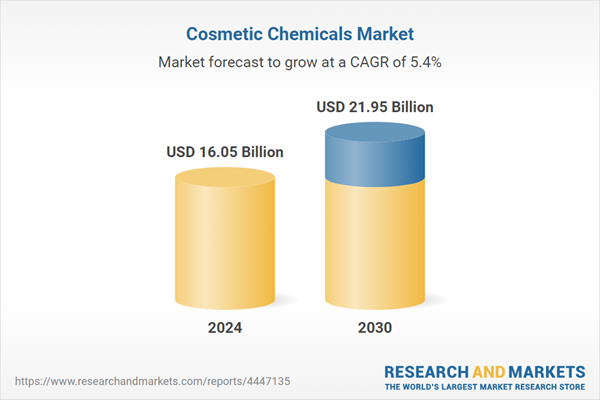

Polymer Ingredients is the fastest growing segment, North America is the largest regional market

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The global cosmetic chemicals market is significantly shaped by the increasing consumer shift towards natural and sustainable ingredients

Growing consumer preference for natural and environmentally responsible ingredients is reshaping the cosmetic chemicals landscape. Consumers increasingly scrutinize product labels, prioritizing transparency and safety. According to the American Academy of Dermatology, 73% of consumers in 2023 reported reading ingredient labels before purchasing skincare products, emphasizing the importance of clean formulations. This shift drives demand for bio-based emollients, plant-derived extracts, and biodegradable polymers, prompting manufacturers to reformulate and innovate with sustainable materials.Key Market Challenges

The complex and varied global regulatory landscape

Diverse regulatory frameworks across global markets pose significant challenges for cosmetic chemical manufacturers. Differing ingredient approval processes, safety standards, and labeling requirements create operational hurdles, increasing compliance costs and extending development timelines. Cosmetics Europe’s Annual Report 2024 highlights how regulatory changes, such as Regulation 2023/1545 - which expanded the list of fragrance allergens requiring declaration from 24 to 81 substances with mandatory compliance by July 2026 - add substantial burdens for companies. Frequent regulatory updates force manufacturers to continuously reformulate products, complicating international market expansion and limiting innovation, particularly for smaller enterprises.Key Market Trends

Personalized and Customized Cosmetic Solutions

The market is experiencing strong growth in personalized and customized cosmetic products tailored to individual needs. Advances in diagnostic tools, digital platforms, and formulation science enable solutions based on biological profiles, lifestyle factors, and environmental conditions. This demand requires diverse chemical ingredients and adaptable formulation systems. BASF highlighted in May 2025 its development of age-specific ingredient solutions and synergistic ingredient combinations designed to enhance texture and sensory experiences in personalized products. The Personal Care Products Council also reported that over 5,700 STEM professionals were employed in the U.S. personal care sector in 2022, underscoring the industry’s scientific investment in targeted formulation development.Key Market Players Profiled:

- BASF SE

- Akzo Nobel NV

- Clariant International, Ltd.

- Solvay SA

- Dow Chemical Company

- Evonik Industries AG

- Procter & Gamble Company

- Cargill, Inc.

- Sederma SAS

- FMC Corporation

Report Scope:

In this report, the Global Cosmetic Chemicals Market has been segmented into the following categories:By Type:

- Surfactants

- Polymer Ingredients

- Colorants

- Preservatives

By Application:

- Skin Care

- Hair Care

- Nail Care

- Oral Care

- Others

By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Cosmetic Chemicals Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Cosmetic Chemicals market report include:- BASF SE

- Akzo Nobel NV

- Clariant International, Ltd.

- Solvay SA

- Dow Chemical Company

- Evonik Industries AG

- Procter & Gamble Company

- Cargill, Inc.

- Sederma SAS

- FMC Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | November 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 16.05 Billion |

| Forecasted Market Value ( USD | $ 21.95 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |