Factors such as the rising demand for lightweight vehicles and the growing utilization of aluminum in diecasting auto parts are expected to fuel the market's growth during the forecast period. Stringent environmental regulations and CAFE standards were imposed across various regions to support the adoption of the diecasting process.

In addition, increased demand for electric and hybrid vehicles turned automakers’ focus to using lightweight materials like aluminum as a substitute for heavier steel and iron in all types of vehicles. Furthermore, the rising cost of fossil fuels and rising electric vehicle adoption are significant market drivers. Players operating in the market are focused on raising their production capacities to meet this rising demand. For instance,

Key Highlights

- In August 2022, WencanGroup Co., Ltd. Invested CNY 1 billion (USD 0.14 billion) in China to build a production base of aluminum diecast parts for New Energy Vehicles (NEVs) in Lu'anEconomic and Technological Development Zone, Anhui Province.

- In May 2022, Tamil Nadu Small Industries Development Corporation invested an amount of INR 5.8 crore (around USD 0.70 million) to establish a common facility center for aluminum high-pressure die casting.

Automotive Parts Aluminum Die Casting Market Trends

Increasing Aluminum Penetration in Automobiles is Likely to Bolster Demand

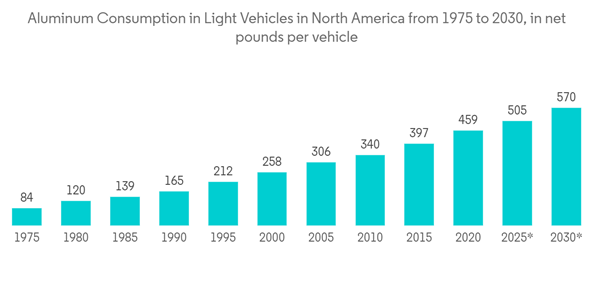

Aluminum is the most preferred metal for die casting. Within the automotive application, hybrid and electric vehicle technologies are on the rise. Taking North America as an example, since 2016, there was an increase in terms of aluminum content of 62 lbs (28 kg) per vehicle, with 2020 reaching a total vehicle content figure of 459 lbs (208 kg). It is expected to reach 570 lbs (258 kg) by the year 20230. The shift toward the light truck and battery electric vehicles primarily drives it.Further, it is expected that by 2026, 550 lbs (250 kg) of aluminum content per vehicle for light-duty trucks. This increase is seen primarily in three main areas of material usage: aluminum auto body sheets, castings, and extrusions. A good example of this is Tesla’s Model-S BEV, which uses over 800 lbs (360 kg) of aluminum for structural components, castings, extrusions, and the whole body of the vehicle.

On the other side, rising prices and risks associated with raw material sourcing are expected to hinder market growth during the longer-term forecast period. Base metal prices are under pressure in recent weeks due to the looming trade war between the United States and the rest of the world. The imposition of tariffs on imports from the US allies (including the European Union, Mexico, and Canada) on aluminum (10%) and steel (25%) by the President-elect is expected to increase the domestic aluminum prices.

Moreover, the increasing production and sales of passenger cars in several emerging economies, such as India, Thailand, Indonesia, Egypt, and other Middle East & African countries, are anticipated to drive the automotive parts aluminum die casting market during the forecast period.

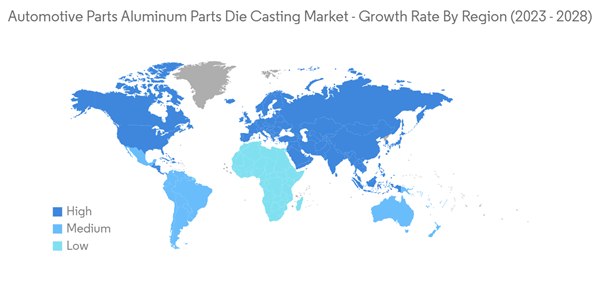

Asia-Pacific Region Anticipated to Witness Significant Growth

Asia-Pacific is expected to witness the fastest growth rate during the forecast period. In the Asia-Pacific region, major countries like India, China, and Japan are expected to contribute significantly to the development of the market over the forecast period. China is one of the major producers of die-casting parts, and the growing adoption of passenger cars in the region is likely to provide an optimistic impact on the market.For instance, according to the China Association of Automobile Manufacturers, China's car production reached 27.02 million units in 2022, an increase of 3.4% year-on-year, while sales increased by 2.1% to 26.86 million units.

The Asia-Pacific region, being one of the world's largest manufacturers of vehicles, tends to attract major market manufacturers. Many players adopt growth strategies, such as geographic expansion and production capacity expansion, to stay competitive in this market. For instance,

- In January 2022, a Chinese part supplier ordered super die-casting machines from a Tesla partner, hinting at potential adoption by NIO and XPeng. The machines enable one-piece manufacturing, reducing production time and costs, and align with Tesla's goal of improving efficiency in its supply chain.

Automotive Parts Aluminum Die Casting Industry Overview

The automotive parts aluminum die casting market is consolidated and led by globally and regionally established players. These companies adopt strategies such as new product developments, collaborations, and contracts and agreements to sustain their market positions. For instance,- In March 2023, Gränges, a Swedish aluminum supplier, joined forces with China's Shandong Innovation Group to produce sustainable aluminum. The partnership aims to leverage Gränges' expertise in sustainable materials and Shandong Innovation Group's capabilities in recycling and clean energy. Together, they aim to meet the increasing demand for environmentally friendly aluminum casting products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Form Technologies Inc.(Dynacast)

- Nemak

- Endurance Technologies Ltd (CN)

- Sundaram Clayton Ltd

- Shiloh Industries Inc.

- Georg Fischer Limited

- Kochi Enterprises (Gibbs Die Casting Corporation)

- Bocar Group

- Engtek Group

- Rheinmetall AG

- Rockman Industries

- Ryobi Die Casting Ltd

- Linmar Corporation

- Meridian Light weight Technologies UK Limited

- Sandhar Group