An electric motor is an electro-mechanical device that converts electrical energy into mechanical energy by utilizing electromagnetic phenomena. It generates the mechanical torque by the interaction of conductors that carry current to the magnetic field. It is efficient, consumes less energy, and has a long operating life and better endurance for fluctuating voltages.

As a result, it is integrated into fans, disk drives, compressors, and electric cars, which are further employed in the residential, real estate, manufacturing, and commercial sectors. At present, there is a rise in the demand for electric motors in Saudi Arabia on account of the upcoming construction projects undertaken by governing authorities in the country.

Saudi Arabia Electric Motor Market Trends:

Due to rapid urbanization and inflating income levels of individuals, there is a considerable rise in the utilization of electrical appliances, such as washing machines, dishwashers, coffee grinders, microwaves, and electric can openers. This is positively influencing the sales of electric motors in Saudi Arabia. In addition to this, the prevalent weather conditions are resulting in a significant reliance on air conditioning systems that operate on electric motors, which is contributing to the market growth. The market is further driven by the growing trend of replacing gas turbines with electric motors in large industrial plants.Moreover, the Government of Saudi Arabia is continuously focusing on introducing different policies that support new industries. It is also considerably investing in construction activities and infrastructural development, which, in turn, is fueling the sales of electric motors across the country. Furthermore, due to rising environmental concerns, there is a rise in the production and adoption of electric vehicles. This is anticipated to strengthen the growth of the market in the country.

Key Market Segmentation:

The research provides an analysis of the key trends in each segment of the Saudi Arabia electric motor market report, along with forecasts for the period 2024-2032. Our report has categorized the market based on efficiency, application and end use.Breakup by Efficiency:

- Standard Efficiency Electric Motors

- High-Efficiency Electric Motors

- Premium Efficiency Electric Motors

- Super Premium Efficiency Electric Motor.

Breakup by Application:

- Heating, Ventilation and Air Conditioning (HVAC)

- Oil and Gas

- Food, Beverage and Tobacco

- Mining

- Water and Utilities

- Others

Breakup by End Use:

- Pumps and Fans

- Compressors

- Other Uses

Competitive Landscape:

The competitive landscape of the market has also been examined with some of the key players being ABB, NIDEC Corporation, Siemens, TECO Middle East and WEG Industries.Key Questions Answered in This Report:

- How has the Saudi Arabia electric motor market performed so far and how will it perform in the coming years?

- What are the key applications in the Saudi Arabia electric motor market?

- What are the key efficiencies in the Saudi Arabia electric motor market?

- What has been the impact of COVID-19 on the Saudi Arabia electric motor market?

- What are the major end-use segments in the Saudi Arabia electric motor market?

- What are the various stages in the value chain of the Saudi Arabia electric motor industry?

- What are the key driving factors and challenges in the Saudi Arabia electric motor industry?

- What is the structure of the Saudi Arabia electric motor industry and who are the key players?

- What is the degree of competition in the Saudi Arabia electric motor industry?

- What are the profit margins in the Saudi Arabia electric motor industry?

- What are the key requirements for setting up an electric motor manufacturing plant?

- How is electric motor manufactured?

- What are the various unit operations involved in an electric motor manufacturing plant?

- What is the total size of land required for setting up an electric motor manufacturing plant?

- What are the machinery requirements for setting up an electric motor manufacturing plant?

- What are the raw material requirements for setting up an electric motor manufacturing plant?

- What are the packaging requirements for electric motor?

- What are the transportation requirements for electric motor?

- What are the utility requirements for setting up an electric motor manufacturing plant?

- What are the manpower requirements for setting up an electric motor manufacturing plant?

- What are the infrastructure costs for setting up an electric motor manufacturing plant?

- What are the capital costs for setting up an electric motor manufacturing plant?

- What are the operating costs for setting up an electric motor manufacturing plant?

- What will be the income and expenditures for an electric motor manufacturing plant?

- What is the time required to break-even?

Table of Contents

Companies Mentioned

- ABB

- NIDEC Corporation

- Siemens

- TECO Middle East

- WEG Industries

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 117 |

| Published | June 2025 |

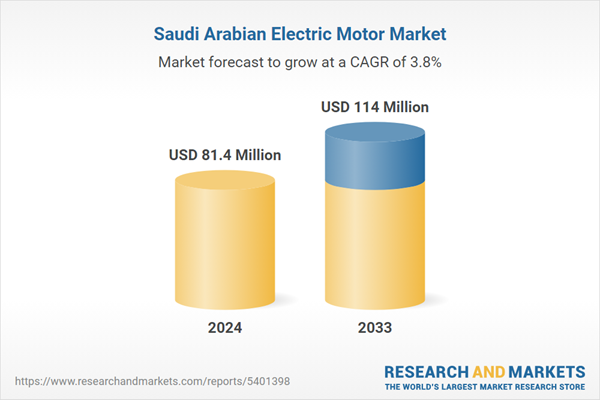

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 81.4 Million |

| Forecasted Market Value ( USD | $ 114 Million |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Saudi Arabia |

| No. of Companies Mentioned | 5 |