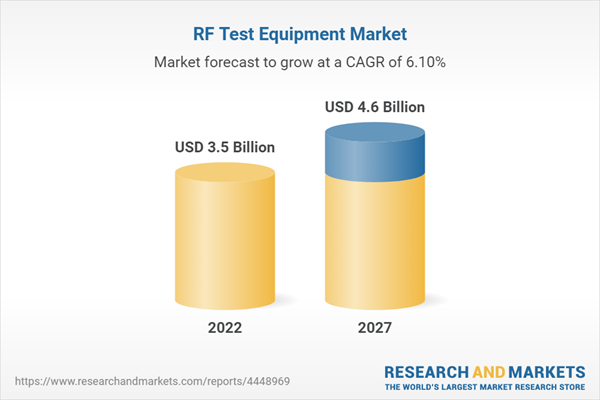

The RF test equipment market is estimated to be worth USD 3.5 billion in 2022 and is projected to reach USD 4.6 billion by 2027, at a CAGR of 6.1% during the forecast period.

An increasing number of smartphone subscriptions, surging adoption of wireless systems in residential and commercial buildings, and growing use of 5G-compatible devices are some of the major factors driving the RF test equipment market growth. However, the extended longevity of communication systems and complexities related to antenna arrays are some of the major factors expected to impact the market growth adversely

Benchtop RF test equipment to account for the largest market share during the forecast period

Benchtop RF test equipment accounted for the largest market share in 2021. A similar trend is likely to be observed from 2022 to 2027. With the growing need for high-precision equipment during the product development phase, engineers prefer benchtop equipment because of their high-precision capabilities. Moreover, the bigger benchtop RF test equipment allows manufacturers to integrate them with more components, increasing the reading speed performance and providing wide measurement ranges and large graphical screen displays.

North America to account for the second-largest share in the RF test equipment market during the forecast period

North America accounted for the second-largest market share in 2021; a similar trend is expected to continue during the forecast period. The prominent presence of established providers of network infrastructure solutions, such as AT&T (US) and Verizon (US), who are extensively focused on testing 5G infrastructure and the increased adoption of IoT-based devices in various applications, such as smart manufacturing and in-vehicle infotainment solutions, accelerate the market growth in North America. Moreover, the region, being a global hub for chip makers, is expected to provide new opportunities to RF test equipment providers.

The key players in the RF test equipment market include Keysight Technologies, Inc. (US), Anritsu Group (Japan), Rohde & Schwarz (Germany), Tektronix, Inc. (US), Teledyne Technologies Incorporated (US), Berkeley Nucleonics Corporation (US), AnaPico (Switzerland), B&K Precision Corporation (US), National Instruments Corporation (US), Boonton Electronics (US), Tabor Electronics Ltd. (Israel).

Research Coverage

The report segments the RF test equipment market and forecasts its size, by value, based on region, type, form factor, frequency range, and end-use application, and by volume based on type. The report also provides a comprehensive review of drivers, restraints, opportunities, and challenges influencing the market growth. The report also covers qualitative aspects in addition to the quantitative aspects of the market.

Key Benefits of Buying This Report

- This report includes the market statistics pertaining to type, form factor, frequency range, end-use application, and region

- An in-depth supply chain analysis has provided deep insight into the RF test equipment market.

- Major market drivers, restraints, opportunities, and challenges have been detailed in this report.

The report includes in-depth analysis, market share, and ranking of key players.

Table of Contents

1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Study Scope

1.3.1 Markets Covered

Figure 1 RF Test Equipment Market Segmentation

1.3.2 Geographic Scope

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Stakeholders

1.7 Summary of Changes

2 Research Methodology

2.1 Research Approach

Figure 2 RF Test Equipment Market: Research Design

2.1.1 Secondary Data

2.1.1.1 Major Secondary Sources

2.1.1.2 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews with Experts

2.1.2.2 List of Key Primary Interview Participants

2.1.2.3 Breakdown of Primaries

2.1.2.4 Key Data from Primary Sources

2.1.3 Secondary and Primary Research

2.1.3.1 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

Figure 3 Bottom-Up Approach

2.2.2 Top-Down Approach

Figure 4 Top-Down Approach

2.3 Factor Analysis

2.3.1 Demand-Side Analysis

Figure 5 Market Size Estimation: Demand-Side Analysis

2.3.2 Supply-Side Analysis

Figure 6 Market Size Estimation: Supply-Side Analysis

2.3.3 Growth Forecast Assumptions

Table 1 Market Growth Assumptions

2.4 Market Breakdown and Data Triangulation

Figure 7 Data Triangulation

2.5 Research Assumptions

2.6 Risk Assessment

Table 2 Risk Assessment: RF Test Equipment Market

3 Executive Summary

3.1 Growth Rate Assumptions

Figure 8 Spectrum Analyzers Segment to Register Highest CAGR in RF Test Equipment Market, by Type, During Forecast Period

Figure 9 More Than 6 Ghz Segment to Hold Largest Share of RF Test Equipment Market, by Frequency Range, in 2022

Figure 10 Benchtop Segment to Hold Largest Share of RF Test Equipment Market, by Form Factor, in 2022

Figure 11 Automotive Segment to Register Highest CAGR in RF Test Equipment Market, by End-Use Application, During Forecast Period

Figure 12 Asia-Pacific to Record Highest CAGR in RF Test Equipment Market During Forecast Period

4 Premium Insights

4.1 Attractive Growth Opportunities for Players in RF Test Equipment Market

Figure 13 Increasing Use of Wireless Devices in Proximity Marketing to Create Opportunities for Market Players

4.2 RF Test Equipment, by Type

Figure 14 Oscilloscopes to Hold Largest Market Share in 2027

4.3 RF Test Equipment, by Frequency Range

Figure 15 RF Test Equipment with Frequency Range of More Than 6 Ghz to Capture Largest Market Share in 2027

4.4 RF Test Equipment, by Form Factor

Figure 16 Benchtop RF Test Equipment to Lead RF Test Equipment Market Throughout Forecast Period

4.5 RF Test Equipment, by End-Use Application

Figure 17 Consumer Electronics to Dominate RF Test Equipment Market from 2022 to 2027

4.6 RF Test Equipment, by Region

Figure 18 Asia-Pacific to Hold Largest Share of RF Test Equipment Market in 2027

4.7 RF Test Equipment in Europe, by Type and Country

Figure 19 Germany and Oscilloscopes Accounted for Largest Share of European RF Test Equipment Market in 2021

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

Figure 20 RF Test Equipment Market Dynamics: Drivers, Opportunities, Restraints, and Challenges

5.2.1 Drivers

5.2.1.1 Surging Adoption of Wireless Systems in Commercial and Residential Buildings

5.2.1.2 Rising Number of Smartphone Subscriptions

Figure 21 Smartphone Subscriptions, 2018 - 2027 (Million)

5.2.1.3 Increasing Use of 5G-Compatible Devices

Figure 22 5G Mobile Subscribers, 2021 - 2027 (Million)

5.2.1.4 Growing Number of Iot-Connected Devices

Figure 23 Shipment of Connected Devices and Cellular IoT Devices, 2018 - 2027 (Million Units)

Figure 24 Impact Analysis: RF Test Equipment Market Drivers

5.2.2 Restraints

5.2.2.1 Extended Longevity of Communication Systems

5.2.2.2 Inclination of Customers to Take RF Test Equipment on Rent

Figure 25 Impact Analysis: Test Equipment Market Restraints

5.2.3 Opportunities

5.2.3.1 Surging Adoption of RF Testing Instruments in Automotive Applications

5.2.3.2 Rising Use of Wireless Devices in Proximity Marketing

5.2.3.3 Increasing Number of Space Programs Globally and Advancements in Aerospace Industry

Figure 26 Impact Analysis: RF Test Equipment Market Opportunities

5.2.4 Challenges

5.2.4.1 High Capital Requirement to Remain Competitive

5.2.4.2 Complexities Related to Antenna Arrays

Figure 27 Impact Analysis: RF Test Equipment Market Challenges

5.3 Supply Chain Analysis

Figure 28 RF Test Equipment Market: Supply Chain

Table 3 RF Test Equipment Market: Ecosystem

5.4 RF Test Equipment Ecosystem

Figure 29 Ecosystem of RF Test Equipment

5.5 Average Selling Price Analysis

5.5.1 Average Selling Price of Cmos RF Test Equipment, by Key Player

Figure 30 Average Selling Price of RF Test Equipment, by Key Player

Table 4 Average Selling Price of Cmos RF Test Equipment, by Key Player (USD Thousand)

5.6 Revenue Shifts and New Revenue Pockets for Market Players

Figure 31 Revenue Shifts in RF Test Equipment Market

5.7 Technology Trends

5.7.1 Emergence of 5G Network

5.7.2 Commercialization of IoT Technology

5.7.3 Advancements in Warfare Technology

5.7.4 Improvements in Automotive Technology

5.8 Porter's Five Forces Analysis

Table 5 RF Test Equipment Market: Porter's Five Forces Analysis

Figure 32 Porter's Five Forces Analysis

5.8.1 Threat of New Entrants

5.8.2 Threat of Substitutes

5.8.3 Bargaining Power of Suppliers

5.8.4 Bargaining Power of Buyers

5.8.5 Intensity of Competitive Rivalry

5.9 Key Stakeholders and Buying Criteria

5.9.1 Key Stakeholders in Buying Process

Figure 33 Influence of Stakeholders on Buying Process for Top Three End-Use Applications

Table 6 Influence of Stakeholders on Buying Process for Top Three End-Use Applications (%)

5.9.2 Buying Criteria

Figure 34 Key Buying Criteria for Top Three End-Use Applications

Table 7 Key Buying Criteria: Top Three End-Use Applications

5.10 Case Study Analysis

5.10.1 R&S Scope Rider Rth Handheld Oscilloscope Helped Politecnico Di Torino Design Vehicles with Record-Low Fuel Consumption

5.10.2 Rohde & Schwarz Helped Mixcomm Overcome Quick Beam Switching Issue by Monitoring Synchronization Time Between Signal Generator and Analyzer Using RF Test Equipment

5.10.3 Panasonic Corporation Deployed Rf-Tested Camera Systems to Ensure Security of Inhabitants and Visitors in Slovakia

5.11 Trade Analysis

5.11.1 Import Scenario

Table 8 Import Data, by Country, 2017-2021 (USD Million)

5.11.2 Export Scenario

Table 9 Export Data, by Country, 2017-2021 (USD Million)

5.12 Patent Analysis, 2012-2022

Figure 35 Number of Patents Granted for RF Test Equipment, 2012-2022

Figure 36 Regional Analysis of Patents Granted for RF Test Equipment, 2021

Table 10 List of Key Patents Pertaining to RF Test Equipment, 2020-2021

5.13 Key Conferences and Events, 2022-2023

Table 11 RF Test Equipment Market: List of Key Conferences and Events

5.14 Tariff Analysis

Table 12 Mfn Tariffs for Hs Code 9030-Compliant Products Exported by US

Table 13 Mfn Tariffs for Hs Code 9030-Compliant Products Exported by China

Table 14 Mfn Tariffs for Hs Code 9030-Compliant Products Exported by Japan

5.15 Standards and Regulatory Landscape

5.15.1 Regulatory Bodies, Government Agencies, and Other Organizations

Table 15 North America: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 16 Europe: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 17 Asia-Pacific: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 18 RoW: List of Regulatory Bodies, Government Agencies, and Other Organizations

5.15.2 Regulatory Standards

5.15.3 Government Regulations

5.15.3.1 Canada

5.15.3.2 US

5.15.3.3 Europe

5.15.3.4 Asia-Pacific

6 RF Test Equipment Market, by Type

6.1 Introduction

Figure 37 RF Test Equipment Market, by Type

Table 19 RF Test Equipment Market, by Type, 2018-2021 (USD Million)

Figure 38 Oscilloscopes to Account for Largest Share of RF Test Equipment Market Throughout Forecast Period

Table 20 RF Test Equipment Market, by Type, 2022-2027 (USD Million)

6.2 Oscilloscopes

6.2.1 Increasing Adoption of Modular Oscilloscopes to Provide Growth Opportunities for Market Players

Table 21 RF Test Equipment Market for Oscilloscopes, 2018-2021 (Thousand Units)

Table 22 RF Test Equipment Market for Oscilloscopes, 2022-2027 (Thousand Units)

Table 23 Oscilloscopes: RF Test Equipment Market, by End-Use Application, 2018-2021 (USD Million)

Table 24 Oscilloscopes: RF Test Equipment Market, by End-Use Application, 2022-2027 (USD Million)

Table 25 Oscilloscopes: RF Test Equipment Market, by Frequency Range, 2018-2021 (USD Million)

Table 26 Oscilloscopes: RF Test Equipment Market, by Frequency Range, 2022-2027 (USD Million)

Table 27 Oscilloscopes: RF Test Equipment Market, by Region, 2018-2021 (USD Million)

Figure 39 Asia-Pacific to Dominate RF Test Equipment Market for Oscilloscopes Throughout Forecast Period

Table 28 Oscilloscopes: RF Test Equipment Market, by Region, 2022-2027 (USD Million)

Table 29 Oscilloscopes: RF Test Equipment Market in North America, by Country, 2018-2021 (USD Million)

Table 30 Oscilloscopes: RF Test Equipment Market in North America, by Country, 2022-2027 (USD Million)

Table 31 Oscilloscopes: RF Test Equipment Market in Europe, by Country, 2018-2021 (USD Million)

Table 32 Oscilloscopes: RF Test Equipment Market in Europe, by Country, 2022-2027 (USD Million)

Table 33 Oscilloscopes: RF Test Equipment Market in Asia-Pacific, by Country, 2018-2021 (USD Million)

Table 34 Oscilloscopes: RF Test Equipment Market in Asia-Pacific, by Country, 2022-2027 (USD Million)

Table 35 Oscilloscopes: RF Test Equipment Market in Row, by Region, 2018-2021 (USD Million)

Table 36 Oscilloscopes: RF Test Equipment Market in Row, by Region, 2022-2027 (USD Million)

6.3 Spectrum Analyzers

6.3.1 High Versatility and Availability of Spectrum Analyzers in Different Form Factors to Spike Their Demand

Table 37 RF Test Equipment Market for Spectrum Analyzers, 2018-2021 (Thousand Units)

Table 38 RF Test Equipment Market for Spectrum Analyzers, 2022-2027 (Thousand Units)

Table 39 Spectrum Analyzers: RF Test Equipment Market, by End-Use Application, 2018-2021 (USD Million)

Table 40 Spectrum Analyzers: RF Test Equipment Market, by End-Use Application, 2022-2027 (USD Million)

Table 41 Spectrum Analyzers: RF Test Equipment Market, by Frequency Range, 2018-2021 (USD Million)

Table 42 Spectrum Analyzers: RF Test Equipment Market, by Frequency Range, 2022-2027 (USD Million)

Table 43 Spectrum Analyzers: RF Test Equipment Market, by Region, 2018-2021 (USD Million)

Figure 40 Asia-Pacific to Command RF Test Equipment Market for Spectrum Analyzers During Forecast Period

Table 44 Spectrum Analyzers: RF Test Equipment Market, by Region, 2022-2027 (USD Million)

Table 45 Spectrum Analyzers: RF Test Equipment Market in North America, by Country, 2018-2021 (USD Million)

Table 46 Spectrum Analyzers: RF Test Equipment Market in North America, by Country, 2022-2027 (USD Million)

Table 47 Spectrum Analyzers: RF Test Equipment Market in Europe, by Country, 2018-2021 (USD Million)

Table 48 Spectrum Analyzers: RF Test Equipment Market in Europe, by Country, 2022-2027 (USD Million)

Table 49 Spectrum Analyzers: RF Test Equipment Market in Asia-Pacific, by Country, 2018-2021 (USD Million)

Table 50 Spectrum Analyzers: RF Test Equipment Market in Asia-Pacific, by Country, 2022-2027 (USD Million)

Table 51 Spectrum Analyzers: RF Test Equipment Market in Row, by Region, 2018-2021 (USD Million)

Table 52 Spectrum Analyzers: RF Test Equipment Market in Row, by Region, 2022-2027 (USD Million)

6.4 Signal Generators

6.4.1 Rising Use of Signal Generators in Industrial and Telecommunications Sectors to Stimulate Market Growth

Table 53 RF Test Equipment Market for Signal Generators, 2018-2021 (Thousand Units)

Table 54 RF Test Equipment Market for Signal Generators, 2022-2027 (USD Million)

Table 55 Signal Generators: RF Test Equipment Market, by End-Use Application, 2018-2021 (USD Million)

Table 56 Signal Generators: RF Test Equipment Market, by End-Use Application, 2022-2027 (USD Million)

Table 57 Signal Generators: RF Test Equipment Markt, by Frequency Range, 2018-2021 (USD Million)

Figure 41 Signal Generators with More Than 6 Ghz Frequency to Lead RF Test Equipment Market During Forecast Period

Table 58 Signal Generators: RF Test Equipment Market, by Frequency Range, 2022-2027 (USD Million)

Table 59 Signal Generators: RF Test Equipment Market, by Region, 2018-2021 (USD Million)

Table 60 Signal Generators: RF Test Equipment Market, by Region, 2022-2027 (USD Million)

Table 61 Signal Generators: RF Test Equipment Market in North America, by Country, 2018-2021 (USD Million)

Table 62 Signal Generators: RF Test Equipment Market in North America, by Country, 2022-2027 (USD Million)

Table 63 Signal Generators: RF Test Equipment Market in Europe, by Country, 2018-2021 (USD Million)

Table 64 Signal Generators: RF Test Equipment Market in Europe, by Country, 2022-2027 (USD Million)

Table 65 Signal Generators: RF Test Equipment Market in Asia-Pacific, by Country, 2018-2021 (USD Million)

Table 66 Signal Generators: RF Test Equipment Market in Asia-Pacific, by Country, 2022-2027 (USD Million)

Table 67 Signal Generators: RF Test Equipment Market in Row, by Region, 2018-2021 (USD Million)

Table 68 Signal Generators: RF Test Equipment Market in Row, by Region, 2022-2027 (USD Million)

6.5 Network Analyzers

6.5.1 Adoption of Network Analyzers to Differentiate Between Two-Port Networks to Drive Market

Table 69 Network Analyzers: RF Test Equipment Market, 2018-2021 (Thousand Units)

Table 70 Network Analyzers: RF Test Equipment Market, 2022-2027 (Thousand Units)

Table 71 Network Analyzers: RF Test Equipment Market, by End-Use Application, 2018-2021 (USD Million)

Table 72 Network Analyzers: RF Test Equipment Market, by End-Use Application, 2022-2027 (USD Million)

Table 73 Network Analyzers: RF Test Equipment Market, by Frequency Range, 2018-2021 (USD Million)

Figure 42 Network Analyzers with Frequency of More Than 6 Ghz to Account for Largest Share of RF Test Equipment Market During Forecast Period

Table 74 Network Analyzers: RF Test Equipment Market, by Frequency Range, 2022-2027 (USD Million)

Table 75 Network Analyzers: RF Test Equipment Market, by Region, 2018-2021 (USD Million)

Table 76 Network Analyzers: RF Test Equipment Market, by Region, 2022-2027 (USD Million)

Table 77 Network Analyzers: RF Test Equipment Market in North America, by Country, 2018-2021 (USD Million)

Table 78 Network Analyzers: RF Test Equipment Market in North America, by Country, 2022-2027 (USD Million)

Table 79 Network Analyzers: RF Test Equipment Market in Europe, by Country, 2018-2021 (USD Million)

Table 80 Network Analyzers: RF Test Equipment Market in Europe, by Country, 2022-2027 (USD Million)

Table 81 Network Analyzers: RF Test Equipment Market in Asia-Pacific, by Country, 2018-2021 (USD Million)

Table 82 Network Analyzers: RF Test Equipment Market in Asia-Pacific, by Country, 2022-2027 (USD Million)

Table 83 Network Analyzers: RF Test Equipment Market in Row, by Region, 2018-2021 (USD Million)

Table 84 Network Analyzers: RF Test Equipment Market in Row, by Region, 2022-2027 (USD Million)

6.6 Others

Table 85 Others: RF Test Equipment Market, by End-Use Application, 2018-2021 (USD Million)

Table 86 Others: RF Test Equipment Market, by End-Use Application, 2022-2027 (USD Million)

Table 87 Others: RF Test Equipment Market, by Frequency Range, 2018-2021 (USD Million)

Table 88 Others: RF Test Equipment Market, by Frequency Range, 2022-2027 (USD Million)

Table 89 Others: RF Test Equipment Market, by Region, 2018-2021 (USD Million)

Table 90 Others: RF Test Equipment Market, by Region, 2022-2027 (USD Million)

Table 91 Others: RF Test Equipment Market in North America, by Country, 2018-2021 (USD Million)

Table 92 Others: RF Test Equipment Market in North America, by Country, 2022-2027 (USD Million)

Table 93 Others: RF Test Equipment Market in Europe, by Country, 2018-2021 (USD Million)

Table 94 Others: RF Test Equipment Market in Europe, by Country, 2022-2027 (USD Million)

Table 95 Others: RF Test Equipment Market in Asia-Pacific, by Country, 2018-2021 (USD Million)

Table 96 Others: RF Test Equipment Market in Asia-Pacific, by Country, 2022-2027 (USD Million)

Table 97 Others: RF Test Equipment Market in Row, by Region, 2018-2021 (USD Million)

Table 98 Others: RF Test Equipment Market in Row, by Region, 2022-2027 (USD Million)

7 RF Test Equipment Market, by Form Factor

7.1 Introduction

Figure 43 RF Test Equipment Market, by Form Factor

Table 99 RF Test Equipment Market, by Form Factor, 2018-2021 (USD Million)

Figure 44 Modular RF Test Equipment to Register Highest CAGR During Forecast Period

Table 100 RF Test Equipment Market, by Form Factor, 2022-2027 (USD Million)

7.2 Rackmount

7.2.1 Flexible Mounting and Floor Space-Saving Capabilities of Rackmount RF Test Equipment to Drive Their Adoption

7.3 Benchtop

7.3.1 Extensive Use of Benchtop RF Test Equipment in R&D to Accelerate Market Growth

7.4 Portable

7.4.1 Significant Adoption of Portable RF Test Equipment in On-Field Applications to Stimulate Market Growth

7.5 Modular

7.5.1 Growing Use of Modular RF Test Equipment for Conformance-Driven Large-Volume Manufacturing to Support Market Growth

8 RF Test Equipment Market, by Frequency Range

8.1 Introduction

Figure 45 RF Test Equipment Market, by Frequency Range

Table 101 RF Test Equipment Market, by Frequency Range, 2018-2021 (USD Million)

Figure 46 RF Test Equipment with Frequency of More Than 6 Ghz to Record Highest CAGR During Forecast Period

Table 102 RF Test Equipment Market, by Frequency Range, 2022-2027 (USD Million)

8.2 More Than 6 Ghz

8.2.1 Advancements in Telecommunications Industry to Augment Demand for RF Test Equipment with More Than 6 Ghz

Table 103 More Than 6 Ghz: RF Test Equipment Market, by Type, 2018-2021 (USD Million)

Figure 47 Spectrum Analyzers with More Than 6 Ghz of Frequency Range to Register Highest CAGR During Forecast Period

Table 104 More Than 6 Ghz: RF Test Equipment Market, by Type, 2022-2027 (USD Million)

8.3 1 to 6 Ghz

8.3.1 Use of RF Test Equipment from Product Development to Installation Phases in Industries to Fuel Market Growth

Table 105 1 to 6 Ghz: RF Test Equipment Market, by Type, 2018-2021 (USD Million)

Table 106 1 to 6 Ghz: RF Test Equipment Market, by Type, 2022-2027 (USD Million)

8.4 Less Than 1 Ghz

8.4.1 Adoption of Rf Equipment to Test Accuracy of Low-Frequency Standalone Devices to Foster Market Growth

Table 107 Less Than 1 Ghz: RF Test Equipment Market, by Type, 2018-2021 (USD Million)

Table 108 Less Than 1 Ghz: RF Test Equipment Market, by Type, 2022-2027 (USD Million)

9 RF Test Equipment Market, by End-Use Application

9.1 Introduction

Figure 48 RF Test Equipment Market, by End-Use Application

Table 109 RF Test Equipment Market, by End-Use Application, 2018-2021 (USD Million)

Figure 49 Consumer Electronics Segment to Account for Largest Share of RF Test Equipment Market During Forecast Period

Table 110 RF Test Equipment Market, by End-Use Application, 2022-2027 (USD Million)

9.2 Consumer Electronics

9.2.1 Popularity of 5G Devices to Boost Demand for RF Test Equipment in Consumer Electronics Applications

Table 111 Consumer Electronics: RF Test Equipment Market, by Type, 2018-2021 (USD Million)

Figure 50 Spectrum Analyzers to Register Highest CAGR in RF Test Equipment Market for Consumer Electronics During Forecast Period

Table 112 Consumer Electronics: RF Test Equipment Market, by Type, 2022-2027 (USD Million)

9.3 Telecommunications

9.3.1 Rapid Proliferation of 5G Networks to Create Growth Opportunities for Providers of RF Test Equipment

Table 113 Telecommunications: RF Test Equipment Market, by Type, 2018-2021 (USD Million)

Table 114 Telecommunications: RF Test Equipment Market, by Type, 2022-2027 (USD Million)

9.4 Automotive

9.4.1 Integration of Complex Electronic Systems in Automated Cars to Spike Demand for RF Test Equipment

Table 115 Automotive: RF Test Equipment Market, by Type, 2018-2021 (USD Million)

Figure 51 Spectrum Analyzers to Register Highest CAGR in RF Test Equipment Market for Automotive During Forecast Period

Table 116 Automotive: RF Test Equipment Market, by Type, 2022-2027 (USD Million)

9.5 Industrial

9.5.1 Adoption of Industry 4.0 By Manufacturing Firms to Create Requirements for RF Test Equipment

Table 117 Industrial: RF Test Equipment Market, by Type, 2018-2021 (USD Million)

Table 118 Industrial: RF Test Equipment Market, by Type, 2022-2027 (USD Million)

9.6 Aerospace and Defense

9.6.1 Requirement to Test Reliability of Aerospace Components and Systems to Fuel Demand for RF Test Equipment

Table 119 Aerospace and Defense: RF Test Equipment Market, by Type, 2018-2021 (USD Million)

Table 120 Aerospace and Defense: RF Test Equipment Market, by Type, 2022-2027 (USD Million)

9.7 Medical

9.7.1 Need to Test Medical Devices in Real-World Environment to Surge Demand for RF Test Equipment

Table 121 Medical: RF Test Equipment Market, by Type, 2018-2021 (USD Million)

Table 122 Medical: RF Test Equipment Market, by Type, 2022-2027 (USD Million)

9.8 Research and Development

9.8.1 Requirement for High-End RF Test Equipment in R&D Applications to Drive Market

Table 123 Research and Development: RF Test Equipment Market, by Type, 2018-2021 (USD Million)

Table 124 Research and Development: RF Test Equipment Market, by Type, 2022-2027 (USD Million)

10 RF Test Equipment Market, by Region

10.1 Introduction

Figure 52 China to Exhibit Highest CAGR in Global RF Test Equipment Market During Forecast Period

Table 125 RF Test Equipment Market, by Region, 2018-2021 (USD Million)

Table 126 RF Test Equipment Market, by Region, 2022-2027 (USD Million)

10.2 North America

Figure 53 North America: RF Test Equipment Market Snapshot

Table 127 North America: RF Test Equipment Market, by Type, 2018-2021 (USD Million)

Table 128 North America: RF Test Equipment Market, by Type, 2022-2027 (USD Million)

Table 129 North America: RF Test Equipment Market, by Country, 2018-2021 (USD Million)

Table 130 North America: RF Test Equipment Market, by Country, 2022-2027 (USD Million)

10.2.1 US

10.2.1.1 Rising Investments in Revitalizing Digital Infrastructure to Provide Lucrative Opportunities to Market Players

Table 131 US: RF Test Equipment Market, by Type, 2018-2021 (USD Million)

Table 132 US: RF Test Equipment Market, by Type, 2022-2027 (USD Million)

10.2.2 Canada

10.2.2.1 Thriving Telecommunications Sector to Drive Market Growth

Table 133 Canada: RF Test Equipment Market, by Type, 2018-2021 (USD Million)

Table 134 Canada: RF Test Equipment Market, by Type, 2022-2027 (USD Million)

10.2.3 Mexico

10.2.3.1 Booming Manufacturing Sector to Stimulate Demand for RF Test Equipment

Table 135 Mexico: RF Test Equipment Market, by Type, 2018-2021 (USD Million)

Table 136 Mexico: RF Test Equipment Market, by Type, 2022-2027 (USD Million)

10.3 Europe

Figure 54 Europe: RF Test Equipment Market Snapshot

Table 137 Europe: RF Test Equipment Market, by Type, 2018-2021 (USD Million)

Table 138 Europe: RF Test Equipment Market, by Type, 2022-2027 (USD Million)

Table 139 Europe: RF Test Equipment Market, by Country, 2018-2021 (USD Million)

Table 140 Europe: RF Test Equipment Market, by Country, 2022-2027 (USD Million)

10.3.1 Germany

10.3.1.1 Established Automotive and Healthcare Industries to Contribute to Market Growth

Table 141 Germany: RF Test Equipment Market, by Type, 2018-2021 (USD Million)

Table 142 Germany: RF Test Equipment Market, by Type, 2022-2027 (USD Million)

10.3.2 UK

10.3.2.1 Surging Demand for Advanced Healthcare Solutions to Provide Growth Opportunities for Market Players

Table 143 UK: RF Test Equipment Market, by Type, 2018-2021 (USD Million)

Table 144 UK: RF Test Equipment Market, by Type, 2022-2027 (USD Million)

10.3.3 France

10.3.3.1 Rapid Advancements in Transportation and Communication Industries to Spur Demand for RF Test Equipment

Table 145 France: RF Test Equipment Market, by Type, 2018-2021 (USD Million)

Table 146 France: RF Test Equipment Market, by Type, 2022-2027 (USD Million)

10.3.4 Italy

10.3.4.1 Rapid Development of Industrial Sector to Foster Market Growth

Table 147 Italy: RF Test Equipment Market, by Type, 2018-2021 (USD Million)

Table 148 Italy: RF Test Equipment Market, by Type, 2022-2027 (USD Million)

10.3.5 Rest of Europe

Table 149 Rest of Europe: RF Test Equipment Market, by Type, 2018-2021 (USD Million)

Table 150 Rest of Europe: RF Test Equipment Market, by Type, 2022-2027 (USD Million)

10.4 Asia-Pacific

Figure 55 Asia-Pacific: RF Test Equipment Market Snapshot

Table 151 Asia-Pacific: RF Test Equipment Market, by Type, 2018-2021 (USD Million)

Table 152 Asia-Pacific: RF Test Equipment Market, by Type, 2022-2027 (USD Million)

Table 153 Asia-Pacific: RF Test Equipment Market, by Country, 2018-2021 (USD Million)

Table 154 Asia-Pacific: RF Test Equipment Market, by Country, 2022-2027 (USD Million)

10.4.1 China

10.4.1.1 Thriving Telecommunications Sector to Provide Lucrative Growth Opportunities for Market Players

Table 155 China: RF Test Equipment Market, by Type, 2018-2021 (USD Million)

Table 156 China: RF Test Equipment Market, by Type, 2022-2027 (USD Million)

10.4.2 Japan

10.4.2.1 Prominent Presence of RF Test Equipment and Connectivity Solution Providers to Fuel Market Growth

Table 157 Japan: RF Test Equipment Market, by Type, 2018-2021 (USD Million)

Table 158 Japan: RF Test Equipment Market, by Type, 2022-2027 (USD Million)

10.4.3 India

10.4.3.1 Strong Focus on Improving Communication Infrastructure to Accelerate Demand for RF Test Equipment

Table 159 India: RF Test Equipment Market, by Type, 2018-2021 (USD Million)

Table 160 India: RF Test Equipment Market, by Type, 2022-2027 (USD Million)

10.4.4 South Korea

10.4.4.1 Investments by Mobile Operators to Strengthen 5G Infrastructure to Support Market Growth

Table 161 South Korea: RF Test Equipment Market, by Type, 2018-2021 (USD Million)

Table 162 South Korea: RF Test Equipment Market, by Type, 2022-2027 (USD Million)

10.4.5 Rest of Asia-Pacific

Table 163 Rest of Asia-Pacific: RF Test Equipment Market, by Type, 2018-2021 (USD Million)

Table 164 Rest of Asia-Pacific: RF Test Equipment Market, by Type, 2022-2027 (USD Million)

10.5 Rest of the World (Row)

Table 165 RoW: RF Test Equipment Market, by Type, 2018-2021 (USD Million)

Table 166 RoW: RF Test Equipment Market, by Type, 2022-2027 (USD Million)

Table 167 RoW: RF Test Equipment Market, by Region, 2018-2021 (USD Million)

Table 168 RoW: RF Test Equipment Market, by Region, 2022-2027 (USD Million)

10.5.1 South America

10.5.1.1 Growing Demand for 5G and Iot-Based Devices to Drive Market

Table 169 South America: RF Test Equipment Market, by Type, 2018-2021 (USD Million)

Table 170 South America: RF Test Equipment Market, by Type, 2022-2027 (USD Million)

10.5.2 Middle East & Africa

10.5.2.1 Increasing Investments in Developing Communication and Network Infrastructure to Create Lucrative Opportunities for Market Players

Table 171 Middle East & Africa: RF Test Equipment Market, by Type, 2018-2021 (USD Million)

Table 172 Middle East & Africa: RF Test Equipment Market, by Type, 2022-2027 (USD Million)

11 Competitive Landscape

11.1 Overview

11.2 Strategies Adopted by Key Players/Right to Win

Table 173 Overview of Strategies Deployed by Key RF Test Equipment Providers

11.2.1 Product Portfolio

11.2.2 Regional Focus

11.2.3 Manufacturing Footprint

11.2.4 Organic/Inorganic Strategies

11.3 Market Share Analysis, 2021

Table 174 RF Test Equipment Market: Market Share Analysis (2021)

11.4 Ranking Analysis: RF Test Equipment Type, by Market Player

11.5 Five-Year Company Revenue Analysis

Figure 56 Five-Year Revenue Analysis of Top Five Players in RF Test Equipment Market, 2017-2021

11.6 Company Evaluation Quadrant

11.6.1 Stars

11.6.2 Emerging Leaders

11.6.3 Pervasive Players

11.6.4 Participants

Figure 57 RF Testing Equipment Market: Company Evaluation Quadrant, 2021

11.7 Start-Ups/Small and Medium-Sized Enterprises (Sme) Evaluation Quadrant

Table 175 RF Test Equipment Market: Detailed List of Key Start-Ups/Smes

Table 176 Start-Ups/Small and Medium-Sized Enterprises (Sme) in RF Test Equipment Market

Table 177 RF Testing Equipment Market: Competitive Benchmarking of Key Start-Ups/Smes (Type Footprint)

Table 178 RF Testing Equipment Market: Competitive Benchmarking of Key Start-Ups/Smes (End-Use Application Footprint)

Table 179 RF Testing Equipment Market: Competitive Benchmarking of Key Start-Ups/Smes (Region Footprint)

11.7.1 Progressive Companies

11.7.2 Responsive Companies

11.7.3 Dynamic Companies

11.7.4 Starting Blocks

Figure 58 Start-Up/Sme Evaluation Quadrant

11.8 Company Footprint

Table 180 Company Footprint

Table 181 Company Type Footprint

Table 182 Company End-Use Application Footprint

Table 183 Company Region Footprint

11.9 Competitive Scenarios and Trends

11.9.1 Product Launches

Table 184 Product Launches, March 2019-May 2022

11.9.2 Deals

Table 185 Deals, March 2019-May 2022

11.9.3 Others

Table 186 Others, January 2020-January 2022

12 Company Profiles

(Business Overview, Products Offered, Recent Developments, Analyst's View Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats) *

12.1 Introduction

12.2 Key Players

12.2.1 Keysight Technologies, Inc.

Table 187 Keysight Technologies, Inc.: Company Overview

Figure 59 Keysight Technologies, Inc.: Company Snapshot

Table 188 Keysight Technologies, Inc.: Product Launches

Table 189 Keysight Technologies, Inc.: Deals

Table 190 Keysight Technologies, Inc.: Others

12.2.2 Anritsu Group

Table 191 Anritsu Group: Company Overview

Figure 60 Anritsu Group: Company Snapshot

Table 192 Anritsu Group: Product Launches

Table 193 Anritsu Group: Deals

12.2.3 Rohde & Schwarz

Table 194 Rohde & Schwarz: Company Overview

Table 195 Rohde & Schwarz: Product Launches

Table 196 Rohde & Schwarz: Deals

Table 197 Rohde & Schwarz: Others

12.2.4 Tektronix, Inc. (Fortive Corporation)

Table 198 Tektronix, Inc. (Fortive Corporation): Company Overview

Figure 61 Tektronix, Inc. (Fortive Corporation): Company Snapshot

Table 199 Tektronix, Inc. (Fortive Corporation): Product Launches

12.2.5 Teledyne Technologies Incorporated

Table 200 Teledyne Technologies Incorporated: Company Overview

Figure 62 Teledyne Technologies Incorporated: Company Snapshot

Table 201 Teledyne Technologies: Product Launches

Table 202 Teledyne Technologies: Others

12.2.6 Berkeley Nucleonics Corporation

Table 203 Berkeley Nucleonics Corporation: Company Overview

Table 204 Berkeley Nucleonics Corporation: Product Launches

12.2.7 Anapico

Table 205 Anapico: Company Overview

Table 206 Anapico: Product Launches

Table 207 Anapico: Deals

12.2.8 B&K Precision Corporation

Table 208 B&K Precision Corporation: Company Overview

Table 209 B&K Precision Corporation: Product Launches

12.2.9 National Instruments Corporation

Table 210 National Instruments Corporation: Company Overview

Figure 63 National Instruments Corporation: Company Snapshot

Table 211 National Instruments Corporation: Product Launches

Table 212 National Instruments Corporation: Deals

12.2.10 Boonton Electronics

Table 213 Boonton Electronics: Company Overview

Table 214 Boonton Electronics: Product Launches

12.2.11 Tabor Electronics Ltd.

Table 215 Tabor Electronics Ltd.: Company Overview

Table 216 Tabor Electronics Ltd.: Product Launches

Table 217 Tabor Electronics Ltd.: Deals

Table 218 Tabor Electronics Ltd.: Others

12.3 Other Players

12.3.1 Teradyne, Inc.

12.3.2 Signalcore, Inc.

12.3.3 Ds Instruments

12.3.4 Rf-Lambda

12.3.5 Stanford Research Systems

12.3.6 Aim & Thurlby Thandar Instruments (Aim-Tti)

12.3.7 Vaunix Technology Corporation

12.3.8 Rigol Technologies Co. Ltd.

12.3.9 Aaronia Ag

12.3.10 Viavi Solutions Inc.

12.3.11 Exfo Inc.

12.3.12 Yokogawa Test & Measurement Corporation

12.3.13 Era Instruments

12.3.14 Saluki Technology Inc.

*Details on Business Overview, Products Offered, Recent Developments, Analyst's View, Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats Might Not be Captured in Case of Unlisted Companies.

13 Appendix

13.1 Discussion Guide

13.2 Knowledgestore: The Subscription Portal

13.3 Customization Options

Companies Mentioned

- Aaronia Ag

- Aim & Thurlby Thandar Instruments (Aim-Tti)

- Anapico

- Anritsu Group

- B&K Precision Corporation

- Berkeley Nucleonics Corporation

- Boonton Electronics

- Ds Instruments

- Era Instruments

- Exfo Inc.

- Keysight Technologies, Inc.

- National Instruments Corporation

- Rf-Lambda

- Rigol Technologies Co. Ltd.

- Rohde & Schwarz

- Saluki Technology Inc.

- Signalcore, Inc.

- Stanford Research Systems

- Tabor Electronics Ltd.

- Tektronix, Inc. (Fortive Corporation)

- Teledyne Technologies Incorporated

- Teradyne, Inc.

- Vaunix Technology Corporation

- Viavi Solutions Inc.

- Yokogawa Test & Measurement Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 241 |

| Published | December 2022 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value ( USD | $ 3.5 Billion |

| Forecasted Market Value ( USD | $ 4.6 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |