The COVID-19 pandemic positively impacted the blood glucose test strips market growth. Patients with diabetes injected with SARS-CoV-2 may experience additional stress and increased secretion of hyperglycaemic hormones such as glucocorticoid and catecholamines, which results in elevated blood glucose, abnormal glucose variability, and diabetic complications. To avoid aggravation, a patient's blood glucose may be monitored during the COVID-19 patient's hospitalization, which has underlined the importance of blood glucose test strips. Pandemic emergency has increased remote care from both patients and providers and removed many long-standing regulatory barriers. Thus, the COVID-19 outbreak increased the global growth of the blood glucose test strips market.

According to International Diabetes Federation (IDF), the adult diabetes population in 2021 was approximately 537 million, which is expected to increase by 643 million in 2030. Obesity is considered one of the major factors contributing to the disease, primarily Type 2 diabetes. Furthermore, other factors such as awareness, government initiatives, increased disposable income, and technological advances drive the market.

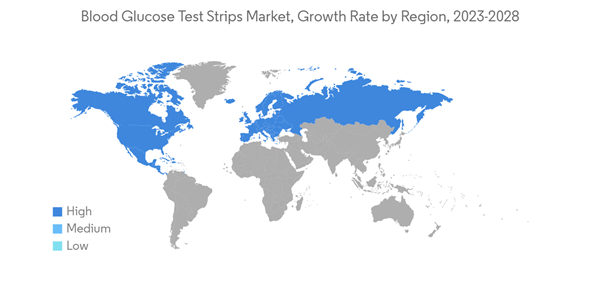

About 10% of all diabetes cases are Type-1, and the remaining are Type-2. As of 2021, North America accounted for a major market share, followed by Europe. North America is anticipated to dominate the market during the forecast period, owing to the rising prevalence of diabetes in the region.

Blood Glucose Test Strips Market Trends

Rising diabetes prevalence globally

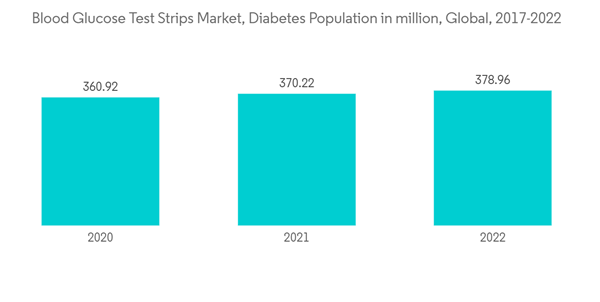

The diabetes population globally is expected to rise by 1.9% over the forecast period.According to International Diabetes Federation, the adult diabetes population in 2021 was approximately 537 million, which will increase by 643 million in 2030. Obesity is considered one of the major factors contributing to the disease, primarily Type 2 diabetes. Continued elevation in blood glucose levels in diabetes patients can contribute to progressive complications such as renal, nerve, and ocular damage.

Due to the ease of handling glucometers, patients prefer to use them for personal use. Tight glucose control is key to the long-term health of diabetic people and the primary prevention of chronic diabetic complications. Diabetic patients are educated to control capillary glucose levels daily to maintain them within target limits. Blood glucose meters are widely used not only by diabetic patients to self-manage their disease but also by physicians to monitor critically ill patients. Within seconds, glucometers provide blood glucose levels with accuracy. There is constant upgradation in glucometers for better use and more efficiency. The innovations in test strips are increasing and are under development. The new test strip includes features, such as underfill detection, and allows the user to reapply blood when the test strip is underfilled, called second chance sampling.

According to the UNICEF target product profile, 1st edition, access to diagnostic laboratories remains a key challenge in low-resource settings. Point-of-care diagnostic tests enable healthcare workers to provide more rapid and effective care. Simple, rapid, affordable point-of-care tests requiring minimal or no electricity, a laboratory, or highly trained staff are now available and widely used for several common conditions in low- and middle-income countries. These point-of-care tests offer an unprecedented opportunity to reduce health inequalities and help LMICs achieve health-related sustainable development goals.

Thus, the abovementioned factors are expected to drive segment growth over the forecast period.

The North American region held the highest market share in the Blood Glucose Test Strips Market in the current year

North America, especially the United States, held the largest share of 52% in the current year's blood glucose test strips market due to the large patient pool and wide acceptance of advanced technologies. Owing to the availability of healthcare reimbursements and the fastest adoption rate for new medical technologies. North America is the fastest-growing region in the market. It portrays a massive potential for future growth due to the increasing government initiatives to combat diabetes and corporate investments to streamline R&D in diabetes.The Centres for Disease Control and Prevention (CDC) National Diabetes Statistics Report 2022 estimated that more than 130 million adults are living with diabetes or prediabetes in the United States. Type 2 diabetes is more common, and diabetes is more consequential among communities of color, those who live in rural areas, and those with less education, lower incomes, and lower health literacy.

Blood glucose devices are garnering widespread adoption due to the availability of reimbursement options for glucose meters. Glucose meter devices must be replaced within six to eight months. As a result, most people prefer health insurance plans that cover most of their total expenditure on healthcare devices. Various schemes are covering the costs of diabetes testing supplies, test strips, and blood glucose meters. For example, Medicare, the federal health insurance program in the United States, covers blood glucose meters and the necessary test strips as durable medical equipment under Medicare Part B. It covers medical services and supplies necessary to treat a health condition.

Therefore, the factors above are expected to drive segment growth over the forecast period.

Blood Glucose Test Strips Industry Overview

The blood glucose test strips market is fragmented, with few major manufacturers like Roche, LifeScan, Ascensia, and Abbott having a presence in major regions of the global market. In contrast, the remaining manufacturers confine to the other local or region-specific manufacturers.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott

- Roche

- ARKRAY Inc.

- Ascensia Diabetes Care

- LifeScan IP Holdings LLC

- AgaMatrix

- Bionime Corporation

- ACON Laboratories Inc.

- Trividia Health Inc.

- Rossmax International Ltd