Electric motors are devices that convert electrical energy into mechanical energy. They offer numerous advantages, such as extended operating life, low energy consumption, minimal maintenance, and high endurance for fluctuating voltages. They are vital in the oil and gas industry, which requires high-value and complex rotating equipment systems. Apart from this, electric motors have a diverse range of applications in devices, such as dishwashers, vacuum cleaners, printing presses, smartphones, and automobiles.

They are a crucial component for operating various machines and are often used in industrial settings to perform heavy-duty tasks. One of the key advantages of electric motors is that they can operate with high efficiency, making them an environmentally friendly choice. Additionally, they require less maintenance than their combustion engine counterparts, thus reducing costs and downtime.

GCC Electric Motor Market Trends:

The GCC electric motor market is driven by the increasing demand for energy-efficient and sustainable technologies and favorable government initiatives promoting electric vehicles (EVs). Moreover, rising investments in renewable energy sources and the escalating need to reduce carbon emissions are bolstering the market growth. Furthermore, the rapid growth of the construction and industrial sectors, coupled with the surging adoption of automation, is accelerating the market growth.Apart from this, the burgeoning product usage in various applications, including heating, ventilation, and air conditioning (HVAC) systems, pumps, and compressors, and the growing trend of electrification in the transportation sector are creating a positive outlook for the market. Other factors, such as the easy availability of raw materials and skilled labor in the region, the development of advanced technologies, such as brushless DC motors, and the increasing demand for electric motors in the oil and gas sector, are fueling the market growth.

Key Market Segmentation:

The research provides an analysis of the key trends in each segment of the GCC electric motor market report, along with forecasts at the regional and country level from 2025-2033. Our report has categorized the market based on efficiency, end-use industry, and applications.Efficiency Insights:

- Standard Efficiency Electric Motors

- High Efficiency Electric Motors

- Premium Efficiency Electric Motors

- Super Premium Efficiency Electric Motors

End-Use Industry Insights:

- HVAC

- Mining

- Oil and Gas

- Water and Utilities

- Food, Beverage and Tobacco

- Others

Applications Insights:

- Pumps and Fans

- Compressors

- Other Uses

Country Insights:

- Saudi Arabia

- UAE

- Oman

- Qatar

- Kuwait

- Bahrain

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the GCC electric motor market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered include ABB, Siemens, WEG Industries, NIDEC Corporation, and TECO Middle East Electrical and Machinery Co. Ltd, etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.Key Questions Answered in This Report:

- How has the GCC electric motor market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the GCC electric motor market?

- What is the impact of each driver, restraint, and opportunity on the GCC electric motor market?

- What is the breakup of the market based on the efficiency?

- Which is the most attractive efficiency in the GCC electric motor market?

- What is the breakup of the market based on the end-use industry?

- Which is the most attractive end-use industry in the GCC electric motor market?

- What is the breakup of the market based on applications?

- Which is the most attractive application in the GCC electric motor market?

- What is the competitive structure of the GCC electric motor market?

- Who are the key players/companies in the GCC electric motor market?

Table of Contents

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 139 |

| Published | June 2025 |

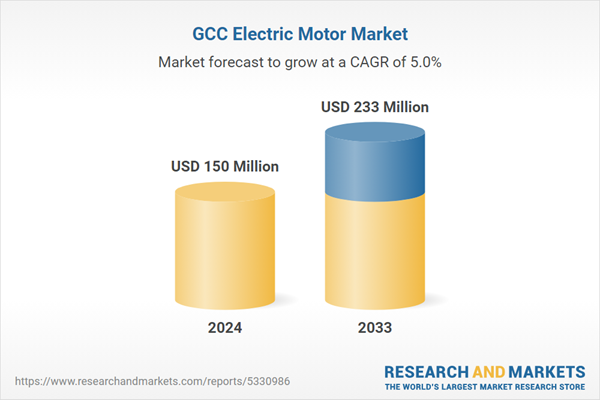

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 150 Million |

| Forecasted Market Value ( USD | $ 233 Million |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Middle East |

| No. of Companies Mentioned | 5 |