2028 (USD Million)

Table 42 Life Science Instrumentation Market for Polymerase Chain Reaction, by Region, 2021-2028 (USD Million)

Table 43 Life Science Instrumentation Market for Polymerase Chain Reaction, by Application, 2021-2028 (USD Million)

Table 44 Life Science Instrumentation Market for Polymerase Chain Reaction, by End-user, 2021-2028 (USD Million)

6.4.1 Quantitative Pcr (Qpcr)

6.4.1.1 Increasing Adoption of Qpcr Among Researchers and Healthcare Professionals to Drive Segment

Table 45 Life Science Instrumentation Market for Qpcr, by Region, 2021-2028 (USD Million)

6.4.2 Digital Pcr (Dpcr)

6.4.2.1 Ongoing Technological Developments to Drive Segment

Table 46 Life Science Instrumentation Market for Dpcr, by Region, 2021-2028 (USD Million)

6.5 Immunoassays

6.5.1 High Sensitivity and Accuracy of Immunoassay Tests to Aid Market

Table 47 Life Science Instrumentation Market for Immunoassays, by Region, 2021-2028 (USD Million)

Table 48 Life Science Instrumentation Market for Immunoassays, by Application, 2021-2028 (USD Million)

Table 49 Life Science Instrumentation Market for Immunoassays, by End-user, 2021-2028 (USD Million)

6.6 Lyophilization

Table 50 Life Science Instrumentation Market for Lyophilization, by Type, 2021-2028 (USD Million)

Table 51 Life Science Instrumentation Market for Lyophilization, by Region, 2021-2028 (USD Million)

Table 52 Life Science Instrumentation Market for Lyophilization, by Application, 2021-2028 (USD Million)

Table 53 Life Science Instrumentation Market for Lyophilization, by End-user, 2021-2028 (USD Million)

6.6.1 Tray-Style Freeze Dryers

6.6.1.1 Rising Demand for Freeze-Dried in Pharmaceutical Industry to Propel Segment

Table 54 Life Science Instrumentation Market for Tray-Style Freeze Dryers, by Region, 2021-2028 (USD Million)

6.6.2 Manifold Freeze Dryers

6.6.2.1 Rising Use in Laboratories for Storage of Bottles and Vials to Drive Segment

Table 55 Life Science Instrumentation Market for Manifold Freeze Dryers, by Region, 2021-2028 (USD Million)

6.6.3 Shell (Rotary) Freeze Dryers

6.6.3.1 Rising Research for Development of Food Ingredients and Biologic Molecules to Drive Segment

Table 56 Life Science Instrumentation Market for Shell (Rotary) Freeze Dryers, by Region, 2021-2028 (USD Million)

6.7 Liquid Handling Systems

Table 57 Life Science Instrumentation Market for Liquid Handling Systems, by Type, 2021-2028 (USD Million)

Table 58 Life Science Instrumentation Market for Liquid Handling Systems, by Region, 2021-2028 (USD Million)

Table 59 Life Science Instrumentation Market for Liquid Handling Systems, by Application, 2021-2028 (USD Million)

Table 60 Life Science Instrumentation Market for Liquid Handling Systems, by End-user, 2021-2028 (USD Million)

6.7.1 Electronic Liquid Handling Systems

6.7.1.1 High Accuracy and Reproducibility Benefits in Pharmaceutical Industry to Augment Segment

Table 61 Life Science Instrumentation Market for Electronic Liquid Handling Systems, by Region, 2021-2028 (USD Million)

6.7.2 Automated Liquid Handling Systems

6.7.2.1 Elimination of Cross-Contamination and Clogging to Drive Segment

Table 62 Life Science Instrumentation Market for Automated Liquid Handling Systems, by Region, 2021-2028 (USD Million)

6.7.3 Manual Liquid Handling Systems Market

6.7.3.1 Rising Use of Manual Systems by Small-Scale Industries to Drive Segment

Table 63 Life Science Instrumentation Market for Manual Liquid Handling Systems, by Region, 2021-2028 (USD Million)

6.8 Clinical Chemistry Analyzers

6.8.1 Rising Volume of Clinical Testing Procedures to Drive Market

Table 64 Life Science Instrumentation Market for Clinical Chemistry Analyzers, by Region, 2021-2028 (USD Million)

Table 65 Life Science Instrumentation Market for Clinical Chemistry Analyzers, by Application, 2021-2028 (USD Million)

Table 66 Life Science Instrumentation Market for Clinical Chemistry Analyzers, by End-user, 2021-2028 (USD Million)

6.9 Microscopy

Table 67 Life Science Instrumentation Market for Microscopy, by Type, 2021-2028 (USD Million)

Table 68 Life Science Instrumentation Market for Microscopy, by Region, 2021-2028 (USD Million)

Table 69 Life Science Instrumentation Market for Microscopy, by Application, 2021-2028 (USD Million)

Table 70 Life Science Instrumentation Market for Microscopy, by End-user, 2021-2028 (USD Million)

6.9.1 Optical Microscopes

6.9.1.1 Low Maintenance Costs and Ease of Use to Drive Segment

Table 71 Life Science Instrumentation Market for Optical Microscopes, by Region, 2021-2028 (USD Million)

6.9.2 Electron Microscopes

6.9.2.1 Increasing R&D and Availability of Funds to Support Segment

Table 72 Life Science Instrumentation Market for Electron Microscopes, by Region, 2021-2028 (USD Million)

6.9.3 Scanning Probe Microscopes

6.9.3.1 Rising Applications in Nanotechnology Research to Fuel Segment

Table 73 Life Science Instrumentation Market for Scanning Probe Microscopes, by Region, 2021-2028 (USD Million)

6.9.4 Other Microscopes

Table 74 Life Science Instrumentation Market for Other Microscopes, by Region, 2021-2028 (USD Million)

6.10 Flow Cytometry

Table 75 Life Science Instrumentation Market for Flow Cytometry, by Type, 2021-2028 (USD Million)

Table 76 Life Science Instrumentation Market for Flow Cytometry, by Region, 2021-2028 (USD Million)

Table 77 Life Science Instrumentation Market for Flow Cytometry, by Application, 2021-2028 (USD Million)

Table 78 Life Science Instrumentation Market for Flow Cytometry, by End-user, 2021-2028 (USD Million)

6.10.1 Cell Analyzers

6.10.1.1 Ongoing Technological Advancements Resulting in Innovative Product Launches to Fuel Market

Table 79 Life Science Instrumentation Market for Cell Analyzers, by Region, 2021-2028 (USD Million)

6.10.2 Cell Sorters

6.10.2.1 Utilization of Cost-Efficient Cell Sorters in Core Laboratory Functions to Drive Market

Table 80 Life Science Instrumentation Market for Cell Sorters, by Region, 2021-2028 (USD Million)

6.11 Next-Generation Sequencing (Ngs)

6.11.1 Wide Application in Personalized Medicine for Cancer and Genetic Disorders to Drive Market

Table 81 Life Science Instrumentation Market for Next-Generation Sequencing, by Region, 2021-2028 (USD Million)

Table 82 Life Science Instrumentation Market for Next-Generation Sequencing, by Application, 2021-2028 (USD Million)

Table 83 Life Science Instrumentation Market for Next-Generation Sequencing, by End-user, 2021-2028 (USD Million)

6.12 Centrifuges

Table 84 Life Science Instrumentation Market for Centrifuges, by Type, 2021-2028 (USD Million)

Table 85 Life Science Instrumentation Market for Centrifuges, by Region, 2021-2028 (USD Million)

Table 86 Life Science Instrumentation Market for Centrifuges, by Application, 2021-2028 (USD Million)

Table 87 Life Science Instrumentation Market for Centrifuges, by End-user, 2021-2028 (USD Million)

6.12.1 Microcentrifuges

6.12.1.1 Growing Use in Blood Transfusion and Biomedical Analysis to Support Segment

Table 88 Life Science Instrumentation Market for Microcentrifuges, by Region, 2021-2028 (USD Million)

6.12.2 Multipurpose Centrifuges

6.12.2.1 Applications in Cell Culture and Microbiology to Propel Segment

Table 89 Life Science Instrumentation Market for Multipurpose Centrifuges, by Region, 2021-2028 (USD Million)

6.12.3 Minicentrifuges

6.12.3.1 Compact-Sized and Smooth Functioning in Clinical & Diagnostic Applications to Support Segment

Table 90 Life Science Instrumentation Market for Minicentrifuges, by Region, 2021-2028 (USD Million)

6.12.4 Ultracentrifuges

6.12.4.1 Routine Density and Size-Gradient Separations to Support Adoption of Ultracentrifuges

Table 91 Life Science Instrumentation Market for Ultracentrifuges, by Region, 2021-2028 (USD Million)

6.13 Electrophoresis

Table 92 Life Science Instrumentation Market for Electrophoresis, by Type, 2021-2028 (USD Million)

Table 93 Life Science Instrumentation Market for Electrophoresis, by Region, 2021-2028 (USD Million)

Table 94 Life Science Instrumentation Market for Electrophoresis, by Application, 2021-2028 (USD Million)

Table 95 Life Science Instrumentation Market for Electrophoresis, by End-user, 2021-2028 (USD Million)

6.13.1 Gel Electrophoresis Systems

6.13.1.1 Rising Demand in Proteomics Research and Personalized Medicine to Support Market

Table 96 Life Science Instrumentation Market for Gel Electrophoresis Systems, by Region, 2021-2028 (USD Million)

6.13.2 Capillary Electrophoresis Systems

6.13.2.1 Numerous Analytical Benefits Offered by Ce Systems to Support Segment

Table 97 Life Science Instrumentation Market for Capillary Electrophoresis Systems, by Region, 2021-2028 (USD Million)

6.14 Cell Counting

Table 98 Life Science Instrumentation Market for Cell Counting, by Type, 2021-2028 (USD Million)

Table 99 Life Science Instrumentation Market for Cell Counting, by Region, 2021-2028 (USD Million)

Table 100 Life Science Instrumentation Market for Cell Counting, by Application, 2021-2028 (USD Million)

Table 101 Life Science Instrumentation Market for Cell Counting, by End-user, 2021-2028 (USD Million)

6.14.1 Automated Cell Counters

6.14.1.1 Growing Focus on Research for Life-Threatening Diseases to Drive Market

Table 102 Life Science Instrumentation Market for Automated Cell Counters, by Region, 2021-2028 (USD Million)

6.14.2 Hemocytometers and Manual Cell Counters

6.14.2.1 Rising Use of Manual Cell Counters Over Automated Cell Counters to Support Market

Table 103 Life Science Instrumentation Market for Hemocytometers and Manual Cell Counters, by Region, 2021-2028 (USD Million)

6.15 Other Technologies

Table 104 Life Science Instrumentation Market for Other Technologies, by Type, 2021-2028 (USD Million)

Table 105 Life Science Instrumentation Market for Other Technologies, by Region, 2021-2028 (USD Million)

6.15.1 Laboratory Freezers

6.15.1.1 Rising Demand for Blood and Blood Components to Drive Market

Table 106 Life Science Instrumentation Market for Laboratory Freezers, by Type, 2021-2028 (USD Million)

Table 107 Life Science Instrumentation Market for Laboratory Freezers, by Region, 2021-2028 (USD Million)

6.15.1.2 Freezers

6.15.1.3 Refrigerators

6.15.1.3.1 Blood Bank Refrigerators

6.15.1.3.2 Chromatography Refrigerators

6.15.1.3.3 Explosion-Proof Refrigerators

6.15.1.3.4 Flammable Material Refrigerators

6.15.1.3.5 Laboratory Refrigerators

6.15.1.3.6 Pharmacy Refrigerators

6.15.1.3.7 Cryopreservation Systems

6.15.2 Heat Sterilization

6.15.2.1 Rising Incidence of Hospital-Acquired Infections to Drive Market

Table 108 Life Science Instrumentation Market for Heat Sterilization, by Type, 2021-2028 (USD Million)

Table 109 Life Science Instrumentation Market for Heat Sterilization, by Region, 2021-2028 (USD Million)

6.15.2.2 Moist Heat/Steam Sterilization Instruments

6.15.2.3 Dry Heat Sterilization Instrumentation

Table 110 Drying Cycles Recommended as Per Bp (British Pharmacopeia), 1988

6.15.3 Microplate Systems

6.15.3.1 Wide Applications in Several Industries to Support Market Growth

Table 111 Life Science Instrumentation Market for Microplate Systems, by Type, 2021-2028 (USD Million)

Table 112 Life Science Instrumentation Market for Microplate Systems, by Region, 2021-2028 (USD Million)

6.15.3.2 Microplate Readers

6.15.3.3 Microplate Dispensers

6.15.3.4 Microplate Washers

6.15.4 Laboratory Balances

6.15.4.1 Increasing Adoption of Laboratory Balances due to Technical Benefits to Support Market Growth

Table 113 Life Science Instrumentation Market for Laboratory Balances, by Region, 2021-2028 (USD Million)

6.15.5 Colorimeters

6.15.5.1 Low Price and Ease of Operation to Support Market

Table 114 Life Science Instrumentation Market for Colorimeters, by Region, 2021-2028 (USD Million)

6.15.6 Incubators

6.15.6.1 Rising Demand for Microbiological Applications to Drive Market

Table 115 Life Science Instrumentation Market for Incubators, by Region, 2021-2028 (USD Million)

6.15.7 Fume Hoods

6.15.7.1 Improvements in Device Structure to Fuel Market

Table 116 Life Science Instrumentation Market for Fume Hoods, by Region, 2021-2028 (USD Million)

6.15.8 Robotic Systems

6.15.8.1 Technological Advancements to Support Market

Table 117 Life Science Instrumentation Market for Robotic Systems, by Type, 2021-2028 (USD Million)

Table 118 Life Science Instrumentation Market for Robotic Systems, by Region, 2021-2028 (USD Million)

6.15.8.2 Robotic Arms

6.15.8.3 Track Robot Systems

6.15.9 Ph Meters

6.15.9.1 Applications in Pharmaceutical and Food & Beverage Industries to Drive Market

Table 119 Life Science Instrumentation Market for Ph Meters, by Region, 2021-2028 (USD Million)

6.15.10 Conductivity and Resistivity Meters

6.15.10.1 Efficient Operation and Low Cost Benefits to Support Market

Table 120 Life Science Instrumentation Market for Conductivity and Resistivity Meters, by Region, 2021-2028 (USD Million)

6.15.11 Dissolved Co2 and O2 Meters

6.15.11.1 Rising Utilization in Water Testing to Fuel Market

Table 121 Life Science Instrumentation Market for Dissolved Co2 and O2 Meters, by Region, 2021-2028 (USD Million)

6.15.12 Titrators

6.15.12.1 Quality Control Testing for Industrial Chemical Applications to Support Market Growth

Table 122 Life Science Instrumentation Market for Titrators, by Region, 2021-2028 (USD Million)

6.15.13 Gas Analyzers

6.15.13.1 Utilization in Iron and Steel Industries to Support Market Growth

Table 123 Life Science Instrumentation Market for Gas Analyzers, by Region, 2021-2028 (USD Million)

6.15.14 Toc Analyzers

6.15.14.1 Critical Parameter for Water Testing & Purification to Drive Market

Table 124 Life Science Instrumentation Market for Toc Analyzers, by Region, 2021-2028 (USD Million)

6.15.15 Thermal Analyzers

6.15.15.1 Applications in Polymer & Metal Industries to Fuel Segment

Table 125 Life Science Instrumentation Market for Thermal Analyzers, by Region, 2021-2028 (USD Million)

6.15.16 Shakers/Rotators and Stirrers

6.15.16.1 Increasing Research in Pharmaceutical & Biotechnology Research to Drive Market

Table 126 Life Science Instrumentation Market for Shakers/Rotators and Stirrers, by Region, 2021-2028 (USD Million)

Table 127 Life Science Instrumentation Market, by Application, 2021-2028 (USD Million)

7.2 Research Applications

7.2.1 Rising Research Activities in Drug Discovery & Biomarker Development to Fuel Market

Table 128 Life Science Instrumentation Market for Research Applications, by Region, 2021-2028 (USD Million)

7.3 Clinical & Diagnostic Applications

7.3.1 Rising Prevalence of Infectious & Target Diseases to Drive Market

Table 129 Life Science Instrumentation Market for Clinical & Diagnostic Applications Market, by Region, 2021-2028 (USD Million)

7.4 Other Applications

Table 130 Life Science Instrumentation Market for Other Applications, by Region, 2021-2028 (USD Million)

Table 131 Life Science Instrumentation Market, by End-user, 2021-2028 (USD Million)

8.2 Hospitals and Diagnostic Laboratories

8.2.1 Growing Adoption of Molecular Diagnostics to Drive Market

Table 132 Life Science Instrumentation Market for Hospitals and Diagnostic Laboratories, by Region, 2021-2028 (USD Million)

8.3 Pharmaceutical & Biotechnology Companies

8.3.1 Growing Focus on Expanding R&D for Therapeutic Drug Pipelines to Drive Market

Table 133 Life Science Instrumentation Market for Pharmaceutical & Biotechnology Companies, by Region, 2021-2028 (USD Million)

8.4 Academic & Research Institutes

8.4.1 Increasing Number of Clinical Trials and Research Activities to Bolster Demand for Life Science Instruments

Table 134 Life Science Instrumentation Market for Academic & Research Institutes, by Region, 2021-2028 (USD Million)

8.5 Agriculture & Food Industries

8.5.1 Growing Focus on Food Safety and Quality Control to Drive Market

Table 135 Life Science Instrumentation Market for Agriculture & Food Industries, by Region, 2021-2028 (USD Million)

8.6 Environmental Testing Laboratories

8.6.1 Increasing Adoption of Chromatography Instruments for Air Quality Testing to Drive Market

Table 136 Life Science Instrumentation Market for Environmental Testing Laboratories, by Region, 2021-2028 (USD Million)

8.7 Clinical Research Organizations

8.7.1 Outsourcing of R&D Activities by Pharma & Biotech Companies to Support Market Growth

Table 137 Life Science Instrumentation Market for Clinical Research Organizations Market, by Region, 2021-2028 (USD Million)

8.8 Other End-users

Table 138 Life Science Instrumentation Market for Other End-users, by Region, 2021-2028 (USD Million)

Table 139 Life Science Instrumentation Market, by Region, 2021-2028 (USD Million)

9.2 North America

Figure 26 North America: Life Science Instrumentation Market Snapshot

Table 140 North America: Life Science Instrumentation Market, by Country, 2021-2028 (USD Million)

Table 141 North America: Life Science Instrumentation Market, by Technology, 2021-2028 (USD Million)

Table 142 North America: Life Science Instrumentation Market for Spectroscopy, by Type, 2021-2028 (USD Million)

Table 143 North America: Life Science Instrumentation Market for Chromatography, by Type, 2021-2028 (USD Million)

Table 144 North America: Life Science Instrumentation Market for Pcr, by Type, 2021-2028 (USD Million)

Table 145 North America: Life Science Instrumentation Market for Lyophilization, by Type, 2021-2028 (USD Million)

Table 146 North America: Life Science Instrumentation Market for Liquid Handling, by Type, 2021-2028 (USD Million)

Table 147 North America: Life Science Instrumentation Market for Microscopy, by Type, 2021-2028 (USD Million)

Table 148 North America: Life Science Instrumentation Market for Flow Cytometry, by Type, 2021-2028 (USD Million)

Table 149 North America: Life Science Instrumentation Market for Centrifuges, by Type, 2021-2028 (USD Million)

Table 150 North America: Life Science Instrumentation Market for Electrophoresis, by Type, 2021-2028 (USD Million)

Table 151 North America: Life Science Instrumentation Market for Cell Counting, by Type, 2021-2028 (USD Million)

Table 152 North America: Life Science Instrumentation Market for Other Technologies, by Type, 2021-2028 (USD Million)

Table 153 North America: Life Science Instrumentation Market, by Application, 2021-2028 (USD Million)

Table 154 North America: Life Science Instrumentation Market, by End-user, 2021-2028 (USD Million)

9.2.1 US

9.2.1.1 Increased Presence of Major Pharmaceutical and Biotechnology Companies to Drive Market

Table 155 US: Life Science Instrumentation Market, by Technology, 2021-2028 (USD Million)

9.2.2 Canada

9.2.2.1 Increasing Funding for Genomic and Clinical Research to Increase Adoption of Life Science Instrumentation Technologies

Table 156 Canada: Life Science Instrumentation Market, by Technology, 2021-2028 (USD Million)

9.3 Europe

Table 157 Europe: Life Science Instrumentation Market, by Country, 2021-2028 (USD Million)

Table 158 Europe: Life Science Instrumentation Market, by Technology, 2021-2028 (USD Million)

Table 159 Europe: Life Science Instrumentation Market for Spectroscopy, by Type, 2021-2028 (USD Million)

Table 160 Europe: Life Science Instrumentation Market for Chromatography, by Type, 2021-2028 (USD Million)

Table 161 Europe: Life Science Instrumentation Market for Pcr, by Type, 2021-2028 (USD Million)

Table 162 Europe: Life Science Instrumentation Market for Lyophilization, by Type, 2021-2028 (USD Million)

Table 163 Europe: Life Science Instrumentation Market for Liquid Handling, by Type, 2021-2028 (USD Million)

Table 164 Europe: Life Science Instrumentation Market for Microscopy, by Type, 2021-2028 (USD Million)

Table 165 Europe: Life Science Instrumentation Market for Flow Cytometry, by Type, 2021-2028 (USD Million)

Table 166 Europe: Life Science Instrumentation Market for Centrifuges, by Type, 2021-2028 (USD Million)

Table 167 Europe: Life Science Instrumentation Market for Electrophoresis, by Type, 2021-2028 (USD Million)

Table 168 Europe: Life Science Instrumentation Market for Cell Counting, by Type, 2021-2028 (USD Million)

Table 169 Europe: Life Science Instrumentation Market for Other Technologies, by Type, 2021-2028 (USD Million)

Table 170 Europe: Life Science Instrumentation Market, by Application, 2021-2028 (USD Million)

Table 171 Europe: Life Science Instrumentation Market, by End-user, 2021-2028 (USD Million)

9.3.1 Germany

9.3.1.1 Favorable Reimbursement and Insurance Scenarios for Various Diagnostic Tests to Support Market

Table 172 Germany: Life Science Instrumentation Market, by Technology, 2021-2028 (USD Million)

9.3.2 UK

9.3.2.1 Rising Number of Research Activities and Academia-Industry Partnerships to Propel Market

Table 173 UK: Life Science Instrumentation Market, by Technology, 2021-2028 (USD Million)

9.3.3 France

9.3.3.1 Increasing Investments in Infrastructure Development for Life Science R&D to Fuel Market

Table 174 France: Life Science Instrumentation Market, by Technology, 2021-2028 (USD Million)

9.3.4 Spain

9.3.4.1 Growing Focus on Cancer Research and Advanced R&D Structure to Support Market

Table 175 Spain: Life Science Instrumentation Market, by Technology, 2021-2028 (USD Million)

9.3.5 Italy

9.3.5.1 Growing Advancements in Biotechnology and Increasing R&D Investments by Pharmaceutical Companies to Boost Market

Table 176 Italy: Life Science Instrumentation Market, by Technology, 2021-2028 (USD Million)

9.3.6 Rest of Europe

Table 177 Rest of Europe: Life Science Instrumentation Market, by Technology, 2021-2028 (USD Million)

9.4 Asia-Pacific

Figure 27 Asia-Pacific: Life Science Instrumentation Market Snapshot

Table 178 Asia-Pacific: Life Science Instrumentation Market, by Country, 2021-2028 (USD Million)

Table 179 Asia-Pacific: Life Science Instrumentation Market, by Technology, 2021-2028 (USD Million)

Table 180 Asia-Pacific: Life Science Instrumentation Market for Spectroscopy, by Type, 2021-2028 (USD Million)

Table 181 Asia-Pacific: Life Science Instrumentation Market for Chromatography, by Type, 2021-2028 (USD Million)

Table 182 Asia-Pacific: Life Science Instrumentation Market for Pcr, by Type, 2021-2028 (USD Million)

Table 183 Asia-Pacific: Life Science Instrumentation Market for Lyophilization, by Type, 2021-2028 (USD Million)

Table 184 Asia-Pacific: Life Science Instrumentation Market for Liquid Handling, by Type, 2021-2028 (USD Million)

Table 185 Asia-Pacific: Life Science Instrumentation Market for Microscopy, by Type, 2021-2028 (USD Million)

Table 186 Asia-Pacific: Life Science Instrumentation Market for Flow Cytometry, by Type, 2021-2028 (USD Million)

Table 187 Asia-Pacific: Life Science Instrumentation Market for Centrifuges, by Type, 2021-2028 (USD Million)

Table 188 Asia-Pacific: Life Science Instrumentation Market for Electrophoresis, by Type, 2021-2028 (USD Million)

Table 189 Asia-Pacific: Life Science Instrumentation Market for Cell Counting, by Type, 2021-2028 (USD Million)

Table 190 Asia-Pacific: Life Science Instrumentation Market for Other Technologies, by Type, 2021-2028 (USD Million)

Table 191 Asia-Pacific: Life Science Instrumentation Market, by Application, 2021-2028 (USD Million)

Table 192 Asia-Pacific: Life Science Instrumentation Market, by End-user, 2021-2028 (USD Million)

9.4.1 Japan

9.4.1.1 Growing Adoption of Technologically Advanced Products to Increase Adoption of Life Science Instruments

Table 193 Japan: Life Science Instrumentation Market, by Technology, 2021-2028 (USD Million)

9.4.2 China

9.4.2.1 Increasing Production and Export of Pharmaceuticals to Favor Market Growth

Table 194 China: Life Science Instrumentation Market, by Technology, 2021-2028 (USD Million)

9.4.3 India

9.4.3.1 Increasing Healthcare Expenditure and Growing Availability of Advanced Molecular Diagnosis Technology to Drive Market

Table 195 India: Life Science Instrumentation Market, by Technology, 2021-2028 (USD Million)

9.4.4 Australia

9.4.4.1 Rising Healthcare Spending, Increasing Cancer Diagnostics, and Growing Agricultural Research to Augment Market

Table 196 Australia: Life Science Instrumentation Market, by Technology, 2021-2028 (USD Million)

9.4.5 South Korea

9.4.5.1 High Spending on Research Activities and Developments in Pharmaceutical Drug Discovery to Positively Influence Market

Table 197 South Korea: Life Science Instrumentation Market, by Technology, 2021-2028 (USD Million)

9.4.6 Rest of Asia-Pacific

Table 198 Rest of Asia-Pacific: Life Science Instrumentation Market, by Technology, 2021-2028 (USD Million)

9.5 Latin America

Table 199 Latin America: Life Science Instrumentation Market, by Country, 2021-2028 (USD Million)

Table 200 Latin America: Life Science Instrumentation Market, by Technology, 2021-2028 (USD Million)

Table 201 Latin America: Life Science Instrumentation Market for Spectroscopy, by Type, 2021-2028 (USD Million)

Table 202 Latin America: Life Science Instrumentation Market for Chromatography, by Type, 2021-2028 (USD Million)

Table 203 Latin America: Life Science Instrumentation Market for Pcr, by Type, 2021-2028 (USD Million)

Table 204 Latin America: Life Science Instrumentation Market for Lyophilization, by Type, 2021-2028 (USD Million)

Table 205 Latin America: Life Science Instrumentation Market for Liquid Handling, by Type, 2021-2028 (USD Million)

Table 206 Latin America: Life Science Instrumentation Market for Microscopy, by Type, 2021-2028 (USD Million)

Table 207 Latin America: Life Science Instrumentation Market for Flow Cytometry, by Type, 2021-2028 (USD Million)

Table 208 Latin America: Life Science Instrumentation Market for Centrifuges, by Type, 2021-2028 (USD Million)

Table 209 Latin America: Life Science Instrumentation Market for Electrophoresis, by Type, 2021-2028 (USD Million)

Table 210 Latin America: Life Science Instrumentation Market for Cell Counting, by Type, 2021-2028 (USD Million)

Table 211 Latin America: Life Science Instrumentation Market for Other Technologies, by Type, 2021-2028 (USD Million)

Table 212 Latin America: Life Science Instrumentation Market, by Application, 2021-2028 (USD Million)

Table 213 Latin America: Life Science Instrumentation Market, by End-user, 2021-2028 (USD Million)

9.5.1 Brazil

9.5.1.1 Rising R&D Activities and Increasing Growth in Biologics Sector to Propel Market

Table 214 Brazil: Life Science Instrumentation Market, by Technology, 2021-2028 (USD Million)

9.5.2 Mexico

9.5.2.1 Presence of Favorable Business Environment for Market Players to Attract Investment and Drive Market

Table 215 Mexico: Life Science Instrumentation Market, by Technology, 2021-2028 (USD Million)

9.5.3 Rest of Latin America

Table 216 Rest of Latin America: Life Science Instrumentation Market, by Technology, 2021-2028 (USD Million)

9.6 Middle East & Africa

9.6.1 Increasing Government Expenditure and Developing Healthcare Infrastructure to Fuel Market

Table 217 Middle East & Africa: Life Science Instrumentation Market, by Technology, 2021-2028 (USD Million)

Table 218 Middle East & Africa: Life Science Instrumentation Market for Spectroscopy, by Type, 2021-2028 (USD Million)

Table 219 Middle East & Africa: Life Science Instrumentation Market for Chromatography, by Type, 2021-2028 (USD Million)

Table 220 Middle East & Africa: Life Science Instrumentation Market for Pcr, by Type, 2021-2028 (USD Million)

Table 221 Middle East & Africa: Life Science Instrumentation Market for Lyophilization, by Type, 2021-2028 (USD Million)

Table 222 Middle East & Africa: Life Science Instrumentation Market for Liquid Handling, by Type, 2021-2028 (USD Million)

Table 223 Middle East & Africa: Life Science Instrumentation Market for Microscopy, by Type, 2021-2028 (USD Million)

Table 224 Middle East & Africa: Life Science Instrumentation Market for Flow Cytometry, by Type, 2021-2028 (USD Million)

Table 225 Middle East & Africa: Life Science Instrumentation Market for Centrifuges, by Type, 2021-2028 (USD Million)

Table 226 Middle East & Africa: Life Science Instrumentation Market for Electrophoresis, by Type, 2021-2028 (USD Million)

Table 227 Middle East & Africa: Life Science Instrumentation Market for Cell Counting, by Type, 2021-2028 (USD Million)

Table 228 Middle East & Africa: Life Science Instrumentation Market for Other Technologies, by Type, 2021-2028 (USD Million)

Table 229 Middle East & Africa: Life Science Instrumentation Market, by Application, 2021-2028 (USD Million)

Table 230 Middle East & Africa: Life Science Instrumentation Market, by End-user, 2021-2028 (USD Million)

10.2 Right-To-Win Strategies Adopted by Players

10.3 Key Strategies Adopted by Major Players in Life Science Instrumentation Market

10.4 Revenue Share Analysis

Figure 28 Revenue Share Analysis of Top Five Market Players (2020-2022)

10.5 Market Share Analysis

Figure 29 Thermo Fisher Scientific Held Leading Position in Life Science Instrumentation Market in 2022

10.5.1 Market Share Analysis for Spectroscopy

10.5.2 Market Share Analysis for Chromatography

10.5.3 Market Share Analysis for Pcr

10.5.4 Market Share Analysis for Ngs

10.6 Company Evaluation Quadrant for Key Players (2022)

10.7 Vendor Inclusion Criteria

10.7.1 Stars

10.7.2 Pervasive Players

10.7.3 Emerging Leaders

10.7.4 Participants

Figure 30 Life Science Instrumentation Market: Company Evaluation Quadrant, 2022

10.8 Company Evaluation Quadrant for Smes/Start-Ups (2022)

10.8.1 Progressive Companies

10.8.2 Starting Blocks

10.8.3 Responsive Companies

10.8.4 Dynamic Companies

Figure 31 Life Science Instrumentation Market: Company Evaluation Quadrant for Start-Ups/Smes (2022)

10.9 Competitive Benchmarking

Figure 32 Product Analysis of Top Players in Life Science Instrumentation Market

10.10 Competitive Scenario and Trends

10.10.1 Key Product Launches

Table 231 Life Science Instrumentation Market: Key Product Launches, January 2020-February 2023

10.10.2 Key Deals

Table 232 Life Science Instrumentation Market: Key Deals, January 2020-February 2023

10.10.3 Other Key Developments

Table 233 Life Science Instrumentation Market: Other Key Developments, January 2020-February 2023

11.1 Key Players

11.1.1 Thermo Fisher Scientific Inc.

Table 234 Thermo Fisher Scientific Inc.: Company Overview

Figure 33 Thermo Fisher Scientific Inc.: Company Snapshot (2021)

11.1.2 Danaher Corporation

Table 235 Danaher Corporation: Company Overview

Figure 34 Danaher Corporation: Company Snapshot (2021)

11.1.3 Agilent Technologies, Inc.

Table 236 Agilent Technologies, Inc: Company Overview

Figure 35 Agilent Technologies, Inc.: Company Snapshot (2022)

11.1.4 Waters Corporation

Table 237 Waters Corporation: Company Overview

Figure 36 Waters Corporation: Company Snapshot

11.1.5 Shimadzu Corporation

Table 238 Shimadzu Corporation: Company Overview

Figure 37 Shimadzu Corporation: Company Snapshot (2021)

11.1.6 Becton, Dickinson and Company

Table 239 Becton, Dickinson and Company: Company Overview

Figure 38 Becton, Dickinson and Company: Company Snapshot (2022)

11.1.7 Perkinelmer Inc.

Table 240 Perkinelmer Inc.: Company Overview

Figure 39 Perkinelmer Inc.: Company Snapshot (2022)

11.1.8 Bio-Rad Laboratories, Inc.

Table 241 Bio-Rad Laboratories, Inc.: Company Overview

Figure 40 Bio-Rad Laboratories, Inc.: Company Snapshot (2021)

11.1.9 Bruker

Table 242 Bruker.: Company Overview

Figure 41 Bruker: Company Snapshot (2021)

11.1.10 Qiagen N.V.

Table 243 Qiagen N.V.: Company Overview

Figure 42 Qiagen N.V.: Company Snapshot (2021)

11.1.11 Eppendorf Se

Table 244 Eppendorf Se: Company Overview

Figure 43 Eppendorf Se: Company Snapshot (2021)

11.1.12 Hitachi High-Technologies Corporation

Table 245 Hitachi High-Technologies Corporation: Company Overview

Figure 44 Hitachi High-Technologies Corporation: Company Snapshot (2021)

11.1.13 Horiba, Ltd.

Table 246 Horiba, Ltd.: Company Overview

Figure 45 Horiba, Ltd.: Company Snapshot (2021)

11.1.14 Merck KGaA

Table 247 Merck KGaA: Company Overview

Figure 46 Merck KGaA: Company Snapshot (2022)

11.1.15 Jeol Ltd.

Table 248 Jeol Ltd.: Company Overview

Figure 47 Jeol Ltd.: Company Snapshot (2021)

11.2 Other Companies

11.2.1 Biomerieux S.A.

11.2.2 Carl Zeiss Ag

11.2.3 Tecan Trading Ag

11.2.4 Sigma Laborzentrifugen GmbH

11.2.5 Illumina, Inc.

11.2.6 Avantor, Inc.

11.2.7 Olympus Corporation

11.2.8 Oxford Instruments

11.2.9 Gilson Incorporated

11.2.10 Gl Sciences Inc.

11.2.11 Accu-Scope

11.2.12 Panomex Inc.

11.2.13 Cleaver Scientific

11.2.14 Motic Group

11.2.15 Hyris Ltd.

*Details on Business Overview, Products Offered, Recent Developments, Analyst's View, Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats Might Not be Captured in Case of Unlisted Companies.

12.2 Knowledgestore: The Subscription Portal

12.3 Customization Options

Companies Mentioned

- Accu-Scope

- Agilent Technologies, Inc.

- Avantor, Inc.

- Becton, Dickinson and Company

- Biomerieux S.A.

- Bio-Rad Laboratories, Inc.

- Bruker

- Carl Zeiss Ag

- Cleaver Scientific

- Danaher Corporation

- Eppendorf Se

- Gilson Incorporated

- Gl Sciences Inc.

- Hitachi High-Technologies Corporation

- Horiba, Ltd.

- Hyris Ltd.

- Illumina, Inc.

- Jeol Ltd.

- Merck KGaA

- Motic Group

- Olympus Corporation

- Oxford Instruments

- Panomex Inc.

- Perkinelmer Inc.

- Qiagen N.V.

- Shimadzu Corporation

- Sigma Laborzentrifugen GmbH

- Tecan Trading Ag

- Thermo Fisher Scientific Inc.

- Waters Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 416 |

| Published | May 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 54.9 Billion |

| Forecasted Market Value ( USD | $ 73.9 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |