Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Market Drivers

Increasing Affordability and Disposable Income

As India’s middle class continues to grow, an increasing number of consumers can afford to purchase used cars. Rising disposable income, particularly among urban dwellers, is enabling more people to consider private vehicle ownership as a feasible option. With the high cost of new cars, used cars provide an affordable alternative that caters to budget-conscious consumers. The demand for cost-effective solutions, coupled with access to financing options, has made used cars a popular choice, contributing to the steady growth of the market.Improved Access to Financing

The availability of tailored financial products for used car buyers has significantly boosted the market. Financial institutions are offering loans with flexible terms, low interest rates, and minimal down payments, making it easier for individuals to purchase pre-owned vehicles. The easing of credit norms, along with the availability of digital loan approval processes, has democratized car ownership, creating opportunities for those who may not have otherwise been able to afford a new car.Digitalization of the Buying and Selling Process

The growth of online platforms and digital tools has transformed the used car buying process. Consumers can now browse, compare, and purchase vehicles from the comfort of their homes, while sellers can access a larger pool of potential buyers. E-commerce giants like OLX and Cars24 have introduced trust-building features such as vehicle certifications, online inspections, and detailed reports, providing greater transparency in the transaction process. This digital shift has increased consumer confidence and is fueling market growth.Rising Preference for Personal Mobility

With an increase in urbanization and a rising number of nuclear families, personal mobility has become a necessity for many. Consumers are now more inclined to own a car for convenience, safety, and flexibility. As urban congestion and public transport challenges persist, owning a vehicle, even a pre-owned one, has become an attractive option. This shift in preference for personal vehicles, driven by the need for mobility independence, has accelerated the demand for used cars.Sustainability and Environmental Concerns

Environmental awareness is influencing consumer behavior, with many opting for pre-owned cars as a sustainable alternative to purchasing new vehicles. A second-hand car reduces the overall carbon footprint associated with manufacturing and transporting new vehicles. Moreover, consumers are increasingly considering electric or hybrid used cars as part of their sustainability efforts. As eco-consciousness grows, the used car market is experiencing a surge in demand for more eco-friendly vehicle options.Key Market Challenges

Lack of Standardization

The used car market in India is still largely unorganized, with a significant portion of transactions occurring without proper documentation or quality assurance. Many buyers face challenges in determining the true value of a vehicle, as pricing is often inconsistent, and the condition of the cars can vary greatly. This lack of standardization creates uncertainty, making it difficult for consumers to trust sellers and dealerships, which, in turn, hampers market growth and consumer confidence.Unclear Vehicle History and Documentation Issues

One of the major concerns for used car buyers in India is the lack of transparency regarding a vehicle’s history. Many vehicles have unclear records of previous accidents, repairs, or ownership transfers, which can lead to legal and financial issues later on. The process of transferring ownership can also be cumbersome, involving complicated paperwork, regional variations in laws, and potential delays. This lack of clarity can deter potential buyers, as it introduces an element of risk into the purchase.Quality Control and Warranty Assurance

Consumers often have concerns about the quality and reliability of used cars. While new cars come with warranties and service guarantees, used cars typically lack these assurances, leaving buyers unsure about the vehicle’s condition. For sellers, the challenge lies in offering quality vehicles while keeping prices competitive. Dealers must balance the demand for lower-cost cars with the need for quality assurance, often investing in refurbishment processes and warranty programs to provide confidence to buyers.Regulatory and Taxation Complexities

Regulatory challenges, such as inconsistent taxation policies and vehicle emission norms, can create friction in the used car market. The government’s varying policies on vehicle registration, road tax, and emissions standards for used cars can lead to confusion and additional costs for both buyers and sellers. Navigating the bureaucratic red tape in vehicle transfers and ensuring compliance with changing regulations can become a time-consuming and costly process for consumers, discouraging participation in the market.High Competition from New Car Sales

The growth of the new car market poses a challenge to the used car sector, especially as consumers are attracted by the latest models, advanced features, and manufacturer warranties offered by new car dealerships. The strong push for affordable entry-level cars from automakers, combined with aggressive financing schemes and promotional offers, makes new cars a compelling choice for many. This competition places pressure on the used car market to maintain price competitiveness and offer attractive alternatives to new vehicles.Key Market Trends

Rise of Online Marketplaces and Aggregators

The digital transformation of the used car industry is one of the most significant trends. Online platforms like Cars24, OLX, and CarDekho are reshaping how cars are bought and sold, allowing consumers to access a wide range of vehicles from various sellers. These platforms offer services such as online vehicle inspections, detailed condition reports, and customer ratings, ensuring greater transparency and trust in the process. The digital shift is not only improving convenience for buyers but also enabling sellers to reach a broader audience, making it easier to navigate the used car market.Growth in Certified Pre-Owned Cars

Certified pre-owned (CPO) vehicles are becoming increasingly popular as consumers seek more reliable and well-maintained used cars. Many dealerships and platforms now offer certified vehicles that undergo thorough inspections and refurbishments, providing a level of assurance to buyers about the car’s condition. CPO programs often come with warranties, offering the peace of mind typically associated with new cars.This trend is helping to professionalize the market, moving it away from the informal, unorganized sector and building consumer confidence. For instance, In 2024, Toyota Kirloskar Motor (TKM) launched its first-ever company-owned outlet for pre-owned Toyota vehicles in New Delhi. This new facility, called the Toyota Used Car Outlet (TUCO), aimed to offer high-quality used cars with the same reliability and trust that Toyota is known for. The outlet provided customers with a range of certified, inspected pre-owned vehicles, allowing them to buy with confidence.

Increasing Popularity of EVs and Hybrid Vehicles

Electric and hybrid vehicles are starting to make their way into the used car market as Indian consumers become more environmentally conscious. While the adoption of electric vehicles (EVs) remains slow, the demand for second-hand EVs and hybrids is rising due to growing awareness of sustainability and lower running costs. As more manufacturers introduce electric models and as government incentives make EVs more affordable, the used car market is witnessing a gradual shift towards greener, more fuel-efficient alternatives.Technological Integration in Vehicle Sales

The integration of advanced technologies is transforming the used car market. Virtual reality (VR) and augmented reality (AR) are being used to create immersive car viewing experiences, while artificial intelligence (AI) tools are assisting with accurate pricing, vehicle condition assessments, and personalized recommendations. These technological innovations are enhancing the buying experience, making it more engaging and data driven. The use of AI also aids in detecting fraudulent listings and improving customer service, boosting the credibility of the market.Shift Toward Online Auctions and B2B Platforms

Another emerging trend is the rise of online auctions and business-to-business (B2B) platforms, where dealers can purchase used cars in bulk. These platforms allow dealers to streamline their inventory management, purchase vehicles directly from individuals or other dealers, and sell them to customers at competitive prices. The ability to bid on cars in real-time, combined with greater transparency about the vehicle’s history and condition, is revolutionizing how cars are sourced and sold, driving efficiency in the market.Segmental Insights

Vendor Type Insights

The unorganized sector represents a large portion of the market, where transactions often occur between private individuals or through local dealers without much formal structure. In this segment, buyers typically rely on word-of-mouth referrals or informal networks to find vehicles. These dealers usually operate without standard certifications or transparent quality checks, meaning that consumers must often rely on their own judgment or a mechanic’s inspection to assess a car’s condition. Pricing in the unorganized market is usually negotiable, and the lack of fixed pricing standards can lead to wide variations in the value of similar vehicles. While this sector is less regulated and offers lower-priced cars, it lacks the transparency and assurance that many consumers now seek. For many, however, the lower upfront cost remains a significant appeal, especially in rural areas or small towns where formal dealership infrastructure may be limited.Regional Insights

In 2024, North India emerged as the dominant region in the used car market, driven by a combination of factors such as urbanization, rising disposable incomes, and a growing middle class. The region encompasses large metropolitan cities like Delhi, Chandigarh, and Jaipur, where the demand for personal vehicles is consistently high due to population growth, traffic congestion, and the preference for private mobility.The region benefits from an expansive network of used car dealerships and a well-established consumer base that actively participates in both buying and selling pre-owned vehicles. Urbanization has led to increased demand for affordable vehicles, as many consumers in cities like Delhi and Gurgaon prefer used cars due to the high cost of new vehicles. The preference for well-maintained, certified pre-owned cars is also on the rise, as consumers in the region seek reliable transportation options that offer value for money.

Key Market Players

- Cars24 Services Private Ltd.

- OLX India Private Limited

- Big Boy Toyz Pvt. Ltd.

- CarTrade Tech Ltd.

- Maruti Suzuki India Limited

- Girnar Software Private Limited (CarDekho)

- Mahindra & Mahindra Limited

- Honda Motor Co. Ltd.

- Ford Motor Company

- Toyota Motor Corporation

Report Scope:

In this report, the India Used Car Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Used Car Market, By Vehicle Type:

- Hatchback

- Sedan

- SUV/MPV

India Used Car Market, By Propulsion Type:

- Petrol

- Diesel

- Electric

- Others

India Used Car Market, By Sales Medium:

- Offline

- Online

India Used Car Market, By Vendor Type:

- Organized

- Unorganized

India Used Car Market, By Sales Channel:

- Dealerships/Broker

- C2C

India Used Car Market, By Region:

- North India

- West India

- South India

- East India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Used Car Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Cars24 Services Private Ltd.

- OLX India Private Limited

- Big Boy Toyz Pvt. Ltd.

- CarTrade Tech Ltd.

- Maruti Suzuki India Limited

- Girnar Software Private Limited (CarDekho)

- Mahindra & Mahindra Limited

- Honda Motor Co. Ltd.

- Ford Motor Company

- Toyota Motor Corporation

Table Information

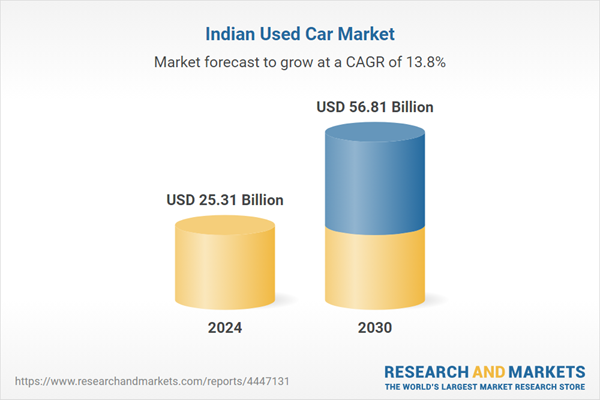

| Report Attribute | Details |

|---|---|

| No. of Pages | 82 |

| Published | December 2024 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 25.31 Billion |

| Forecasted Market Value ( USD | $ 56.81 Billion |

| Compound Annual Growth Rate | 13.8% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |