Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

As part of Vision 2030, the Kingdom is investing heavily in infrastructure, urban development, and non-oil economic sectors, which in turn is fueling demand for passenger vehicles. A young and growing population with high disposable income and increasing urbanization is contributing to higher vehicle ownership, particularly in metropolitan regions such as Riyadh, Jeddah, and Dammam. Moreover, the easing of restrictions on female drivers since 2018 has significantly expanded the consumer base.

The government’s focus on localization of the automotive industry and incentives for electric vehicle (EV) adoption, including plans to manufacture EVs domestically, is expected to shift market dynamics over the next decade. Environmental concerns and rising fuel efficiency awareness are prompting interest in hybrid and electric cars, further supported by the establishment of EV charging infrastructure and strategic partnerships with global EV manufacturers. The market also reflects a trend towards premium and technologically advanced vehicles, with rising demand for in-car connectivity, advanced driver-assistance systems (ADAS), and smart infotainment.

Additionally, a surge in financing options, easy vehicle loans, and digitization of car sales through online platforms are making car ownership more accessible. Post-pandemic recovery and stabilizing oil prices have further strengthened consumer confidence, leading to a rebound in vehicle sales. Importantly, the expansion of ride-hailing and car-sharing services, along with growing investment in smart mobility solutions, is influencing purchase patterns, particularly among younger consumers who prefer flexible mobility over ownership. As the Kingdom moves toward becoming an automotive manufacturing and innovation hub in the Middle East, strategic collaborations, foreign investments, and technological advancements are expected to significantly reshape the landscape of the Saudi passenger car market in the coming years.

Key Market Drivers

Economic Diversification and Infrastructure Growth Under Vision 2030One of the most significant drivers of the passenger car market in Saudi Arabia is the Kingdom's economic diversification agenda under Vision 2030. Saudi Arabia’s non-oil GDP has grown significantly under Vision 2030, reaching SAR 1.889 trillion - approaching the 2023 target of SAR 1.934 trillion - and contributing roughly 50 percent of total GDP in 2023, up from around 1.82 percent growth in 2016. This strategic national framework aims to reduce the country’s dependence on oil revenues by promoting investments in infrastructure, tourism, transport, and manufacturing.

As a result, the government is undertaking massive projects such as NEOM, the Red Sea Project, and the expansion of urban centres, which are spurring mobility needs across the population. With increased construction and urbanization, particularly in emerging smart cities and economic zones, there is growing demand for passenger vehicles to meet transportation needs of residents, professionals, and service providers. These developments are also encouraging population shifts toward urban areas, where the demand for private cars is higher due to limited public transport coverage outside major cities.

Furthermore, Vision 2030 includes initiatives to develop domestic automotive manufacturing capabilities, with partnerships forged with global automakers to establish local assembly lines and electric vehicle (EV) manufacturing hubs. The push for local content and industrial development is expected to reduce import dependency and lower vehicle prices in the long term, making cars more affordable and accessible. The overall boost in economic activity, job creation, and consumer purchasing power resulting from Vision 2030 continues to be a powerful catalyst for the expansion of the passenger car market.

Key Market Challenges

Heavy Reliance on Imports and Limited Domestic Manufacturing

One of the major challenges facing the Saudi passenger car market is its heavy reliance on imports, with most vehicles sourced from Japan, the United States, South Korea, and Europe. Despite the government's push toward local automotive manufacturing under Vision 2030, domestic production remains in its infancy, with only a few assembly plants operational and limited manufacturing capabilities for critical components. This import dependency exposes the market to global supply chain disruptions, currency fluctuations, and import tariffs, all of which can affect vehicle prices and availability.In recent years, disruptions caused by the COVID-19 pandemic and semiconductor shortages globally have highlighted the vulnerabilities of relying heavily on external suppliers. Additionally, the lack of a robust local supply chain for auto parts increases maintenance costs and reduces aftermarket efficiency. The underdeveloped ecosystem also deters global OEMs from establishing large-scale operations in the Kingdom, due to high capital investment requirements and insufficient local technical expertise. As a result, achieving long-term affordability, price stability, and technological self-reliance in the Saudi automotive market remains a challenge. Unless significant strides are made in upskilling the local workforce, incentivizing domestic manufacturing, and developing vendor networks, this structural gap will continue to hinder the market's full potential and its aspirations of becoming a regional automotive hub.

Key Market Trends

Rise of Used Car Market and Online Vehicle Platforms

In recent years, there has been a significant rise in the demand for used cars in Saudi Arabia, fueled by economic pragmatism, increased vehicle ownership among first-time buyers, and broader access to financing. The used car segment is gaining traction, particularly among the middle-income population and younger consumers who seek affordability without compromising on brand or quality. The depreciation curve for new cars in Saudi Arabia is steep, making second-hand vehicles a value-for-money proposition. Simultaneously, the digital transformation of the automotive retail experience has accelerated, with the emergence of online platforms such as Haraj, Syarah, and Motory facilitating used car transactions.These platforms offer price transparency, vehicle history checks, and doorstep inspection services, which help build consumer confidence in the used car space - traditionally considered opaque and unregulated. Furthermore, the integration of AI-driven pricing tools and digital financing options on these platforms is enhancing customer convenience. Even established dealerships are entering the certified pre-owned vehicle segment, offering warranty-backed used cars that address quality concerns. As inflationary pressures and cost-of-living considerations continue to shape purchasing behavior, the trend toward online-enabled used car purchases is expected to solidify, potentially leading to greater market formalization and regulatory oversight. This trend will also open doors for ancillary services like digital auto-financing, insurance bundling, and logistics, contributing to the broader evolution of the automotive value chain in the Kingdom.

Key Market Players

- Toyota Motors Corporation

- Hyundai Motor Company

- Mazda Saudi Arabia

- Nissan Motor Co. Ltd

- General Motors Co.,

- Ford Middle East

- Kia Motors Corp

- Isuzu Motors Saudi Arabia Co. Ltd.

- Volkswagen AG

- Renault Middle East

Report Scope:

In this report, the Saudi Arabia Passenger Car market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Saudi Arabia Passenger Car Market, By Vehicle Type:

- Hatchback

- Sedan

- SUV

- MPV

Saudi Arabia Passenger Car Market, By Propulsion:

- Petrol

- Diesel

- CNG

- Hybrid

- Electric

Saudi Arabia Passenger Car Market, By Transmission Type:

- Automatic

- Manual

Saudi Arabia Passenger Car Market, By Region:

- Northern & Central

- Southern

- Eastern

- Western

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Saudi Arabia Passenger Car market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this Saudi Arabia Passenger Car market report include:- Toyota Motors Corporation

- Hyundai Motor Company

- Mazda Saudi Arabia

- Nissan Motor Co. Ltd

- General Motors Co.,

- Ford Middle East

- Kia Motors Corp

- Isuzu Motors Saudi Arabia Co. Ltd.

- Volkswagen AG

- Renault Middle East

Table Information

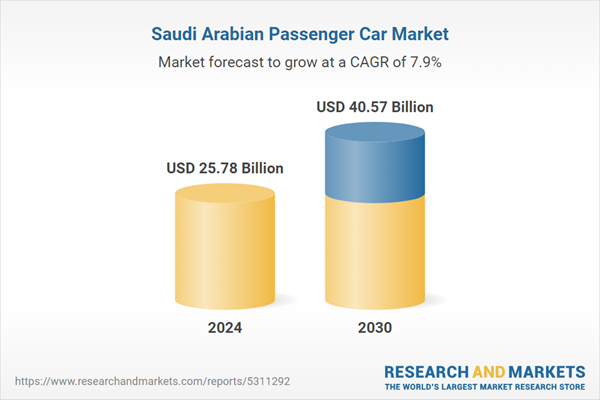

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | September 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 25.78 Billion |

| Forecasted Market Value ( USD | $ 40.57 Billion |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Saudi Arabia |

| No. of Companies Mentioned | 11 |