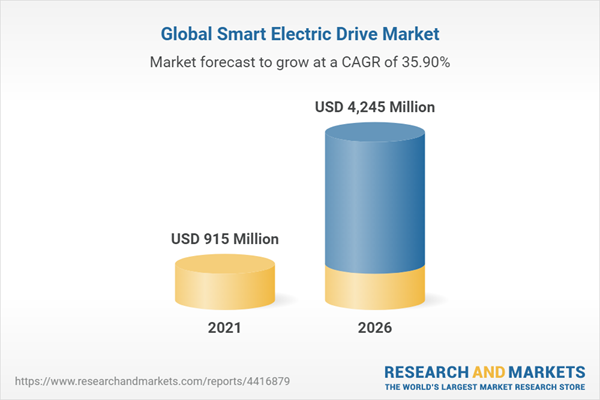

The global smart electric drive market size is projected to grow from USD 915 Million in 2021 to USD 4,245 Million by 2026, at a CAGR of 35.9%. Factors such as increasing demand for electric vehicles around the world, growing demand for smart electric drive equipment due to their higher vehicle efficiency, lower parts weight and compact size of assembly will boost the demand for the smart electric drive market. The growing concern for larger distance commuting using EV’s will also boost the market.

E-axle Segment is expected to be the largest market in the application segment in the forecast.

E-axle demand will be growing at a rapid pace with the increase in demand for EVs in the market. This is due to the fast growing demand for mass produced EVs in the market and growing demand for zero-emission vehicles. Asia Pacific is expected to be the largest market with many large EV manufacturers using e-axles from Aisin and Nidec in the region. For instance, In February 2020, Nidec announced the launch of its two-new e-axles developed for 200 kW and 50 kW drivetrains. Their e-axle system comprises a fully integrated traction motor system with an electric motor, reduction gearbox, and inverter. The Ni200Ex is developed for D and E segment cars and offers a higher output than its earlier available Ni150Ex model. Europe is also expected to be a large market, with GKN producing e-axles for companies like Volvo, BMW, and Porsche. Most manufacturers in the North American region use in-house manufacturing for passenger cars, and companies like Dana, Meritor, etc., manufacture e-axles for electric trucks. For Instance, in January 2019, BorgWarner launched its new range of electric drivetrains through its new iDM e-axle. It is developed for use in all kinds of EVs. Thus, with component manufacturers and OEMs adopting advanced integrated technologies to provide smart electric drive, the market would grow in the near future.

The Asia Pacific is expected to be the largest market during the forecast period.

The Asia Pacific Smart electric drive market will be led by countries like China, Japan and South Korea. The governments of these countries have supported the growth of EV demand through subsidies, favorable policies for EV’s and discouraging the use of petrol. This will lead to a fast-growing demand for the smart electric drive market in the region with their increased adoption in EV’s and rising EV demand. The adoption of smart electric drives have been in use in China and Japan followed by South Korea, India, and Rest of Asia Pacific. The rise in production capacity/ mass manufacturing for smart drivetrains and adoption of technology by OEMs in a country would support the growth of smart electric drive market. China is expected to be the largest and fastest-growing market with high EV demand in the country and companies like Geely, GAC, etc. using e-axles to develop their EV’s. Japan will be one of the fast-growing market in the region due to top component manufacturers like Nidec, Aisin, Denso manufacturing smart electric drive modules and components.

North America to be the fastest-growing region during the forecast period.

The North American region will have one of the fastest-growing demands for the smart electric drive market. The market in the region will be led by sales of some top selling EV’s in the US and Canada due to high demand across some of their states. Top OEM’s like GM, Ford is working with smart electric drive component manufacturers like BorgWarner, Hitachi, LG, Magna, ZF, etc. for their EV’s. This will lead to a gradual increase in demand for the smart electric drive market in the coming years.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: Tier I - 42%, Tier II - 40%, and Tier III - 18%

- By Designation: C Level Executives - 57%, Directors - 29%, and Others - 14%

- By Region: North America - 38%, Europe - 32%, Asia Pacific - 25%, RoW - 5%

The smart electric drive market is dominated by global players such as Nidec Corporation (Japan), Aisin Corporation (Japan), BorgWarner (US), Bosch (Germany) and ZF group (Germany). These companies have been developing new products, adopted expansion strategies, and undertaken collaborations, partnerships, and mergers & acquisitions to gain traction in the high-growth smart electric drive market.

Research Coverage:

The report covers the smart electric drive market, in terms of Vehicle Type (Passenger Cars, Commercial Vehicles and 2-Wheelers), EV Type (BEV, HEV and PHEV), Component, Commercial Vehicle Type, 2-Wheeler, Drive Type, Application, and Region (Asia Pacific, Europe, North America, and Rest of the World). It covers the competitive landscape and company profiles of the major players in the smart electric drive ecosystem.

The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- The report will help market leaders/new entrants in this market with information on the closest approximations of revenue numbers for the overall smart electric drive market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies.

- The report also helps stakeholders understand the pulse of the market and provides them information on key market drivers, restraints, challenges, and opportunities.

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

Figure 1 Electric Scooter (Moped)

1.2.1 Inclusions & Exclusions

Table 1 Inclusions & Exclusions in the Smart Electric Drive Market

1.3 Market Scope

Figure 2 Markets Covered

1.3.1 Years Considered for the Study

1.4 Currency & Pricing

1.5 Package Size

1.6 Stakeholders

1.7 Summary of Changes

2 Research Methodology

2.1 Research Data

Figure 3 Smart Electric Drive Market: Research Design

Figure 4 Research Design Model

2.1.1 Secondary Data

2.1.1.1 Key Secondary Sources

2.1.1.2 Key Data from Secondary Sources

2.1.2 Primary Data

Figure 5 Breakdown of Primary Interviews

2.1.3 Primary Participants

2.2 Market Estimation Methodology

Figure 6 Research Methodology: Hypothesis Building

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

Figure 7 Smart Electric Drive Market: Bottom-Up Approach

2.3.2 Top-Down Approach

Figure 8 Market: Top-Down Approach

Figure 9 Market: Research Design and Methodology

Figure 10 Research Approach: Market

2.3.3 Demand-Side Approach

Figure 11 Top-Down Research Methodology Approach: Company Based Revenue Approach

2.4 Market Breakdown and Data Triangulation

Figure 12 Data Triangulation

2.5 Factor Analysis

2.5.1 Factor Analysis for Market Sizing: Demand and Supply Side

2.6 Assumptions

2.7 Research Limitations

3 Executive Summary

Figure 13 Smart Electric Drive Market: Market Overview

Figure 14 Market, by Region, 2021-2026 (USD Million)

Figure 15 Bev Segment Expected to Grow at a Higher CAGR During Forecast Period (2021-2026)

4 Premium Insights

4.1 Attractive Opportunities in the Market

Figure 16 Increasing Demand for Smart Drive Technology in Electric Vehicles to Drive the Market

4.2 Market Growth Rate, by Region

Figure 17 Asia-Pacific Projected to be the Largest Market

4.3 Market, by Component

Figure 18 EV Batteries to be the Largest Segment (2021-2026)

4.4 Market, by Application

Figure 19 E-Axles Expected to Hold Majority of the Market (2021-2026)

4.5 Market, by Drive Type

Figure 20 Fwd Segment to Occupy a Larger Market Share During Forecast Period (2021-2026)

4.6 Market, by EV Type

Figure 21 Bev Segment Expected to Lead the Market During Forecast Period (2021-2026)

4.7 Market, by Vehicle Type

Figure 22 Commercial Vehicle Segment Expected to Grow at Higher CAGR During Forecast Period (2021-2026)

4.8 Market, by Commercial Vehicle Type

Figure 23 Electric Truck Demand is Expected to Grow at Higher CAGR During Forecast Period (2021-2026)

4.9 Market, by 2-Wheeler Type

Figure 24 Electric Scooters Will be Largest and Fastest Growing Segment (2021-2026)

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

Figure 25 Smart Electric Drive Market Dynamics

Table 2 Market: Impact of Market Dynamics

5.2.1 Drivers

5.2.1.1 Alternate Materials & Overall Weight Reduction to Open New Avenues in Electric Vehicles Technologies

Figure 26 Smart Electric Drive Gkn's Low Weight E-Drive Module

5.2.1.2 Adoption of Advanced Technologies in Electric Vehicles

Table 3 E-Axle Developments, by Key Manufacturers

5.2.1.3 Reducing Cost of EV Batteries Will Reduce the Price of Smart Electric Drive Modules

Figure 27 Global Lithium-Ion EV Battery Prices (Per Kwh)

5.2.1.4 Lower Operating Costs of EVs Will Increase Demand for Smart Electric Drive Modules

Table 4 Average Gasoline and Diesel Prices Over the Years (Us), (2016-2020)

Figure 28 Global Gasoline Consumption Trend, 2011-2020

5.2.2 Restraints

5.2.2.1 High Cost of Smart Electric Drive Systems/Modules

Table 5 Global Average Selling Price of Components

5.2.2.2 Maintaining and Achieving Optimum Power-To-Weight Ratio

Table 6 Vehicle Power to Component Weight Ratio

Table 7 Power Output to Vehicle Weight

5.2.3 Opportunities

5.2.3.1 Increase in Demand for Evs

Figure 29 Bev and Phev Sales (Thousand Units)

5.2.3.2 Government Policies Promoting Sales of Electric Vehicles

Table 8 Government Programs for the Promotion of Electric Commercial Vehicle Sales

Figure 30 Emission Norms Around the World, 2021

Figure 31 Government Targets for Evs

5.2.3.3 Integrated Mobility Solutions and Ride-Hailing Will Increase Demand for Smart Electric Drives

Figure 32 Ridesharing Market is on Rise, 2021 -2026

5.2.4 Challenges

5.2.4.1 Inadequate Charging Infrastructure for Electric Vehicles in Emerging Countries

Figure 33 EV Charging Demand, 2020-2030

5.2.4.2 Developing Fail-Safe Electronic and Electrical Components

5.3 Porter's Five Forces

Figure 34 Porter's Five Forces: Smart Electric Drive Market

Table 9 Market: Impact of Porters 5 Forces

5.3.1 Threat of Substitutes

5.3.2 Threat of New Entrants

5.3.3 Bargaining Power of Buyers

5.3.4 Bargaining Power of Suppliers

5.3.5 Rivalry Among Existing Competitors

5.4 Smart Electric Drive Market Ecosystem

Figure 35 Market: Ecosystem Analysis

5.4.1 EV Charging Providers

5.4.2 Tier I Suppliers

5.4.3 EV Battery Manufacturers

5.4.4 OEMs

5.4.5 End-users

Table 10 Market: Role of Companies in Ecosystem

5.5 Value Chain Analysis

Figure 36 Value Chain Analysis of Smart Electric Drive Market

5.6 Smart Electric Drive Average Pricing Analysis

Table 11 Smart Electric Drive: Average Price Comparison (USD), 2020

5.7 Macro Indicator Analysis

5.7.1 Introduction

5.7.1.1 Battery Electric Vehicle Sales as a Percentage of Total Electric Vehicle Sales

5.7.1.2 Gdp (USD Billion)

5.7.1.3 Gnp Per Capita, Atlas Method (USD)

5.7.1.4 Gdp Per Capita Ppp (USD)

5.7.2 Macro Indicators Influencing the Hybrid System Market for Top 3 Countries

5.7.2.1 Japan

Table 12 Japan: Rising Debt-Gdp Ratio to be the Most Crucial Indicator Given Its Excessively Weak Performance in the Recent Past

5.7.2.2 China

Table 13 China: Domestic Demand Expected to Play a Crucial Role Owing to a Host of Chinese Domestic Carmakers

5.7.2.3 US

Table 14 US: Rising Gni Per Capita Expected to Drive the Sales of Luxury Vehicles During the Forecast Period

5.8 Case Study

5.8.1 a Performance and Cost Overview of Selected Solid-State Electrolytes for EV Batteries

5.8.2 Development of Commercial Vehicle E-Axle System Based on Nvh Performance Optimization

5.9 Regulatory Overview

5.9.1 Netherlands

Table 15 Netherlands: Electric Vehicle Incentives

Table 16 Netherlands: Electric Vehicle Charging Stations Incentives

5.9.2 Germany

Table 17 Germany: Electric Vehicle Incentives

Table 18 Germany: Electric Vehicle Charging Stations Incentives

5.9.3 France

Table 19 France: Electric Vehicle Incentives

Table 20 France: Electric Vehicle Charging Stations Incentives

5.9.4 UK

Table 21 UK: Electric Vehicle Incentives

Table 22 UK: Electric Vehicle Charging Stations Incentives

5.9.5 China

Table 23 China: Electric Vehicle Incentives

Table 24 China: Electric Vehicle Charging Stations Incentives

5.9.6 US

Table 25 US: Electric Vehicle Incentives

Table 26 US: Electric Vehicle Charging Stations Incentives

5.10 Patent Analysis

Table 27 Important Registrations Related to Smart E Drive Market

5.11 Trends and Disruptions

Figure 37 Trends and Disruptions in the Smart Electric Drive Market

5.12 Market: COVID-19 Impact

5.12.1 Impact on Raw Material Supply

5.12.2 COVID-19 Impact on Automotive EV Industry

5.12.3 Announcements-Oem and Component Manufacturer

Table 28 Announcements

5.12.4 Impact on Automotive Production

5.13 Market Scenario Analysis

Figure 38 Smart Electric Drives Market- Future Trends & Scenario, 2021-2026 (USD Million)

5.13.1 Most Likely Scenario

Table 29 Market (Most Likely Scenario), by Region, 2021-2026 (USD Million)

5.13.2 Optimistic Scenario

Table 30 Smart Electric Drive Market (Optimistic), by Region, 2021-2026 (USD Million)

5.13.3 Pessimistic Scenario

Table 31 Market (Pessimistic), by Region, 2021-2026 (USD Million)

6 Technology Overview

6.1 Evolution

6.1.1 E-Drive in Electric Vehicle

Figure 39 E-Drive: Electric Vehicle

6.1.2 E-Drive in Hybrid Electric Vehicles - Series and Parallel Vs. Series-Parallel Combination

Figure 40 E-Drive: Hybrid Electric Vehicle (Series)

Figure 41 E-Drive: Hybrid Electric Vehicle (Parallel)

Figure 42 E-Drive: Hybrid Electric Vehicle (Series-Parallel Combination)

6.2 Spectrum of Drive Train Electrification

Figure 43 Drive Train Electrification

6.3 Components of Electric Drive

6.3.1 Electric Motor

Table 32 Comparison of Ac and Dc Motor

Table 33 Characteristics Comparison of Electrical Motors

6.3.2 Battery

Figure 44 Energy Density Comparison for Different Battery Types

6.3.3 Multispeed Gearbox

6.3.4 Inverter Unit

6.4 New and Upcoming Technology

6.4.1 Solid-State Battery (SSB)

6.4.2 IoT in Electric Vehicles

7 Smart Electric Drive Market, by Application

7.1 Introduction

Figure 45 E-Axle Segment Expected to Dominate the Market, 2021-2026 (USD Million)

Table 34 Market, by Application, 2018-2020 (Thousand Units)

Table 35 Market, by Application, 2021-2026 (Thousand Units)

Table 36 Market, by Application, 2018-2020 (USD Million)

Table 37 Market, by Application, 2021-2026 (USD Million)

7.2 Operational Data

Table 38 Key E-Axle and Smart Electric Drive Manufacturers

7.2.1 Assumptions

Table 39 Assumptions: by Application

7.3 Research Methodology

7.4 E-Axle

Table 40 E-Axle: Smart Electric Drive Market, by Region, 2018-2020 (Thousand Units)

Table 41 E-Axle: Market, by Region, 2021-2026 (Thousand Units)

Table 42 E-Axle: Market, by Region, 2018-2020 (USD Million)

Table 43 E-Axle: Market, by Region, 2021-2026 (USD Million)

7.5 E-Wheel Drive

Table 44 E-Wheel Drive: Market, by Region, 2018-2020 (Thousand Units)

Table 45 E-Wheel Drive: Market, by Region, 2021-2026 (Thousand Units)

Table 46 E-Wheel Drive: Market, by Region, 2018-2020 (USD Million)

Table 47 E-Wheel Drive: Market, by Region, 2021-2026 (USD Million)

7.6 Key Industry Insights

8 Smart Electric Drive Market, by Drive Type

8.1 Introduction

Figure 46 Awd Segment Expected to Dominate the Market, 2021-2026 (USD Million)

Table 48 Market, by Drive Type, 2018-2020 (Thousand Units)

Table 49 Market, by Drive Type, 2021-2026 (Thousand Units)

8.2 Operational Data

Table 50 Bev Vehicle Models and Their Drive Type

Table 51 Phev Vehicle Models and Their Drive Type

8.2.1 Assumptions

Table 52 Assumptions: by Drive Type

8.3 Research Methodology

8.4 Front Wheel Drive

Table 53 Fwd: Smart Electric Drive Market, by Region, 2018-2020 (Thousand Units)

Table 54 Fwd: Market, by Region, 2021-2026 (Thousand Units)

8.5 Rear Wheel Drive

Table 55 Rwd: Market, by Region, 2018-2020 (Thousand Units)

Table 56 Rwd: Market, by Region, 2021-2026 (Thousand Units)

8.6 All-Wheel Drive

Table 57 Awd: Market, by Region, 2018-2020 (Thousand Units)

Table 58 Awd: Market, by Region, 2021-2026 (Thousand Units)

8.7 Key Industry Insights

9 Smart Electric Drive Market, by Component

9.1 Introduction

Figure 47 Electric Drivetrain Components in All-Electric Drive

Figure 48 EV Battery Segment Expected to Dominate the Market, 2021-2026 (USD Million)

Table 59 Market, by Component, 2018-2020 (Thousand Units)

Table 60 Market, by Component, 2021-2026 (Thousand Units)

Table 61 Market, by Component, 2018-2020 (USD Million)

Table 62 Market, by Component, 2021-2026 (USD Million)

9.2 Operational Data

Table 63 Popular Li-Ion Batteries and Their Specifications

Table 64 Smart Electric Drivetrain Providers

Table 65 Electric Motor Providers

Table 66 Motor Controller Providers

9.2.1 Assumptions

Table 67 Assumptions: by Component

9.3 Research Methodology

9.4 EV Battery

Table 68 EV Battery: Smart Electric Drive Market, by Region, 2018-2020 (Thousand Units)

Table 69 EV Battery: Market, by Region, 2021-2026 (Thousand Units)

Table 70 EV Battery: Market, by Region, 2018-2020 (USD Million)

Table 71 EV Battery: Market, by Region, 2021-2026 (USD Million)

9.5 Electric Motor

Table 72 Electric Motor: Market, by Region, 2018-2020 (Thousand Units)

Table 73 Electric Motor: Market, by Region, 2021-2026 (Thousand Units)

Table 74 Electric Motor: Market, by Region, 2018-2020 (USD Million)

Table 75 Electric Motor: Market, by Region, 2021-2026 (USD Million)

9.6 Inverter System

Table 76 Inverter System: Smart Electric Drive Market, by Region, 2018-2020 (Thousand Units)

Table 77 Inverter System: Market, by Region, 2021-2026 (Thousand Units)

Table 78 Inverter System: Market, by Region, 2018-2020 (USD Million)

Table 79 Inverter System: Market, by Region, 2021-2026 (USD Million)

9.7 E-Brake Booster

Table 80 E-Brake Booster: Market, by Region, 2018-2020 (Thousand Units)

Table 81 E-Brake Booster: Market, by Region, 2021-2026 (Thousand Units)

Table 82 E-Brake Booster: Market, by Region, 2018-2020 (USD Million)

Table 83 E-Brake Booster: Market, by Region, 2021-2026 (USD Million)

9.8 Power Electronics

Table 84 Power Electronics: Smart Electric Drive Market, by Region, 2018-2020 (Thousand Units)

Table 85 Power Electronics: Market, by Region, 2021-2026 (Thousand Units)

Table 86 Power Electronics: Market, by Region, 2018-2020 (USD Million)

Table 87 Power Electronics: Market, by Region, 2021-2026 (USD Million)

9.9 Key Industry Insights

10 Smart Electric Drive Market, by Vehicle Type

10.1 Introduction

Table 88 Market, by Vehicle Type, 2018-2020 (Thousand Units)

Table 89 Market, by Vehicle Type, 2021-2026 (Thousand Units)

Table 90 Market, by Vehicle Type, 2018-2020 (USD Million)

Table 91 Market, by Vehicle Type, 2021-2026 (USD Million)

Figure 49 Commercial Vehicle Segment Expected to Grow at Highest CAGR During Forecast Period (2021-2026)

10.2 Operational Data

Table 92 Top Selling EVs Vehicle Type and Supplier Data for Smart Electric Drive Market

10.2.1 Assumptions

Table 93 Assumptions: by Vehicle Type

10.3 Research Methodology

10.4 Passenger Car (Pc)

10.4.1 Adoption of Integrated Units by Oems to Drive Demand

10.5 Commercial Vehicles (Cv)

10.5.1 Growth of E-Commerce and Logistics to Drive Demand

10.6 2-Wheelers (2-W)

10.6.1 Easy Installation & Less Complex Design to Drive Demand

10.7 Key Primary Insights

11 Smart Electric Drive Market, by EV Type

11.1 Introduction

Table 94 Market, by EV Type, 2018-2020 (Thousand Units)

Table 95 Market, by EV Type, 2021-2026 (Thousand Units)

Table 96 Market, by EV Type, 2018-2020 (USD Million)

Table 97 Market, by EV Type, 2021-2026 (USD Million)

Figure 50 Bev Segment Expected to Grow at Highest CAGR During Forecast Period (2021-2026)

11.2 Operational Data

Table 98 EV Models, by Propulsion and Sales

11.2.1 Assumptions

Table 99 Assumptions: by EV Type

11.3 Research Methodology

11.4 Battery Electric Vehicle (Bev)

11.4.1 Increase in Adoption of Integrated Drive Systems by Oems to Drive Demand

Table 100 Bev: Smart Electric Drive Market, by Region, 2018-2020 (Thousand Units)

Table 101 Bev: Market, by Region, 2021-2026 (Thousand Units)

Table 102 Bev: Market, by Region, 2018-2020 (USD Million)

Table 103 Bev: Market, by Region, 2021-2026 (USD Million)

11.5 Plug-In Hybrid Electric Vehicle (Phev)

11.5.1 Growing Need for Flexible Powertrains to Drive Demand

Table 104 Phev: Market, by Region, 2018-2020 (Thousand Units)

Table 105 Phev: Market, by Region, 2021-2026 (Thousand Units)

Table 106 Phev: Market, by Region, 2018-2020 (USD Million)

Table 107 Phev: Market, by Region, 2021-2026 (USD Million)

11.6 Hybrid Electric Vehicle (Hev)

11.6.1 Use of E-Axles in Hevs Will Create Opportunities for Smart Electric Drive Technology

Table 108 Hev: Smart Electric Drive Market, by Region, 2018-2020 (Thousand Units)

Table 109 Hev: Market, by Region, 2021-2026 (Thousand Units)

Table 110 Hev: Market, by Region, 2018-2020 (USD Million)

Table 111 Hev: Market, by Region, 2021-2026 (USD Million)

11.7 Key Industry Insights

12 Smart Electric Drive Market, by Commercial Vehicle

12.1 Introduction

Figure 51 E-Buses Expected to Dominate the Market, 2021-2026 (USD Million)

Table 112 Market, by Commercial Vehicle, 2018-2020 (Thousand Units)

Table 113 Market, by Commercial Vehicle, 2021-2026 (Thousand Units)

Table 114 Market for Commercial Vehicle, 2018-2020 (USD Million)

Table 115 Market for Commercial Vehicle, 2021-2026 (USD Million)

12.2 Operational Data

Table 116 Smart Electric Drive for Commercial Vehicles

12.2.1 Assumptions

Table 117 Assumptions: by Commercial Vehicle

12.2.2 Research Methodology

12.3 Electric Buses

12.3.1 Adoption of Advanced Integrated Technologies to Drive Demand

Table 118 Electric Buses: Smart Electric Drive Market, by Region, 2018-2020 (Thousand Units)

Table 119 Electric Buses: Market, by Region, 2021-2026 (Thousand Units)

Table 120 Electric Buses: Market, by Region, 2018-2020 (USD Million)

Table 121 Electric Buses: Market, by Region, 2021-2026 (USD Million)

12.4 Electric Trucks

12.4.1 Increase in Adoption of Integrated Components by OEMs to Drive Demand

Table 122 Electric Trucks: Market, by Region, 2018-2020 (Thousand Units)

Table 123 Electric Trucks: Market, by Region, 2021-2026 (Thousand Units)

Table 124 Electric Trucks: Market, by Region, 2018-2020 (USD Million)

Table 125 Electric Trucks: Market, by Region, 2021-2026 (USD Million)

12.5 Key Industry Insights

13 Smart Electric Drive Market, by Electric Two-Wheeler

13.1 Introduction

Figure 52 E-Scooters Segment Expected to Dominate the Market, 2021-2026 (USD Million)

Table 126 Market, by 2-Wheeler, 2018-2020 (Thousand Units)

Table 127 Market, by 2-Wheeler, 2021-2026 (Thousand Units)

Table 128 Market, by 2-Wheeler, 2018-2020 (USD Million)

Table 129 Market, by 2-Wheeler, 2021-2026 (USD Million)

13.2 Operational Data

Table 130 Global Electric Two-Wheeler Sales (Thousand Units)

13.2.1 Assumptions

Table 131 Assumptions: by Two-Wheeler

13.2.2 Research Methodology

13.3 Electric Cycles

13.3.1 Growing Demand for Electric Cycles to Drive the Segment

13.4 Electric Scooters

13.4.1 Increasing Use of Smart Electric Drive Technology to Drive the Segment

13.5 Electric Motorcycles

13.5.1 Increasing Use of Integrated Components and Battery Swapping Technology to Drive the Segment

13.6 Key Industry Insights

14 Smart Electric Drive, E-Axle Market, by Region

14.1 Introduction

14.2 Operational Data

Table 132 Top E-Axle Manufacturers and Vehicles Models

14.3 Asia-Pacific

Table 133 Asia-Pacific E-Axle Manufacturers

14.4 Europe

Table 134 Europe E-Axle Manufacturers

14.5 North America

Table 135 North America E-Axle Manufacturers

14.6 Key Primary Insights

15 Smart Electric Drive Market, EV Components-Suppliers Data

15.1 Region-Wise Suppliers Data

Table 136 North America: Suppliers Data

Table 137 Europe: Suppliers Data

Table 138 China: Suppliers Data

Table 139 Japan: Suppliers Data

Table 140 Rest of Asia: Suppliers Data

16 Smart Electric Drive Market, E-Axle Supply Chain

16.1 E-Axle Supply Chain Analysis

Figure 53 E-Axle: Supply Chain Analysis

16.2 Disruptions in the E-Powertrain Value Chain to Create New Opportunities

Figure 54 E-Powertrain Landscape

16.3 In-House Vs Outsourcing Components

16.4 In-house Vs Outsourcing Manufacturing

Table 141 In-house Vs Outsourcing Manufacturing of E-Axle

16.5 List of Key Component Suppliers

Table 142 E-Axle and E-Drivetrain Providers

Table 143 Traction Motor and Electric Motor Providers

Table 144 Motor Controller Provider

17 Smart Electric Drive Market, by Region

17.1 Introduction

Figure 55 Asia-Pacific is Estimated to be the Largest Market During Forecast Period (2021-2026)

Table 145 Market, by Region, 2018-2020 (Units)

Table 146 Market, by Region, 2021-2026 (Units)

Table 147 Market, by Region, 2018-2020 (USD Million)

Table 148 Market, by Region, 2021-2026 (USD Million)

17.2 Asia-Pacific

Figure 56 Asia-Pacific: Market Snapshot, 2021-2026

Table 149 Asia-Pacific: Market, by Country, 2018-2020 (Units)

Table 150 Asia-Pacific: Market, by Country, 2021-2026 (Units)

Table 151 Asia-Pacific: Market, by Country, 2018-2020 (USD Million)

Table 152 Asia-Pacific: Market, by Country, 2021-2026 (USD Million)

17.2.1 China

17.2.1.1 Large Number of EV Manufacturers Offering Integrated Drivetrains to Drive the Market

Table 153 China: Smart Electric Drive Market, by EV Type, 2018-2020 (Units)

Table 154 China: Market, by EV Type, 2021-2026 (Units)

Table 155 China: Market, by EV Type, 2018-2020 (USD Million)

Table 156 China: Market, by EV Type, 2021-2026 (USD Million)

17.2.2 India

17.2.2.1 Integration of Advanced Components in EVs to Drive the Market

Table 157 India: Market, by EV Type, 2018-2020 (Units)

Table 158 India: Market, by EV Type, 2021-2026 (Units)

Table 159 India: Market, by EV Type, 2018-2020 (USD Million)

Table 160 India: Market, by EV Type, 2021-2026 (USD Million)

17.2.3 Japan

17.2.3.1 Presence of Strong Local Manufacturers to Drive the Market

Table 161 Japan: Smart Electric Drive Market, by EV Type, 2018-2020 (Units)

Table 162 Japan: Market, by EV Type, 2021-2026 (Units)

Table 163 Japan: Market, by EV Type, 2018-2020 (USD Million)

Table 164 Japan: Market, by EV Type, 2021-2026 (USD Million)

17.2.4 South Korea

17.2.4.1 Increased Investments in Advanced Technologies to Drive the Market

Table 165 South Korea: Market, by EV Type, 2018-2020 (Units)

Table 166 South Korea: Market, by EV Type, 2021-2026 (Units)

Table 167 South Korea: Market, by EV Type, 2018-2020 (USD Million)

Table 168 South Korea: Market, by EV Type, 2021-2026 (USD Million)

17.2.5 Rest of Asia-Pacific

Table 169 Rest of Asia-Pacific: Market, by EV Type, 2018-2020 (Units)

Table 170 Rest of Asia-Pacific: Market, by EV Type, 2021-2026 (Units)

Table 171 Rest of Asia-Pacific: Market, by EV Type, 2018-2020 (USD Million)

Table 172 Rest of Asia-Pacific: Market, by EV Type, 2021-2026 (USD Million)

17.3 Europe

Figure 57 Europe: Germany Will be Leading the Market During 2021-2026

Table 173 Europe: Smart Electric Drive Market, by Country, 2018-2020 (Units)

Table 174 Europe: Market, by Country, 2021-2026 (Units)

Table 175 Europe: Market, by Country, 2018-2020 (USD Million)

Table 176 Europe: Market, by Country, 2021-2026 (USD Million)

17.3.1 France

17.3.1.1 Increasing Adoption of Integrated Electric Drives and Government Incentives to Drive the Market

Table 177 France: Market, by EV Type, 2018-2020 (Units)

Table 178 France: Market, by EV Type, 2021-2026 (Units)

Table 179 France: Market, by EV Type, 2018-2020 (USD Million)

Table 180 France: Market, by EV Type, 2021-2026 (USD Million)

17.3.2 Germany

17.3.2.1 Rising Sales of EVs Using Integrated E-Axles to Drive the Market

Table 181 Germany: Market, by EV Type, 2018-2020 (Units)

Table 182 Germany: Market, by EV Type, 2021-2026 (Units)

Table 183 Germany: Market, by EV Type, 2018-2020 (USD Million)

Table 184 Germany: Market, by EV Type, 2021-2026 (USD Million)

17.3.3 Norway

17.3.3.1 Strong EV Demand and Adoption of Integrated Electric Drive Technology to Drive the Market

Table 185 Norway: Market, by EV Type, 2018-2020 (Units)

Table 186 Norway: Market, by EV Type, 2021-2026 (Units)

Table 187 Norway: Market, by EV Type, 2018-2020 (USD Million)

Table 188 Norway: Market, by EV Type, 2021-2026 (USD Million)

17.3.4 UK

17.3.4.1 Outsourcing of Smart Electric Drive Technology to Drive the Market

Table 189 UK: Smart Electric Drive Market, by EV Type, 2018-2020 (Units)

Table 190 UK: Market, by EV Type, 2021-2026 (Units)

Table 191 UK: Market, by EV Type, 2018-2020 (USD Million)

Table 192 UK: Market, by EV Type, 2021-2026 (USD Million)

17.3.5 Spain

17.3.5.1 Increasing Investments in EV Technologies to Drive the Market

Table 193 Spain: Market, by EV Type, 2018-2020 (Units)

Table 194 Spain: Market, by EV Type, 2021-2026 (Units)

Table 195 Spain: Market, by EV Type, 2018-2020 (USD Million)

Table 196 Spain: Market, by EV Type, 2021-2026 (USD Million)

17.3.6 Rest of Europe

Table 197 Rest of Europe: Smart Electric Drive Market, by EV Type, 2018-2020 (Units)

Table 198 Rest of Europe: Market, by EV Type, 2021-2026 (Units)

Table 199 Rest of Europe: Market, by EV Type, 2018-2020 (USD Million)

Table 200 Rest of Europe: Market, by EV Type, 2021-2026 (USD Million)

17.4 North America

Figure 58 North America: Market Snapshot

Table 201 North America: Market, by Country, 2018-2020 (Units)

Table 202 North America: Market, by Country, 2021-2026 (Units)

Table 203 North America: Market, by Country, 2018-2020 (USD Million)

Table 204 North America: Market, by Country, 2021-2026 (USD Million)

17.4.1 Canada

17.4.1.1 Increasing Developments in Electric Vehicle Infrastructure to Drive the Market

Table 205 Canada: Smart Electric Drive Market, by EV Type, 2018-2020 (Units)

Table 206 Canada: Market, by EV Type, 2021-2026 (Units)

Table 207 Canada: Market, by EV Type, 2018-2020 (USD Million)

Table 208 Canada: Market, by EV Type, 2021-2026 (USD Million)

17.4.2 US

17.4.2.1 Adoption of In-House Manufacturing of Integrated Drivetrain Components to Drive the Market

Table 209 US: Market, by EV Type, 2018-2020 (Units)

Table 210 US: Market, by EV Type, 2021-2026 (Units)

Table 211 US: Market, by EV Type, 2018-2020 (USD Million)

Table 212 US: Market, by EV Type, 2021-2026 (USD Million)

17.4.3 Mexico

17.4.3.1 Rise in EV Sales with Assembled Drivetrain Components to Drive the Market

Table 213 Mexico: Smart Electric Drive Market, by EV Type, 2018-2020 (Units)

Table 214 Mexico: Market, by EV Type, 2021-2026 (Units)

Table 215 Mexico: Market, by EV Type, 2018-2020 (USD Million)

Table 216 Mexico: Market, by EV Type, 2021-2026 (USD Million)

17.5 Row

Figure 59 Russia to be the Largest Market in Row

Table 217 RoW: Market, by Country, 2018-2020 (Units)

Table 218 RoW: Market, by Country, 2021-2026 (Units)

Table 219 RoW: Market, by Country, 2018-2020 (USD Million)

Table 220 RoW: Market, by Country, 2021-2026 (USD Million)

17.5.1 Russia

17.5.1.1 EV Popularization to Drive the Market

Table 221 Russia: Smart Electric Drive Market, by EV Type, 2018-2020 (Units)

Table 222 Russia: Market, by EV Type, 2021-2026 (Units)

Table 223 Russia: Market, by EV Type, 2018-2020 (USD Million)

Table 224 Russia: Market, by EV Type, 2021-2026 (USD Million)

17.5.2 Brazil

17.5.2.1 Growing EV Demand to Drive the Market

Table 225 Brazil: Market, by EV Type, 2018-2020 (Units)

Table 226 Brazil: Market, by EV Type, 2021-2026 (Units)

Table 227 Brazil: Market, by EV Type, 2018-2020 (USD Million)

Table 228 Brazil: Market, by EV Type, 2021-2026 (USD Million)

17.5.3 Others

Table 229 Others: Smart Electric Drive Market, by EV Type, 2018-2020 (Units)

Table 230 Others: Market, by EV Type, 2021-2026 (Units)

Table 231 Others: Market, by EV Type, 2018-2020 (USD Million)

Table 232 Others: Market, by EV Type, 2021-2026 (USD Million)

18 Competitive Landscape

18.1 Overview

18.2 Market Share Analysis for Smart Electric Drive Market

Table 233 Market Share Analysis, 2020

Figure 60 Market Share Analysis, 2020

18.3 Revenue Analysis of Top Listed/Public Players

Figure 61 Top Public/Listed Players Dominated Market in Last Five Years

18.4 Competitive Scenario

18.4.1 New Product Launches

Table 234 New Product Launches, 2018-2021

18.4.2 Deals

Table 235 Deals, 2018-2021

18.4.3 Others

Table 236 Others, 2018-2021

18.5 Key Players in Smart Electric Drive Market

Table 237 Company Matrix: Top 5 Players in the Market

18.6 Company Evaluation Quadrant

18.6.1 Stars

18.6.2 Emerging Leaders

18.6.3 Pervasive

18.6.4 Participants

Figure 62 Market: Company Evaluation Quadrant, 2021

18.6.5 Market: Company Footprint, 2021

18.6.6 Market: Application Footprint, 2021

18.6.7 Market: Regional Footprint, 2021

18.7 Start-Up/SME Evaluation Quadrant

18.7.1 Progressive Companies

18.7.2 Responsive Companies

18.7.3 Dynamic Companies

18.7.4 Starting Blocks

Figure 63 Smart Electric Drive Market: Startup/SME Evaluation Quadrant, 2021

18.8 Right to Win, 2018-2021

Table 238 Right to Win, 2018-2021

19 Company Profiles

19.1 Key Players

19.1.1 Nidec Corporation

Table 239 Nidec Corporation: Business Overview

Figure 64 Nidec Corporation: Company Snapshot

Figure 65 Nidec Corporation: Snapshot

Table 240 Nidec Corporation: Production Footprint

Table 241 Nidec Corporation: Products Offered

Table 242 Nidec Corporation: New Product Launch

Table 243 Nidec Corporation: Deals

Table 244 Nidec Corporation: Others

19.1.2 Aisin Corporation

Table 245 Aisin Corporation: Business Overview

Figure 66 Aisin Corporation: Company Snapshot

Figure 67 Aisin Corporation: Snapshot

Figure 68 Aisin Corporation: Electric Powertrain Market

Table 246 Aisin Corporation: Products Offered

Table 247 Aisin Corporation: New Product Launch

Table 248 Aisin Corporation: Deals

Table 249 Aisin Corporation: Others

19.1.3 Borgwarner

Table 250 Borgwarner: Business Overview

Figure 69 Borgwarner: Company Snapshot

Figure 70 Borgwarner: Snapshot

Table 251 Borgwarner: Products Offered

Table 252 Borgwarner: New Product Launch

Table 253 Borgwarner: Deals

Table 254 Borgwarner: Others

19.1.4 Bosch

Table 255 Bosch: Business Overview

Figure 71 Bosch: Company Snapshot

Figure 72 Bosch: 2020 Highlights

Figure 73 Bosch: Snapshot

Figure 74 Bosch: Major Brands

Table 256 Bosch: Products Offered

Table 257 Bosch: New Product Launch

Table 258 Bosch: Deals

Table 259 Bosch: Others

19.1.5 Zf Group

Table 260 Zf Group: Business Overview

Figure 75 Zf Group: Company Snapshot

Table 261 Zf Group: Products Offered

Table 262 Zf Group: New Product Launch

Table 263 Zf Group: Deals

19.1.6 Magna International

Table 264 Magna International: Business Overview

Figure 76 Magna International: Company Snapshot

Figure 77 Magna International: E-Mobility Market Scenario

Figure 78 Magna International: E-Mobility Drivetrain

Table 265 Magna International: Products Offered

Table 266 Magna International: New Product Launch

Table 267 Magna International: Deals

19.1.7 Continental Ag

Table 268 Continental Ag: Business Overview

Figure 79 Continental Ag: Company Snapshot

Table 269 Continental Ag: Products Offered

Table 270 Continental Ag: New Product Launch

Table 271 Continental Ag: Deals

19.1.8 Siemens Ag

Table 272 Siemens: Business Overview

Figure 80 Siemens: Company Snapshot

Table 273 Siemens: Products Offered

Table 274 Siemens: New Product Launch

Table 275 Siemens: Deals

19.1.9 Gkn (Melrose)

Table 276 Gkn: Business Overview

Figure 81 Gkn.: Company Snapshot

Figure 82 Gkn: Smart Electric Drive Overview

Table 277 Gkn: Products Offered

Table 278 Gkn: New Product Launch

Table 279 Gkn: Deals

19.1.10 Meritor

Table 280 Meritor: Business Overview

Figure 83 Meritor: Company Snapshot

Table 281 Meritor: Products Offered

Table 282 Meritor: New Product Launch

Table 283 Meritor: Deals

19.1.11 Dana

Table 284 Dana: Business Overview

Figure 84 Dana: Company Snapshot

Table 285 Dana Business Operations

Table 286 Dana: Products Offered

Table 287 Dana: New Product Launch

Table 288 Dana: Deals

19.1.12 Hexagon Ab

Table 289 Hexagon Ab: Business Overview

Figure 85 Hexagon Ab: Company Snapshot

Table 290 Hexagon Ab: Products Offered

Table 291 Hexagon Ab: Deals

19.1.13 Denso

Table 292 Denso: Business Overview

Figure 86 Denso: Company Snapshot

Table 293 Denso: Products Offered

Table 294 Denso: New Product Launch

Table 295 Denso: Deals

19.1.14 Hitachi

Table 296 Hitachi: Business Overview

Figure 87 Hitachi: Company Snapshot

Table 297 Hitachi: Products Offered

Table 298 Hitachi: New Product Launch

Table 299 Hitachi: Deals

19.2 Other Players

19.2.1 Jatco

Table 300 Jatco: Business Overview

19.2.2 Meidensha Corporation

Table 301 Meidensha Corporation: Business Overview

19.2.3 Hyundai Mobis

Table 302 Hyundai Mobis: Business Overview

19.2.4 Allison Transmission

Table 303 Allison Transmission: Business Overview

19.2.5 Lg Electronics

Table 304 Lg Electronics: Business Overview

19.2.6 Jing-Jin Electric Technologies

Table 305 Jing-Jin Electric Technologies: Business Overview

19.2.7 Shanghai Automotive Smart Electric Drive

Table 306 Shanghai Automotive Smart Electric Drive: Business Overview

19.2.8 Huayu Automotive Electric System

Table 307 Huayu Automotive Electric System: Business Overview

19.2.9 ABB

Table 308 ABB: Business Overview

19.2.10 Infineon Technologies

Table 309 Infineon Technologies: Business Overview

19.2.11 Mahle

Table 310 Mahle: Business Overview

19.2.12 Smesh E-Axle

Table 311 Smesh E-Axle: Business Overview

20 Analyst's Recommendations

20.1 China to be Key Focus Area for Smart Electric Drive Market

20.2 Technological Advancements to Help Develop Market for Smart Electric Drives

20.3 Conclusion

21 Appendix

21.1 Key Insights of Industry Experts

21.2 Discussion Guide

21.3 Knowledge Store: The Subscription Portal

21.4 Available Customizations

Companies Mentioned

- ABB

- Aisin Corporation

- Allison Transmission

- Borgwarner

- Bosch

- Continental Ag

- Dana

- Denso

- GKN (Melrose)

- Hexagon AB

- Hitachi

- Huayu Automotive Electric System

- Hyundai Mobis

- Infineon Technologies

- Jatco

- Jing-Jin Electric Technologies

- LG Electronics

- Magna International

- Mahle

- Meidensha Corporation

- Meritor

- Nidec Corporation

- Shanghai Automotive Smart Electric Drive

- Siemens AG

- Smesh E-Axle

- ZF Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 354 |

| Published | November 2021 |

| Forecast Period | 2021 - 2026 |

| Estimated Market Value ( USD | $ 915 Million |

| Forecasted Market Value ( USD | $ 4245 Million |

| Compound Annual Growth Rate | 35.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |