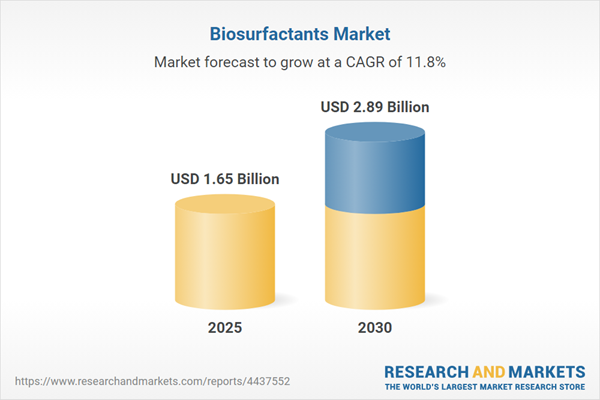

The biosurfactants market is expected to grow from USD 1.65 billion in 2025 to USD 2.89 billion by 2030, at a compound annual growth rate (CAGR) of 11.79% during the forecast period. R&D is being used in the continuous development of next-generation biosurfactants that have a superior surfacing property, stability, and lower cost than previous bio-based formulations. Glycolipid biosurfactants are being reformulated to enhance foaming, emulsification, and antimicrobial performance in challenging applications in detergents, personal care, and food processing, such as sophorolipids and rhamnolipids.Personal Care Product Manufacturers Going Green is to Drive the Market

Biomark engineering, optimization of bioprocesses, and the increase in fermentation yields, as well as enzyme engineering, are also enabling producers to achieve more powerful performance with fewer dosage needs, thereby reducing production costs and environmental impact. Enhancing strains via biotechnology and utilizing renewable feedstocks are also areas that the industry is targeting to achieve the aims of the circular economy. The manufacturers are also investing more money in green and multifunctional biosurfactants, which are natural, non-toxic, and biodegradable substances, thereby driving significant growth in the global market.

Glycolipids segment accounted for the largest share in the biosurfactants market, in terms of value, in 2024.

In 2024, the glycolipids segment, including sophorolipids and rhamnolipids, had the highest percentage of the biosurfactants market share due to its high rate of biodegradation, emulsification capability, and mildness. The use of glycolipids in detergents, cosmetics, and household cleaning products is high due to their performance consistency and environmental compliance.They possess strong cleaning and foaming properties that are non-irritating, which has led to their rapid adoption in both consumer and industrial formulations. Moreover, advancements in fermentation technologies and downstream recovery technologies have enabled an increase in production scale, making them cost-effective and more competitive than synthetic surfactants. With sustainability still influencing consumer trends and regulatory policies, glycolipids are poised to be the primary driver of growth in the biosurfactants market globally.

The personal care segment was the second-largest application, in terms of value, in the global biosurfactants market.

Personal care products that utilize biosurfactants offer mildness, enhanced foaming capacity, and superior emulsification, making them skin-compatible and environmentally safe. These naturally obtained surfactants are gaining sufficient response to the demand for biodegradable and non-toxic ingredients in shampoos, facial cleansers, and cosmetics. Biosurfactants, such as sophorolipids and rhamnolipids, meet this requirement, offering effective levels of cleansing and conditioning functionality without irritation.Moreover, they enable formulators to preserve product texture, stability, and sensory qualities, while also addressing clean-labeling and sustainability statements. With the ever-growing demand from consumers for naturally produced, mild, and eco-friendly formulations, the role of biosurfactants in the personal care industry has expanded significantly. Their versatility, including the ability to emulsify, antimicrobial activity, and so on, is making biosurfactants an important ingredient in the development of personal care in the twenty-first century and beyond.

Europe is estimated to be the largest regional market for biosurfactants, in terms of value, in 2024

Europe continues to dominate the biosurfactants market due to its robust regulatory mechanisms, which promote the use of biodegradable and renewable surfactants. The high demand in the region is due to the widespread use in the detergents, personal care, and food processing sectors, where environmental compliance and green certification will be of high importance.The demand for sustainable, plant-based products among European consumers is high, and awareness of this trend will further accelerate the shift from petrochemical to bio-based surfactants. Additionally, local and foreign manufacturers are expanding their manufacturing capacities in countries such as Germany, France, and the Netherlands, leveraging biotechnology and fermentation efficiency. This local leadership, combined with strong investment in research and development and a favorable regulatory environment, continues to make Europe a key development center in the global biosurfactants market.

- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: Directors - 50%, Managers - 30%, and Others - 20%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, Rest of World - 5%

Research Coverage

This report segments the biosurfactants market by type, application, and region, and provides estimations of value (in USD thousand) for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, and key strategies associated with the biosurfactants market.Reasons to Buy this Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the biosurfactants market, high-growth regions, and market drivers, restraints, and opportunities.The report provides insights into the following points:

- Market Penetration: Comprehensive information on biosurfactants offered by top players in the global market

- Analysis of key drivers: (Increasing demand for green solutions, regulations on use of synthetic surfactants, personal care product manufacturers going green) restraints (Less commercialization due to high production cost, conventional bio-based products gaining popularity) opportunities (Development of cost-effective production techniques, rhamnolipids as antitumor agents and immunomodulators, rising demand from petroleum industry), and challenges (Lack of production technology and cost-competitiveness of rhamnolipids) influencing the growth of the biosurfactants market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the biosurfactants market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for biosurfactants across regions

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global biosurfactants market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the biosurfactants market

Table of Contents

Companies Mentioned

The companies profiled in this Biosurfactants market report include:- Evonik Industries AG

- Shaanxi Deguan Biotechnology Co. Ltd.

- Biotensidon GmbH

- Saraya Co. Ltd.

- Allied Carbon Solutions Co. Ltd.

- Stepan Company

- Daqing Victex Chemical Industries Co. Ltd.

- Holiferm Limited

- Solvay SA

- Dow Inc.

- Givaudan SA

- Agae Technologies, LLC

- Biosurfactants LLC

- Kaneka Corporation

- Kemin Industries, Inc.

- Wheatoleo

- Jeneil Biotech, Inc.

- Glycosurf, LLC

- Tensiogreen Technology Corp.

- Dispersa Inc.

- Zfa Technologies Inc.

- Hub.Tech. SA

- Mg Intobio Co. Ltd.

- Synthezyme LLC

- Sasol Limited

- Teegene Biotech Ltd.

- Biofuture Ltd.

- Toyobo Co. Ltd.

- Vetline

- Kanebo Cosmetics Inc.

- Fraunhofer Igb

- Locus Fermentation Solutions

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 230 |

| Published | November 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 1.65 Billion |

| Forecasted Market Value ( USD | $ 2.89 Billion |

| Compound Annual Growth Rate | 11.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 33 |

![Biosurfactants Market by Type [Glycolipids and Lipopeptides], Application, and Region - Global Forecast to 2030- Product Image](http://www.researchandmarkets.com/product_images/12330/12330372_115px_jpg/biosurfactants_market.jpg)