Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Conversely, a major obstacle hindering broader market expansion is the intensifying regulatory pressure regarding environmental compliance. Governments across the globe are enforcing strict emission standards that force manufacturers to rapidly pivot from internal combustion engines to zero-emission powertrain technologies. This mandatory transition necessitates substantial capital investment for research and production retooling, leading to higher vehicle costs that may strain operator budgets and delay the rate of fleet renewal across key commercial hubs.

Market Drivers

The explosive growth of e-commerce and last-mile delivery networks is fundamentally reshaping the Global Truck Market by heightening the demand for light commercial vehicles and versatile fleet solutions. As consumers increasingly depend on online retail, logistics providers are investing heavily in smaller, fuel-efficient vans designed to navigate congested urban centers and execute high-frequency stops. This structural shift toward direct-to-consumer fulfillment has established light-duty models as a crucial segment for generating volume growth. According to the European Automobile Manufacturers’ Association’s 'New commercial vehicle registrations full year 2023' report from January 2024, new van registrations in the European Union rose by 14.6% to reach nearly 1.5 million units in 2023, reflecting the sector's robust expansion.In parallel, a surge in global infrastructure development and construction activities is driving substantial procurement of heavy-duty trucks, including dump trucks, concrete mixers, and flatbeds. Both emerging economies and industrialized nations are allocating significant capital to residential projects, transportation networks, and industrial facilities, ensuring sustained demand for high-capacity freight units capable of transporting raw materials. This industrial momentum is evident in major markets; according to the China Association of Automobile Manufacturers in their April 2024 'Commercial Vehicle Trends' report, truck sales in China reached 3.54 million units in 2023, marking a 22.4% year-over-year increase. Furthermore, Volvo Trucks reported a record annual volume in 2024, achieving global deliveries of 145,395 trucks in the previous year, underscoring the broader health of the market.

Market Challenges

Strict government regulations regarding environmental compliance constitute a significant barrier to market expansion. Manufacturers are obligated to transition from internal combustion engines to zero-emission technologies to satisfy rigorous emission mandates. This requirement necessitates heavy capital investment in research and production retooling, which directly increases the unit cost of commercial vehicles. Consequently, fleet operators face higher capital expenditure requirements, often leading to deferred purchasing decisions and a slower rate of fleet renewal.This hesitation significantly restricts overall market volume as buyers grapple with increased acquisition costs. The impact of these pressures is visible in recent industry performance metrics where sales have contracted. According to the European Automobile Manufacturers’ Association, in the first nine months of 2024, new EU truck registrations decreased by 7.5 percent, totaling 249,708 units. This decline highlights how the financial strain associated with meeting evolving regulatory standards can disrupt demand and impede the steady growth of the global truck sector.

Market Trends

The rapid electrification of medium and heavy-duty fleets is fundamentally altering the Global Truck Market as manufacturers prioritize zero-emission solutions to meet stringent regulatory mandates. This transition is characterized by significant capital investment in battery-electric vehicle (BEV) platforms designed to reduce carbon footprints while maintaining operational efficiency for logistics providers. Despite broader market fluctuations in vehicle volume, the adoption rate of these green technologies is accelerating, particularly within regulated European zones where fleet operators are actively integrating cleaner units. According to the European Automobile Manufacturers’ Association’s October 2025 report, 'New commercial vehicle registrations: vans -8.2%, trucks -9.8%, buses +3.6% in Q1-Q3 2025', electrically-chargeable trucks secured 3.8% of the EU market in the first nine months of 2025, a notable increase from 2.1% in the previous year.Simultaneously, the integration of advanced telematics for real-time fleet management is becoming a standard operational requirement, enabling operators to optimize route planning and vehicle uptime through data-driven insights. This trend emphasizes the shift toward connected ecosystems where trucks continuously transmit performance data to prevent breakdowns and enhance fuel economy, moving beyond simple GPS tracking to comprehensive predictive analytics. The scale of this digital transformation is evident in the deployment metrics of major original equipment manufacturers who are standardizing connectivity across their portfolios. According to Volvo Trucks’ September 2025 press release, 'Volvo Trucks surpasses 1 million connected trucks worldwide', the company achieved a significant milestone with more than one million digitally connected trucks now operational globally, underscoring the critical role of connectivity in modern freight transport.

Key Players Profiled in the Truck Market

- Daimler Truck AG

- Volvo Group

- PACCAR Inc.

- MAN TRUCK & BUS SE

- Scania CV AB

- International Motors, LLC

- ISUZU MOTORS LIMITED

- Hino Motors, Ltd.

- Ford Motor Company

- Tata Motors Ltd.

Report Scope

In this report, the Global Truck Market has been segmented into the following categories:Truck Market, by Class:

- Class 3

- Class 4

- Class 5

- Class 6

- Class 7

- Class 8

Truck Market, by Fuel Type:

- Gasoline

- Diesel

- Electric

- Natural Gas

- Alternative Fuel

Truck Market, by End User Industry:

- Agriculture

- Mining and Construction

- Logistics and Transportation

- Others

Truck Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Truck Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Truck market report include:- Daimler Truck AG

- Volvo Group

- PACCAR Inc

- MAN TRUCK & BUS SE

- Scania CV AB

- International Motors, LLC

- ISUZU MOTORS LIMITED

- Hino Motors, Ltd

- Ford Motor Company

- Tata Motors Ltd

Table Information

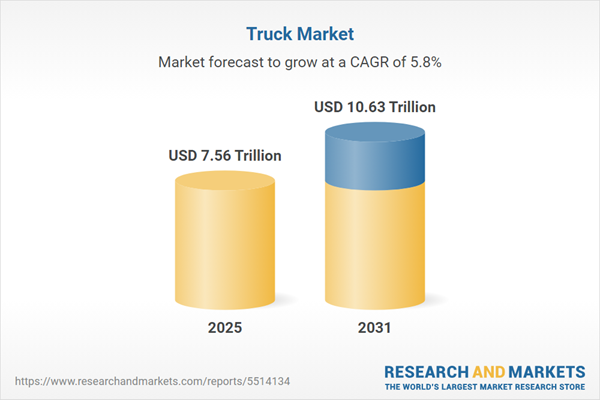

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 7.56 Trillion |

| Forecasted Market Value ( USD | $ 10.63 Trillion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |